Being well-informed and making data-driven decisions is crucial when it comes to cryptocurrency. One useful tool for achieving this is the History Calculator. This digital resource provides data for various cryptocurrencies. Unlike displaying prices, this tool allows you to explore a cryptocurrency's past values at any specific time. We will discuss what history calculators are, how to use them, what their advantages are and how you can use them to improve your knowledge in the crypto industry.

How to Use PlasBit’s History Calculator?

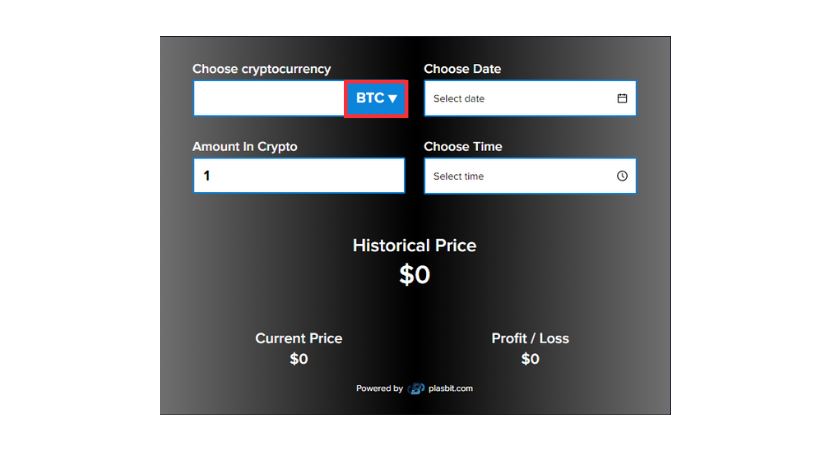

1. Start by selecting your desired cryptocurrency. You can do this by choosing from a dropdown menu.

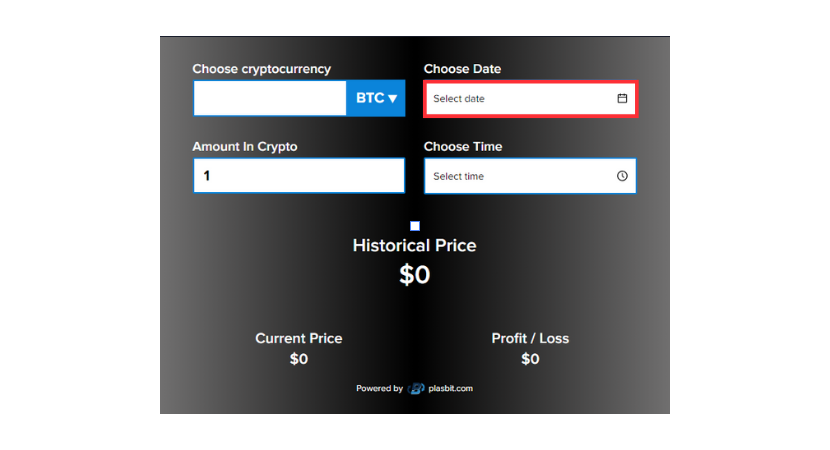

2. Next, choose a date to retrieve crypto historical data. You have the flexibility to pick any date and see the cryptocurrency's value at that particular time.

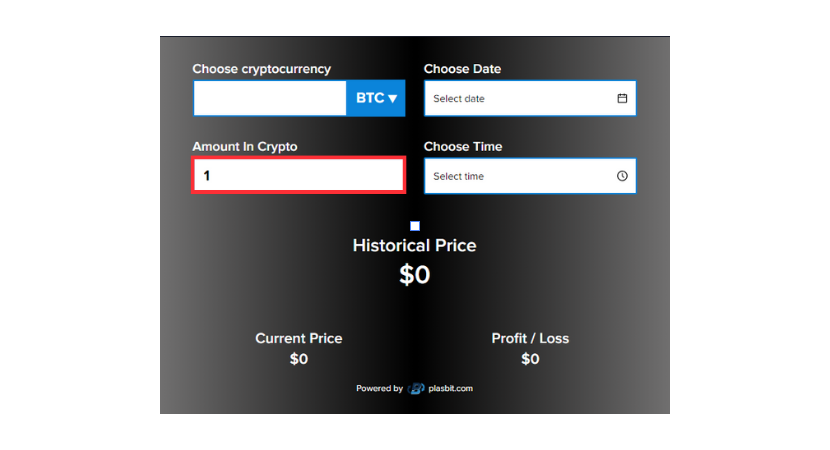

3. Enter the amount of the selected cryptocurrency you want to analyze. This quantity can be any number, such as 1 BTC or 10 BTC depending on your preference.

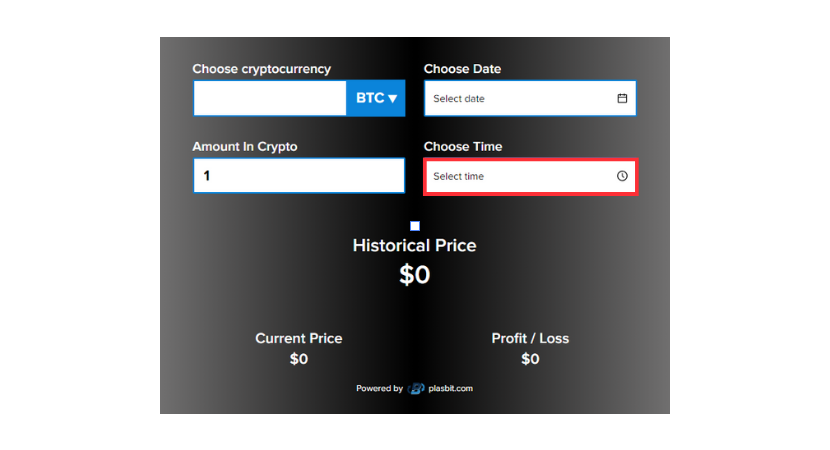

4. You can also specify a time of day for retrieving crypto historical data. This step is optional. It allows you to focus on a particular moment within the chosen date.

5. Once you have provided all the information, the history calculator will generate results that typically include:

● Historical price: The value of the cryptocurrency at your selected date and time.

● Current price: The current market price of the cryptocurrency.

● Profit/loss: If applicable, this calculation displays the difference between the historical price and current price, indicating potential profit or loss.

Benefits of History Calculators

Let's explore the benefits of using the PlasBit History Calculator and how it can help you optimize your trading strategies, manage risks and achieve success in the cryptocurrency industry.

Making Informed Decisions:

History calculators provide a wealth of data that enables you to make informed decisions when engaging in cryptocurrency transactions. By analyzing performance metrics you can gain insights into trends, identify patterns and adapt your strategies accordingly. This knowledge empowers you to navigate the market with increased confidence and precision.

Risk Management:

One of the benefits of calculators lies in their ability to support effective risk management strategies. By analyzing the volatility and stability of cryptocurrencies over extended periods you can gain an understanding of the associated risks. This valuable insight allows you to create tactics for minimizing risks, strategically diversify your portfolios and protect your assets from market fluctuations.

Market Analysis:

Historical calculators are tools for conducting market analysis. By examining data sets, you can uncover insights into market dynamics including trends in supply and demand shifts in market sentiment and correlations between cryptocurrency prices and external factors like news events or regulatory changes. This detailed analysis empowers you to identify emerging opportunities, predict market movements and stay ahead of the game in the world of crypto.

Educational Resource:

In addition to their usefulness, History calculators also serve as educational tools for individuals looking to deepen their understanding of the cryptocurrency industry. By engaging with data and exploring various analytical techniques you can improve your knowledge of market dynamics and refine your analytical skills. This hands-on learning experience equips you with the knowledge and expertise to effectively navigate the complexities of the cryptocurrency market.

Performance Assessment:

History calculators allow you to assess the performance of cryptocurrencies over time providing insights into their long-term viability and growth potential. By monitoring price movements, trading volumes and other relevant metrics, you can evaluate how different cryptocurrencies have performed historically and make informed decisions regarding your trading strategies. This systematic approach to evaluating performance empowers you to identify assets, optimize your asset portfolios and maximize returns in the market.

Strategic Planning:

When it comes to planning history calculators come in handy. They allow you to simulate scenarios and evaluate outcomes based on past data. You can analyze market trends, test asset strategies and assess the performance of assets. By leveraging these history calculators, you can make informed decisions backed by data and optimize your long-term asset goals. This strategic approach helps you adapt to changing market conditions, seize opportunities and achieve your objectives in cryptocurrency.

Comparative Analysis:

History calculators also enable you to conduct analysis between cryptocurrencies. By comparing price movements, market trends and other relevant metrics, you gain insights into their relative performance and asset potential. This analysis allows you to identify the strengths, weaknesses and unique characteristics of each cryptocurrency. Armed with this knowledge, you can make decisions regarding asset allocation, diversification strategies and portfolio optimization. Ultimately this empowers you to maximize your investment returns while minimizing risks in the market.

Continuous Improvement:

One of the benefits of using history calculators is that they facilitate improvement. They help you learn from experiences and refine your strategies accordingly as market conditions evolve over time. To improve your performance in the crypto industry and achieve long-term success, it is important to analyze data, identify patterns and evaluate the effectiveness of your actions. By doing this, you can make improvements to your approaches, optimize your decision-making processes and remain agile, proactive and resilient in the face of uncertainty. This will ultimately position you for success in the world of cryptocurrency.

The Evolution of Bitcoin’s Price

Bitcoin, known for its trading history has undergone significant ups and downs since it was first introduced. Initially launched in 2009 the price of Bitcoin stayed relatively stable at around $0.1 for months. However, things changed in October 2010 when it experienced a surge surpassing the $0.1 mark and signaling the start of its journey toward discovering its value.

Starting from 2011, Bitcoin embarked on a roller coaster ride of price fluctuations. In that year, it skyrocketed past $1 and reached an astonishing peak of $29.6 in June but then faced a sharp decline to $4.7 by the end of the year due to market downturns. The following years witnessed both growth and turbulent rallies as Bitcoin hit major milestones like $100 and $200 before reaching an unprecedented high above $1,000 by the end of 2013. From 2016 to 2020, Bitcoin's ascent continued steadily with prices climbing to over $900 by the end of 2016.

However, it was in 2017 that Bitcoin's extraordinary surge truly caught attention as its value skyrocketed from around $1,000 to an astonishing $19,345.49 by December. This dramatic increase prompted interest from mainstream traders and led to the development of alternative cryptocurrencies. In the midst of ups and downs in 2018 and 2019, including periods of surpassing $10,000 followed by declines, Bitcoin faced a true test during the COVID-19 pandemic in 2020. The rising concerns about the economy sparked a renewed interest in Bitcoin as a safeguard against economic uncertainty. As a result, its prices surged from $6,965.72 at the beginning of the year to nearly $29,000 by November. The year 2021 proved to be another milestone for Bitcoin as it broke previous price records by quickly surpassing $40,000 and reaching unprecedented highs above $60,000 by mid-April. However, this surge in value also brought volatility due to factors like institutional interest, market sentiment fluctuations and global events such as the emergence of the Omicron variant.

By 2022, Bitcoin experienced a period of decline with prices dropping below $30,000 for the first time since 2021. This led to what's commonly referred to as a "crypto winter" characterized by reduced trader confidence and subdued market activity. However, things took a turn in 2023 when Bitcoin made an impressive comeback with prices steadily climbing from $16,605 at the start of the year to $34,154 by October 26th. Despite its journey so far, Bitcoin's resilience and enduring appeal continue to shape the cryptocurrency market landscape while underscoring its status as a groundbreaking digital asset with unparalleled potential for growth and innovation.

Ethereum's Historical Price

Back in August 2014, Ethereum brought a change to the world of cryptocurrencies by introducing its own digital currency called ether through an initial coin offering (ICO). This groundbreaking event involved selling around 50 million ETH at a low price of $0.31 per coin, resulting in a significant fundraising amount of over $16 million. What sets Ethereum apart from other cryptocurrencies is its unlimited supply of ether which means there is no predetermined limit on how many tokens can be circulated.

The price history of Ethereum tells us a story, especially during the period between 2021 and 2022 where we witnessed notable fluctuations. Although Ethereum experienced a decline in value compared to its peak in 2021 it remained resilient and maintained its presence in the market. The surge in Ethereum's value during 2021 can be attributed to factors, including the sale of digital artwork as the most expensive non-fungible token (NFT) ever sold fetching over 38,000 ETH which is equivalent to approximately $69.3 million. Unlike Bitcoin, Ethereum's price rally was primarily driven by advancements such as the implementation of the 'Berlin update' in April 2021 which eventually led to the Ethereum Merge in 2022 and resulted in reduced transaction fees. Despite facing obstacles, such as the collapse of FTX in late 2022, Ethereum continues to be a significant player in the cryptocurrency market. This reflects its ability to adapt and innovate continuously. As of February 8, 2024, Ethereum has a value of $2,424.07 USD, which is lower than the $4,400 USD it reached by the end of 2021. To navigate the world of cryptocurrencies effectively it's important to learn how to utilize tools like the Historical Price Calculator. By using the PlasBit history calculator tool, you can go back in time and analyze specific cryptocurrency prices based on your chosen date, time and investment amount. This tool provides insights into historical prices as well as current values and potential profits or losses at any given moment.

Conclusion:

History calculators are vital crypto tools for navigating the cryptocurrency market. By using the power of crypto historical data, you can make informed decisions, manage risks effectively, conduct comprehensive market analysis and continually expand your knowledge and expertise. Incorporating history calculators into your toolkit can elevate your performance and success in crypto trading.