Ready to take a trip down memory lane and revisit what was the price of Bitcoin in 2015? Bitcoin started 2015 at $318, dropped to $216 in February, marking the year's low, and reached $377 in mid-December, 2015 high. You can watch our table that shows the price for all the calendar months of 2015, and we will show you how you can use our History Calculator to learn more about the price of Bitcoin at any point in 2015 you wish.

Notable events in 2015 started in January 2015, Coinbase set a new record for a bitcoin company by raising $75 million in a Series C funding round and by February 2015, over 100,000 merchants were accepting bitcoin as payment. In September 2015, the University of Pittsburgh announced Ledger, a peer-reviewed academic journal focused on studies of cryptocurrencies and related technologies.

Launched in the year 2009, Bitcoin is the world’s first and most well-known cryptocurrency. It is a digital currency. This means that, like traditional currencies, you can use them to buy and sell goods, but they only exist electronically. Unlike traditional money, which is controlled by governments, Bitcoin has no central authority as it operates on a peer-to-peer network.

Let’s explore the price of Bitcoin in 2015. Later we will discuss an easy tool by PlasBit that you can use to calculate the price of Bitcoin at any time of any year.

Monthly Breakdown Of Price In 2015

While the overall trend was positive, the price of Bitcoin did fluctuate throughout 2015. Here is a table of price breakdowns at the start of each month.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| Jan 4, 2015 | 281.15 | 287.23 | 257.61 | 264.20 |

| Feb 1, 2015 | 216.87 | 231.57 | 212.01 | 226.97 |

| Mar 1, 2015 | 254.28 | 261.66 | 245.93 | 260.20 |

| Apr 1, 2015 | 244.22 | 247.54 | 241.16 | 247.27 |

| May 1, 2015 | 235.94 | 238.97 | 232.08 | 232.08 |

| Jun 1, 2015 | 230.23 | 231.71 | 221.30 | 222.93 |

| Jul 1, 2015 | 263.35 | 265.17 | 255.77 | 258.62 |

| Aug 1, 2015 | 284.69 | 284.93 | 278.11 | 281.60 |

| Sep 1, 2015 | 230.26 | 231.22 | 226.86 | 228.12 |

| Oct 1, 2015 | 236.00 | 238.45 | 235.62 | 237.55 |

| Nov 1, 2015 | 315.01 | 327.47 | 311.88 | 325.43 |

| Dec 1, 2015 | 377.41 | 378.93 | 356.56 | 362.49 |

Let’s analyze each month separately.

January

Bitcoin began the year at around $318. There was a decline from the previous year’s highs. This could be due to a number of factors like general market correction and skepticism surrounding Bitcoin’s long-term viability.

However, you should know that the low price was not a piece of bad news for everyone. Traders found the time to gather new positions.

February

The start of February 2015 was low, and the price fell below $250. Nevertheless, in the middle of the month, there was a gain of $50, which represented a 23% gain over that period. Before closing the month with a little rise to over $250, the price fluctuated around $240 and soon fell back below $250.

March To June

A strong volume increase in the first part of March helped to sustain the price gains in bitcoin, which peaked at $286. The week that ended on March 7th saw the exchange of almost 3.67 million BTC, a 55% rise over the week before. The decline to the low $200s was retaliated against in the second part of the month.

The same pattern was observed during March and repeated from April to June. The price stayed between $220 and $240. The digital currency started looking like good news for those who see it as a potential store of value. However, this development was not taken so optimistically by the traders, but they did consider the low volatility of payment methods.

In June 2015, Ross Ulbricht, the founder of the infamous online marketplace Silk Road, was sentenced to life in prison. Silk Road facilitated illegal transactions using Bitcoin, which raised serious concerns about the association of cryptocurrency with criminal activity. This event could have caused a temporary dip in price or discouraged some investors.

The price of Bitcoin spiked to a high of $257 on 17th June. This was mainly due to the market timing. There were speculations going around that Greece may default because of its debt obligations. Since the ways to move money in and out, like PayPal, were shut off, the hope was that the Greeks would start using digital currency for the purpose.

The month of June ended with a high price of over $260.

July

The price of Bitcoin continued to rise and passed the $300 mark on 13th July because of the situation in Greece and people starting to accept the trend. For the rest of the month, the price was between $275 and $290.

The rise could be due to a combination of a number of factors, such as:

Increased Media Coverage

More articles and discussions about the benefits of Bitcoin could have sparked renewed interest among investors.

Technological Advancements

Developments in blockchain, the foundation of Bitcoin, might have bolstered confidence in its long-term viability.

Improved Exchange Infrastructure

There were new, more user-friendly, and secure cryptocurrency exchanges that could have made it easier for new investors to enter the market.

August

A few noteworthy unfavorable occurrences caused by a single Bitcoin exchange disrupted the overall downward price trend that had been in place throughout August. On August 19th, the price of Bitcoin dropped to 14% within 30 minutes because of a “flash crash” at Bitfinex, a Hong Kong-based cryptocurrency exchange founded in 2012. The price was steady throughout the day but dropped to $214.36 just before midnight.

On 24th August 2015, the price decreased again when Bitfinex decided to close its order book for almost 7 hours.

September

The price ranged from around $230 to $240 and saw a peak on the 8th of September when the price was around $245. Although the month closed at just $236, there was a rising trend that fostered a promising direction.

October

On 13th October, the price of Bitcoin reached $260. The upward trend observed at the end of September continued because there was a sudden surge in Bitcoin trading, mainly due to the Huobi and OKCoin - both Chinese exchanges. On 28th October, the price broke through the $300 barrier.

At the end of the month, the price peaked at $333.75, which was a new high for 2015.

November

The price continued to rise. A significant event in November 2015 was the official adoption of the Bitcoin symbol (฿). This seemingly minor detail coincided with a price surge. The price pushed above $400 for the first time. On 4th November, the price reached $480. The timing suggests that the growing recognition and legitimacy associated with the symbol might have boosted investor confidence. More and more people started to invest, and Wedbush Securities revealed that it expects the price to rise to $600 in 2016.

Unfortunately, there was a sharp drop on the 11th, and the price went back to $300. The price closed at $370 at the end of the month.

December

In the closing month of 2015, the price kept trending up. On 15th December, the price of Bitcoin reached $465 across most major exchanges.

The year ended on a high note of $432.92. This year-end rally could be due to factors such as:

● Positive Sentiment: The overall positive trend throughout the latter half of 2015 might have created a sense of momentum and attracted new investors.

● Holiday Season Buying: Similar to traditional investments, the holiday season can sometimes see increased activity and contribute to a rise in price.

What Was The Price Of Bitcoin In 2015: A Review

Following a volatile 2014, Bitcoin entered 2015 with a downward slope. The price started at around $318, which was a significant decline from the previous year’s highs. This initial dip was not uncommon for Bitcoin in its early years. The fledgling cryptocurrency was still establishing itself, and its value was heavily influenced by speculation and limited adoption.

However, 2015 was not all doom and gloom for Bitcoin. Unlike the sharp price swings that had become somewhat of a trademark, the year saw a slow and steady upward trend. This was a prominent shift for Bitcoin that suggested a move towards greater stability.

Factors That Impacted Price Movement

The factors that likely contributed to the price movement of Bitcoin are discussed below.

Increased Awareness

While it was still in its early stages, Bitcoin was starting to gain mainstream media attention. Articles and discussions about digital currency were piquing public curiosity.

Moreover, some influential figures started expressing their interest in Bitcoin. More people began to explore cryptocurrency. There were online communities specially dedicated to cryptocurrency, which boosted a sense of excitement and speculation.

Technological Advancements

The underlying technology behind Bitcoin, blockchain, was gaining traction. Developers started to recognize the applications beyond just cryptocurrency. This legitimized the existence of Bitcoin.

Additionally, venture capital firms started to show interest in blockchain startups. This influx fueled further development.

Improved Infrastructure

Cryptocurrency exchanges, the platforms where users could buy and sell Bitcoin, were becoming more user-friendly and secure. This made it easier for new investors to enter the market and contributed to a rise in demand.

Furthermore, the emergence of mobile wallet apps made it easier for people to store and manage their Bitcoin holdings on the go. Third-party payment processors also started to offer Bitcoin integration.

Limited Supply, Growing Demand

Bitcoin capped supply (21 million), created a sense of scarcity and continued awareness fueled demand. The basic economic principle - limited supply meeting rising demand - played a crucial role in Bitcoin’s price appreciation.

Global Economic Conditions

The overall economic climate in 2015 played a role. Traditional investment options were perceived as less attractive, and investors might have turned to Bitcoin as an alternative asset class.

Geopolitical Events

Important global events, like currency fluctuations or political instability in certain regions, could have driven some investors towards Bitcoin as a safe option.

The Network Effect

As more people adopted Bitcoin, its network grew stronger and made it more attractive to new users. This positive feedback loop played an imperative role in building trust and value.

Market Size & Investors In 2015

Compared to today’s astronomical figures, the total market capitalization 2015 was a mere fraction. Estimates suggest it was around the $7 billion mark, with Bitcoin dominating the scene. Due to the limited size, the market was less susceptible to financial fluctuations.

Back then, the crypto market was not yet on the radar of major institutions. The driving force came from a dedicated group of early adopters. These were tech pioneers, libertarians, venture capitalists, and crypto enthusiasts. Geopolitical tensions and major economic events that typically rock traditional markets had a muted effect on crypto in 2015. The market was still relatively isolated and had not yet reached a level of interconnectedness with other financial systems.

Other Developments In 2015

Bitcoin undoubtedly captured headlines in the year 2015. However, the year also witnessed significant developments that laid the groundwork for the future of digital currencies.

Rise Of Altcoins

Inspired by Bitcoin’s success, a new wave of cryptocurrencies emerged in 2015. These “alternative coins,” often referred to as altcoins, offered unique features. The rise of altcoins fostered a spirit of innovation in Blockchain. Developers started to push the boundaries of what cryptocurrencies could achieve. While many of these altcoins faded away, others, like Ethereum, which launched on 30th July 2015, continue to be major players even today.

Developments In Blockchain

Bitcoin’s underlying technology, blockchain, started gaining traction. Businesses and organizations began exploring the potential of blockchain for applications in several sectors, such as supply chain management and healthcare recordkeeping. This enhanced people’s trust and interest in blockchain technology and its applications.

Focus On Regulation

As Bitcoin gained mainstream attention, governments and regulatory bodies around the world started to take notice. Discussions began on how to classify and regulate cryptocurrencies. This was a complex issue, with regulators trying to balance innovation with customer protection and financial stability. Although regulations varied from country to country, 2015 marked the beginning of a global conversation on how to integrate cryptocurrencies into the existing framework.

Security Concerns

Unfortunately, 2015 was not without its share of security challenges. Several cryptocurrency exchanges, the platforms where users could buy and sell Bitcoins, were hacked, and a lot of funds were stolen. These incidents led to a need for enhanced security measures and robust regulatory frameworks to ensure investor confidence.

Community Growth

Despite facing some security challenges, the Bitcoin community grew steadily in 2015. More developers contributed to the open-source codebase and further strengthened the core infrastructure. This active community collaboration remains a hallmark of the cryptocurrency space as it fosters continuous improvement.

The Birth Of Bitcoin

Bitcoin was launched in 2009, and its creation was linked to the 2008 financial crisis. The period exposed deep flaws in the traditional financial system. There was a lack of transparency, and the system was vulnerable to manipulation. Enter Satoshi Nakamoto, the enigmatic figure credited with creating Bitcoin (whose true identity remains a mystery to this day).

Who Is Satoshi Nakamoto

Satoshi Nakamoto, shrouded in mystery, is the pseudonym used by the individual or group who authored the Bitcoin white paper and brought the concept to life. Despite numerous attempts to uncover Nakamoto’s true identity, it remains a well-kept secret. Here’s what we can interpret about this figure.

● They are technical brilliance because the complexity of the Bitcoin protocol and blockchain technology suggests a deep understanding of cryptography and computer science.

● Nakamoto is a visionary leader because the white paper laid out a clear vision for a decentralized financial system.

● Nakamoto’s involvement with the Bitcoin project seemingly ceased around 2010.

Motivated by the shortcomings of the existing system, Nakamoto envisioned a revolutionary alternative: a decentralized digital currency free from centralized control. This vision is also outlined in the groundbreaking 2008 white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” Here are some of the reasons that led to the creation of Bitcoin.

● The 2008 financial crisis shattered public interest in traditional financial institutions and government oversight.

● The complexities and lack of transparency in the traditional financial system were a major concern. Bitcoin introduced a public ledger that tracks all transactions.

● The centralized control of traditional currencies allows governments and financial institutions to manipulate them.

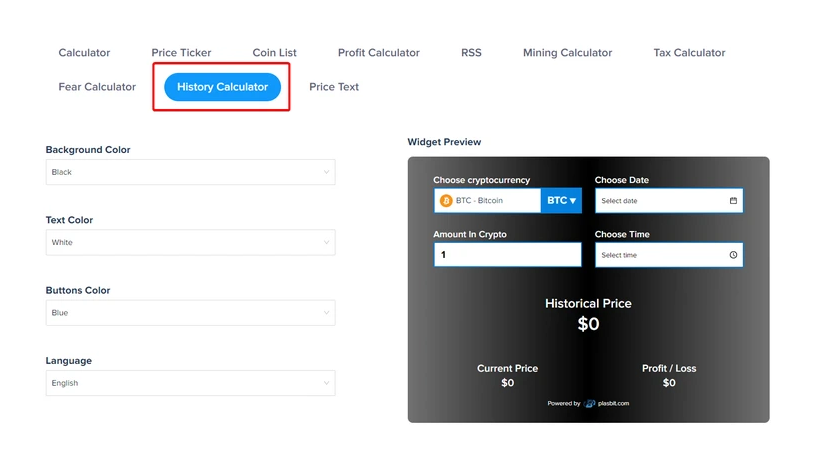

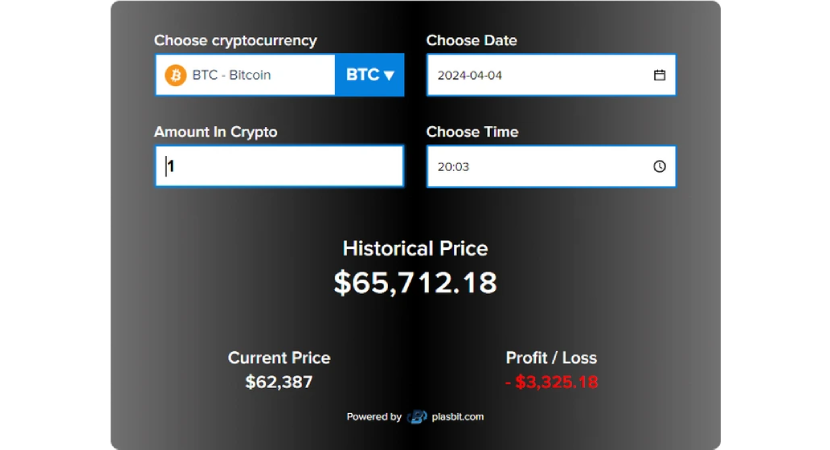

How To Use PlasBit History Calculator

Ready to know exactly what was the price of Bitcoin in 2015 at any time? The PlasBit history calculator is your key. Here is how you can use it to know the price of Bitcoin on any day, any time of the year.

1. On PlasBit’s “Site Widgets” page, You will find a list of calculators. Choose “History Calculator” among them.

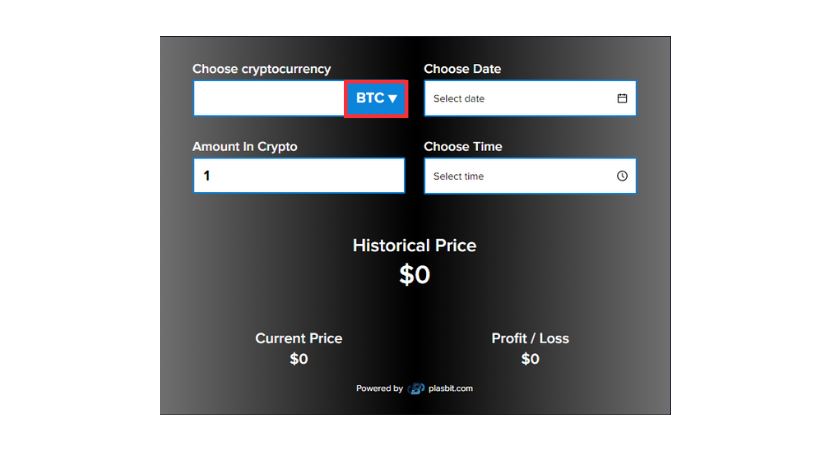

2. select “Bitcoin” from the cryptocurrency dropdown menu.

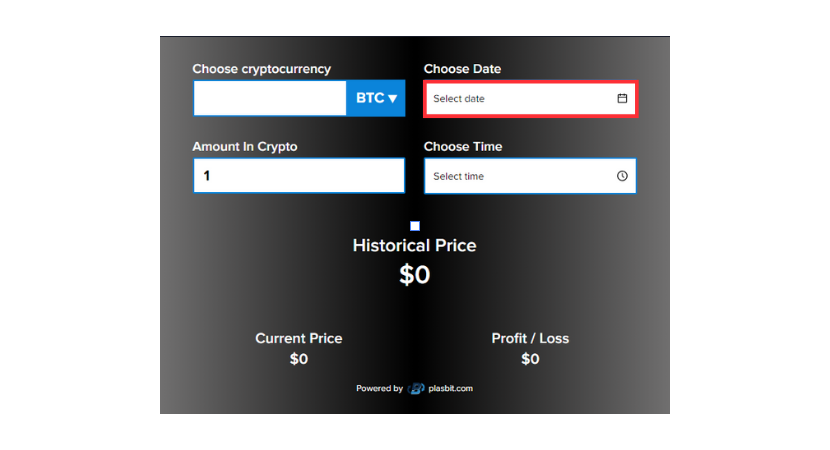

3. Choose your desired date in 2015. You can pick a specific day or use the calendar view for a broader range. This way, you can view trends and identify potential buying or selling opportunities based on historical data.

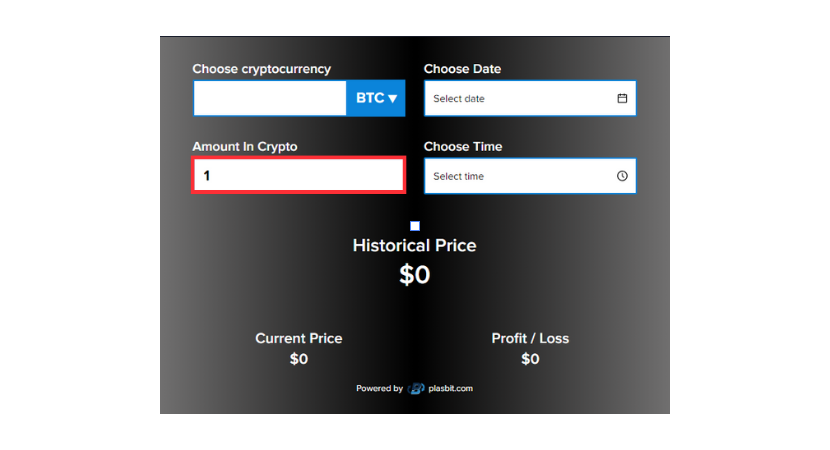

4. Enter the amount of BTC you would like to check.

5. Choose a specific time of the day.

6. When you press “OK,” like magic, the calculator displays the historical price of Bitcoin.

7. The calculator will also display “Profit/ loss” alongside the current price.

Comparison With Other Years

Here is a quick roundup of the price setting of Bitcoin in the years surrounding 2015.

2009 - 2014

Bitcoin’s infancy was marked by extreme volatility. Its price started practically at zero and then skyrocketed to a high of around $30 in 2011, and then plummeted back down dramatically. From 2012 - 2014, there was a continued volatility. The infamous Mt. Gox hack in 2014 significantly affected the price stability.

2015

Compared to previous years, 2015 was a period of relative stability. It started at $318 and ended at around $430. Price swings were less frequent, but there were still fluctuations.

2015 - Present

Bitcoin reached above $20000 in 2017 before experiencing a correction. The market has continued to evolve. As of April 2024, the price of Bitcoin is over $60000. There has been a continued adoption and institutional interest.

Lessons Learned From Bitcoin’s Historical Price Movements In 2015

● Volatility is key: Bitcoin’s price volatility throughout the year shows how unpredictable the cryptocurrency market is. Risk management is important for traders and investors.

● External factors influence price: Regulatory developments, technological advancements, macroeconomic events, and other external factors play major roles in price trajectory. It is important to understand and keep track of such factors.

● Long-term perspective matters: While short-term price fluctuations may capture headlines, taking a long-term perspective is essential for understanding the true potential of investment opportunities. Investors who remained steadfast in 2015 and did not cash out their Bitcoin investments were rewarded heavily in the subsequent years.

Conclusion

While the price of Bitcoin in 2015 may seem like a pittance compared to the valuation today (the price has experienced tremendous volatility as of April 2024 and has reached a high well above $60000), it marked a crucial turning point. The year witnessed a shift in perception, with Bitcoin transitioning from an experiment to a more established asset class. The slow and steady price throughout 2015 hinted at a future with greater stability and wider adoption. Use the PlasBit History Calculator to learn what was the price of Bitcoin in 2015 or any other year and invest smartly.