In cryptocurrencies, a "cash out" holds great intrigue and fascination. It represents the pivotal moment when digital assets are converted into tangible wealth, potentially transforming the lives of those involved. But what exactly does it mean to cash out Bitcoin, and what is the biggest cash out of Bitcoin? To begin our exploration, let's define what a "cash out" entails in cryptocurrencies. Essentially, it refers to converting Bitcoin or other digital currencies into traditional fiat currencies like the US dollar, euro, or government-issued money. This conversion allows individuals to access the financial value of their digital assets and use it for various purposes, such as making purchases, investing in other ventures, or simply securing their wealth.

Exploring the Biggest Cash Out of Bitcoin

When it comes to the biggest cash outs of Bitcoin, notable examples from history immediately come to mind. One such instance is the legendary story of Laszlo Hanyecz , who made the first documented real-world Bitcoin transaction in 2010. Hanyecz famously traded 10,000 Bitcoins for two pizzas, which, at the time, seemed like a small and insignificant transaction. However, with the astronomical rise in Bitcoin's value over the years, those two pizzas would now be worth millions of dollars. The monetary value and impact of the most significant Bitcoin cash out must be considered. They can reshape personal fortunes and even influence the overall cryptocurrency market. Consider the case of early Bitcoin adopters who, through strategic cash outs, have managed to amass vast wealth. Their actions demonstrated the potential profitability of cryptocurrencies and attracted the attention of mainstream investors and institutions, leading to further market growth. So, what is the biggest cash out of Bitcoin? Several factors contribute to the size of Bitcoin cash outs. Market volatility plays a significant role as individuals strive to identify opportune moments when Bitcoin's value peaks. Timing the cash out to coincide with favorable market conditions can result in substantial financial gains. Additionally, the overall supply and demand dynamics of Bitcoin and investor sentiment also impact the size of cashouts. Cashing out significant amounts can yield substantial returns when there is heightened interest and demand for Bitcoin. As we delve deeper into Bitcoin cash outs, it becomes evident that successful strategies are crucial for maximizing gains. In the following chapters, we will uncover the secrets behind such methods, including the importance of timing, diversification, tax considerations, and security measures. These insights will provide valuable guidance for anyone looking to embark on their Bitcoin cash-out journey. So, what is the biggest cash out of Bitcoin? We will explore the evolution of Bitcoin, tracing its path from digital curiosity to multi-million dollar cash outs. Discover the remarkable stories that have shaped the cryptocurrency landscape and set the stage for the transformative power of Bitcoin.

Bitcoin Evolution: From Digital Curiosity to Multi-Million Dollar Cashes

The pioneering cryptocurrency has come a long way since its inception. From its humble beginnings as a digital curiosity, it has evolved into a financial powerhouse, creating numerous opportunities for life-changing cash outs. We will explore the fascinating journey of Bitcoin's evolution and the record-breaking cash outs that have captivated the world. In the early days of Bitcoin, when it was first introduced by the pseudonymous Satoshi Nakamoto in 2009, it was primarily seen as an experimental digital currency with a niche following. Cash outs during this period were relatively modest, as the value of Bitcoin was still in its infancy. However, even these early cash outs laid the foundation for what was to come. As Bitcoin gained traction and more people began to recognize its potential, the value of the cryptocurrency started to soar. Bitcoin's value has been remarkable, with unprecedented growth and volatility. This upward trajectory paved the way for monumental cash outs that would change the lives of those who held substantial amounts of Bitcoin. So, what is the biggest cash out of Bitcoin? One of the most famous cash outs in Bitcoin's history is the case of the Winklevoss twins. Cameron and Tyler Winklevoss, early Bitcoin investors and entrepreneurs, made headlines in 2013 when they revealed that they had amassed a significant Bitcoin fortune. Their cash out of a portion of their holdings, valued at approximately $11 million at the time, showcased the immense potential for wealth accumulation within the cryptocurrency space. Another notable example is the story of Erik Finman, a teenage Bitcoin millionaire. Finman, who invested in Bitcoin at a young age, cashed out a substantial portion of his holdings at 18, amassing a fortune worth millions of dollars. His story not only demonstrates the life-changing possibilities of Bitcoin cash outs but also serves as inspiration for aspiring cryptocurrency investors. So, what is the biggest cash out of Bitcoin? The rise of institutional investors in the cryptocurrency market has also played a pivotal role in the size of Bitcoin cash outs. As more established financial institutions and high-net-worth individuals recognized the potential of Bitcoin, they began to allocate significant sums of money to the cryptocurrency. These institutional cash outs, often involving millions or even billions of dollars, have further solidified Bitcoin's position as a viable asset class. The impact of these record-breaking cash outs extends beyond individual fortunes. They have contributed to the overall growth and legitimacy of the cryptocurrency market, attracting mainstream attention and prompting further adoption. Bitcoin's journey from a digital curiosity to a valuable financial instrument has inspired countless individuals to explore the potential for their cash outs, fueling the continued evolution of the cryptocurrency landscape. But what is the biggest cash out of Bitcoin? In a historic event, a single Bitcoin wallet orchestrated a transaction that shattered all previous records, firmly securing its place as the largest Bitcoin trade. On April 10, 2020, an astounding 161,500 BTC, valued at approximately $1.1 billion, was transferred, making headlines within the crypto community and beyond. This unprecedented transaction caught the attention of astute observers closely monitoring the Bitcoin blockchain. What added intrigue to this monumental trade was that 146,500 bitcoins, a significant portion of the total amount, were returned to the sender's address. At the same time, the remaining 15,000 BTC found a new home in a separate wallet. The initial mystery surrounding this extraordinary transaction was quickly unraveled thanks to a tweet from Paolo Ardoino, the Chief Technical Officer (CTO) of Bitfinex. In his tweet, Ardoino revealed that the crypto-exchange had utilized the transaction to replenish its hot wallet, with the surplus bitcoins safely transferred back to one of its cold wallets. As we move forward, uncovering the secrets behind successful Bitcoin cash outs is crucial. In the next chapter, we will explore the strategies and considerations that can help individuals navigate the complexities of cashing out Bitcoin. From timing the market to managing risks and understanding the legal and financial implications, we will provide valuable insights to maximize the potential of your Bitcoin cash out journey.

Discovering the Strategies Behind Successful Bitcoin Cash Outs

Successful Bitcoin cash outs require careful planning, strategic decision-making, and a deep understanding of the cryptocurrency landscape. We will delve into the secrets behind achieving optimal results when cashing out Bitcoin. From timing the market to diversification and addressing legal considerations, these strategies will empower you to make informed choices and maximize the value of your Bitcoin holdings.

Timing Is Key

Bitcoin's price volatility is well-known, with significant fluctuations occurring over short periods. Timing your cash out strategically can make a substantial difference in the value you receive. Monitoring market trends, analyzing historical data, and staying informed about relevant news and events can help you identify favorable opportunities. It is essential to balance maximizing potential gains and minimizing the risks associated with market volatility.

Diversification and Portfolio Management

Diversification is a crucial strategy for managing risk in any investment portfolio, and it also holds for Bitcoin cash outs. Instead of cashing out all your Bitcoin holdings at once, consider a phased approach. By spreading your cash outs over time, you can benefit from favorable market conditions while minimizing the impact of price fluctuations. Diversifying your assets across different investment vehicles can further mitigate risks and protect your wealth.

Tax Considerations

Before embarking on a Bitcoin cash out journey, it is crucial to understand the tax implications in your jurisdiction. Tax regulations surrounding cryptocurrencies can be complex and vary from country to country. Seeking professional advice from tax experts or accountants familiar with cryptocurrency taxation. Compliance with tax obligations ensures legal compliance and helps you optimize your cash out strategy and preserve the value of your gains.

Best Practices for Secure Bitcoin Cash Outs

Security should be a top priority when cashing out Bitcoin. With the rising popularity of cryptocurrencies, cyber threats, and scams have also increased. Safeguard your Bitcoin holdings by implementing robust security measures. Utilize reputable cryptocurrency wallets, employ multi-factor authentication, and keep your private keys secure. Additionally, be vigilant of phishing attempts and fraudulent schemes, and only conduct cash outs through trusted platforms or exchanges. By employing these strategies, you can confidently navigate the complexities of Bitcoin cash outs. Remember, the journey doesn't end with cashing out; managing your newfound wealth responsibly and exploring secure avenues for holding and utilizing cryptocurrencies is crucial.

Unveiling the Secrets: Discovering the Strategies Behind Successful Bitcoin Cash Outs

Successful Bitcoin cashouts require careful planning, strategic decision-making, and a deep understanding of the cryptocurrency landscape. We will delve into the secrets behind achieving optimal results when cashing out Bitcoin. From timing the market to diversification and addressing legal considerations, these strategies will empower you to make informed choices and maximize the value of your Bitcoin holdings.

Timing Is Key

Bitcoin's price volatility is well-known, with significant fluctuations occurring over short periods. Timing your cash out strategically can make a substantial difference in the value you receive. Monitoring market trends, analyzing historical data, and staying informed about relevant news and events can help you identify favorable opportunities. It is essential to balance maximizing potential gains and minimizing the risks associated with market volatility.

Diversification and Portfolio Management

Diversification is a crucial strategy for managing risk in any investment portfolio, and it also holds for Bitcoin cashouts. Instead of cashing out all your Bitcoin holdings at once, consider a phased approach. By spreading your cashouts over time, you can benefit from favorable market conditions while minimizing the impact of price fluctuations. Diversifying your assets across different investment vehicles can further mitigate risks and protect your wealth.

Tax Considerations

Before embarking on a Bitcoin cashout journey, it is crucial to understand the tax implications in your jurisdiction. Tax regulations surrounding cryptocurrencies can be complex and vary from country to country. Seeking professional advice from tax experts or accountants familiar with cryptocurrency taxation. Compliance with tax obligations ensures legal compliance and helps you optimize your cash out strategy and preserve the value of your gains.

Best Practices for Secure Bitcoin Cash Outs

Security should be a top priority when cashing out Bitcoin. With the rising popularity of cryptocurrencies, cyber threats, and scams have also increased. Safeguard your Bitcoin holdings by implementing robust security measures. Utilize reputable cryptocurrency wallets, employ multi-factor authentication, and keep your private keys secure. Additionally, be vigilant of phishing attempts and fraudulent schemes, and only conduct cash outs through trusted platforms or exchanges. By employing these strategies, you can confidently navigate the complexities of Bitcoin cash outs. Remember, the journey doesn't end with cashing out; managing your newfound wealth responsibly and exploring secure avenues for holding and utilizing cryptocurrencies is crucial.

How to Cash Out BTC?

Our platform allows you to cash out safely, quickly, and confidentially. We will explore a step-by-step guide to understand the procedure better:

Step 1: Sign up on our platform. You only need an email and a secure password; the procedure only takes a few minutes

Step 2: Verify your email to complete your registration and gain access to our platform's features.

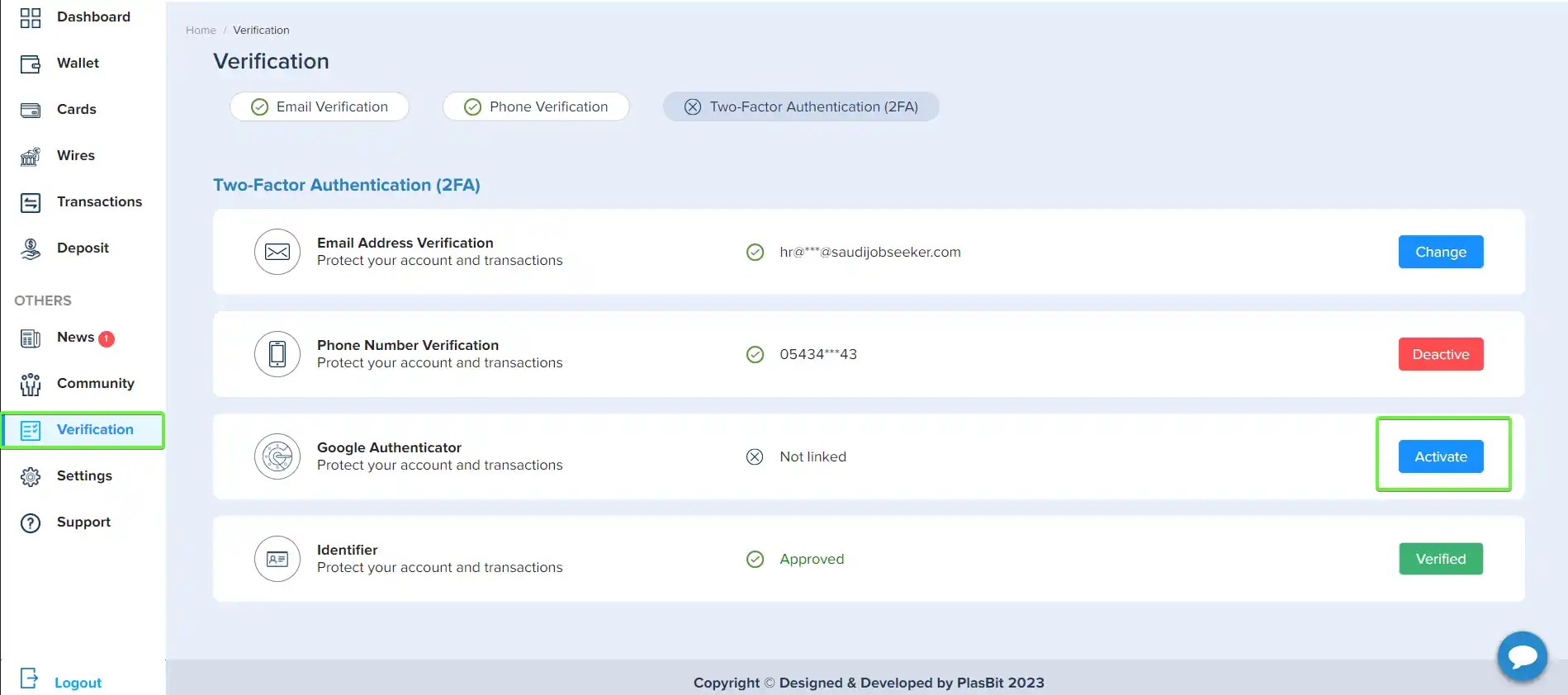

Step 3: Enable two-factor authentication for maximum security and peace of mind. You can do this by phone number or Google Authenticator.

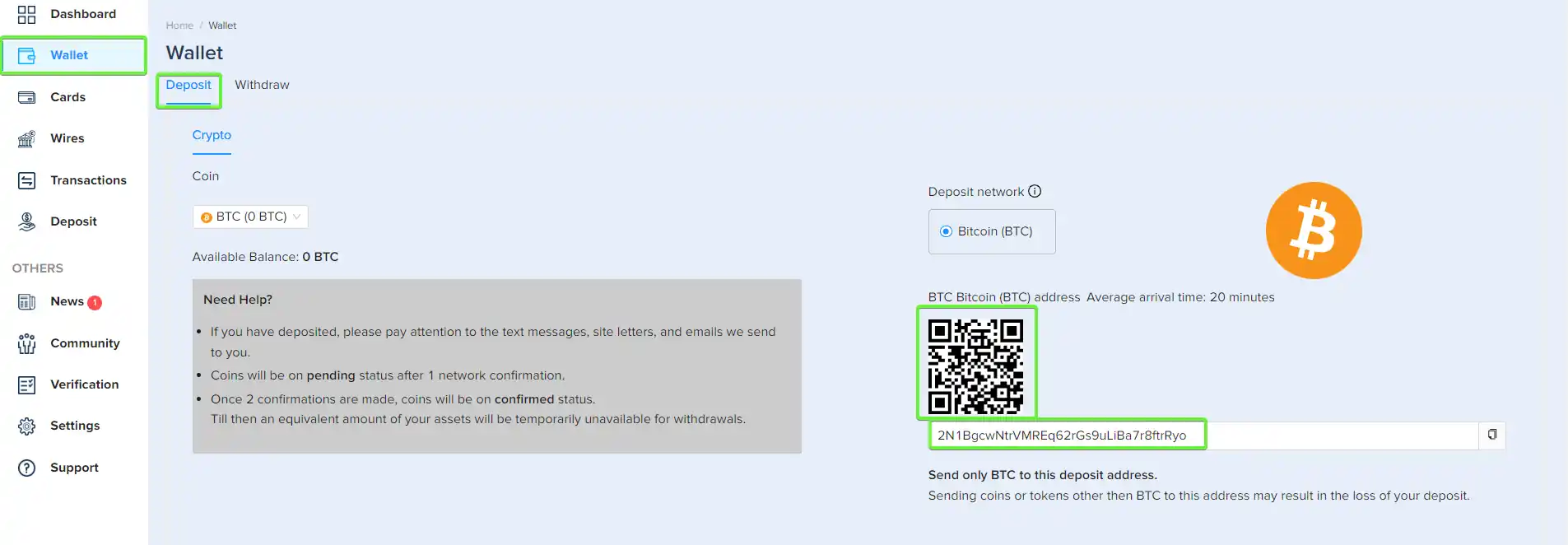

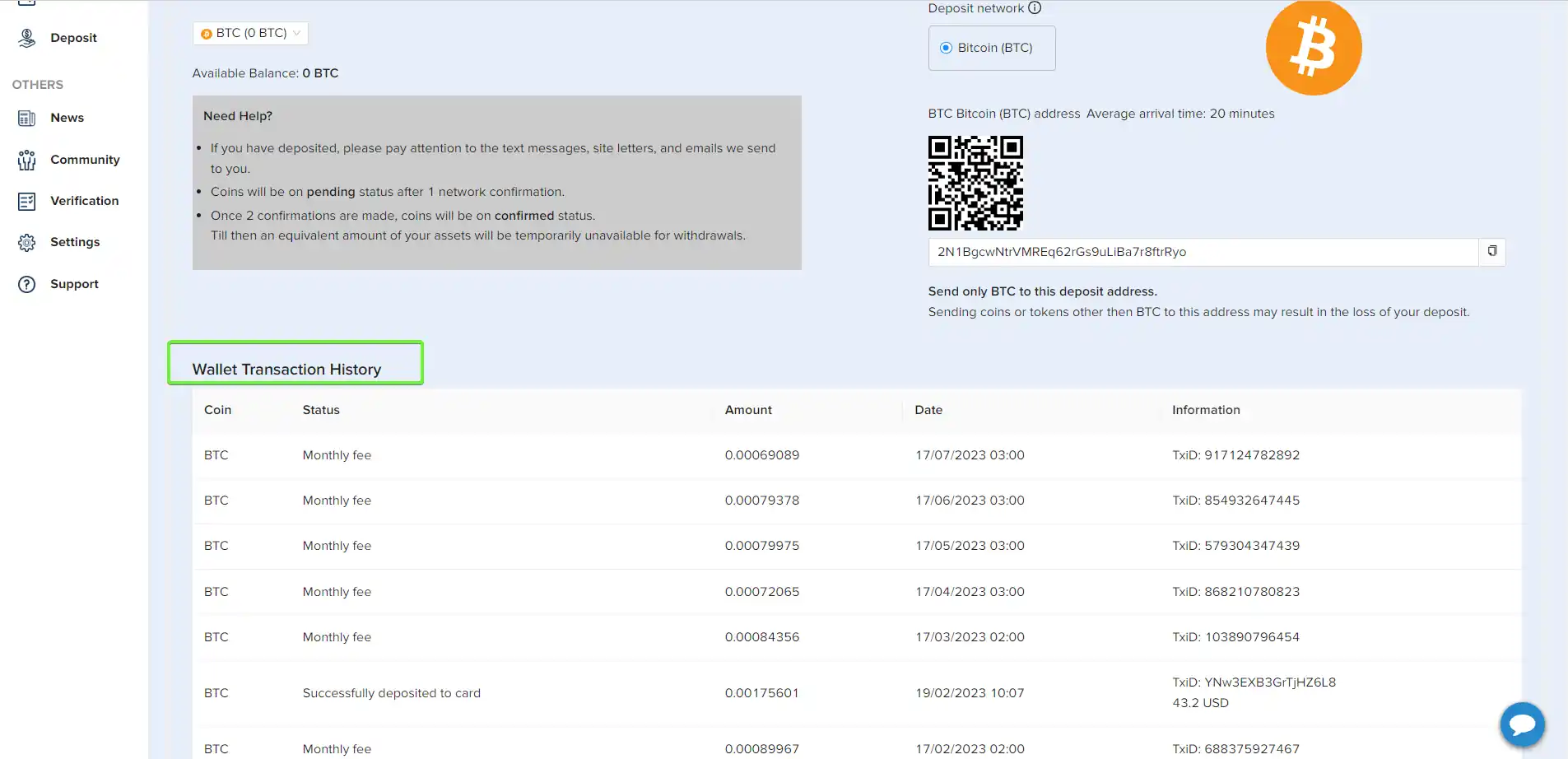

Step 4: Deposit your cryptocurrencies to start the cash-out process. You can do this by going to the Wallet section and clicking Deposit. Copy your wallet address to deposit into your account.

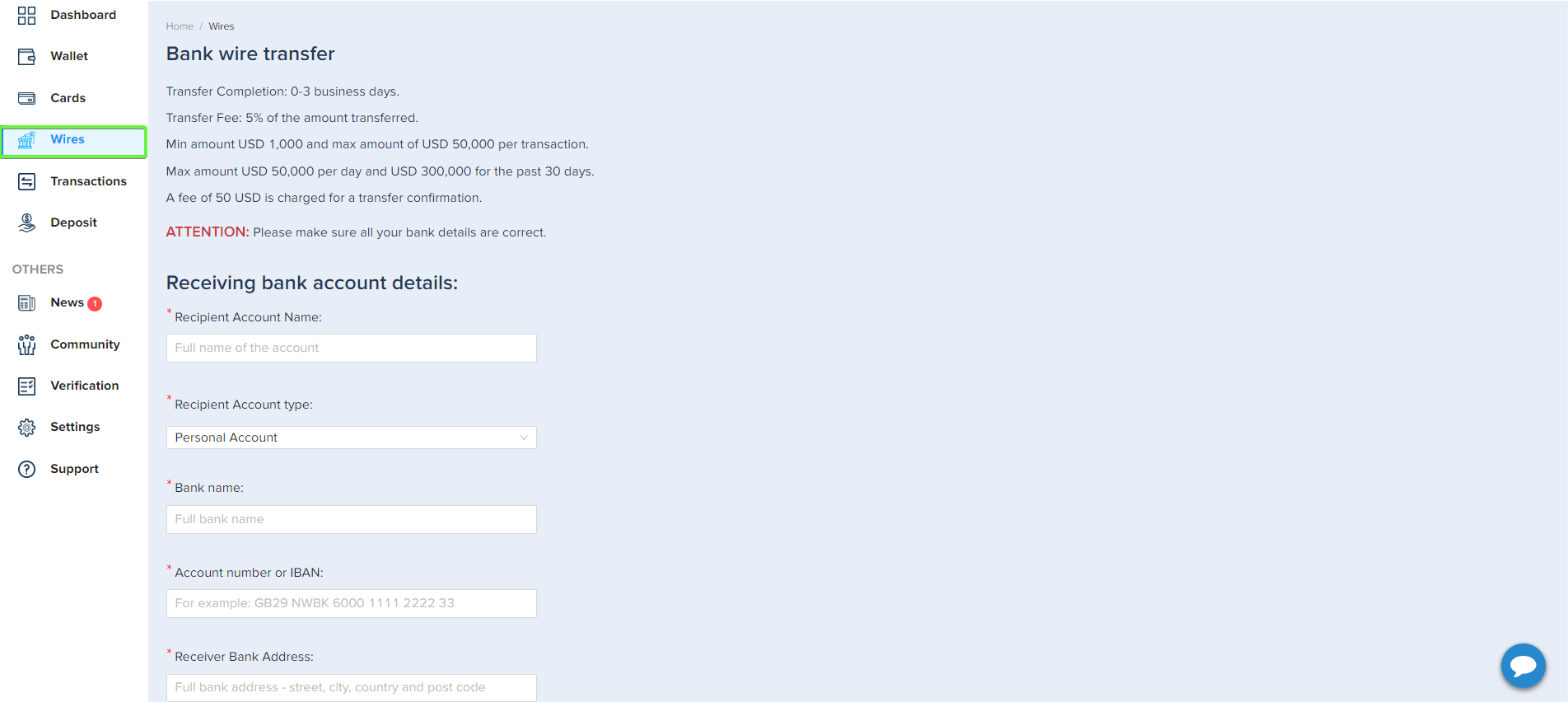

Step 5: Choose how to cash out with our debit cards or a wire transfer.

Using the card section, you will receive a debit card to make online and offline purchases and withdrawals from ATMs. You can send the money to a bank account using a wire transfer, and the crypto conversion will be done automatically.

Step 6: You have finally completed the cash-out process with security, confidentiality, and speed. Approve the transaction with two-factor authentication and receive your fiat currency, easily converted from cryptocurrencies. Check the transaction history for confirmation.

Your Secure Path to Holding and Utilizing Cryptocurrencies

In the fast-paced world of cryptocurrencies, finding a secure and convenient way to hold and utilize your digital assets is paramount. At PlasBit, we understand the challenges faced by cryptocurrency enthusiasts and have developed a cutting-edge platform to address them. We invite you to explore the learning part of our blog articles and discover why we are the ultimate solution for your cryptocurrency needs. We are more than just a platform; we are a gateway to a world of possibilities. Our mission is to empower individuals like you to embrace the potential of cryptocurrencies with confidence and ease. Whether you are a seasoned investor or new to the crypto landscape, our comprehensive suite of crypto debit cards caters to your unique requirements, offering seamless integration of traditional and digital currencies. With our Visa cards, you can conveniently convert your Bitcoin and other digital assets into spendable fiat currency, allowing you to make everyday purchases seamlessly. Security is at the forefront of our offerings. At PlasBit, we implement state-of-the-art security measures, including advanced encryption and secure protocols, to safeguard your funds and personal information. Our cold storage technology ensures you have complete control and ownership of your assets, mitigating the risk of unauthorized access or theft. As you embark on your Bitcoin cash out journey, consider us your trusted partner. Experience the benefits of crypto and join the growing community of individuals who easily hold and utilize cryptocurrencies.