Overall, Bitcoin's price dynamics in 2013 reveal the rapidly changing nature of the rising cryptocurrency market. Therefore, for those wondering what was the price of Bitcoin in 2013 it started at approximately $13.50 in January and soared to nearly $266 in April amid expanding interest. Then it had a sharp correction, plummeting to almost $50 with prices ranging between $70 to $120 during the summer and eventually reaching $1,150 in December.

In 2013, the crypto market was marked by high volatility and increasing attention from investors and the media. Despite skepticism from various critical voices, it was a period of rising public recognition of Bitcoin. The value of Bitcoin fluctuated dramatically under the influence of speculative trading, regulation, and new value developments in the emerging cryptocurrency sector. It was a turning point for Bitcoin's transition from complete market disinterest to mainstream financial matters.

You can check the Bitcoin price in 2013 and at any other point in time you wish using our history price calculator.

| DATE | OPEN | HIGH | LOW | CLOSE |

|---|---|---|---|---|

| December 31 2013 | $760.32 | $760.58 | $738.17 | $754.01 |

| December 30 2013 | $741.35 | $766.60 | $740.24 | $756.13 |

| December 29 2013 | $728.05 | $748.61 | $714.44 | $745.05 |

| December 28 2013 | $737.98 | $747.06 | $705.35 | $727.83 |

| December 27 2013 | $763.28 | $777.51 | $713.60 | $735.07 |

| December 26 2013 | $683.94 | $777.75 | $683.94 | $761.98 |

| December 25 2013 | $666.31 | $682.70 | $649.48 | $682.21 |

| December 24 2013 | $672.36 | $684.39 | $645.71 | $665.58 |

| December 23 2013 | $613.06 | $680.91 | $611.04 | $673.41 |

| December 22 2013 | $601.78 | $666.74 | $585.64 | $617.18 |

| December 21 2013 | $619.90 | $654.27 | $579.17 | $605.66 |

| December 20 2013 | $694.22 | $729.16 | $595.33 | $625.32 |

| December 19 2013 | $519.06 | $707.23 | $502.89 | $691.96 |

| December 18 2013 | $678.20 | $679.32 | $420.51 | $522.70 |

| December 17 2013 | $706.37 | $754.83 | $630.88 | $682.12 |

| December 16 2013 | $880.33 | $882.25 | $668.25 | $705.97 |

| December 15 2013 | $875.29 | $886.16 | $825.00 | $876.12 |

| December 14 2013 | $899.85 | $904.65 | $858.36 | $872.60 |

| December 13 2013 | $874.98 | $941.79 | $860.05 | $892.58 |

| December 12 2013 | $882.78 | $901.94 | $844.95 | $873.26 |

| December 11 2013 | $989.07 | $1,001.58 | $834.23 | $878.48 |

| December 10 2013 | $892.32 | $997.23 | $892.32 | $988.51 |

| December 09 2013 | $793.80 | $921.93 | $780.90 | $893.19 |

| December 08 2013 | $697.31 | $802.51 | $670.88 | $795.87 |

| December 07 2013 | $835.32 | $854.64 | $640.22 | $698.23 |

| December 06 2013 | $1,042.38 | $1,042.38 | $829.45 | $829.45 |

| December 05 2013 | $1,152.73 | $1,154.36 | $897.11 | $1,045.11 |

| December 04 2013 | $1,077.58 | $1,156.12 | $1,070.16 | $1,151.17 |

| December 03 2013 | $1,046.40 | $1,096.00 | $1,011.21 | $1,078.28 |

| December 02 2013 | $951.42 | $1,055.42 | $938.41 | $1,043.33 |

| December 01 2013 | $1,128.92 | $1,133.08 | $801.82 | $955.85 |

| November 30 2013 | $1,129.37 | $1,156.14 | $1,106.61 | $1,129.43 |

| November 29 2013 | $1,042.01 | $1,146.97 | $1,000.64 | $1,131.97 |

| November 28 2013 | $1,003.38 | $1,077.56 | $962.17 | $1,031.95 |

| November 27 2013 | $923.85 | $1,001.96 | $891.68 | $1,001.96 |

| November 26 2013 | $805.73 | $928.54 | $800.80 | $928.10 |

| November 25 2013 | $773.02 | $810.68 | $754.43 | $799.11 |

| November 24 2013 | $795.63 | $807.36 | $722.87 | $774.25 |

| November 23 2013 | $771.70 | $844.97 | $771.70 | $797.82 |

| November 22 2013 | $724.07 | $780.85 | $668.13 | $771.44 |

| November 21 2013 | $594.32 | $733.40 | $577.29 | $722.43 |

| November 20 2013 | $577.98 | $599.65 | $448.45 | $590.83 |

| November 19 2013 | $712.76 | $806.11 | $456.39 | $584.61 |

| November 18 2013 | $496.58 | $703.78 | $494.94 | $703.56 |

| November 17 2013 | $440.96 | $500.58 | $440.24 | $492.11 |

| November 16 2013 | $417.28 | $450.26 | $415.57 | $440.22 |

| November 15 2013 | $419.41 | $437.89 | $396.11 | $417.95 |

| November 14 2013 | $406.41 | $425.90 | $395.19 | $420.20 |

| November 13 2013 | $360.97 | $414.05 | $359.80 | $407.37 |

| November 12 2013 | $343.06 | $362.81 | $342.80 | $360.33 |

| November 11 2013 | $325.41 | $351.27 | $311.78 | $342.44 |

| November 10 2013 | $348.82 | $350.70 | $277.24 | $326.62 |

| November 09 2013 | $338.58 | $370.82 | $319.71 | $339.11 |

| November 08 2013 | $297.85 | $338.66 | $296.93 | $338.11 |

| November 07 2013 | $261.68 | $304.17 | $261.55 | $296.41 |

| November 06 2013 | $244.78 | $263.00 | $244.78 | $262.50 |

| November 05 2013 | $229.21 | $250.66 | $226.22 | $245.24 |

| November 04 2013 | $214.66 | $231.01 | $213.94 | $229.10 |

| November 03 2013 | $205.99 | $215.05 | $203.99 | $215.05 |

| November 02 2013 | $205.81 | $207.76 | $201.65 | $206.22 |

| November 01 2013 | $203.90 | $206.65 | $202.13 | $206.18 |

| October 31 2013 | $199.83 | $205.18 | $198.85 | $204.00 |

| October 30 2013 | $204.39 | $209.16 | $199.97 | $199.97 |

| October 29 2013 | $198.55 | $204.79 | $198.55 | $204.39 |

| October 28 2013 | $196.21 | $198.62 | $192.06 | $198.55 |

| October 27 2013 | $176.60 | $196.44 | $176.60 | $196.44 |

| October 26 2013 | $187.45 | $188.41 | $175.75 | $177.32 |

| October 25 2013 | $197.69 | $198.87 | $168.50 | $186.69 |

| October 24 2013 | $214.30 | $217.42 | $168.52 | $198.23 |

| October 23 2013 | $193.36 | $213.62 | $192.38 | $213.62 |

| October 22 2013 | $182.65 | $196.27 | $182.65 | $193.76 |

| October 21 2013 | $174.80 | $184.82 | $174.80 | $182.21 |

| October 20 2013 | $171.66 | $174.91 | $168.95 | $174.61 |

| October 19 2013 | $155.91 | $177.48 | $155.70 | $172.42 |

| October 18 2013 | $146.37 | $155.96 | $145.57 | $155.96 |

| October 17 2013 | $142.41 | $147.42 | $142.41 | $146.25 |

| October 16 2013 | $145.65 | $152.23 | $142.43 | $142.55 |

| October 15 2013 | $140.77 | $145.39 | $139.13 | $145.24 |

| October 14 2013 | $139.27 | $144.12 | $138.90 | $140.52 |

| October 13 2013 | $135.19 | $138.66 | $134.55 | $138.13 |

| October 12 2013 | $130.90 | $135.66 | $130.56 | $135.19 |

| October 11 2013 | $130.75 | $131.81 | $129.64 | $130.90 |

| October 10 2013 | $130.67 | $131.50 | $129.26 | $130.59 |

| October 09 2013 | $125.85 | $131.75 | $125.58 | $130.69 |

| October 08 2013 | $126.74 | $127.47 | $124.71 | $126.00 |

| October 07 2013 | $129.43 | $130.27 | $126.36 | $126.94 |

| October 06 2013 | $128.36 | $129.66 | $126.15 | $129.00 |

| October 05 2013 | $128.63 | $130.44 | $128.03 | $128.55 |

| October 04 2013 | $123.41 | $130.09 | $123.41 | $129.01 |

| October 03 2013 | $114.45 | $123.63 | $111.82 | $123.63 |

| October 02 2013 | $132.05 | $133.59 | $102.25 | $114.13 |

| October 01 2013 | $132.68 | $134.63 | $131.55 | $132.18 |

| September 30 2013 | $137.15 | $138.35 | $130.27 | $133.00 |

| September 29 2013 | $134.90 | $140.61 | $134.71 | $137.34 |

| September 28 2013 | $133.77 | $135.63 | $132.56 | $134.78 |

| September 27 2013 | $128.94 | $134.74 | $128.49 | $133.78 |

| September 26 2013 | $128.21 | $134.93 | $127.32 | $128.38 |

| September 25 2013 | $127.38 | $129.69 | $127.33 | $128.22 |

| September 24 2013 | $126.05 | $127.46 | $125.39 | $127.25 |

| September 23 2013 | $128.98 | $132.73 | $125.66 | $125.95 |

| September 22 2013 | $127.87 | $133.94 | $126.59 | $129.12 |

| September 21 2013 | $126.95 | $128.61 | $126.24 | $127.43 |

| September 20 2013 | $129.70 | $135.62 | $126.68 | $127.04 |

| September 19 2013 | $131.37 | $131.77 | $128.45 | $129.65 |

| September 18 2013 | $131.71 | $133.20 | $130.54 | $131.47 |

| September 17 2013 | $131.59 | $132.76 | $124.89 | $131.66 |

| September 16 2013 | $130.86 | $132.72 | $129.77 | $131.72 |

| September 15 2013 | $129.40 | $131.44 | $128.26 | $130.37 |

| September 14 2013 | $135.01 | $135.85 | $128.87 | $129.22 |

| September 13 2013 | $132.83 | $137.58 | $132.27 | $134.98 |

| September 12 2013 | $135.55 | $136.08 | $131.81 | $133.13 |

| September 11 2013 | $125.89 | $137.83 | $123.27 | $135.25 |

| September 10 2013 | $127.27 | $129.74 | $125.90 | $125.91 |

| September 09 2013 | $121.86 | $129.06 | $119.75 | $127.11 |

| September 08 2013 | $124.13 | $124.72 | $120.49 | $121.66 |

| September 07 2013 | $118.89 | $125.94 | $118.46 | $124.15 |

| September 06 2013 | $126.49 | $127.34 | $119.15 | $119.15 |

| September 05 2013 | $126.76 | $131.44 | $121.83 | $126.43 |

| September 04 2013 | $136.53 | $144.50 | $123.61 | $126.74 |

| September 03 2013 | $135.61 | $138.34 | $133.00 | $136.77 |

| September 02 2013 | $138.63 | $146.50 | $134.89 | $135.85 |

| September 01 2013 | $135.14 | $145.81 | $134.81 | $138.34 |

| August 31 2013 | $133.09 | $140.89 | $132.72 | $135.35 |

| August 30 2013 | $122.35 | $135.75 | $120.99 | $133.49 |

| August 29 2013 | $122.62 | $123.70 | $122.21 | $122.39 |

| August 28 2013 | $126.48 | $127.32 | $122.62 | $122.62 |

| August 27 2013 | $120.07 | $127.24 | $120.07 | $126.50 |

| August 26 2013 | $122.11 | $122.76 | $119.93 | $120.06 |

| August 25 2013 | $119.60 | $122.99 | $119.17 | $122.11 |

| August 24 2013 | $118.51 | $121.39 | $118.02 | $120.05 |

| August 23 2013 | $122.00 | $122.00 | $118.44 | $118.50 |

| August 22 2013 | $123.30 | $123.50 | $120.60 | $121.15 |

| August 21 2013 | $121.21 | $124.91 | $119.68 | $123.30 |

| August 20 2013 | $119.00 | $123.01 | $117.51 | $121.21 |

| August 19 2013 | $113.38 | $123.06 | $111.77 | $119.00 |

| August 18 2013 | $112.75 | $114.69 | $112.00 | $113.50 |

| August 17 2013 | $108.99 | $113.75 | $108.23 | $113.50 |

| August 16 2013 | $110.00 | $112.30 | $108.52 | $108.99 |

| August 15 2013 | $112.56 | $113.25 | $109.00 | $109.99 |

| August 14 2013 | $109.56 | $115.00 | $108.00 | $112.56 |

| August 13 2013 | $106.99 | $109.35 | $104.65 | $109.00 |

| August 12 2013 | $105.00 | $108.00 | $103.50 | $106.64 |

| August 11 2013 | $103.00 | $105.19 | $102.76 | $105.00 |

| August 10 2013 | $102.80 | $103.90 | $102.41 | $103.00 |

| August 09 2013 | $103.07 | $105.75 | $101.94 | $102.80 |

| August 08 2013 | $106.75 | $106.75 | $101.26 | $103.00 |

| August 07 2013 | $106.75 | $106.75 | $106.75 | $106.75 |

| August 06 2013 | $106.72 | $107.38 | $105.56 | $106.75 |

| August 05 2013 | $105.12 | $107.77 | $105.00 | $106.22 |

| August 04 2013 | $104.95 | $105.95 | $103.52 | $105.14 |

| August 03 2013 | $104.50 | $105.78 | $102.00 | $104.01 |

| August 02 2013 | $104.86 | $108.00 | $101.21 | $104.50 |

| August 01 2013 | $106.21 | $108.00 | $103.01 | $104.00 |

| July 31 2013 | $107.95 | $111.34 | $103.88 | $106.09 |

| July 30 2013 | $101.49 | $107.99 | $100.47 | $107.99 |

| July 29 2013 | $98.60 | $102.50 | $98.46 | $101.20 |

| July 28 2013 | $94.40 | $100.58 | $94.00 | $99.76 |

| July 27 2013 | $96.02 | $97.00 | $93.00 | $94.12 |

| July 26 2013 | $96.95 | $97.47 | $96.00 | $96.02 |

| July 25 2013 | $94.51 | $97.33 | $93.87 | $96.90 |

| July 24 2013 | $95.56 | $95.99 | $93.00 | $94.51 |

| July 23 2013 | $91.60 | $96.82 | $91.60 | $95.56 |

| July 22 2013 | $92.00 | $92.00 | $90.08 | $91.61 |

| July 21 2013 | $89.82 | $91.95 | $88.00 | $90.76 |

| July 20 2013 | $92.00 | $93.10 | $89.27 | $89.39 |

| July 19 2013 | $90.07 | $95.20 | $87.80 | $92.17 |

| July 18 2013 | $98.50 | $98.80 | $86.20 | $90.58 |

| July 17 2013 | $96.71 | $99.97 | $96.18 | $98.50 |

| July 16 2013 | $98.89 | $99.86 | $96.14 | $97.45 |

| July 15 2013 | $93.61 | $101.90 | $93.11 | $98.40 |

| July 14 2013 | $98.70 | $98.70 | $92.86 | $94.69 |

| July 13 2013 | $93.99 | $98.25 | $88.06 | $98.13 |

| July 12 2013 | $88.98 | $104.00 | $88.17 | $93.59 |

| July 11 2013 | $88.00 | $90.28 | $85.08 | $88.98 |

| July 10 2013 | $76.72 | $87.00 | $76.20 | $86.76 |

| July 09 2013 | $76.00 | $78.30 | $72.52 | $76.69 |

| July 08 2013 | $76.50 | $80.00 | $72.60 | $76.52 |

| July 07 2013 | $68.75 | $74.56 | $66.62 | $74.56 |

| July 06 2013 | $68.51 | $75.00 | $66.82 | $70.28 |

| July 05 2013 | $79.99 | $80.00 | $65.53 | $68.43 |

| July 04 2013 | $78.89 | $83.11 | $72.00 | $80.53 |

| July 03 2013 | $90.41 | $90.98 | $76.98 | $77.53 |

| July 02 2013 | $88.05 | $92.30 | $87.51 | $90.13 |

| July 01 2013 | $97.51 | $97.66 | $86.30 | $88.05 |

| June 30 2013 | $95.00 | $98.12 | $94.22 | $96.61 |

| June 29 2013 | $94.66 | $99.99 | $93.00 | $94.99 |

| June 28 2013 | $101.74 | $101.74 | $92.33 | $94.65 |

| June 27 2013 | $104.00 | $104.00 | $101.10 | $101.44 |

| June 26 2013 | $103.33 | $105.49 | $102.79 | $104.00 |

| June 25 2013 | $102.09 | $106.47 | $101.01 | $103.95 |

| June 24 2013 | $107.90 | $108.33 | $100.98 | $102.74 |

| June 23 2013 | $108.20 | $108.80 | $106.23 | $107.60 |

| June 22 2013 | $109.50 | $109.96 | $107.51 | $108.30 |

| June 21 2013 | $111.29 | $114.99 | $107.69 | $109.50 |

| June 20 2013 | $108.25 | $114.30 | $107.50 | $110.15 |

| June 19 2013 | $107.05 | $110.23 | $105.76 | $108.25 |

| June 18 2013 | $101.95 | $111.11 | $101.03 | $107.40 |

| June 17 2013 | $99.90 | $102.21 | $99.00 | $101.70 |

| June 16 2013 | $99.80 | $101.60 | $98.95 | $99.51 |

| June 15 2013 | $100.00 | $103.70 | $98.00 | $99.99 |

| June 14 2013 | $103.95 | $104.70 | $98.00 | $99.98 |

| June 13 2013 | $108.78 | $110.30 | $100.53 | $104.00 |

| June 12 2013 | $109.00 | $111.79 | $106.73 | $108.15 |

| June 11 2013 | $106.35 | $109.60 | $104.00 | $108.90 |

| June 10 2013 | $100.44 | $110.10 | $95.00 | $106.35 |

| June 09 2013 | $107.89 | $108.99 | $88.50 | $100.00 |

| June 08 2013 | $111.00 | $111.42 | $107.30 | $108.30 |

| June 07 2013 | $118.97 | $119.00 | $106.42 | $111.50 |

| June 06 2013 | $121.90 | $123.10 | $117.25 | $118.00 |

| June 05 2013 | $121.40 | $123.47 | $119.90 | $121.65 |

| June 04 2013 | $120.74 | $123.84 | $119.10 | $121.42 |

| June 03 2013 | $122.50 | $122.50 | $116.00 | $122.22 |

| June 02 2013 | $129.30 | $129.40 | $115.05 | $122.29 |

| June 01 2013 | $128.82 | $129.78 | $127.20 | $129.30 |

| May 31 2013 | $128.80 | $129.90 | $126.40 | $129.00 |

| May 30 2013 | $132.25 | $132.25 | $127.00 | $128.80 |

| May 29 2013 | $129.00 | $132.59 | $127.66 | $132.30 |

| May 28 2013 | $129.77 | $130.58 | $125.60 | $129.00 |

| May 27 2013 | $133.50 | $135.47 | $124.70 | $129.75 |

| May 26 2013 | $131.99 | $136.00 | $130.62 | $133.48 |

| May 25 2013 | $133.10 | $133.22 | $128.90 | $131.98 |

| May 24 2013 | $126.30 | $133.85 | $125.72 | $133.20 |

| May 23 2013 | $123.80 | $126.93 | $123.10 | $126.70 |

| May 22 2013 | $122.89 | $124.00 | $122.00 | $123.89 |

| May 21 2013 | $122.02 | $123.00 | $121.21 | $122.88 |

| May 20 2013 | $122.50 | $123.62 | $120.12 | $122.00 |

| May 19 2013 | $123.21 | $124.50 | $119.57 | $121.99 |

| May 18 2013 | $123.50 | $125.25 | $122.30 | $123.50 |

| May 17 2013 | $118.21 | $125.30 | $116.57 | $123.02 |

| May 16 2013 | $114.22 | $118.76 | $112.20 | $118.76 |

| May 15 2013 | $111.40 | $115.81 | $103.50 | $114.22 |

| May 14 2013 | $117.98 | $119.80 | $110.25 | $111.50 |

| May 13 2013 | $114.82 | $118.70 | $114.50 | $117.98 |

| May 12 2013 | $115.64 | $117.45 | $113.44 | $115.00 |

| May 11 2013 | $117.70 | $118.68 | $113.01 | $115.24 |

| May 10 2013 | $112.80 | $122.00 | $111.55 | $117.20 |

| May 09 2013 | $113.20 | $113.46 | $109.26 | $112.67 |

| May 08 2013 | $109.60 | $115.78 | $109.60 | $113.57 |

| May 07 2013 | $112.25 | $113.44 | $97.70 | $111.50 |

| May 06 2013 | $115.98 | $124.66 | $106.64 | $112.30 |

| May 05 2013 | $112.90 | $118.80 | $107.14 | $115.91 |

| May 04 2013 | $98.10 | $115.00 | $92.50 | $112.50 |

| May 03 2013 | $106.25 | $108.13 | $79.10 | $97.75 |

| May 02 2013 | $116.38 | $125.60 | $92.28 | $105.21 |

| May 01 2013 | $139.00 | $139.89 | $107.72 | $116.99 |

| April 30 2013 | $144.00 | $146.93 | $134.05 | $139.00 |

| April 29 2013 | $134.44 | $147.49 | $134.00 | $144.54 |

| April 28 2013 | $135.30 | $135.98 | $132.10 | $134.21 |

| April 27 2013 | $136.90 | $136.90 | $136.90 | $136.90 |

| April 26 2013 | $141.71 | $141.71 | $141.71 | $141.71 |

| April 25 2013 | $154.20 | $154.20 | $154.20 | $154.20 |

| April 24 2013 | $143.48 | $143.48 | $143.48 | $143.48 |

| April 23 2013 | $127.40 | $127.40 | $127.40 | $127.40 |

| April 22 2013 | $119.20 | $119.20 | $119.20 | $119.20 |

| April 21 2013 | $126.62 | $126.62 | $126.62 | $126.62 |

| April 20 2013 | $118.48 | $118.48 | $118.48 | $118.48 |

| April 19 2013 | $109.01 | $109.01 | $109.01 | $109.01 |

| April 18 2013 | $93.07 | $93.07 | $93.07 | $93.07 |

| April 17 2013 | $68.36 | $68.36 | $68.36 | $68.36 |

| April 16 2013 | $82.39 | $82.39 | $82.39 | $82.39 |

| April 15 2013 | $90.00 | $90.00 | $90.00 | $90.00 |

| April 14 2013 | $93.00 | $93.00 | $93.00 | $93.00 |

| April 13 2013 | $117.00 | $117.00 | $117.00 | $117.00 |

| April 12 2013 | $124.90 | $124.90 | $124.90 | $124.90 |

| April 11 2013 | $165.00 | $165.00 | $165.00 | $165.00 |

| April 10 2013 | $230.00 | $230.00 | $230.00 | $230.00 |

| April 09 2013 | $187.50 | $187.50 | $187.50 | $187.50 |

| April 08 2013 | $162.30 | $162.30 | $162.30 | $162.30 |

| April 07 2013 | $142.63 | $142.63 | $142.63 | $142.63 |

| April 06 2013 | $142.32 | $142.32 | $142.32 | $142.32 |

| April 05 2013 | $132.12 | $132.12 | $132.12 | $132.12 |

| April 04 2013 | $135.00 | $135.00 | $135.00 | $135.00 |

| April 03 2013 | $117.98 | $117.98 | $117.98 | $117.98 |

| April 02 2013 | $104.00 | $104.00 | $104.00 | $104.00 |

| April 01 2013 | $93.03 | $93.03 | $93.03 | $93.03 |

| March 31 2013 | $92.19 | $92.19 | $92.19 | $92.19 |

| March 30 2013 | $90.50 | $90.50 | $90.50 | $90.50 |

| March 29 2013 | $86.18 | $86.18 | $86.18 | $86.18 |

| March 28 2013 | $88.92 | $88.92 | $88.92 | $88.92 |

| March 27 2013 | $78.50 | $78.50 | $78.50 | $78.50 |

| March 26 2013 | $73.60 | $73.60 | $73.60 | $73.60 |

| March 25 2013 | $71.50 | $71.50 | $71.50 | $71.50 |

| March 24 2013 | $64.35 | $64.35 | $64.35 | $64.35 |

| March 23 2013 | $69.87 | $69.87 | $69.87 | $69.87 |

| March 22 2013 | $70.85 | $70.85 | $70.85 | $70.85 |

| March 21 2013 | $64.49 | $64.49 | $64.49 | $64.49 |

| March 20 2013 | $59.14 | $59.14 | $59.14 | $59.14 |

| March 19 2013 | $51.60 | $51.60 | $51.60 | $51.60 |

| March 18 2013 | $47.40 | $47.40 | $47.40 | $47.40 |

| March 17 2013 | $47.00 | $47.00 | $47.00 | $47.00 |

| March 16 2013 | $46.95 | $46.95 | $46.95 | $46.95 |

| March 15 2013 | $47.17 | $47.17 | $47.17 | $47.17 |

| March 14 2013 | $46.92 | $46.92 | $46.92 | $46.92 |

| March 13 2013 | $44.29 | $44.29 | $44.29 | $44.29 |

| March 12 2013 | $48.40 | $48.40 | $48.40 | $48.40 |

| March 11 2013 | $46.00 | $46.00 | $46.00 | $46.00 |

| March 10 2013 | $46.85 | $46.85 | $46.85 | $46.85 |

| March 09 2013 | $44.18 | $44.18 | $44.18 | $44.18 |

| March 08 2013 | $42.00 | $42.00 | $42.00 | $42.00 |

| March 07 2013 | $41.02 | $41.02 | $41.02 | $41.02 |

| March 06 2013 | $40.33 | $40.33 | $40.33 | $40.33 |

| March 05 2013 | $36.15 | $36.15 | $36.15 | $36.15 |

| March 04 2013 | $34.50 | $34.50 | $34.50 | $34.50 |

| March 03 2013 | $34.25 | $34.25 | $34.25 | $34.25 |

| March 02 2013 | $34.50 | $34.50 | $34.50 | $34.50 |

| March 01 2013 | $33.38 | $33.38 | $33.38 | $33.38 |

| February 28 2013 | $30.90 | $30.90 | $30.90 | $30.90 |

| February 27 2013 | $31.10 | $31.10 | $31.10 | $31.10 |

| February 26 2013 | $30.40 | $30.40 | $30.40 | $30.40 |

| February 25 2013 | $29.89 | $29.89 | $29.89 | $29.89 |

| February 24 2013 | $29.80 | $29.80 | $29.80 | $29.80 |

| February 23 2013 | $30.25 | $30.25 | $30.25 | $30.25 |

| February 22 2013 | $29.75 | $29.75 | $29.75 | $29.75 |

| February 21 2013 | $29.65 | $29.65 | $29.65 | $29.65 |

| February 20 2013 | $29.42 | $29.42 | $29.42 | $29.42 |

| February 19 2013 | $26.95 | $26.95 | $26.95 | $26.95 |

| February 18 2013 | $26.81 | $26.81 | $26.81 | $26.81 |

| February 17 2013 | $27.22 | $27.22 | $27.22 | $27.22 |

| February 16 2013 | $27.10 | $27.10 | $27.10 | $27.10 |

| February 15 2013 | $27.22 | $27.22 | $27.22 | $27.22 |

| February 14 2013 | $24.20 | $24.20 | $24.20 | $24.20 |

| February 13 2013 | $25.17 | $25.17 | $25.17 | $25.17 |

| February 12 2013 | $24.65 | $24.65 | $24.65 | $24.65 |

| February 11 2013 | $23.97 | $23.97 | $23.97 | $23.97 |

| February 10 2013 | $23.65 | $23.65 | $23.65 | $23.65 |

| February 09 2013 | $22.66 | $22.66 | $22.66 | $22.66 |

| February 08 2013 | $22.15 | $22.15 | $22.15 | $22.15 |

| February 07 2013 | $21.18 | $21.18 | $21.18 | $21.18 |

| February 06 2013 | $20.60 | $20.60 | $20.60 | $20.60 |

| February 05 2013 | $20.43 | $20.43 | $20.43 | $20.43 |

| February 04 2013 | $20.59 | $20.59 | $20.59 | $20.59 |

| February 03 2013 | $19.63 | $19.63 | $19.63 | $19.63 |

| February 02 2013 | $20.50 | $20.50 | $20.50 | $20.50 |

| February 01 2013 | $20.41 | $20.41 | $20.41 | $20.41 |

| January 31 2013 | $19.70 | $19.70 | $19.70 | $19.70 |

| January 30 2013 | $19.53 | $19.53 | $19.53 | $19.53 |

| January 29 2013 | $18.72 | $18.72 | $18.72 | $18.72 |

| January 28 2013 | $17.82 | $17.82 | $17.82 | $17.82 |

| January 27 2013 | $17.88 | $17.88 | $17.88 | $17.88 |

| January 26 2013 | $17.40 | $17.40 | $17.40 | $17.40 |

| January 25 2013 | $16.90 | $16.90 | $16.90 | $16.90 |

| January 24 2013 | $17.50 | $17.50 | $17.50 | $17.50 |

| January 23 2013 | $17.26 | $17.26 | $17.26 | $17.26 |

| January 22 2013 | $16.80 | $16.80 | $16.80 | $16.80 |

| January 21 2013 | $15.70 | $15.70 | $15.70 | $15.70 |

| January 20 2013 | $15.62 | $15.62 | $15.62 | $15.62 |

| January 19 2013 | $15.70 | $15.70 | $15.70 | $15.70 |

| January 18 2013 | $15.50 | $15.50 | $15.50 | $15.50 |

| January 17 2013 | $14.73 | $14.73 | $14.73 | $14.73 |

| January 16 2013 | $14.25 | $14.25 | $14.25 | $14.25 |

| January 15 2013 | $14.30 | $14.30 | $14.30 | $14.30 |

| January 14 2013 | $14.12 | $14.12 | $14.12 | $14.12 |

| January 13 2013 | $14.24 | $14.24 | $14.24 | $14.24 |

| January 12 2013 | $14.14 | $14.14 | $14.14 | $14.14 |

| January 11 2013 | $14.14 | $14.14 | $14.14 | $14.14 |

| January 10 2013 | $13.77 | $13.77 | $13.77 | $13.77 |

| January 09 2013 | $13.74 | $13.74 | $13.74 | $13.74 |

| January 08 2013 | $13.59 | $13.59 | $13.59 | $13.59 |

| January 07 2013 | $13.45 | $13.45 | $13.45 | $13.45 |

| January 06 2013 | $13.44 | $13.44 | $13.44 | $13.44 |

| January 05 2013 | $13.50 | $13.50 | $13.50 | $13.50 |

| January 04 2013 | $13.40 | $13.40 | $13.40 | $13.40 |

| January 03 2013 | $13.28 | $13.28 | $13.28 | $13.28 |

| January 02 2013 | $13.30 | $13.30 | $13.30 | $13.30 |

| January 01 2013 | $13.51 | $13.51 | $13.51 | $13.51 |

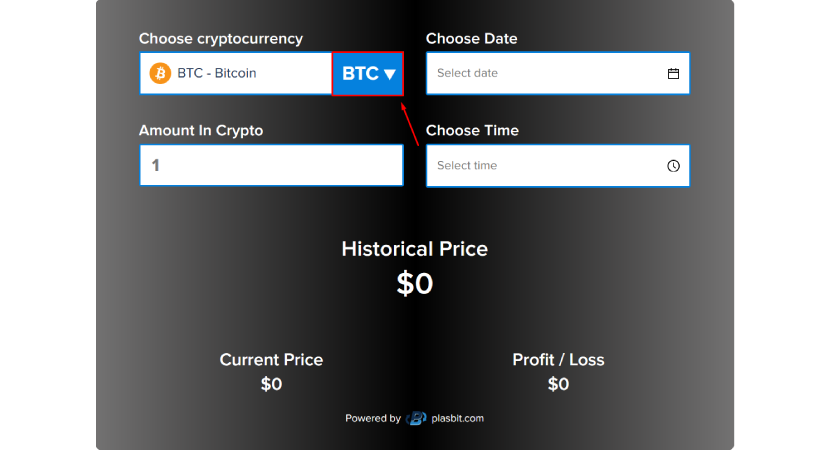

Finding the Historical Price of Bitcoin in 2013 Using the PlasBit History Calculator

What was the price of Bitcoin in 2013? To find out, you can use the PlasBit History Calculator. This unique tool contains all the necessary data about the cost of Bitcoin in a given date, and will allow you to calculate profit or loss. Let's look at how to use the PlasBit History Calculator.

Step 1: Choose the Cryptocurrency

On our calculator, select Bitcoin using the drop-down list.

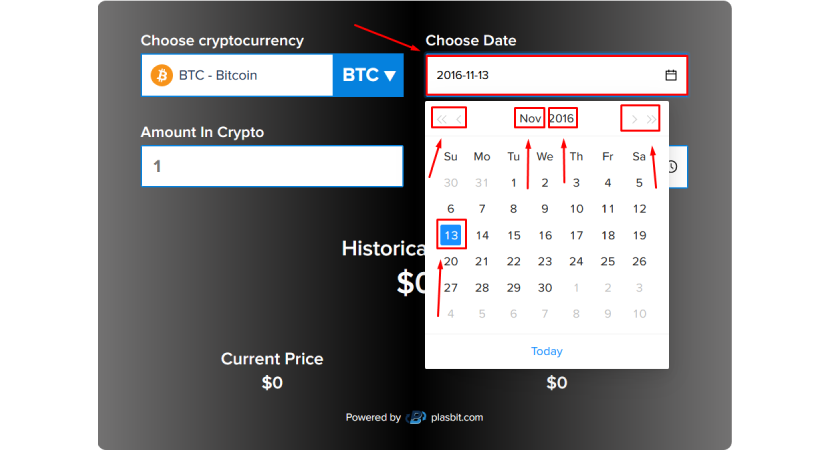

Step 2: Input Specific Dates

Choose the specific date you want checked into the calculator.

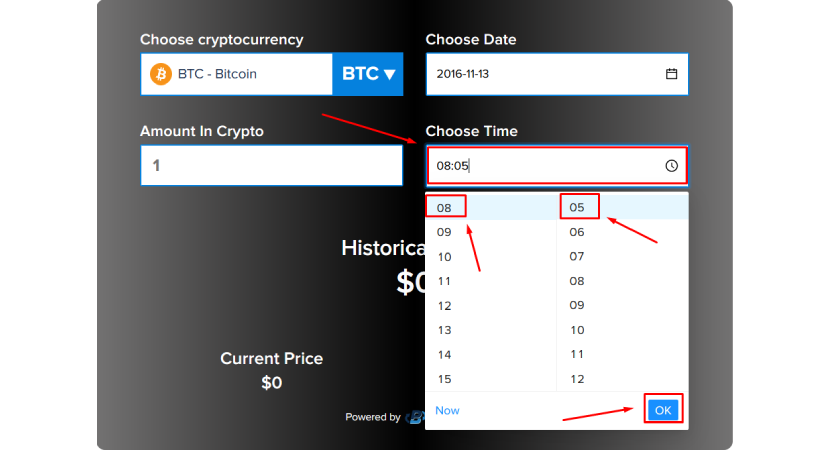

Step 3: Enter the Amount of Crypto

After selecting the date, enter the amount of Bitcoin you want to learn about. For instance, you can input 1 BTC, 2 BTC, or any amount.

Step 4: View the Prices

After entering the dates, the calculator will show you results with historical prices, the current price of the crypto, and the difference between historical and current prices.

The Creation of Bitcoin: Origins and Motivations

The 2008 financial crisis brought attention to the financial unrest and economic instability that led to the creation of Bitcoin, the first decentralized cryptocurrency. It's important to note that The identity of Satoshi Nakamoto, the pseudonym used by the person or group of people that are credited with the creation of this ground-breaking digital money, is still a mystery.

The Genesis of Bitcoin

The idea for Bitcoin was first formulated in 2008, when Satoshi Nakamoto released its whitepaper, "Bitcoin: A Peer-to-Peer Electronic Cash System," in October of the same year. This timing coincided with the global financial crisis, highlighting Bitcoin as an alternative to traditional financial systems.

Banks and governments negatively affected and disappointed millions of people worldwide, and the global economy experienced significant failures.

Reasons Behind the Creation of Bitcoin

The 2008 financial crisis, which rocked the global economy, creating widespread distrust in banks and the financial system. The recession was fueled by the collapse of key financial institutions, the housing market bubble, and unprecedented taxpayer-funded bailouts.

This interplay of economic instability and dissatisfaction with centralized banking powers served as the backdrop for the creation of Bitcoin. Here are the main reasons behind the creation of Bitcoin:

· Decentralization: Since Bitcoin is supposed to function without central authority, banks and governments have less influence over monetary policy and financial transactions.

· Transparency: The blockchain, a public database that records every Bitcoin transaction, encourages transparency and lowers the possibility of fraud and corruption.

· Security: Bitcoin transactions are secured by cryptographic methods, making it difficult for unauthorized parties to alter transaction data or commit fraud. This cryptographic security is fundamental to Bitcoin’s reliability and trustworthiness.

· Financial Inclusion: Bitcoin provided financial services to the unbanked and underbanked populations worldwide. By allowing individuals to transfer value without a traditional bank account, Bitcoin empowers people who are excluded from conventional financial systems.

· Decreased Transaction Fees: By eliminating middlemen, Bitcoin transactions could be completed with reduced fees compared to existing banking and payment systems.

Who is Satoshi Nakamoto?

Satoshi Nakamoto is the pseudonym used by the unknown person or group of people who created Bitcoin. Despite numerous attempts to uncover Nakamoto's identity, it remains one of the greatest mysteries in the cryptocurrency world. Nakamoto’s work included developing the Bitcoin protocol, authoring the whitepaper "Bitcoin: A Peer-to-Peer Electronic Cash System" published in 2008, and creating and deploying Bitcoin's original reference implementation.

Nakamoto mined the first Bitcoin block, known as the "genesis block," on January 3, 2009. Nakamoto was actively involved in the Bitcoin project’s development until 2010, when they ceased all communications and handed over control to other developers. Since then, Nakamoto's identity has been shrouded in secrecy, with no public appearances or verified communications.

To sum it up, Bitcoin emerged as a response to the failure of conventional banking systems exposed by the 2008 financial crisis. Satoshi Nakamoto envisioned a decentralized, transparent, and secure digital currency to give people control over their finances without relying on centralized institutions.

The State of the Crypto Market in 2013

2013 saw Bitcoin grow quickly, experience significant volatility, and gain more public recognition. The market dynamics were impacted by several significant international and economic events, which raised excitement and mistrust among investors and the general public.

Influential World and Economic Events

The following global and economic developments significantly influenced the 2013 cryptocurrency market:

Cypriot Financial Crisis

Another crisis that can be touched on is the Cypriot financial crisis in March 2013, which addressed the need for bank closures and capital controls. Depositors could lose their savings due to the proposed bailout plan.

As a result, people were disappointed in the banking system, and Bitcoin represented a safe haven and an alternative to fiat currencies. The significant increase in demand and popularity directly affected the rise in the price of the coin.

Regulatory Developments

In 2013, multiple governments and regulatory bodies began to acknowledge the existence of Bitcoin. In November, the U.S. Senate even held hearings on virtual currencies, resulting in officials being cautiously optimistic that Bitcoin could provide significant benefits while also expressing concern over its dangers.

This recognition brought more attention to the issue, with The People's Bank of China even going so far as processing Bitcoin transactions, which led to the currency's devaluation. This reaction was due to the market trying to understand the implications of regulatory changes on the future of cryptocurrencies.

Media Coverage

The wide fluctuations in the price of Bitcoin and the numerous potential applications made cryptocurrency an appealing topic for the media. Consequently, readers of major news outlets could have easily learned about Bitcoin's existence.

Articles ranged from recognizing the revolutionary potential of Bitcoin to expressing distrust and allegations of its use for criminal activities. Thus, in one way or another, between April and June 2011, the first mentions of Bitcoin were published on news platforms, which could already pique the interest of a random person.

Market Capitalization

The aggregated market capitalization of the cryptocurrency market increased significantly in 2013. As of the end of 2013, Bitcoin market capitalization had reached $12 billion.

This growth reflects investors' interest and the influx of financial resources into the cryptocurrency space. The rise shows that Bitcoin is becoming a recognized asset for a range of people, including investors and funds.

Biggest Investors and Influencers

The following well-known investors and early adopters had a significant impact on the 2013 cryptocurrency market:

1. Winklevoss Twins: The Winklevoss Twins, Cameron and Tyler, were two of the most well-known Bitcoin investors. They made their sizeable Bitcoin holdings publicly known, which increased market awareness and emphasized the cryptocurrency's potential as an investment. This contributed to the perception of Bitcoin as legitimate among many conventional investors.

2. Roger Ver:Often referred to as "Bitcoin Jesus," Roger Ver was among the first and most outspoken supporters of Bitcoin. He made significant investments in Bitcoin-related startups and was instrumental in promoting Bitcoin and its adoption. Ver's investments and advocacy helped grow the Bitcoin ecosystem.

3. Barry Silbert: Another important player in the cryptocurrency sector, Barry Silbert founded and served as CEO of Digital Currency Group. His financial contributions and encouragement of Bitcoin-related companies fueled the market's expansion and legitimacy. Silbert's role as an investor facilitated the greater acceptance and incorporation of Bitcoin into the financial sector.

4. Armstrong: Fred Ehrsam and Brian Armstrong, co-founders of Coinbase, introduced one of the most well-liked and approachable cryptocurrency exchanges. Coinbase's success was a major factor in the acceptance and accessibility of Bitcoin and other cryptocurrencies. Coinbase was instrumental in popularizing Bitcoin by offering a user-friendly platform for purchasing, selling, and storing cryptocurrency.

For those wondering what was the price of Bitcoin in 2013, it is clear that the year was marked by significant price fluctuations influenced by a variety of factors, including global economic events and the actions of prominent investors.

Overall, the 2013 cryptocurrency market saw increased mainstream media attention and heightened public interest, partly due to the influence and actions of these prominent figures. Their investments and endorsements helped transform Bitcoin from a niche digital asset to a recognized and legitimate financial instrument.

The Rise of Bitcoin: Reasons Behind Its Growing Popularity

Bitcoin's transformation into a generally accepted, valuable digital asset was caused by many different factors, including technological innovation, economic conditions, and an increasing level of trust among many users and investors. Many supporters saw promise, however, several factors helped grow Bitcoin’s popularity:

Technological Innovation

By implementing blockchain technology, Bitcoin revolutionized the way transactions were made by offering a decentralized and secure method of exchange without banks.

While traditional financial systems faced problems such as sizeable transaction fees, long processing times, and high risks of fraud, blockchain technology stabilized the exchange by enabling transparency and immutability.

These factors helped develop trust since all transactions were open for everyone to see and could not be changed once they were confirmed.

Response to Economic Instability

The economic crisis of 2008 revealed the fragility and dangers of the traditional banking system. While central banks and banking institutions worldwide desperately sought to contain and control the crisis, people grew disillusioned with conventional financial systems.

Bitcoin, which was not susceptible to the same weaknesses, became a viable option for an "alternative, digital gold," a potential "store of value " for financial sovereignty. Bitcoin was decentralized and, thus, not governed by one organization, thus drawing attention from people weary of centralized financial authorities.

Increasing Adoption and Awareness

When was Bitcoin used for the first time? Initially, Bitcoin was utilized only by a small group of technologists and enthusiasts. Still, gradually, it started gaining more popularity because systematic groups of its proponents and early adopters started promoting it.

Advocates significantly impacted the distribution of Bitcoin because developers, investors, and other fans reached the public and popularized the usage of Bitcoin in their companies.

Media Attention and Public Perception

The media also played a significant part in Bitcoin's rise by bringing it to the general public. Human interest stories about Bitcoin's skyrocketing prices, stories of Bitcoins in diverse sectors accepting the currency, and its disruptive potential in finance made it an attractive story to follow. Consequently, this was brought into the public light before people may have just heard of it in passing.

Network Effects and Community Support

The growing community of Bitcoin users, developers, and investors also helped to fuel adoption. The larger the community of people using and investing in Bitcoin, the more useful and valuable it becomes.

This was also due to the flourishing ecosystem of services and infrastructure around the currency. Exchanges, wallets, payment processors, and other services made it easier for people to buy, sell, and use Bitcoin, thus increasing its utility.

Regulatory Developments

Regulatory uncertainty posed a significant challenge for Bitcoin during its early stages of development. However, over time, various countries began to adopt regulatory frameworks that provided clearer guidelines and greater security for investors and users.

It is worth noting that fears about legal problems also disappeared as governments and state structures understood the possibilities and potential of blockchain and cryptocurrency.

Trust and Security

However, the increased trust in it as a security and reliability source happened to be the fundamentals of Bitcoin's increase. Unlike the long history of central banks, Bitcoin's innovative technology has been robustly developed over the years, enduring various challenges and attacks.

All possible risks to the sustainability of the security mechanism, such as leverage, attacks, and fiat currency acceptance, were easily externalized. As a result, people could think of Bitcoin as a security store and frictionless transaction instrument.

Why It Took So Long

The following factors contributed to the gradual adoption of Bitcoin:

· Technological Learning Curve: At first, only a more tech-savvy audience could adopt Bitcoin because it required a certain amount of technical understanding to understand and use.

· Distrust and Misunderstanding: The general public and financial specialists initially distrusted Bitcoin. Adoption was sluggish due to misconceptions over its potential, security, and application.

· Regulatory Uncertainty: Potential users and investors hesitated to proceed because the regulations were unclear. As the rules became more evident, more people felt at ease using Bitcoin.

· Market Volatility: Many saw Bitcoin as a risky investment due to its price's extreme volatility. This view price shifted as the market developed and more institutional investors joined the fray.

· Infrastructure Development: It took some time for the exchanges, wallets, and merchant services to come into being. Adoption rose as these services developed and got easier to use.

Conclusion

It took a long time for Bitcoin to get to where it is today, largely thanks to both how well off it's doing in terms of finance and the general public's deeper understanding of cryptos. From Bitcoin's incubation in reaction to the 2008 financial crisis through its dramatic ascent in 2013 and afterward. Bitcoin’s journey has been marked by innovation, fluctuation, and mounting usage levels as a viable alternative for global consumers.

Incremental improvements in technology and policy changes led to widespread appreciation of Bitcoin as possibly the first financial system that is decentralized secure and also secure and transparent for people using it. 2013 saw the emergence of the financial aspect of Bitcoin: fresh, powerful forces combined with some good fortune.

Besides this, capitalists began to get in on what would soon be a valuable digital asset. The factors driving Bitcoin's technological developments, economic insecurity, and the desire for financial freedom are enough to keep alive the fever that grips users and investors from around every corner of our World again today.

For those curious about what was the price of Bitcoin in 2013, understanding its long historical background is invaluable for comprehending the evolution of Bitcoin as a cryptocurrency and what has brought success.

As a symbol of blockchain technology's transformative power and decentralized financial systems' sustainable appeal, Bitcoin continues to grow stronger today. It went from a lifeless market niche into hot stuff for everyone's tastes. The story of how this happened shows the value of inventiveness and determination to meet change head-on for success.