Michael Saylor Bitcoin has been gaining attention as an unconventional but influential advocate and spokesperson for BTC. He is currently the founder and chairman of MicroStrategy, a publicly traded business intelligence firm that he founded in 1989. It is the public company that holds the largest amount of Bitcoin in the world (244,800 Bitcoin, currently valued at around $14.3 billion dollars; updated September 16, 2024). Michael Saylor Bitcoin prediction is $13 million per coin in 21 years (2045), and, even if it seems an ambitious prediction, it would mean that Bitcoin accounts for “only” 7% of the total global capital. This prediction came in a recent interview on CNBC on September 11, 2024, and Michael Saylor hypothesized different scenarios: In a bear case, by 2045, he predicts Bitcoin at $3 million (57x), the base case sees Bitcoin at $13 million (247x), while, in the most bullish hypothesis, he predicts an ambitious $49 million per coin (931x).

Michael Saylor Bitcoin accumulation strategy is currently working very well, and since MicroStrategy’s first purchase of Bitcoin in August 2020, its investment led to a remarkable average annual return of 44%, which is incredible compared to the S&P 500, the main benchmark for investments, that performed “only” 12% return in the same time frame (also considering that only a very small part of active traders and financial institutions manage to consistently outperform the S&P 500 over the years). Michael Saylor is betting hard on Bitcoin, considering it a “smart, fast, strong money” and “a bank in cyberspace, run by incorruptible software, offering a global, affordable, simple, and secure savings account to billions of people that don’t have the option or desire to run their own hedge fund.” Let’s analyze Michael Saylor’s life to understand the background that led him to become the greatest Bitcoin advocator and supporter in the world.

Michael Saylor: Who is he?

Michael Saylor was born in Nebraska on February 4, 1965, and during his childhood, he moved and lived among various U.S. Air Force bases worldwide with his family since the father was a chief master sergeant. At 18 years, in 1983, he enrolled at the Massachusetts Institute of Technology (MIT) on an Air Force Reserve Officers’ Training Corps (ROTC), also joining the Delta Chi fraternity, where he met the future co-founder of MicroStrategy, Sanju Bansal. He graduated in 1987 with dual degrees in aeronautics and astronautics, as well as in science, technology, and society. However, he couldn't become a pilot due to a medical condition. He got a job in The Federal Group, a consulting firm, in 1987, developing computer simulation modeling for software development, and in 1988 he became an internal consultant at DuPont. He continued developing computer models to predict market changes for this company, predicting the severe recession in many markets linked to DuPont, which happened in 1990.

The Growth of MicroStrategy

His military childhood, economic and technological background, and great interest in entrepreneurial ventures set the stage for the creation of MicroStrategy.

The Birth of MicroStrategy in 1989

At only 24 years old, in 1989, together with his college friend Sanju Bansal, he co-founded MicroStrategy, starting to provide business intelligence, mobile, and cloud-based software and services. Under his leadership, on average, the company doubled its revenue every year and became one of the leading companies, first in data mining and then in business intelligence services. One of the first great milestones was the $10 million contract won by MicroStrategy with McDonald’s in 1992, analyzing and improving their fractionated data to gain valuable insights and allowing them to improve their business performances.

MicroStrategy listing on the stock market in 1998

After expanding MicroStrategy’s business model and services, another big milestone for the company was on June 11, 1988, when it became a public company listed on major stock exchanges through an initial public offering. In just a few days of trading after its launch, MicroStrategy stock’s value doubled, experiencing remarkable growth. The company’s growth continued, and the value reached a new all-time high on Mar 10, 2000, reaching $313 per stock.

SEC filed a case against executives of MicroStrategy in 2000

However, as shown in the following chart, the company’s value quickly dropped in the following months during 2000 since the U.S. Securities and Exchange Commission (SEC) accused MicroStrategy of having overstated its revenue during the previous years, while it should have reported net losses from 1997 through 2000. Consequently, without admitting or denying the accusations, MicroStrategy was forced to pay disgorgement totaling $10 million (Saylor -- $8,280,000, Bansal -- $1,630,000, Lynch -- $138,000) and ordering each to pay a $350,000 civil penalty.

MicroStrategy Services Growth from 2000

After being fined by the SEC, MicroStrategy's price fell consistently. However, under the leadership of Michael Saylor, the company returned to growth (at a slower and more sustainable rate) over the year. The company started selling additional services, and increased its profitability, and, consequently, the stock’s price. For example, in 2009, MicroStrategy sold Alarm.com to ABS Capital Partners for $27.7 million; in 2010, Michael Saylor’s company started developing business intelligence services for mobile platforms (including, among many, Apple products such as iPhone and iPad); In 2011 it included more services focusing on cloud-based services; in 2013, it sold Angel to Genesys Telecommunications Laboratories for $110 million; in 2014, it introduced new platform called PRIME (Parallel Relation In-Memory Engine) in collaboration with Facebook. Another milestone was in 2014: Michael Saylor auto-reduced its salary from $875,000 to $1 and started laying off 770 employees, simplifying and optimizing the workflow of the company.

Michael Saylor Bitcoin Focus - Accumulation Phase from 2020

MicroStrategy, and Michael Saylor in particular, probably also due to the 2000’s SEC charge and the increasing amount of dollars printed by government and banks in recent years, changed approach and started buying Bitcoin. In July 2020, Saylor announced that he wanted to start focusing and investing in Bitcoin and other asset classes, not trusting fiat currencies for long-term capital preservation anymore. On 11 August 2020, MicroStrategy made the first purchase of Bitcoin in its history, paying $250 million to get 21,454 BTC, aiming to hedge against inflation, effectively storing their funds, and trying to profit from the long-term price appreciation of Bitcoin.

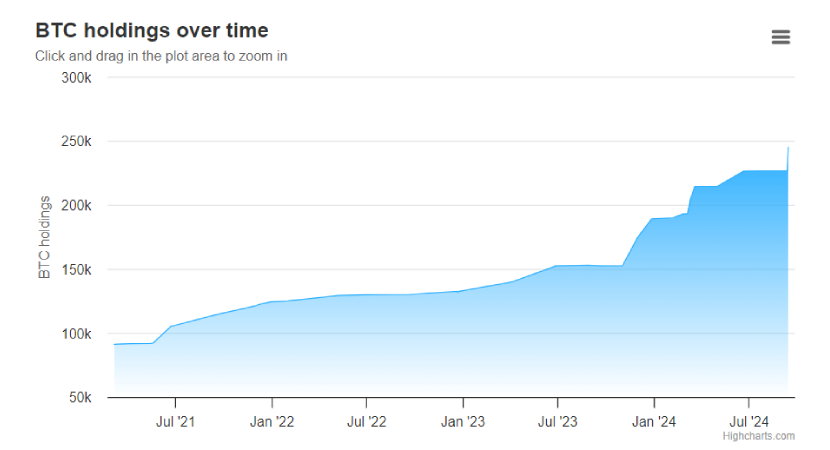

By the end of 2020, MicroStrategy already accumulated 70,470 BTC worth $1.125B. In August 2022, once the company had around $4 billion worth of Bitcoin, Michael Saylor resigned as CEO to focus on Bitcoin and continue its accumulation strategy, both in the company and personal life. Even if MicroStrategy and Michael Saylor are still accumulating Bitcoin (even at higher rates than before), we must point out that the company, on one occasion, sold part of their BTC: On December 2022, the company sold 704 BTC, valued around $11.8M ($16,750 per coin), and it might be considered the only time in which they “Bought high and sold low”. However, they started accumulating Bitcoin and have been doing it in the last few days. Currently, on 15 September 2024, MicroStrategy holds 244,800 BTC, valued at around $9.5 billion.

| Date | BTC Purchased | Amount invested | Total BTC | Total Dollars |

|---|---|---|---|---|

| 9/13/2024 | 18,300 | $1.11B | 244,800 | $9.45B |

| 8/1/2024 | 169 | $11.4M | 226,500 | $8.34B |

| 6/20/2024 | 11,931 | $786.0M | 226,331 | $8.33B |

| 4/1/2024 - 5/1/2024 | 164 | $7.8M | 214,400 | $7.538B |

| 03/19/2024 | 9,245 | $623.0M | 214,246 | $7.53B |

| 03/11/2024 | 12,00 | $821.7M | 205,000 | $6.91B |

| 02/26/2024 | 3,000 | $155.0M | 193,000 | $6.09B |

| 02/06/2024 | 850 | $37.2M | 190,000 | $5.93B |

| 12/27/2023 | 14,620 | $615.7M | 189,150 | $5.90B |

| 11/30/2023 | 16,130 | $593.3M | 174,530 | $5.28B |

| 11/01/2023 | 155 | $5.3M | 158,400 | $4.69B |

| 09/24/2023 | 5,445 | $147.3M | 158,245 | $4.68B |

| 07/01/2023 - 7/31/2023 | 467 | $14.4M | 152,800 | $4.53B |

| 04/29/2023 - 6/27/2023 | 12,333 | $347M | 152,333 | $4.517B |

| 04/05/2023 | 1,045 | $29.30M | 140,000 | $4.170B |

| 03/27/2023 | 6,455 | $150.00M | 138,955 | $4.140B |

| 12/24/2022 | 810 | $13.65M | 132,500 | $4.027B |

| 12/22/2022 | -704 | $11.8M | 131,690 | $4.012B |

| 11/01/2021 - 12/21/2022 | 2,395 | $42.8M | 132,395 | $4.024B |

| 9/20/2022 | 301 | $6M | 130,000 | $3.981B |

| 6/28/2022 | 480 | $10M | 129,699 | $3.975B |

| 2/15/2022 - 4/5/2022 | 4,167 | $190M | 129,218 | $3.965B |

| 1/1/2022 - 1/31/2022 | 660 | $25M | 125,051 | $3.775B |

| 12/30/2021 | 1,914 | $94.2M | 124,391 | $3.750B |

| 11/29/21 - 12/8/2021 | 1,434 | $82.4M | 122,478 | $3.655B |

| 11/28/21 | 7,002 | $414M | 121,044 | $3.573B |

| 9/13/21 | 8,957 | $419M | 114,042 | $3.159B |

| 6/21/21 | 13,005 | $249M | 105,085 | $2.740B |

| 5/18/21 | 229 | $10M | 92,079 | $2.251B |

| 5/13/21 | 271 | $15M | 91,850 | $2.241B |

| 4/5/21 | 253 | $15M | 91,579 | $2.226B |

| 3/12/21 | 262 | $15M | 91,326 | $2.211B |

| 3/5/21 | 205 | $10M | 91,064 | $2.196B |

| 3/1/21 | 328 | $15M | 90,859 | $2.186B |

| 2/24/21 | 19,452 | $1.026B | 90,531 | $2.171B |

| 2/2/21 | 295 | $10M | 71,079 | $1.145B |

| 1/22/21 | 314 | $10M | 70,784 | $1.135B |

| 12/21/20 | 29,646 | $650M | 70,470 | $1.125B |

| 12/4/20 | 2,574 | $50M | 40,824 | $475M |

| 9/14/20 | 16,796 | $175M | 38,250 | $425M |

| 8/11/20 | 21,454 | $250M | 21,454 | $250M |

Michael Saylor Bitcoin strategy: Why is he investing in BTC?

Michael Saylor, as he explained in various of his blog posts, videos, interviews, books, and social media content, started investing in Bitcoin for various reasons. Unlike many crypto investors, however, his focus is exclusively on Bitcoin, avoiding other cryptocurrencies. Why is Michael Saylor investing so heavily in Bitcoin? What are the beliefs behind his moves?

Bitcoin as a store of value and inflation hedge

The main reason, Michael Saylor emphasizes, is the ability of Bitcoin to serve as a store of value and a safe haven. Unlike fiat currencies, which are not limited in supply and are controlled by governments and banks, Bitcoin is inherently limited to 21,000,000 coins, making it deflationary and suitable to serve as a store of value. Bitcoin can help people hedge against inflation and overcome problems related to central banks policy, government money-printing and mismanagement, and more.

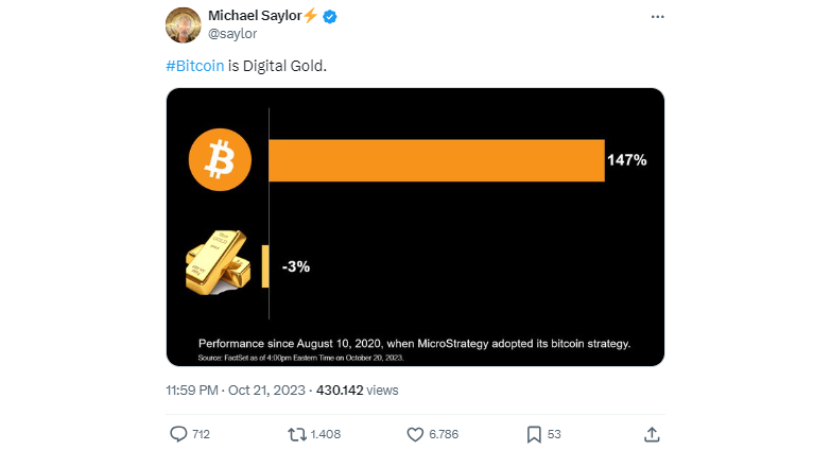

Bitcoin as digital gold

One of the most famous quotes of Michael Saylor is "Bitcoin is a superior investment to gold, equity bonds and real estate because it's digital. You can trade it a million times faster than conventional assets using a computer. It's available. Most other assets trade less than 20% of the time. Bitcoin is trading 168 hours a week”. It shows that Michael Saylor strongly believes in the potential of Bitcoin, comparing it to gold and underscoring that it could be even better. Performances apart, Bitcoin is more inherently limited than gold since its supply is capped at 21,000,000, while new deposits of gold are discovered over the years (without considering that gold is also present in space and in the future, it’s plausible that humans will be able to get gold also from other planets). Additionally, even if gold is tangible and comes in the form of physical metal, its storage and transportation are complex, requiring strong security measures and high costs. Conversely, Bitcoin is easier to store and move across the world, since it relies on crypto wallets secured with 24-words, allowing people to store and protect it more easily.

Decentralization and financial sovereignty

After being investigated by the SEC, Michael Saylor became skeptical about government and financial institutions (without considering the remarkable drop in the value of fiat currencies due to central banks and government quantitative easing policies). Consequently, one of his top priorities is freedom, financial sovereignty, and self-custody of his own assets. He correctly sees Bitcoin as a tool to give people sovereignty and full ownership over their own assets, and at PlasBit, we totally agree with his vision. For the first time in human history, people have the possibility to store wealth without relying on governments, banks, and other centralized systems that could have the authority to seize or control their assets. Bitcoin is based on a decentralized network without a central authority, a new revolutionary way to allow people to be the only responsible and controller of their own wealth.

Safe haven against financial instability and recessions

As we just mentioned, government and bank policies, recessions, black swans, wars, and social issues can cause significant instability among societies and financial assets. Fiat currencies, stocks, bonds, real estate, and other asset classes can be remarkably influenced by external factors, with the possibility of likely becoming worthless in a matter of days, weeks, or months. Bitcoin fixes this: becoming increasingly uncorrelated to traditional financial assets, it can become a safe haven against financial instability and recession. As Michael Saylor stated in one of his many famous tweets: “Nation state conflicts create uncertainty, constrain production, weaken currency, cripple trade, and undermine credit, making investments in debt & equity riskier and underscoring the benefit of converting treasury assets into pure digital energy. #Bitcoin”.

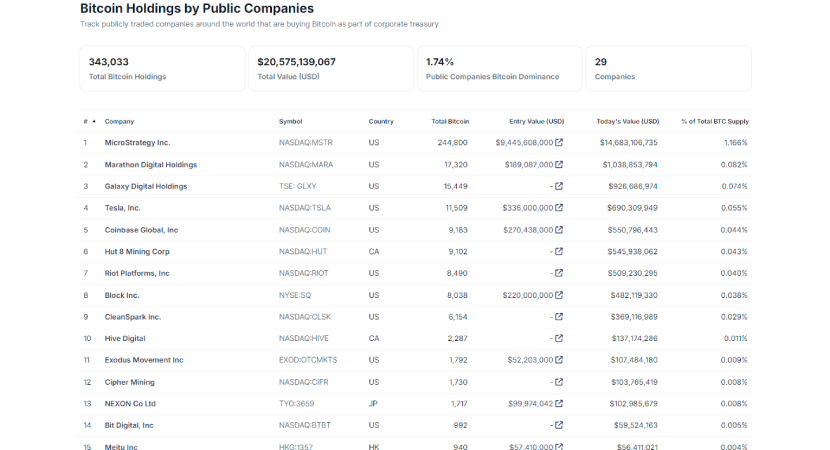

Michael Saylor Bitcoin: Is MicroStrategy the company that holds the most BTC?

Among the various entities that hodl the most Bitcoin, there are various well-known crypto companies, financial companies, and governments. However, we must distinguish that some companies, such as Binance, Blackrock, Grayscale, and more, do not actually hold BTC as a treasury reserve, but they do so for their clients. So, even if they have the largest BTC AUM (asset under management), the assets cannot be considered their property. In the following image, you can see the Top Bitcoin holders in the world, including, however, entities that hold it for clients and institutions. Michael Saylor Bitcoin accumulation strategy is evident and remarkable, with the company at the 5th place among all the top holders.

However, as shown in the following table, MicroStrategy is the first public company that actually hodl the most Bitcoin as its own treasury reserve, with 244,800 BTC, currently worth around $14.5 billion. This is the reason why we can definitely consider Michael Saylor as the biggest Bitcoin advocate in the world since his company owns the largest amount of BTC in the world. His strategy can be considered a huge success, with over $5 billion in profit, a performance of around +50%, and an incredible 1.16% ownership of all the BTC in circulation.

Conclusion: Will Michael Saylor and MicroStrategy stop to buy Bitcoin?

Despite volatility and price fluctuations, it seems unlikely that Michael Saylor and MicroStrategy will stop buying Bitcon and abandon their bullish vision for the future. As banks and government money-printing continue, inflation will keep increasing, and the valuation of fiat currencies will tend to zero. MicroStrategy and other companies and institutional investors have deeply understood the dynamics of quantitative easing policies and see Bitcoin as the best form of store of value and tool to hedge against inflation. Additionally, considering that governments are continuously increasing the control over citizens’ assets, people are looking for a reliable, secure, and autonomous way to store and preserve wealth, having full control and ownership over their own assets.

It’s very probable that the aggressive Bitcoin accumulation strategy of Michael Saylor and MicroStrategy will continue over time, and Michael Saylor could be considered the greatest Bitcoin advocator in human history. In a recent tweet on September 13, 2024, in fact, Michael Saylor announced that MicroStrategy had acquired an additional 18,300 BTC for $1.11 billion, and the company now holds an incredible amount of 244,800 BTC, with an average price of $38,585 per Bitcoin. In the future, economics and history books will likely speak about Michael Saylor and how it helped to educate people and spread a new, fairer form of digital money, decentralized, incorruptible, and unstoppable, incentivizing people to store and preserve their wealth autonomously, having full-ownership and sovereignty over their assets.