Understanding market momentum is key to successful trading, and one powerful tool for this purpose is the Relative Strength Index (RSI). You can learn how to use RSI in crypto trading by knowing that if the RSI rises above 70, the asset may be overbought, and the price may fall, indicating a good time to open a short position, but if the RSI drops below 30, the asset may be oversold, which could signal an upward trend, and your sign to open a long position. By effectively using RSI, traders can make more informed decisions based on market trends and better anticipate potential reversals.

In this PlasBit article, we will review the basics a crypto day trader needs to know about RSI. Moreover, we will go through a guide about adding and using RSI on a chart. We will also cover the different factors used in interpreting RSI results. Furthermore, we will go into financial and emotional risk management and give some tips on how to stay levelheaded in a volatile market. These are very important aspects of crypto day trading, and every trader needs to have such knowledge to increase their chance of success in this industry.

What is RSI?

The Relative Strength Index (RSI) is a commonly used technical analysis tool that helps measure the momentum and speed of price changes in financial markets. The first step in learning how to use RSI in crypto trading is understanding that this indicator is crucial for spotting whether an asset is overbought or oversold, which can signal a potential trend reversal or shift in the direction of the price.

How RSI is Calculated

RSI is calculated by comparing the average gains to the average losses over a set period. The formula gives a value between 0 and 100, where a higher number indicates that recent price gains outweigh losses, and a lower number suggests the opposite. The Relative Strength Index (RSI) is calculated using a straightforward formula.

RSI = 100 − (100 ÷ (1+RS))

In this formula:

RS stands for Relative Strength, which is the average gain divided by the average loss over the chosen period.

RS = Average Gain ÷ Average Loss

Let’s walk through a simple example of calculating the RSI for an asset over a 14-day period.

Step 1: Gather Price Changes Over 14 Days

Imagine we have the following price changes over 14 days:

- Days with Gains: +2%, +1.5%, +3%, +0.5%, +1%, +2.5%, +1%

- Days with Losses: -1%, -1.5%, -2%, -0.5%, -1.5%, -1%, -2%

Step 2: Calculate the Average Gain and Average Loss

Sum of Gains

2 + 1.5 + 3 + 0.5 + 1 + 2.5 + 1 = 11.5%

Sum of Losses

1 + 1.5 + 2 + 0.5 + 1.5 + 1 + 2 = 9.5%

We are calculating for a 14-day period

Average Gain = 11.5% ÷ 14 ≈ 0.82%

Average Loss = 9.5% ÷ 14 ≈ 0.68%

Step 3: Calculate the Relative Strength (RS)

Divide the average gain by the average loss

RS = Average Gain ÷ Average Loss = 0.82 ÷ 0.68 ≈ 1.21

Step 4: Apply the RSI Formula

RSI = 100 − (100 ÷ (1 + 1.21))

RSI = 100 − (100 ÷ 2.21)

RSI= 100− 45.25 ≈ 54.75

In this example, the RSI is approximately 54.75. This value suggests that the asset is neither strongly overbought nor oversold, so it might indicate a stable trend rather than an immediate buy or sell signal.

RSI is a valuable tool for traders looking to identify possible reversal points and confirm trends in the market. By providing insight into price momentum and the balance between recent gains and losses, RSI supports more strategic trading decisions.

How to Use RSI

Another part of learning how to use RSI in crypto trading is setting it up on your chart and understanding how to interpret the results.

A Step by Step Guide on Using RSI

This step-by-step guide will walk you through setting up RSI on your chart customizing its settings.

Find the indicators tab

Find the indicators button and press it to access the indicator page.

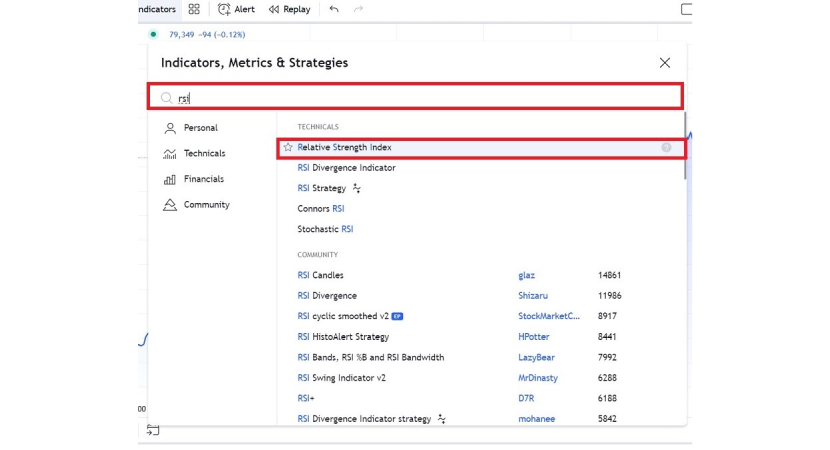

Search RSI

In the search bar, type RSI or Relative Strength Index and click once to add an RSI to your chart.

Change RSI Setting

You can change the RSI line’s position by clicking and dragging the RSI line. Select the RSI text on the left side of your chart. Then, from the menu, click on the gear icon.

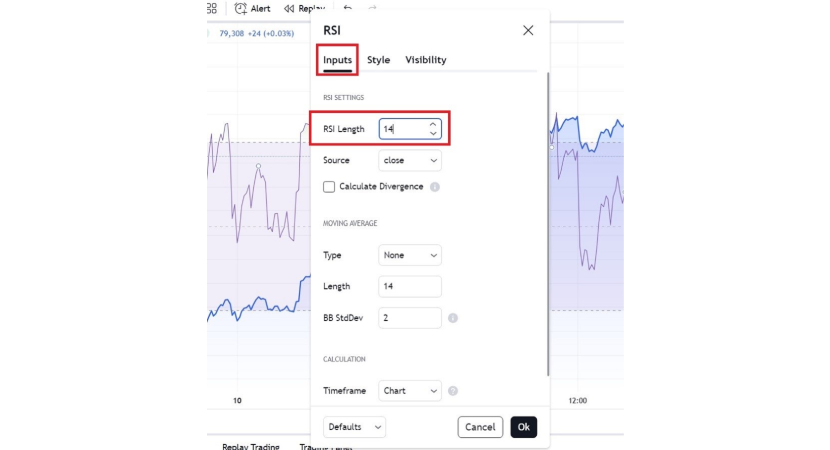

Inputs Page

In the Inputs page you can change the length of RSI.

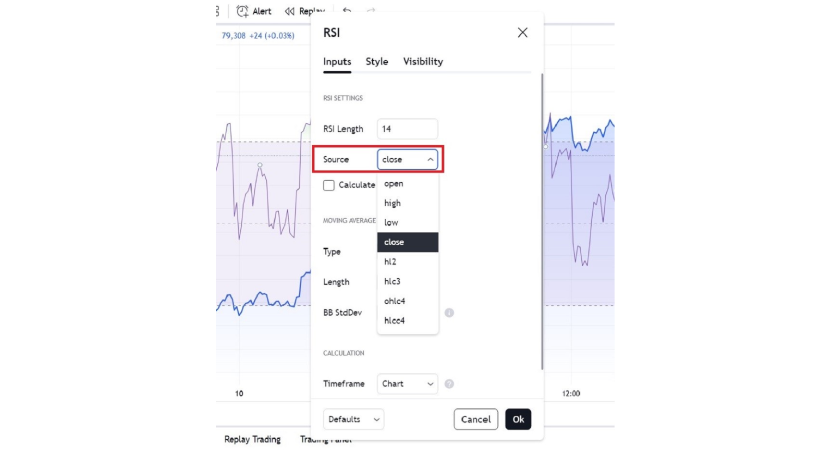

You can also change the source of price used in measuring the RSI.

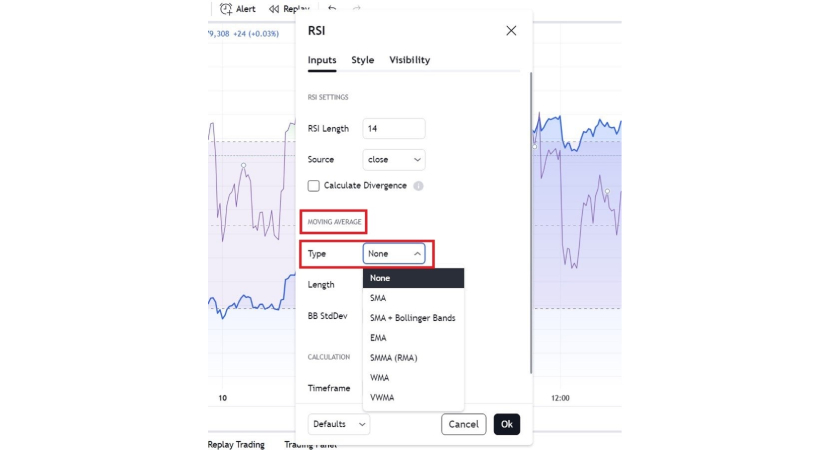

There is also an option for adding various moving averages, which can give you a side-by-side comparison with RSI.

How to Interpret and Read RSI

If the RSI is over 70, the asset may be considered overbought, indicating that it might have been bought by too many traders, which could signal a possible price drop and an opportunity to open a short position.

An RSI below 30 suggests it may be oversold, meaning the price could rise, a signal to open a long position.

You might want to enter the trade when the RSI moves away from these extremes and back toward the middle, which signals a strong trend that may continue.

Divergence

Divergence happens when the price of a crypto and its RSI go in opposite directions, which can signal a reversal in trend. In a bullish divergence, the price keeps going down, but the RSI starts going up, suggesting the downtrend might be slowing and an uptrend could be coming.

In a bearish divergence, the price keeps going up, but the RSI begins to go down, meaning the upward trend might be losing strength, and a downward trend could be on the way.

By analyzing RSI levels, divergence patterns, and trend behaviors, traders gain a comprehensive view of market momentum and understand the basics of how to use RSI in crypto trading. This knowledge helps them in making well-informed trading decisions. But remember, if you’re new to trading, try this strategy with a demo account or through “paper trading” to practice without risking real money and see if it suits you.

Risk Management in Trading

Risk management is at the core of protecting your capital and building a sustainable approach toward the markets. So, understanding and applying basic principles of financial and emotional risk management make quite a difference in minimizing losses and maximizing profitability over time.

Financial Risk Management

There are many ways in which traders can take control of their financial exposure and manage financial risk effectively. Here are some tips that will provide realistic guidance on how to start trading crypto with effective financial risk management strategies. Learning such tips can give you the ability to protect your assets while growing and learning in trading.

Develop a Comprehensive Trading Plan

You should have a good trading plan that lays out a roadmap for your future actions. This includes your financial goals, your level of risk tolerance, and the strategies you intend to use to reach your goal. Moreover, to perfect your plan, you should also consider entry and exit criteria, profit targets, and maximum allowable losses. Having such a trading plan sets effective barriers before getting caught up in impulsive actions. Developing a perfect plan also helps you prepare for different possibilities and events. This keeps you disciplined because you are less affected by market sudden changes.

Review and Adjust Your Plan

The crypto market is dynamic, and a static plan gets outdated very fast. Constant review and refinement of your trading plan allows you to adapt to new conditions, learn from past trades, and fine-tune your strategies. Furthermore, this will help you easily build confidence, improve over time, and keep your approach fresh and appropriate.

Diversify Your Portfolio

Diversification spreads your investments across different assets and sectors. Instead of holding all the funds in one crypto, diversification balances the exposure so that the potential losses in one security can be gained in another area. This also helps beginners keep volatility on the lower scale and create a more stable portfolio.

Use Proper Position Size

When trading cryptocurrency, it's important to decide how much to invest in each trade based on your total budget and how much risk you're willing to take. This strategy helps make sure that if a trade doesn't go as planned, your loss is still within an acceptable limit. Beginners should particularly focus on setting their trade sizes carefully to protect their capital from large losses.

Avoid Overleveraging

Leverage in crypto trading is a financial tool that allows you to borrow money to increase your investment capacity. It enables you to trade larger amounts than what is available in your trading account, potentially increasing your profits on successful trades. However, using leverage can also magnify your losses if the market moves against you. Because of the high risk associated with leverage, it's generally not recommended for new traders. If you must use leverage as part of your strategy, keep it to a minimum. This approach helps you develop a sustainable trading method without risking a large portion of your capital on a single trade.[NK3]

Stay Informed About Market Conditions

Keep track of market trends, economic indicators, and world events to make more informed trading decisions. This will allow you to predict volatilities or changes in momentum and thus modify your strategies based on the new market trends. For example, following Donald Trump's victory in the 2024 U.S. presidential election, Bitcoin surged to a record high, surpassing $75,000. This increase is attributed to expectations of a more favorable regulatory environment for cryptocurrencies under Trump's administration.

By applying these financial risk management techniques, beginners can face the trading environment more confidently and securely. Each of these strategies enhances the foundation for stable trading. Knowledge of such methods also helps traders preserve their capital and grow their trading knowledge with time and experience. Such principles enable traders to make informed decisions even under the most turbulent market conditions. By learning about these techniques as a new trader, you can be sure that your financial risks are appropriately managed.

Emotional Risk Management

People often overlook emotional risk management, which is just as vital as managing financial risks. Mastering how to regulate emotions like fear, greed, and stress can make trading for beginners balanced and less overwhelming. There are many techniques that can help traders keep a positive mindset throughout the ups and downs of trading. Here are some tips and techniques that help you enhance emotional control, build discipline, and develop the mental toughness required to sustain success throughout your trading journey.

Develop Emotional Discipline

Emotional discipline refers to the process of controlling emotions during trading. Emotions like fear, greed, or frustration lead to impulsive decisions and risks. So, you should develop emotional discipline to make decisions based on strategy and data. This results in greater performance consistency and effective risk management.

Practice Stress Management

Techniques such as meditation or deep breathing help you stay calm during stressful situations. Training and using mindfulness techniques also strengthens resilience, enabling you to easily focus when market fluctuations create chaos. Mastering such techniques reduces the effect of stress on your trades and allows you to make more logical decisions.

Avoid Trading Under Emotional Discomfort

The worst time to trade is when you are anxious, frustrated, or distracted. Strong emotions cloud judgment and lead to poor decisions. Taking a break and returning later will help clear your mind and reduce emotional risk. This allows you to approach the market in a rational and disciplined manner.

Seek Support and Education

Trading communities, forums, and mentorship programs can provide you with emotional support and learning opportunities. Furthermore, interaction brings fresh perspectives and helps reduce stress and feelings of isolation. Also, new traders can learn from the shared experiences and get encouragement.

Establish a Routine

A consistent routine provides structure to the trade. This helps you stay organized and focused. Routine will reinforce discipline and predictability, which are essential in controlling trades and emotions. A structured approach reduces distractions and creates a more stable trading experience.

Focus on Process Over Outcomes

To reach long-term success, you must focus on the proper execution of the trade, not on profits or losses. As traders learn to follow the process, they refine their skills and develop consistent, disciplined habits. Doing so can minimize your emotional reactions to individual trade outcomes by focusing on a long-term perspective.

Limit Information Overload

With too much information comes many conflicting opinions. Not effectively managing information leads to different contradictory analyses. So, you need to filter the information you consume. This way, you can stay focused on relevant data instead of being overwhelmed. Furthermore, reducing information overload leads to better decision-making.

Mastering emotional risk is a process that takes time, but learning about these techniques will give you the ability to start your trading journey strong. Being disciplined, mindful, and self-reflective can help new traders feel much more at ease when going through the ups and downs of trading. Moreover, emotionally resilient traders are generally calm and objective in order to be more consistent and strategic in their decision-making. Building a solid emotional foundation makes you feel much more fulfilled and balanced and enjoy your trading experience.

Challenges and Stresses of Day Trading Cryptocurrency

Day trading in cryptocurrencies comes along with a lot of challenges and risks. So, to effectively learn how to start trading crypto, you need to be informed about these challenges. Here are some of the key risks and challenges involving this business.

Security Risks

One of the main challenges crypto traders face is the possibility of security breaches. The traditional stock markets are less vulnerable to cyberattacks, but because of the digital and anonymous nature of crypto assets, there is an easier way for hacking, phishing scams, and fraud. So, crypto traders need extra vigilance to avoid the theft of their funds and should use strong passwords, secure wallets, and two-factor authentication. If proper security measures are not used, traders risk the loss of investments through cyberattacks, adding great stress to the already fast-paced environment of day trading.

Emotional Stress

Day trading crypto can be mentally exhausting. This is because the volatility of this market can result in rapid and unpredictable changes in prices. Such price swings often create emotions like fear, anxiety, and greed. This emotional tension can give rise to impulsive behavior, such as selling in a panic or trend-chasing without a strategy in mind. Traders have to develop control over emotional decisions in crypto trading if they are to be successful.

Technical Complexity

Day trading crypto effectively involves a lot of technical knowledge. This includes everything from reading complex charts to advanced tools and indicators. Learning about technical analysis, risk control, interpretation of market data, and so on can be too much for new traders. Furthermore, the technology of blockchain and trading platforms is not easy to work with. These things add to the pressure traders experience as they take a great deal of time to master and require continuous education.

Time Commitment

Crypto day trading can be extremely time-consuming since the markets operate around the clock. Day trading demands you to be highly alert for any changes in prices and news at all times, which may interfere with personal time and make your life unbalanced. The constant pressure created by the need for swift and prompt decision-making may also result in burnout. Such a daily schedule is generally a stressful experience and can lead to mental problems.

These factors highlight the complexities and inherent risks of day trading cryptocurrencies, emphasizing the need for thorough preparation, continuous education, and robust risk management strategies to navigate this challenging environment.

When to Close a Trade

Beginner traders learning how to start trading crypto should note that closing the trade at the right time is really important for efficient risk management and securing profit. So, here are some tips that will help new traders in deciding the proper time to close a trade.

Adhere to Your Trading Plan

One of the best habits formed by successful traders is to stick with their trading plan. Your plan should include when to enter and when to exit a trade, set goals for profit, and instructions on how you will manage risk. Once you follow such a plan, you will be less likely to make reckless decisions based on short-term market fluctuation because you have set your eyes on your long-term goals. A structured approach also helps you make decisions based on logic and strategy instead of emotions and helps you to be more consistent over time.

Utilize Stop-Loss Orders

Stop-loss orders are useful measures in preventing unforeseen losses. This is because they automatically close the trade when the price reaches your pre-defined level and prevent further loss if the market happens to turn against you. For example, if you set your stop-loss order just below a major support level, a level where a coin’s price has historically stopped falling and went back up, then the order will close the trade at that support level, limiting your losses. Stop-loss orders can also be used to eliminate the need for constant monitoring of the market and, at the same time, give you a reliable means of protecting your capital.

Set Take-Profit Targets

Setting targets for take-profit is another efficient means of locking in gains when the time is right. A take-profit order involves choosing a price at which you automatically close the trade. This way, you lock in your profit and do not have to monitor the market all the time. Furthermore, having a clear profit objective avoids holding a position for too long and reduces the risk of a reversal.

Monitor Technical Indicators

Technical indicators can help you to make informed decisions when you are closing trades. Some indicators, such as RSI and MACD, will provide an indication of the continuation or reversal of a trend. For example, you could use RSI and notice that an asset is overbought. That means a reversal of trend is likely, and it is a good time to take profits before prices fall.

Following a well-structured trading plan will drive you to make more disciplined and informed decisions. Furthermore, implementing strategies like stop-loss and take-profit orders will enable you to manage risks, protect your capital, and get closer to trading success.

Day Trading Bitcoin and Altcoins for Beginners

Day trading in cryptos is about buying and selling digital assets within one day to capitalize on short-term movements in their prices. To make a comprehensive comparison between trading Bitcoin and altcoin, we need to discuss multiple factors and characteristics of these coins.

Potential for High Returns

Considering their volatility and starting stage, altcoins have the potential for rapid gains. They also bear a high level of risk, but these coins can give large returns within a very short period. This characteristic is significant for day traders searching for high reward potential and those who are ready to make high-risk moves in the market.

Historical Performance

Bitcoin has a long history as the biggest cryptocurrency, and its reputation as "digital gold" goes a long way toward creating investment in its market. By contrast, many altcoins have limited historical data. This makes it harder to have solid predictions about their future performance. Furthermore, their limited history shows that new altcoins fail frequently. This makes altcoin investments too risky, especially for traders without experience.

Community and Support

Bitcoin has an active community through which lots of discussions and educational content are created, which helps beginners learn how to trade. On the other hand, Altcoins that are just coming into the market lack developed communities. This means there will be limited resources and reliable support for new traders just beginning an altcoin trade.

Information Availability

Bitcoin enjoys wide coverage and analysis by various researchers and news organizations. This helps traders easily access needed information and make informed decisions. On the other hand, most altcoins are not thoughtfully explored and analyzed. This is especially true for new projects and platforms.

Technological and Security Risks

Newer altcoin projects may have unproven technology and be more vulnerable to security issues. Therefore, due to its track record and a much greater network size than any of its alternative cryptocurrencies, Bitcoin can be considered a much better choice for those who value security.

Based on our research in PlasBit, we recommend that most beginners start day trading with Bitcoin due to its higher liquidity, extensive information availability, and higher stability. And after gaining some experience and learning about the crypto landscape, they can try altcoins while keeping the risks and volatility of altcoins in mind.

Conclusion

In this PlasBit article, we explored key points that help new traders understand how to use RSI in crypto trading. We also discussed the mental demands of trading and how to handle the stresses and challenges of the cryptocurrency trading environment. Furthermore, we covered some tips for smart decision-making, including recognizing the right moment to close a trade and how to maximize gains or minimize losses. These insights can lay a solid foundation for anyone eager to enter the world of crypto trading.

It is our hope that we have helped you with these insights and tips to get you started in this exciting world of crypto trading. The crypto market constantly evolves, and new trends, technologies, and opportunities surface every minute. So, your long-term success as a trader will depend on your ability to stay informed and continue learning.