If you are looking for a solution on how to buy Bitcoin with bank transfer, you can navigate into the ‘Deposit’ section to get the bank account details and then make a transfer from your bank in the amount you wish to buy. Once the transfer is completed, your euro wallet will be credited automatically, and you can navigate to the ‘Exchange’ section to convert the euro into Bitcoin. Make sure that the name on the bank account you wire the funds from exactly matches your PlasBit account name, and know that we do not accept wires from a third-party bank account.

Also, check the fees on the ’deposit’ page and ensure that you complete a KYC process, verifying both your identity and address before you attempt to deposit funds via bank transfer. It’s required in order to comply with government regulations. Read more about buying Bitcoin below.

Quick Guide to Buying Bitcoin with a Bank Transfer

To use PlasBit to buy Bitcoin, you will first need an account and wallet. Visit our website and click the blue "Get Started" button in the top right. From there, you can input all your details and verify your account using the KYC process to become fully compliant.

Now, you are ready to transfer your fiat currency to your account and exchange it for Bitcoin or other cryptocurrencies that we offer.

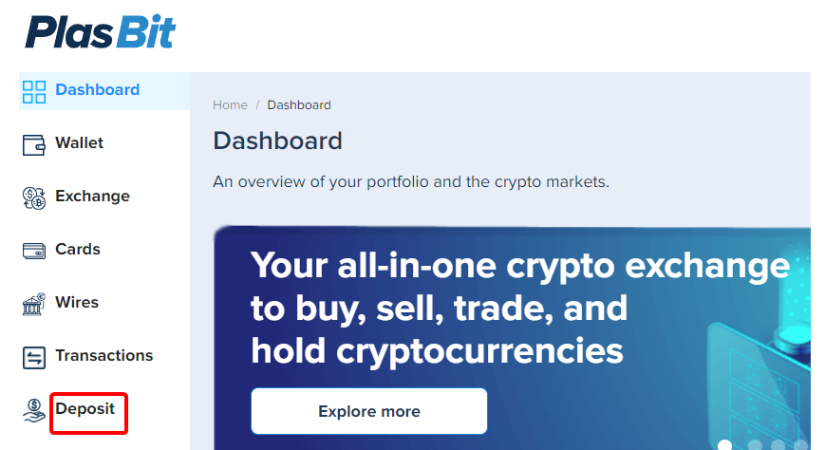

Step 1. Once you are logged in, go to the [Deposit] section.

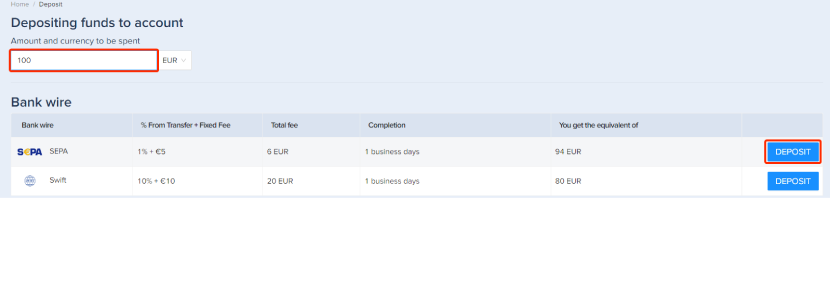

Step 2. Next, go to your personal [Wallet] and choose the amount you wish to transfer from your bank account. Select "SEPA" for the type of transfer and then click the blue "Deposit" button.

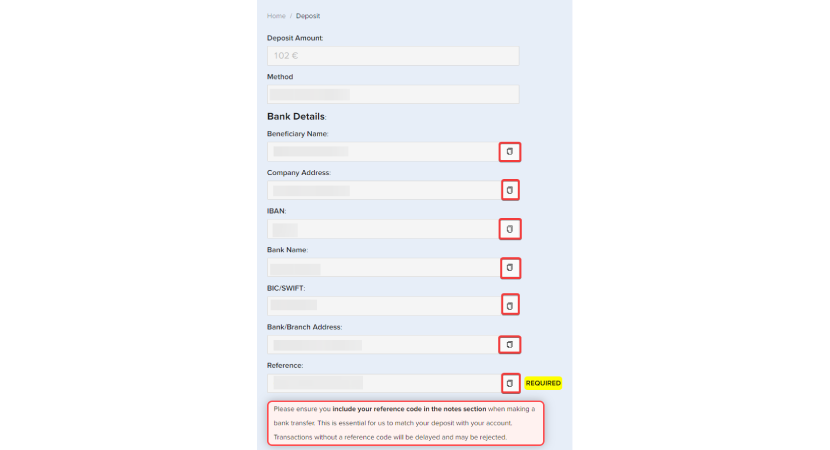

Step 3. Now look for PlasBit's bank details on the deposit details page for the necessary information regarding your bank wire transfer. Next, log into your bank account and fill out the details to begin transferring your funds.

Important Note: The referral code must be entered under "Notes" to help us identify your deposit with your bank account.

The name on the bank account from which you make the transfer must match the name registered to your PlasBit account. Trying to transfer funds from a joint account will also likely be declined.

Once your request is submitted, please allow for some time to process and approve the request. We will update you as soon as possible with an email confirmation once the bank wire has successfully arrived in our bank account and the funds have been credited to your wallet.

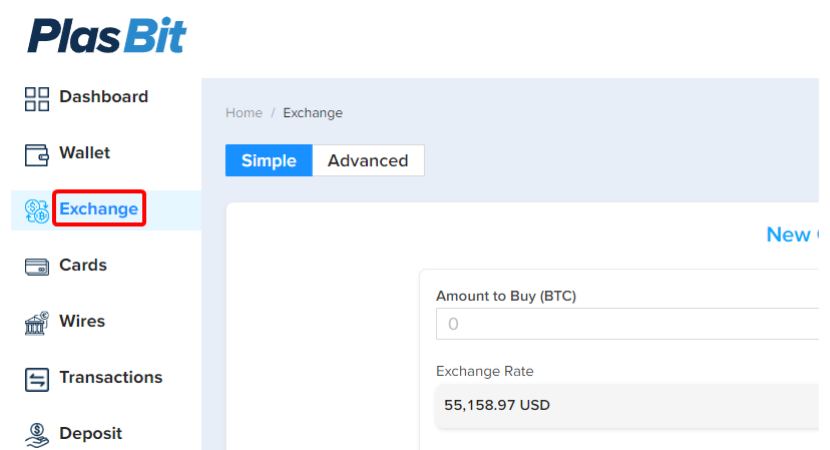

Step 4. Once your funds have cleared and been deposited into your wallet, you can exchange them for Bitcoin by going to the [Exchange] section in the left menu.

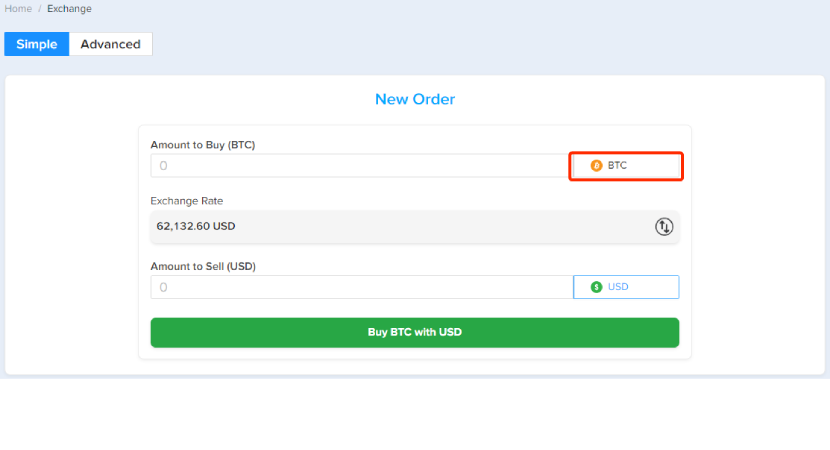

Step 5. In the "Amount to Buy" field, choose BTC from the pop-up menu to convert into Bitcoin.

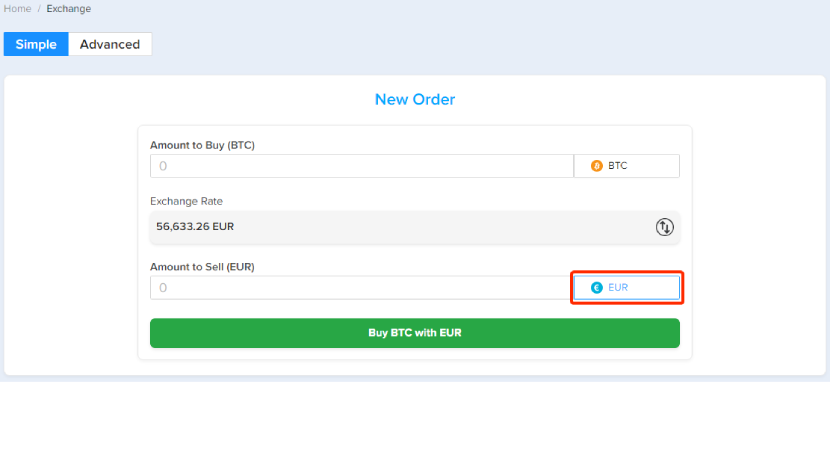

Step 6. Next, you should select Amount to sell" and choose EUR from the pop-up menu.

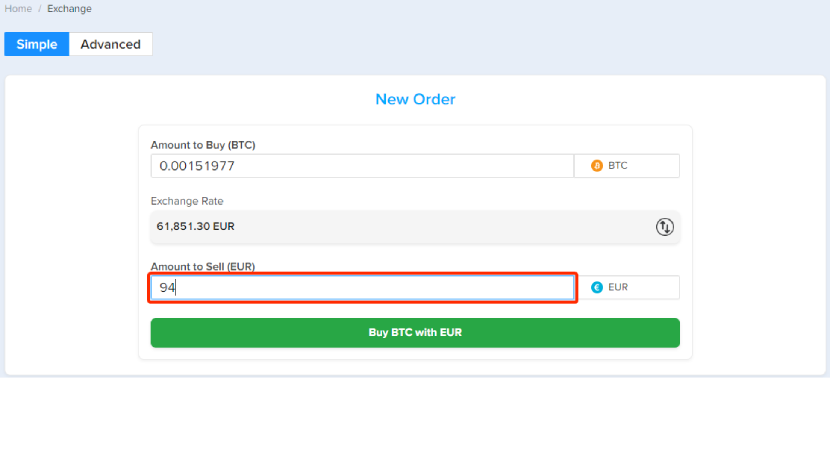

Step 7. Here, you can input how much Euro you wish to exchange into Bitcoin. Pay attention to the current exchange rate.

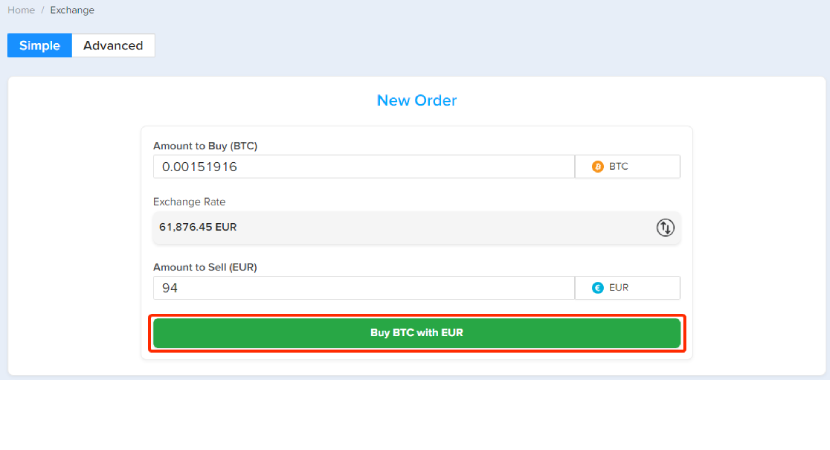

Step 8. Click the green "Buy BTC with EUR" button to begin the exchange from euros to Bitcoin.

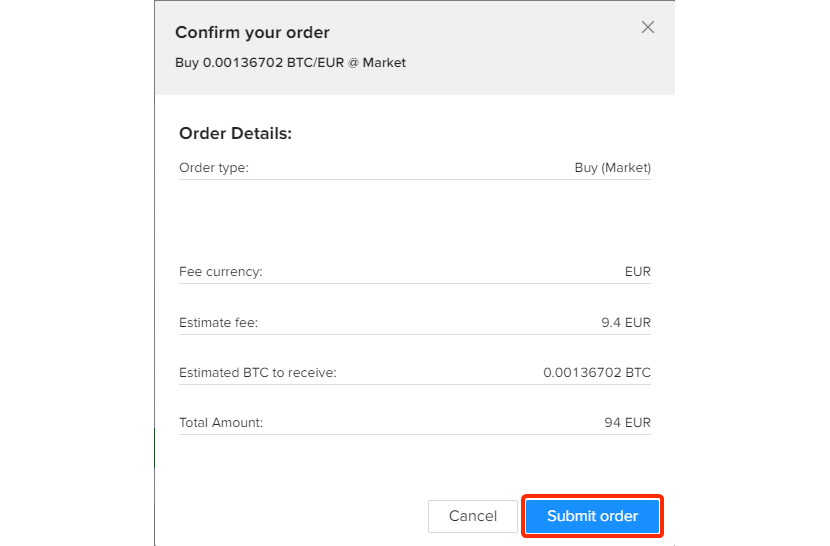

Step 9. Please check that all the details are correct, then click the blue "Submit order" button to confirm your choice and receive your Bitcoin.

Once this step has been completed, you will be credited the chosen amount of Bitcoin in your personal wallet. The exchange should be instantaneous, so you will only need to wait for the bank transfer throughout this process.

Currently, you can use a SEPA bank transfer within the European Union or a Swift transfer for international transactions. Please note that when depositing through Swift, only the specified currencies are supported:

- AUD

- CAD

- CHF

- EUR

- GBP

- JPY

Comparing Crypto-Buying Methods

Now that you know how to buy Bitcoin with bank transfers, we thought it would be a good time to compare different methods of purchasing cryptocurrencies currently available.

Using Crypto Exchanges

One of the most popular ways of buying Bitcoin or other types of cryptocurrencies is through a so-called crypto exchange. These are platforms designed to make the process easy and safe for users. Choosing the proper crypto exchange is essential, however, and it is recommended to pick one with a transparent fee structure without hidden fees or added expenses while also being secure in terms of KYC verification and a policy for personal data. This is important because your crypto exchange will provide you with a digital wallet that holds your cryptocurrency once converted.

Another feature that is worth considering is whether the crypto exchange uses cold storage for its cryptocurrencies. What this means is that your funds will not be stored online but rather in a safer manner that allows the exchange to fully back your funds in case anything unexpected happens.

Depending on your specific nationality, you will also need to find an exchange that allows you bank transfers from your local bank, possibly using SEPA or Swift, as these are the most popular and safest forms of bank transfers.

Other features to look out for include direct conversion from fiat to cryptocurrencies, additional safety features like two-factor authentication, and the option to exchange various fiat currencies into different cryptocurrencies besides Bitcoin.

Taking your time to research the crypto exchange properly before trusting them with your money can go a long way in ensuring a safe experience for you and your funds.

Compared to other methods, crypto exchanges typically offer some of the best rates for converting into Bitcoin or exchanging back into fiat currency.

Using a Credit Card

In addition to using a bank transfer, buying Bitcoin with a credit card is another option. Typically, this option is more costly, as fees range from 3% to 5% or even more, plus a flat fee per transfer.

Not all banks allow their users to buy crypto using credit or debit cards, meaning that this option might not be available depending on your specific circumstances.

If your account is already KYC verified, then credit card purchases can be a quick method to buy Bitcoin. Still, the added fees and more strict rules for cash advances and other regulations might not make this the best option for everyone.

Peer-to-Peer Trading

It is also possible to find people who already have Bitcoin and who wish to exchange it into fiat currencies and then trade directly with them. If you are physically close to each other, this can be done in person, and it will allow you to confirm that every step is correct before you hand over your cash.

There are also online marketplaces that help you find Bitcoin sellers. Still, in this case, you will need to be careful, as you must trust that the seller will deliver your Bitcoin once you have paid. This process can be challenging to get started with, and depending on the other person, it can also take several days, if not weeks, before you actually receive your Bitcoin.

Bitcoin ATMs

Another method is to find a local Bitcoin ATM and deposit your fiat currency into it. This is a quick and convenient method if you are located next to an ATM, but note that these machines' fees are anywhere from 5% to more than 10% per transfer.

This large percentage can deter many people from actually using the machines for any meaningful purchases, as these fees are typically the highest out of any method possible.

Digital Wallets

The last method we cover in this article is using digital wallets to buy Bitcoin. Some of these digital wallets allow Bitcoin-related activities, while others do not, so check before opening an account on the platform you are considering.

Also, note that PayPal is typically not accepted by any serious exchange or platform, as the return policy of PayPal can be considered unsafe for sellers of Bitcoin and, therefore, be problematic in the case of fraud or other problems arising with the transaction.

General Considerations

No matter what option you choose, be aware that KYC is a tool designed to help protect you. Interacting only with other verified people increases your chances of having a positive experience.

Another factor to consider is each method's limits. Typically, bank transfers have the highest limits, meaning you can move more money with this method than with Bitcoin ATMs.

Also, remember that Bitcoin transfers are non-reversible, so only the current owner can initiate another transfer once Bitcoin has been transferred to or from your account.

Why KYC Matters When Buying Bitcoin

When dealing with financial institutions in our modern world, the concept of Know Your Customer (KYC) is important, especially when you want to learn how to buy Bitcoin with bank transfer. While it might seem strange that you need to verify your identity with each Bitcoin exchange, bank account provider, and more, ensuring the law is being upheld and adhered to is crucial.

Safe for Customers

KYC also helps make buying and selling with Bitcoin a safer and more secure journey. This is because identifying both the buyer and seller helps governments and institutions avoid money laundering, fraud, and other illicit activities. KYC is fully committed to following the regulations to guarantee the best customer experience.

KYC has also been known to positively impact the overall market stability and legitimacy of Bitcoin. This is because the increased transparency and adherence to regulatory standards have meant fewer illegal activities are taking place, thus making Bitcoin and other cryptocurrencies more trustworthy and, in turn, attracting more investors of all sizes.

So when you use an exchange or other method that has KYC verification when buying Bitcoin through bank wire transfers, the KYC systems will check whether the funds used are coming from a legitimate source and create a paper trail that is important in case of any issues. Not only does this process help the different institutions, but it also helps you, our customers. KYC is an added layer of security that makes it more difficult for scammers or criminals to move money or Bitcoin.

Making Crypto Trustworthy

KYC is also an important aspect of making cryptocurrencies more trustworthy in the larger scheme of things. Many national governments require this level of verification in any form of monetary institution, and by implementing KYC, we are doing our part to make our platform a trusted and safe exchange for Bitcoin.

Many newcomers to the world of crypto are worried about exchanging into or from Bitcoin, but KYC can be a great tool to ensure compliance and procedures. It also comes with the added benefit of getting legal help if anything happens along the way, once again improving the customer experience.

As time goes on, the requirements for verifying users with KYC are also updated to account for new methods and processes. At PlasBit, we keep up with new rules to help our customers stay safe and exchange Bitcoin lawfully. A critical part of making the world of cryptocurrency safer and more trustworthy is adopting solid policies for personal user information and verifying each user through the KYC process. First-time users will need to confirm their identity in some cases. Still, just like traditional Fintech, it is an integral part of making crypto more trustworthy.

The Case for Storing Value in Bitcoin

Bitcoin is a unique way of storing money value compared to traditional bank accounts or cash fiat. This is because the cryptocurrency is decentralized, and no single instance, such as a bank or government, is in control of your currency. Therefore, you have more freedom over your funds, allowing you to withdraw or deposit, no matter what economic situation your country is in.

Furthermore, Bitcoin can be a great hedge against national inflation in some parts of the world. Various countries see a significant depreciation of their local currency year over year, meaning that the value of fiat in this currency goes down every day due to government choices or the country's state overall.

Limited Supply

This is because Bitcoin has a limited supply of just 21 million. As time passes, more and more of this Bitcoin will be mined, making the cryptocurrency more akin to gold or silver than traditional currencies. After all, any government can print more money if it wishes to, which will devalue the existing currency already in circulation, thus leading to inflation.

By storing a part of your funds in Bitcoin, you will no longer be exposed to inflation in the same way. This allows you to exchange Bitcoin for fiat currency when you need it and get the most out of your funds. Bitcoin's scarcity helps to preserve its value, and it can thus be used for both short—and long-term storage of your funds.

Hedging Your Bets

One bonus of storing your value in Bitcoin is that you will always have full control over your funds. Suppose your government suddenly gets hit with international restrictions or sanctions. In that case, that might mean you can no longer withdraw or deposit traditional fiat currencies. Less severe reasons could be anything from banking holidays, government orders, or technical failures, all leading to a temporary hold of your money.

With Bitcoin, you can always move your funds around as you prefer. The currency is accessible at all times of day, including nights and weekends, making it a highly flexible method of storing value. You can react instantly to any news that might affect you and your funds.

This makes Bitcoin an excellent option for people worried about stability or future decisions by their government or banking institutions since Bitcoin provides a safe haven for their funds outside the control of other people. By being the only one who can access the funds, you guarantee that you decide what happens.

Fiat vs. Decentralized Finance

For people new to cryptocurrencies, the term fiat might need to be clarified. However, it simply means any form of official currency that is backed by a national bank. When comparing fiat and decentralized currencies, such as Bitcoin, there are some significant differences between the two methods, which we will explore here.

Government Backed Fiat

As mentioned, fiat money is any currency governments issue, such as the US dollar or euro. These currencies are known to be stable and trusted, as they are regulated by central authorities that back the value of the currencies in question. Banks and other financial institutions provide a wide range of services with fiat currencies due to the long-established systems that have been put in place.

At the same time, government-issued currencies also offer users a sort of safety net, which protects customers against fraud or other financial issues that could arise from a range of areas, which is why currencies like the US dollar and the euro have become staples in many parts of the world not even using these currencies in their own country.

Fiat money is being regulated in a centralized manner, which means that a controlling party is in charge of regulating each of the currencies in this category. For instance, the US central bank, the Federal Reserve Board, could at any time print more money, set limits on what accounts can do, or even freeze certain funds in specific bank accounts, meaning that they are in complete control over the currency.

This concept of centralized finance has been the normal way of operating for hundreds of years, as there never really been a good alternative until digital cryptocurrencies such as Bitcoin were invented and adopted by a large number of people.

Decentralized Currencies

The world of decentralized finance offers digital assets like Bitcoin and blockchain, removing the central controlling authority and instead giving full control back to the currency's owners.

Decentralized currencies can be an effective way of safeguarding against a national bank failure, as well as weathering the storm during a financial crisis or in case of government bailouts, where more money is printed to account for hard times. Bitcoin will be insulated from these scenarios directly because its value is not directly tied to the traditional banking system.

Since Bitcoin uses the blockchain, the cryptocurrency makes it possible for people to fully manage how their funds are stored and spent, and can, in some ways, even be safer than using fiat currencies, as all transactions are public to some extent, meaning that the accountability and transparency is more significant than with a centralized currency.

In recent times, decentralized services and platforms have developed smart contracts and other solutions, allowing lending, borrowing, and investing without the need for a centralized authority to govern or control the value or currency.

Finally, Bitcoin has also been shown to be an excellent long-term investment. Even though many people use the currency to hedge against centralized fiat currencies, the added benefit of a potential return on investment can be another reason to consider storing some of your funds in Bitcoin.

Which option you prefer will depend on your specific needs and wishes. As a rule of thumb, it is a good idea to split up funds so that they are not all in the same "basket of eggs," as it were. This means that you might want to store some of your funds in centralized currencies and some in decentralized currencies.

Conclusion

That is all we have to share in this article. We hope you learned how to buy Bitcoin with bank transfers and that you are ready to begin your journey to the exciting world of cryptocurrencies.

When you buy Bitcoin with a bank transfer, you can take advantage of low fees for transfers, a secure Bitcoin exchange, and strong customer protection policies, such as KYC, that help protect your money and keep everything transparent and compliant.

If you wish to learn more, we have an extensive blog with many helpful articles and guides. If you have any questions, we also offer an online chat and other customer service options to help you in any way we can.

Bitcoin can be used in many different ways, from investing a portion of your funds to hedging against government decisions or inflation to just dipping your toes in decentralized finance and learning more about this world. Enjoy!