You can quickly sell Bitcoin in Spain and wire it to your bank account, using PlasBit's bank wire feature. This guide will go through one of the most common questions, which is How do I sell Bitcoin in Spain? Recent reports show that Spain is buzzing with Bitcoin activity, making it easier than ever to sell your digital assets.

Stay tuned to our blog as we will guide you through the local regulations, taxes, and best practices for cashing out your Bitcoin safely and efficiently.

Keep reading to unlock the simplicity of selling Bitcoin in sunny Spain!

How Do I Sell Bitcoin in Spain? A Step-By-Step Guide

Selling your Bitcoins and exchanging them for Euros is a standard procedure, which we will present to you in the next steps.

Step 1: Account Creation

Go to PlasBit's website and initiate your journey by clicking the "Sign Up" button. The registration process emphasizes security, requiring an email address and the completion of KYC protocols to ensure a safe trading environment.

Step 2: Bitcoin Deposit

Once your account is active, select “Deposit” in your account options and choose Bitcoin. PlasBit will generate a unique deposit address for your transaction. Double-check this address to safeguard your Bitcoin transfer against any potential mishaps.

Step 3: Access the Wire Tool

Head over to the "Wire" section within your dashboard. This utility is crafted to facilitate the conversion of cryptocurrencies to fiat currencies, offering a user-friendly interface designed specifically for EUR exchanges.

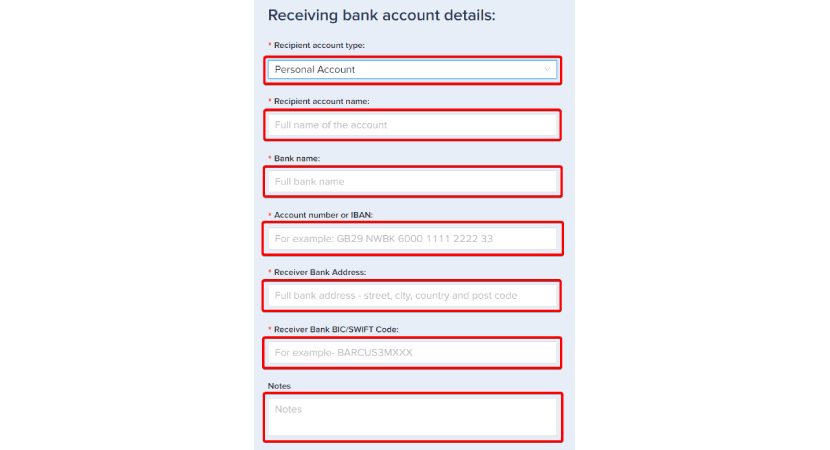

Step 4: Bank Details Submission

Input necessary bank information, including your account number, the bank's name, and its SWIFT/BIC code. This step is critical for ensuring the secure transfer of funds to your designated bank account.

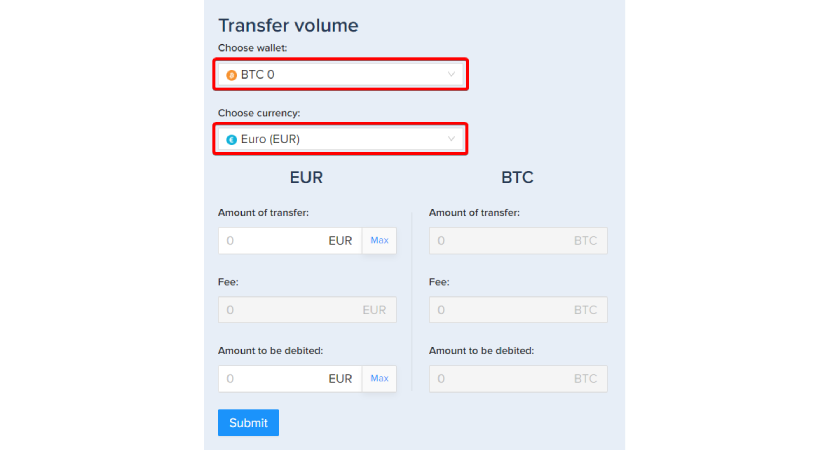

Step 5: Choose the Desired Crypto and Fiat currency for Conversion

In this case, choose to exchange Bitcoin for EUR. PlasBit offers real-time exchange rates, enabling you to make informed decisions based on current market conditions.

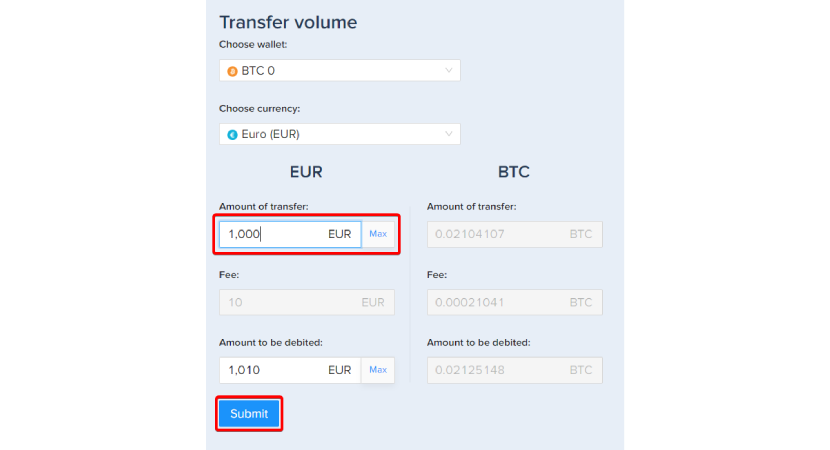

Step 6: Specify the Wire Amount

Determine the EUR amount you wish to receive from your Bitcoin sale. You can include transaction fees in your specified amount or have them deducted.

Step 7: Transaction Confirmation

Review all transaction details for accuracy, including the Bitcoin amount, exchange rate, and banking information. Confirming these details ensures the correctness of your wire transaction before submission.

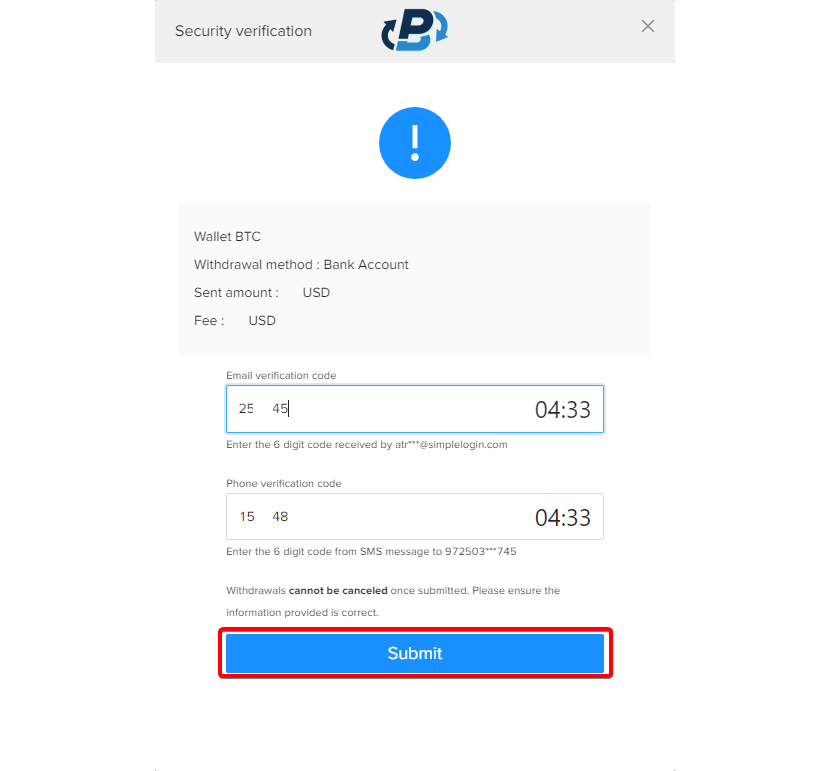

Step 8: Security Measures

Complete a verification process via email and phone. This dual-factor authentication strengthens the safety of your financial operation.

Step 9: Confirmation Receipt

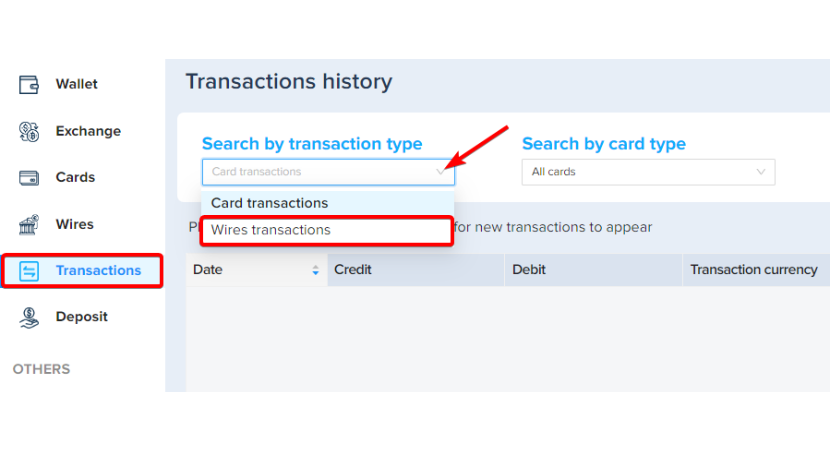

Following successful security verification, you'll receive an email confirmation of your wire request. In order to monitor the transaction yourself, go to the "Transactions" section and select “Wires transactions” from the dropdown menu.

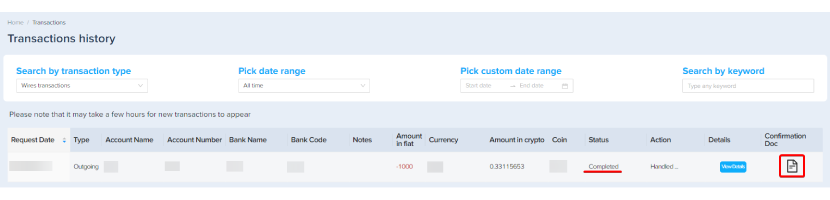

Once you open the “Wires transactions” tab, you will have your transaction status available. If needed, you can download the “Confirmation Doc".

Cryptocurrency History and Adoption in Spain

Cryptocurrency adoption in Spain has been quite progressive compared to many other countries. As an early adopter of Bitcoin and other cryptocurrencies, Spain has shown an apparent openness to integrating these new forms of digital assets into its economy. It starkly contrasts countries like China, where cryptocurrencies have faced outright bans and stringent regulatory hurdles.

The legalization of crypto payments in Spain dates back to 2015, which marked a significant step forward in providing a regulated environment for the use of digital currencies. The legal framework has enabled businesses and individuals to transact with cryptocurrencies, thereby fostering an environment conducive to the growth of the crypto market.

Regarding global ranking, Spain's position in the cryptocurrency adoption index has substantially improved over the years. In 2020, Spain was ranked 37th in the world for crypto adoption. By embracing cryptocurrencies and integrating them into various financial operations, Spain climbed significantly in the global rankings to 22nd. This leap reflects the growing acceptance and usage of digital currencies among the Spanish population and businesses.

Another indicator of Spain's commitment to embracing cryptocurrency is the proliferation of Bitcoin ATMs. With 309 Bitcoin ATMs installed across the country, Spain holds the 4th spot worldwide for the number of these machines. It reflects the country's adoption of cryptocurrency and its dedication to making digital currencies accessible to the general public. Bitcoin ATMs provide easy access to cryptocurrencies, facilitate transactions, and foster more significant inclusion in the digital economy.

How is Bitcoin Taxed in Spain?

In Spain, cryptocurrencies are subject to various taxes, and individuals must report and pay taxes on their crypto transactions. This means that if you sell Bitcoin or any other cryptocurrencies for more than you paid, you are expected to pay tax on the profits, unlike tax-free countries, which are pretty liberal with cryptos.

Crypto-tax-free countries are those where cryptocurrency transactions, trades, or capital gains are not subject to taxation – such as Switzerland, Malaysia, Dubai, Belarus, etc. While this can be an attractive feature for crypto investors and traders seeking to maximize their earnings, it's important to note that Spain is not a crypto-tax-free country.

The Spanish Tax Administration Agency, or AEAT (Agencia Tributaria), requires taxpayers to declare any profits from the sale of cryptocurrencies as they would with any other capital gains.

The AEAT is vigilant in enforcing tax compliance and has been known to send reminders to those who might need to be made aware of their tax obligations. Failure to accurately report your cryptocurrency transactions and pay the appropriate taxes in Spain can lead to prosecution and penalties. Therefore, crypto holders in Spain must keep detailed records of all their cryptocurrency activities and seek advice from a tax professional to ensure compliance.

When considering "How do I sell Bitcoin in Spain?", it's essential to understand the tax implications tied to such transactions. The taxation on Bitcoin selling and other crypto activities in Spain is variable and depends on the nature of the transaction and the income it generates.

If you are selling Bitcoin for cash, your capital gains are subject to a progressive tax rate. The amount of profit determines the rates realized and follows a tiered structure. For gains up to 6,000 EUR, the crypto tax rate is 19%. If your gains are between 6,000 EUR and 50,000 EUR, the crypto tax rate increases to 21%. For gains between 50,000 EUR and 200,000 EUR, the rate is 23%. And for gains that exceed 200,000 EUR, the crypto tax rate peaks at 26%.

It's also worth noting that calculating which specific Bitcoins are sold is essential. Spain uses the FIFO method, known in Spanish as PEPS (primero en entrar, primer en salir), which stands for "first-in, first-out." This means that the coins you bought first are also the ones considered sold first for tax purposes.

Regarding crypto mining activities, the crypto tax rates can be significantly steeper. Depending on the miner's overall income, these activities can be taxed from 24% to 47%. This is because mining is treated as income from economic activities, which falls under the progressive income tax rates.

To ensure compliance with Spanish tax laws, any individual engaging in Bitcoin transactions must keep accurate records of their purchase and selling prices, dates, and the amounts of Bitcoin bought and sold.

Crypto Mining Tax Breakdown and Other Taxes

Navigating the tax obligations for cryptocurrency in Spain, particularly for Bitcoin, can be complex due to the various activities and their respective tax implications. Here’s a detailed breakdown of the taxes related to crypto mining and the taxation framework for Bitcoin selling and other crypto-related activities in Spain.

Taxes on Crypto Mining and Direct Payments

In Spain, if you're engaged in mining cryptocurrencies or accepting them as payment for goods or services, these activities fall under the category of general taxable income, which typically incurs higher tax rates than capital gains. The moment you earn mining rewards, they're considered income and are taxed accordingly at the time of receipt.

Should you decide to sell the mined cryptocurrency, later on, the subsequent appreciation in value is subject to capital gains tax. For those wondering, "How Do I Sell Bitcoin in Spain?" it's crucial to understand these tax distinctions to ensure proper reporting and compliance with Spanish tax laws.

General Taxable Income Rates

The tax rates for general taxable income in Spain range from 24% to 47%. Here's a breakdown of these rates:

- For income up to €12,450, the rate is 19%.

- Between €12,450 and €20,200, the rate increases to 24%.

- Income between €20,200 and €35,200 is taxed at 30%.

- Between €35,200 and €60,000, the tax rate is 37%.

- For income between €60,000 and €300,000, the rate is 45%.

- And for income over €300,000, the highest rate of 47% applies.

Wealth Taxes

“How do I sell Bitcoin in Spain?” requires you to find one more topic – wealth taxes. These come into play when an individual’s total assets exceed €700,000, including cryptocurrency holdings. The wealth tax rates vary by region, ranging from 0.2% to 3.5%. It is essential to be aware of these variations to accurately assess your wealth tax obligations.

Many crypto owners report finding crypto tax loopholes to mitigate their tax liabilities. However, these strategies are often complex and may be risky. Always refer to the latest guidance from the Spanish Tax Administration Agency (AEAT) or a qualified tax professional for the most current and personalized advice.

How Do I Sell Bitcoin in Spain as a Foreigner?

Selling Bitcoin in Spain as a foreigner is a process that is contingent on your residency status and the purpose of your stay. The tax implications can vary significantly depending on these factors. Here’s what you need to know:

Rule Expectations for Foreigners

Foreigners should adhere to the tax regulations of Spain when engaging in activities such as the sale of Bitcoin. However, your obligation to file and pay taxes in Spain depends on your residency status.

Dependence on Your Status

- On Holiday: If you are a foreigner on holiday in Spain and engage in buying or selling Bitcoin, the profits are generally not taxed in Spain. Instead, you would be subject to the tax laws of your home country. It is essential to declare any gains or losses in your tax return in the country where you are a tax resident.

- Tax Resident in Spain: If you are not Spanish by nationality but are a tax resident (meaning you live in Spain for more than 183 days in a year or your economic activities are mainly based there), you should declare your Bitcoin sales on your Spanish tax return. As a tax resident, you pay taxes based on your worldwide income, which includes any gains from the sale of Bitcoin.

- Non-Resident with Mining Rigs in Spain: If you are from somewhere other than Spain, do not live in Spain, but have mining rigs or other substantial equipment, you will likely have a tax obligation in Spain. The income generated from the operation of these rigs would be considered Spanish-sourced income, and you would need to file taxes in Spain for this income.

For all scenarios, it's crucial to keep accurate records of all your transactions, including dates, amounts in Bitcoin, the corresponding value in euros, and any associated costs that could be deductible.

How Do Spanish Crypto Taxes Compare to Those in Other European Countries?

The taxation of cryptocurrency gains in Spain is similar to other European countries, with specific nuances that reflect each nation's broader economic and regulatory environment. In Spain, capital gains from the sale of cryptocurrencies are taxed as savings income, which means they are subject to a sliding scale of tax rates that start at 19% for gains up to €6,000, 21% for gains between €6,000 and €50,000, and 23% for gains over €50,000.

In France, the approach to crypto taxation is somewhat straightforward, with a flat 30% tax on crypto gains, applicable only after an annual trading threshold of €305. This flat tax simplifies the process for taxpayers, offering clarity and predictability in their crypto-related obligations.

Germany offers more flexibility in its tax regime, with a notable exemption where single taxpayers have a zero tax rate for income up to €10,908, which doubles for married taxpayers. As income increases, the crypto tax rate scales up, reaching as high as 45% for individuals earning over €277,000 or €555,000 for couples. This progressive tax structure relieves lower-income earners while ensuring that high earners contribute a larger share.

Italy's tax system imposes a 26% tax on crypto gains exceeding €2,000. Italian residents have an additional option to declare the value of their digital assets as of January 1st and opt for a 14% tax rate. So, that offers a degree of flexibility and can be a strategic option for taxpayers depending on the performance of their crypto assets.

In comparison, Bulgaria and Croatia offer some of the lowest tax rates in Europe at 10% each, appealing to those looking for tax efficiency within the European context. Hungary also leans towards a lower rate with a 15% tax on crypto gains. Meanwhile, Poland and Slovakia have a fixed tax rate of 19%, positioning them in the mid-range of the spectrum.

How Big Is the Crypto Community in Spain?

The cryptocurrency community in Spain has shown significant growth, mirroring the global increase in interest and investment in blockchain and digital assets. As of 2024, Spain is home to approximately 35 crypto companies and startups. These enterprises range from blockchain development firms to cryptocurrency trading platforms, indicating a robust and diverse crypto ecosystem.

Beyond the corporate presence, the grassroots communities and interest groups reflect the vibrancy of the crypto scene in Spain.

Bitcoin Spain

One notable group is "Bitcoin Spain," which boasts a membership of approximately 5.4K individuals. This group serves as a comprehensive platform for discussions, news, and information exchange about Bitcoin. Its wide-reaching focus encompasses the entire country, making it a pivotal online meeting spot for anyone in Spain interested in Bitcoin, whether they're looking to understand its fundamentals, stay updated on the latest news, or engage with like-minded individuals on the nuances of trading and investment strategies within the Spanish context.

GroupBtc

GroupBTC Spain is a dynamic community from Girona with 2.5K members dedicated to exploring the intersection of blockchain technology and Bitcoin. The group focuses on future projects within the crypto space, offering insights into blockchain developments and conducting Bitcoin price analysis, making it a valuable resource for enthusiasts keen on understanding market trends and technological advancements.

Telegram

Bitcoin Spain

Bitcoin Spain is a vibrant Spanish group on Telegram with a community of 2.7K members. It distinguishes itself with an admin bot that helps manage interactions, ensuring a smooth experience for all participants. The group is a hub for engaging discussions on a variety of interesting queries related to Bitcoin, from trading strategies and market analysis to the latest news and developments in the cryptocurrency world. It's an essential space for Spanish speakers interested in deepening their understanding of Bitcoin and connecting with like-minded individuals.

Spain Cryptos

Spain Cryptos is a flourishing Telegram community with over 1.6K members, catering exclusively to Spanish-speaking cryptocurrency enthusiasts. This group provides a space for discussions, news, and updates related to the crypto world, all in Spanish. It's an ideal platform for those looking to engage in crypto-related conversations and share insights in their native language, fostering a sense of community among Spanish speakers interested in the evolving landscape of digital currencies.

Alternative Ways To Sell Bitcoin for Fiat Money in Spain

Selling Bitcoin for Fiat Money in Spain can be done through various methods, each offering different levels of convenience and speed. Here are some of the options available for those looking to convert their Bitcoin into euros:

- Bitcoin ATMs: As previously noted, Spain has many Bitcoin ATMs, making it convenient to sell. These ATMs are located across the country and allow you to sell your Bitcoin for cash. The process is typically straightforward: You send Bitcoin to the ATM's address and withdraw the equivalent amount in euros. However, it's essential to know the transaction fees and limits that may apply.

- Crypto Debit Cards: Crypto debit cards are a convenient way to spend your Bitcoin as fiat money without selling it first. You can use your Bitcoin as a traditional debit card by loading your fiat converted from Bitcoin onto a crypto debit card.

Each of these methods has its advantages and considerations. Bitcoin ATMs and crypto debit cards provide immediacy and convenience. When choosing a method, consider fees, exchange rates, transaction limits, and the time it takes to access your funds. It's also essential to ensure you comply with any tax obligations from selling your Bitcoin.

Conclusion

It's essential to acknowledge that Spain, a country with a crypto-friendly stance and a robust community of adopters, offers various methods for swapping Bitcoin for cash. PlasBit is one of the best places to connect your Bitcoin wallet and exchange it for other cryptos or cash out for fiat money. You can easily store and spend your Bitcoins and swap them for euros and dollars whenever you want.