For anyone wondering how do I sell Bitcoin in Italy, You need to deposit Bitcoin into your wallet, navigate to the ‘Wires’ section, provide your personal bank details, choose Euro as your preferred currency to transfer, and submit the request and the transfer will show up in your bank account on the same day.

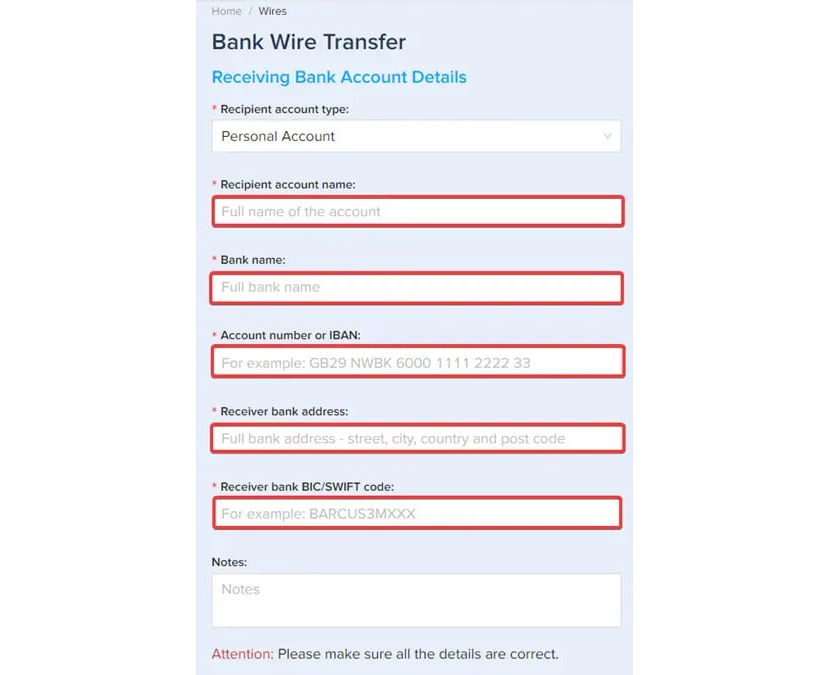

It's important to note that before you submit your request, you need to make sure you've completed a full KYC process that includes verifying your identity and address before transferring funds to your bank account. Additionally, the beneficiary name on the bank account must match the name on your PlasBit account exactly. Due to regulatory restrictions, any wire transfers to bank accounts with a different name will denied and be refunded to your wallet. Wire transfers to third-party bank accounts are also strictly prohibited.

This article will guide you through all the steps needed to wire fiat money to your bank account in Italy, explain the legal regulations and tax issues, and provide you with some facts about Italy's crypto state of affairs.

How to Use the Bank Wire Feature on PlasBit

If you have never done this, things might seem intimidating, but as you will soon see, it is a very easy and secure process that answers How do I Sell Bitcoin in Italy?

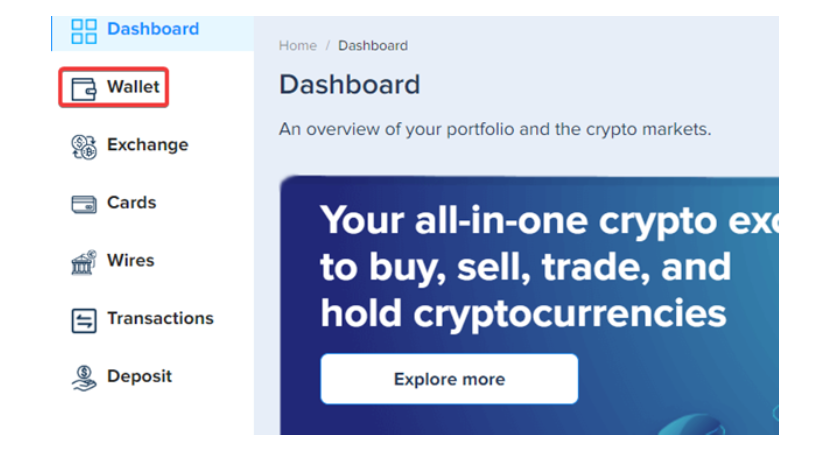

1. Log in to your PlasBit account and click on the [Wallet] tab in the upper left corner.

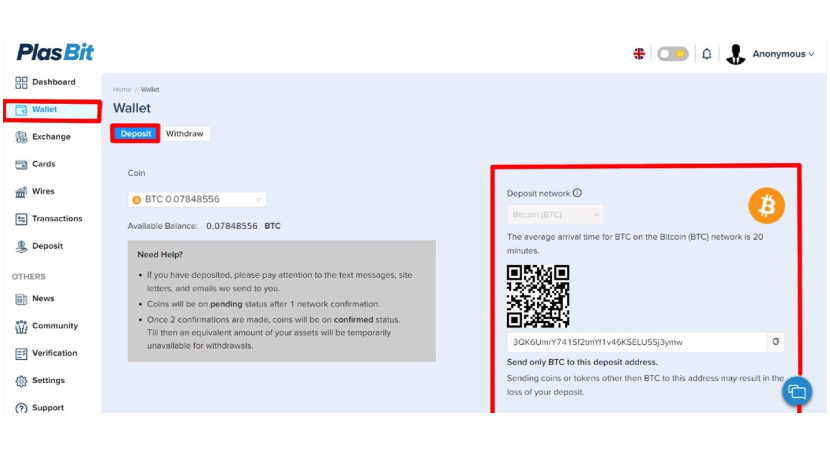

2. Now press Deposit, and deposit Bitcoin into your PlasBit wallet. The wallet address is on your right, or you can use the QR code.

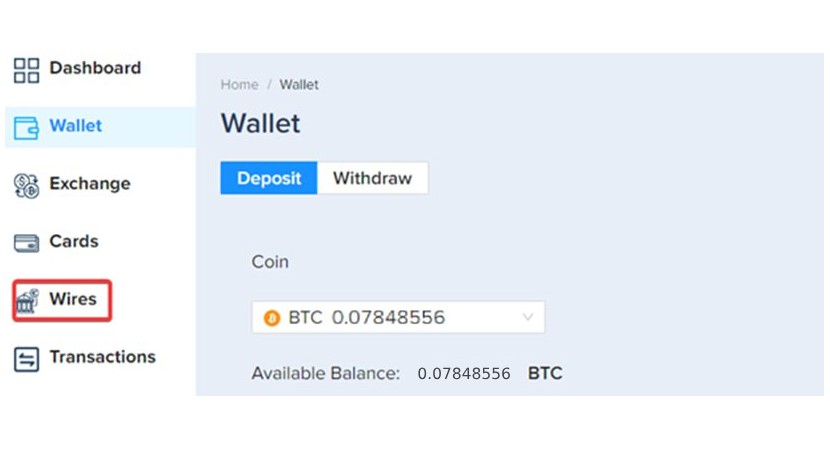

3. When the Bitcoin has been deposited, navigate to the [Wire] tab on the dashboard.

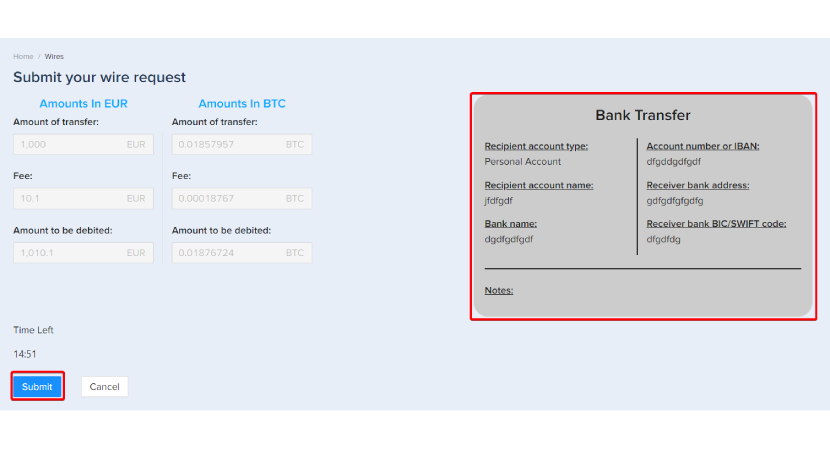

4. Next, you will need to fill in the bank details for the wire. Please note that you can only send the funds to yourself. The name of the bank account holder and the PlasBit account needs to be the same.

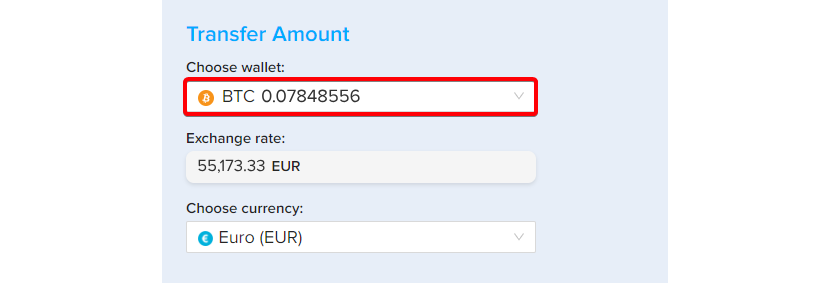

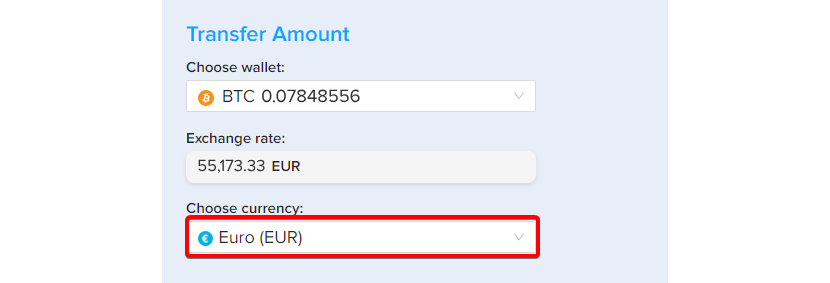

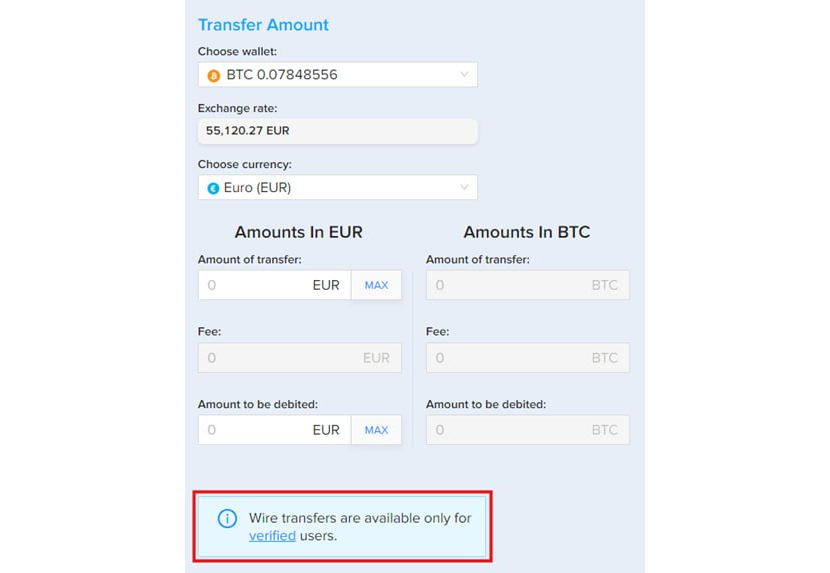

5. After filling in the bank details, you need to specify the wallet from which the funds should be withdrawn. Choose the wallet where you have just deposited your Bitcoins.

6. You can choose the currency, in this case, EURO, and see the exchange rate.

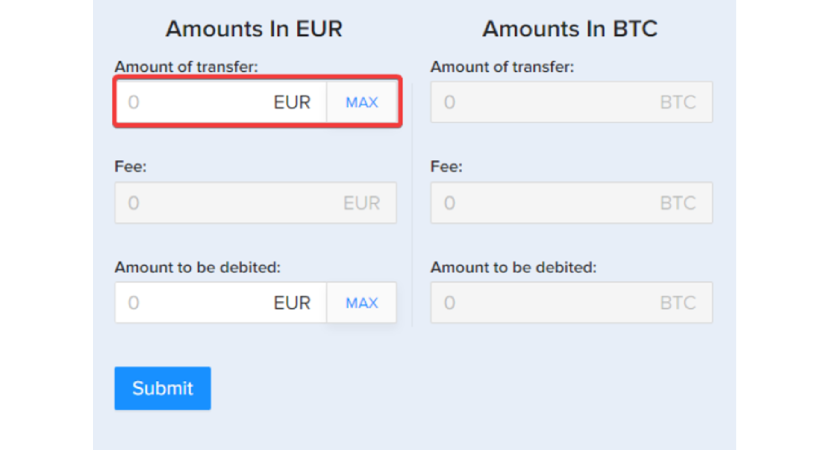

7. Fill in the Amount of transfer field with the exact amount you want to receive in your bank account; all the fees will be automatically added and debited from your wallet.

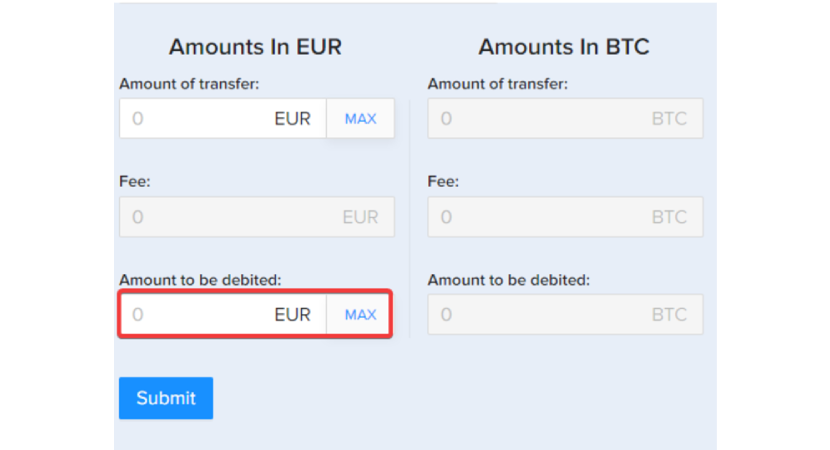

Alternatively, you can fill in the Amount to be debited field, which is the total amount that will be deducted together with the fees from your wallet. The amount you receive in your bank account will be this amount minus the fees.

Now, just press [Submit].

* Note that to be able to do the wire transfer, you will have to complete the identity verification. If you haven’t done so, you won’t have the option to press submit.

8. Carefully check all the details of the Bank Transfer and press [Submit] again.

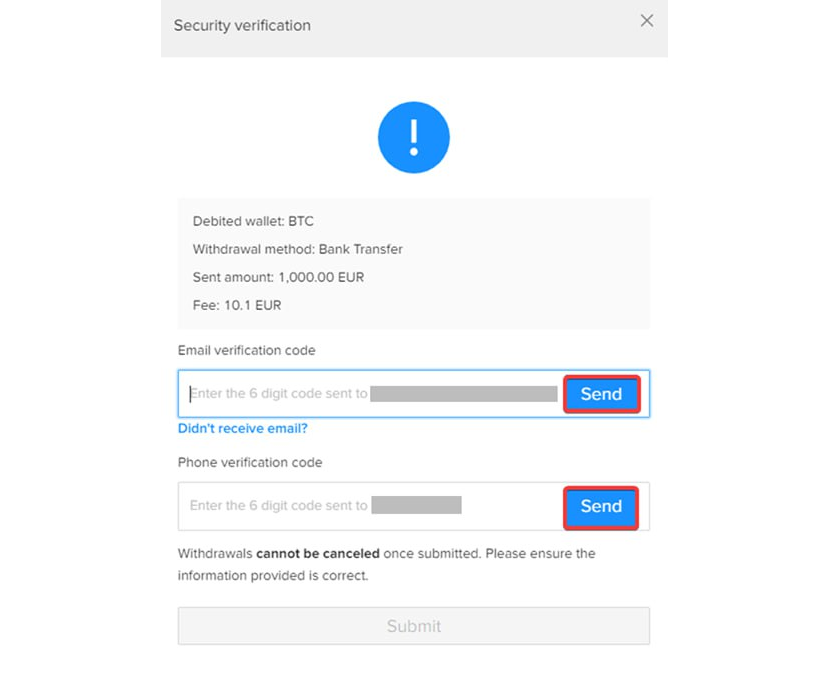

9. Now, you will need to go through the security verification. Please press [Send] to receive verification codes on your email and phone.

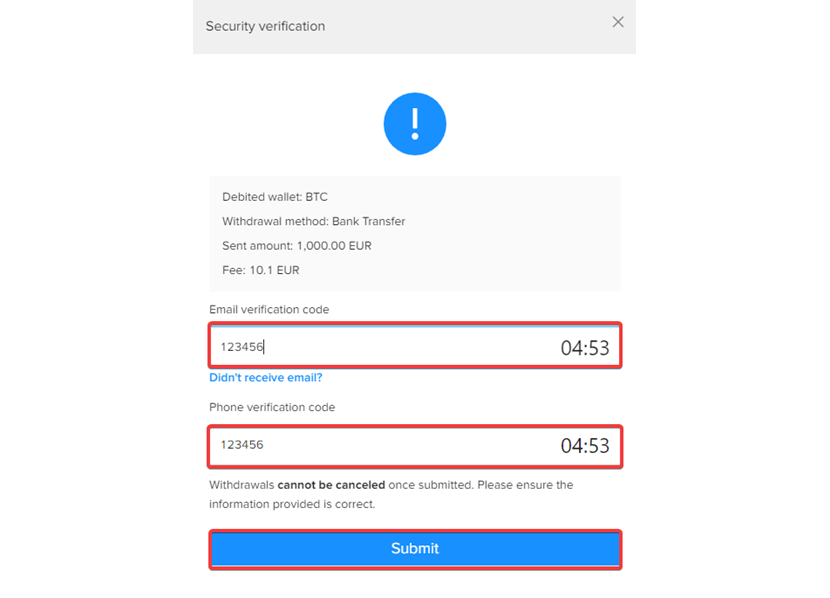

10. Copy and paste both verification codes after receiving them and click [Submit] to finish. You have 5 minutes before the codes expire.

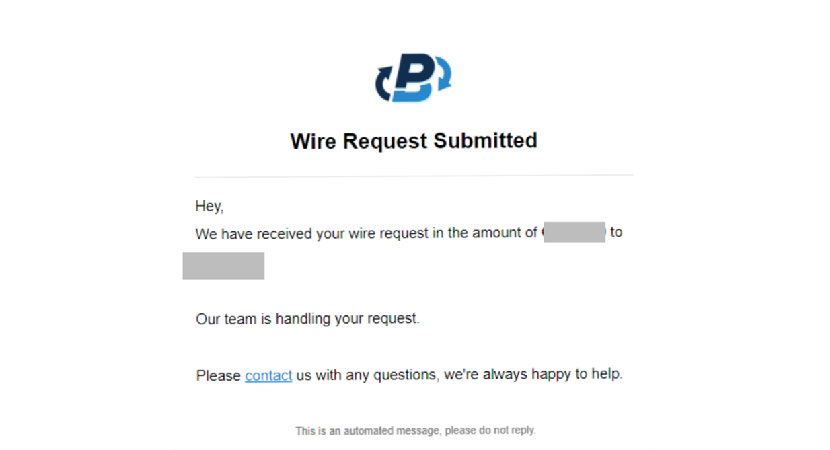

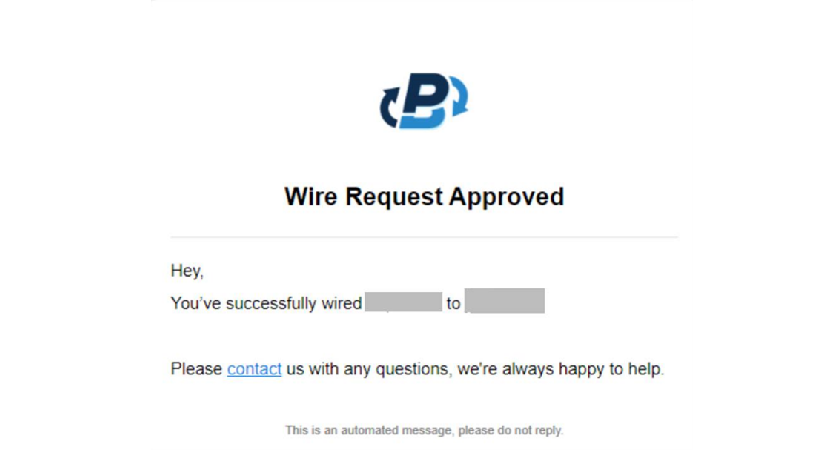

11. After this, you will be automatically redirected to the dashboard and will also receive an email verifying “Wire Request Submitted.”

After we approve the request, you will receive another email, “Wire Request Approved.”

The transfer of funds usually takes 0 to 5 days.

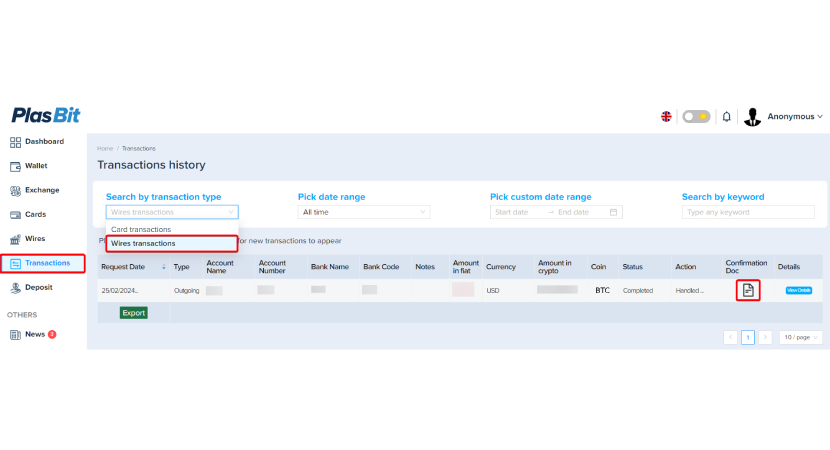

12. In the [Transactions] section, if you select [Wires transaction] from the drop-down menu, you will be able to see the status of your transfer, and after the transaction is approved, you’ll be able to download the transaction details in PDF.

Crypto regulations and taxes in Italy

Traditionally, Italy has strict tax laws and strong policies against money laundering. This is the reason the authorities are somewhat skeptical of cryptocurrency. On the other hand, cryptocurrencies and Bitcoin are legal to own and trade in Italy. From 2023, all crypto exchanges that allow Italian citizens and residents to use them must be registered and have offices in Italy. They have to provide all transaction information to authorities if requested. Therefore, while you now know how do I Sell Bitcoin in Italy it is also important to understand what taxes you need to pay, especially because it is your responsibility to report income from Bitcoin and not doing so can lead to severe fines of up to 240% of unpaid taxes.

Capital Gains and Income Tax

While there are still no specific laws regulating cryptocurrencies, Italian tax authorities treat them as foreign currency, and therefore, taxes are to be paid on capital gains. On the other hand, holding crypto and transferring it between private crypto wallets is not taxed. Paying for goods or services is taxable, similar to using cash. There is no VAT (value-added tax) on cryptocurrencies as such.

From 2023, any income made from selling cryptocurrencies by a private individual, over €2,000 annually, is taxed at 26%. There are also national, regional, and municipal taxes to be considered on top of this.

If a person is considered to be a trader, their income can be progressively taxed between 23% and 43%. You should remember that this applies to any foreign currency, so income from those trades adds up to the crypto one. In this sense, it is not entirely clear what would constitute a trader because, in Italy, only registered brokers can trade for others, and they are working through an institution and not individually.

At the same time, losses over €2,000 can be deducted from profits, and this deduction can be used for up to 5 years.

Recently, the Italian government announced that tax on crypto gains in Italy for private individuals will rise from 26% to 42%. This still has not been put into practice, and we have to wait to see if this will become a regulation. For the time being, income tax for individuals who are not considered traders stays at 26%. Nevertheless, the announcement has caused a significant stir among crypto enthusiasts and traders in Italy, with many believing it will greatly reduce crypto trading in the country. This tax rise happens simultaneously as the EU is trying to implement its MiCA framework, which is meant to unify rules around crypto in the whole of the EU. Some hope that the MiCa framework will help crypto traders fully understand the rules around crypto in the whole EU and would simplify any tax obligation in Italy as well.

Corporate Taxation

Companies need to include their crypto income into the taxable base for corporate income tax of 24%. Any losses can offset gains in the same fiscal year, and excess losses can be carried into future years, up to an 80% limit on income.

Annual Declaration Obligations

Every year, everyone has to declare the value of his or her crypto assets as of December 31. Penalties for not doing so range between 3% to 15% of the amount, and the late fee for over 90 days is currently €258.

Their fair market value determines the value of these assets at the end of the year, and any profits are taxable.

Mining, airdrops, and staking taxes

As previously said, currently, there are still no specific legal or tax regulations related to cryptocurrencies in Italy as such. Therefore, the tax authorities do not specifically define or regulate activities like mining, receiving crypto through airdrops, or earning from staking.

Nevertheless, for private individuals, it seems clear that one does not pay any taxes at the moment of receiving crypto from any of these activities, only after the profit is made by selling them into fiat. If these activities are considered business activities, then the 23% to 43% tax rate is applicable. It is not very clear what constitutes a business activity and what can be considered a private income in this sphere. There are opinions that mining can only be fiscally treated as an investment and not a business activity.

On the other hand, corporations would be subjected to a 24% corporate tax on the market value of the crypto value when they are mined or received.

History of Crypto in Italy

Bitcoin, the first cryptocurrency, was developed in 2008 and was already traded in early 2009. And while perhaps Italy is not world-famous for technological advancement, it did go down in history as the first country in which a football club was bought by cryptocurrency. In 2018, ten years after the creation of Bitcoin, a Gibraltar-based crypto firm, Quantocoin, bought 25% of Italian series C football club Rimini FC 1992.

Before that, in 2015, the Central Bank of Italy issued the first warning about cryptocurrencies, pointing out that nothing is really known about Bitcoin and its founder, adding that Bitcoin and other digital currencies are recognized by Italian law. However, cryptocurrencies were not banned at any point, leaving it to individuals to decide if they are prepared to take a risk buying them.

Even with these warnings, nothing was stopping Italians from buying and using crypto. This made tax authorities take an interest in the crypto world in 2016, while, as we saw, they still did not fully determine the status of Bitcoin and crypto in general. Nevertheless, they demanded their share of the profits through taxation.

At the end of 2017, a consumer association in Italy wanted Bitcoin to be investigated as a possible fraud. Nothing really came out of it, and cryptocurrencies are still legal, just still without any clear legal definition.

In 2018, the local community of Berceto, at least their Mayor, initiated the creation of AHU! a council-run cryptocurrency that was meant to help the local economy. At the time, the Mayor claimed that the local cryptocurrency would serve as an alternative to Euro. The project does not seem to have been really developed, and everything remained more of a marketing stunt. Nevertheless, it did show the public interest and the possibilities of cryptocurrency on the local level.

In the last two years, there has also been a big uptake in crypto holdings. From 2022 to early 2024, the number of Italians having crypto has gone from 8% to 18%, more than doubling. No other investment market has had such a rise in Italy, clearly showing that Italians are more and more interested in cryptocurrencies. In 2022, reports show that the transactions in cryptocurrency were worth more than €10 billion.

Crypto community in Italy

While the crypto community in Italy might not be as big as in some other developed countries, there is still a large number of activities and growing groups on a number of platforms, like Reddit and Telegram.

Italian Crypto Club is another group that brings together crypto enthusiasts in Italy active both on X platform and Telegram. The channel has over six thousand active members on Telegram. The members discuss numerous topics, mainly investment in the crypto market.

r/BitcoinIT was an active subreddit for more than 10 years, covering many different topics in Italian, but the group has not been active recently. It is still a good resource in Italian language on many topics in Crypto.

More recently, big cities have emerged as crypto hubs. Crypto EXPO Milan was to be held in 2024 but has been canceled; it was previously held both in 2022 and 2023. Workshops like La Rivoluzione Blockchain are also held this year in Milan, and The 5th Crypto Asset Lab Conference (CAL2025) will be held in January 2025, organized by the European Commission and the University of Milano–Bicocca. The conference brings together researchers, users, and policymakers on the topic of cryptocurrency. In Rome, events like Blockchain Week have been held annually, with over 2000 participants and 50 speakers. While the event is international there is a clear focus on Italians working in the crypto space.

These groups, events, and conferences are very helpful in promoting education and involvement in crypto investments, assisting both experienced traders and newcomers in understanding the various complexities of the new world of cryptocurrencies. They also play the role of updating their users on the current trends in Italian crypto regulations, news, and technologies.

In Other News

Crypto is gaining traction in Italy, as we can also see by Italy’s state-owned bank Cassa Depositi e Prestiti SpA, together with investment bank Intesa Sanpaolo, issuing €25 million digital bonds via Polygon (Matic) network earlier this year. This was the first digital bond issuance in Italy and is part of a wider interest in blockchain technology by the European Central Bank. Tokenizing real-world assets is an example of a growing trend in traditional finance where institutions are using blockchain to streamline processes, cut costs, and increase transparency, all of which could only further expose blockchain and crypto usage in the broader financial landscape.

Before this, in 2023, the Central Bank of Italy signed an agreement with the Central Bank of South Korea to work together on possible central bank digital currency. This is part of an ongoing interest of the Central Bank of Italy in distributed ledger technology, which is essential in blockchain technology and cryptocurrencies, while at the same time, the Central Bank is still raising concerns about cryptocurrency. Recently, the Italian government announced higher fines for anyone who manipulates the crypto market, with the highest fine going up to 5 million euros.

With the rise of crypto usage, there are also more and more instances of scams related to crypto. In a major joint operation, authorities from Italy and Albania have dismantled an elaborate cryptocurrency investment fraud scheme that duped victims out of an estimated Є15 million. The operation, coordinated by Eurojust, the European Union Agency for Criminal Justice Cooperation, targeted a crime ring that lured unsuspecting investors with promises of “zero-risk”, high-reward crypto investments.

The scammers worked from a call center in Tirana, Albania, pretending to be brokers persuading their victims to open accounts on their webpage and make deposits. They gained trust by sending back profits from initial, small, investments. When bigger deposits were made the scammers stole the funds. They also tried to gain the bank details of victims and take out even more funds. In cases where the victims became suspicious, scammers even contacted them asking for even more funds in order to recover the lost. Of course, those who sent more money were at a double loss.

Alternative Methods for Using Bitcoin in Italy

Bank transfers are only one answer to how do I Sell Bitcoin in Italy and there are alternatives. In Italy, there are a number of crypto ATMs installed where you can sell your Bitcoin for cash. Also, more and more shops and restaurants are accepting crypto these days, and you can even use your PlasBit debit card to pay in places that do not accept crypto.

ATMs and Vendors in Italy

Interestingly, as early as 2014, Italy had its first Bitcoin ATM. The ATM was built in Italy and was a two-way system for both selling and buying Bitcoin. Today, most big cities in Italy have ATMs installed, with Milan, Rome, and Bologna leading the way. More than 100 such ATMs exist and are used each day.

Many vendors also accept crypto payments for goods and services. A few years back, the small city of Rovereto, with 40 thousand inhabitants, made the headlines as the place where you could buy almost everything and everywhere with crypto in over 70 different shops.

As of today, hundreds of vendors are accepting cryptocurrency, mainly in Rome and Milan. For instance, in Rome, there are a couple of restaurants where you can pay for your delicious Italian meal with crypto. Also, some cafes in Rome, Milan, and even outside big cities will let you pay for your cappuccino or espresso. It is not super common, but even your accommodation in Italy can be paid in some places with crypto. Admittedly, most places you visit will not accept crypto, but the trend is rising.

The famous Italian carmaker Ferrari has also announced that by the end of 2024, European customers will be able to purchase their Ferraris with crypto. The move is an expansion of such practice in the US and Canada, where this option is available from October 2023. Another luxurious Italian carmaker, Lamborghini, has been associated with crypto for years with the “When Lambo?” meme.

Using PlasBit Debit Cards in Italy

If you don’t like to use Bitcoin ATMs, as they are usually not cheap, or one isn’t around, or want to spend your Bitcoin in stores that don’t directly accept cryptocurrency, then there is the PlasBit debit card that can help you.

To start, you need to move Bitcoin into your PlasBit wallet and order the card. You can use your virtual card immediately or wait for your physical card to arrive and then use it wherever you like. And if you already have a PlasBit card, then you just need to top it up with your crypto.

The card comes with enhanced security, a chip and a pin, and can be used with different currencies worldwide. Depending on your chosen card, you can withdraw up to $10.000 from an ATM daily or spend on POS purchases up to up to $30.000 daily.

Conclusion

Hopefully, this answers your question: how do I Sell Bitcoin in Italy? The easiest, most secure, and cheapest option is using our PlasBit bank wire service. Alternatively, you can use PlasBit debit cards to pay for goods and services wherever debit cards are accepted. Remember that your tax obligations and payments are your responsibility. While this guide is meant to give you basic information, we advise you to talk to a lawyer or accountant in Italy, especially if you are a business owner working with crypto.