If you’ve ever thought about buying crypto, the chances are that you’ve thought about using a credit card to pay for it. When you buy crypto with a credit card, you get instant access to your cryptocurrency and avoid the hassle of dealing with bank transfers, which can take days to go through. It’s no surprise that credit cards are one of the most popular ways of buying crypto. And so, you’re probably asking yourself, how can I buy crypto with a credit card in Germany? Just go to the deposit section, enter the amount you wish to buy, select deposit via credit card, and enter your card details. You will receive the crypto in your wallet.

It’s important to note that you’ll need to complete a know your customer (KYC) check first, which is a critical step in verifying their customers’ identities and combatting money laundering. Generally speaking, this will mean providing information like your full name, address, and date of birth, as well as some sort of official documentation (e.g., a passport or a driver’s license). You’ll also need to ensure that the name on your credit card matches the name on your crypto exchange account and on the paperwork that you’ve submitted to prove your identity. We’ll share a step-by-step guide on how I can buy crypto with a credit card in Germany shortly, but before we do that, let’s take a look at a quick example.

Meet Hans

Hans is an elder millennial who lives and works in Berlin, where he’s a graphic designer for a marketing agency that specializes in working with tech companies. He loves his job, but he also wouldn’t mind having some cash put aside for a rainy day, especially with the increased uncertainty around his future caused by the threat of generative AI. One day, while he was waiting for the coffee machine to work its magic, he overheard a couple of the company’s web developers talking about crypto and how one of them was thinking about quitting his job and spending some time traveling, thanks to the money he’d made from it. With a little help from his friend, Hans signed up for an exchange account and bought crypto with a credit card. Before he knew it, he even made enough profit to withdraw some of it and deposit it into his savings account. His rainy day fund had never looked so good.

What to Consider Before Purchasing Crypto with a Credit Card

Even though buying crypto with a credit card has a ton of advantages (it’s almost immediate, available around the globe, and it’s much more convenient and user friendly than bank transfers or using a Bitcoin ATM), it also has a few downsides. The good news is that by being aware of these downsides, you can mitigate them and ensure you’re not in for any nasty surprises.

Here’s what you need to know:

· Buying crypto with a credit card usually means paying higher transaction fees than you would if you paid via bank transfers

· You may need to pay exchange fees if your native currency differs from that of the exchange (e.g., if you’re paying with euros and the crypto exchange uses US dollars)

· As mentioned earlier, some credit card companies have a block in place to stop you from purchasing cryptocurrency

· Some credit card companies also have limits in place to cap the amount of crypto you can buy at any given time

However, as long as you’re aware of these downsides and limitations, you’ll be able to work around them. For example, you may be able to contact your credit card company to ask them to lift any limits they’ve placed on crypto purchases.

How Can I Buy Crypto with a Credit Card in Germany? A Step by Step guide

Now that you’re ready to buy crypto, the next step is to determine which crypto exchange you’re going to buy from. For the purposes of this walkthrough, we’re going to assume that you’re using PlasBit and that you’ve already created an account and completed the KYC check. We’re also going to assume that you’re not based in one of PlasBit’s prohibited countries (if you’re in Germany, you’re good to go). Make sure that you have your credit card handy so that there aren’t any delays while you figure out where it is. Here’s what to do next.

Step #1

Log into your account on PlasBit.com, open up your crypto wallet, click “Deposit,” and then enter the amount of crypto that you’d like to purchase.

Step #2

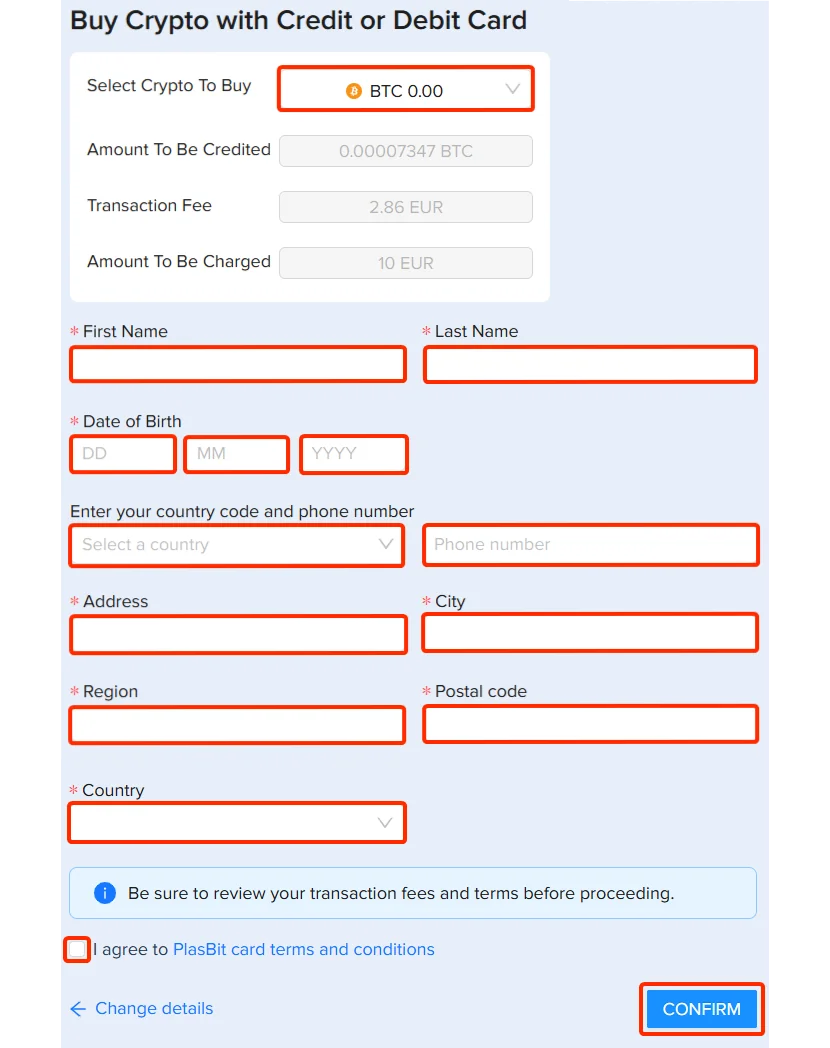

Choose which cryptocurrency you want to purchase. For this tutorial, we’ll assume that you’re purchasing Bitcoin. You’ll also need to provide some identifying information. Then, click the “I agree” checkbox and then click “Confirm”.

Step #3

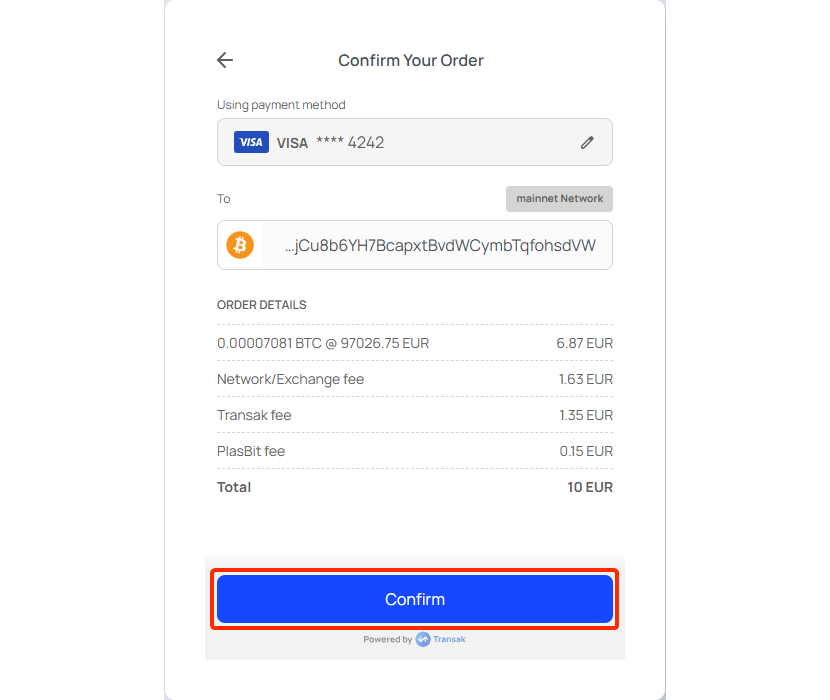

You’ll be provided with a summary of the transaction, showing key details such as how much you’re going to pay, what fees will be charged, and how much of your chosen cryptocurrency you’ll receive. Double-check to make sure that you’re happy with those details, and then click the “Buy Now” button.

Step #4

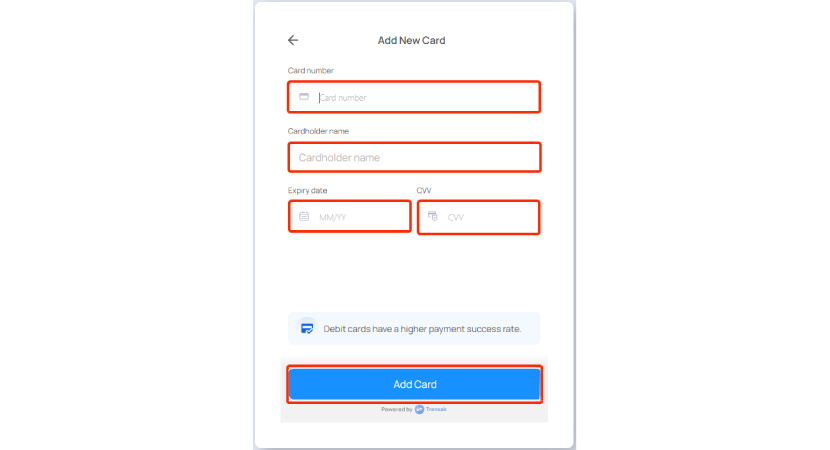

Next up, you’ll be asked to enter your credit card details. Fill out the form and then click “Add Card” to add the card to your account.

Step #5

Provide the address of your crypto wallet, making sure that you double-check that all of your information is correct. Then click “Confirm”.

Step #6

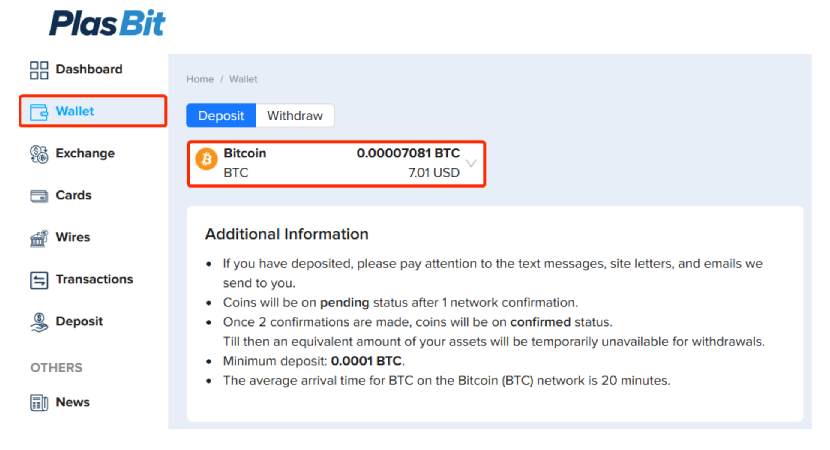

If you’ve followed all of the above steps, your transaction is now complete. Head over to your wallet to double-check that the crypto has arrived, noting that it can take a few minutes for the transaction to process.

Know Your Limits

Let’s take a closer look at some of the limits that are in place when it comes to purchasing crypto. This chart shows the daily, weekly, monthly, and yearly maximum purchase limits in USD and other currencies, including euros.

USD Purchase Limits

| KYC Level | Maximum Limit Per Transaction | Daily Maximum Limit | Monthly Maximum Limit | Yearly Maximum Limit |

|---|---|---|---|---|

| 1 | $50 | $150 | $500 | $500 |

| 2 | $3,000 | $5,000 | $25,000 | $100,000 |

| 3 | $3,000 | $10,000 | $50,000 | $200,000 |

Other Currencies Purchase Limits*

| KYC Level | Maximum Limit Per Transaction | Daily Maximum Limit | Monthly Maximum Limit | Yearly Maximum Limit |

|---|---|---|---|---|

| 1 | GBP & EUR - $100 / Rest - $50 | $300 | $1,000 | $3,000 |

| 2 | $3,000 | $15,000 | $50,000 | $100,000 |

| 3 | $6,000 | $30,000 | $100,000 | $200,000 |

* For purchases in non-USD currencies, limits apply in the equivalent amount of the purchase currency.

KYC Verification Levels

Be aware that there are different levels of KYC verification in place, with a higher KYC level meaning that you’re able to spend more money per transaction, per day, per month, and per year. You’ll need to provide differing levels of identity verification depending on the amount of money you plan to spend. These measures are in place to better protect you when you purchase crypto.

Here’s some more information on each of those verification levels.

Level One: Basic verification

Includes filling in first and last name, date of birth, and complete address as well as providing your ID and going through a liveness check. If you’re in Germany, this will give you the following limits:

· Maximum Limit Per Transaction: $100 USD

· Daily Maximum Limit: $300 USD

· Monthly Maximum Limit: $1,000 USD

· Yearly Maximum Limit: $3,000 USD

Level Two: Full Verification

Includes providing proof of address and completing a short questionnaire. The good news is that this is quick and easy, and it will enable you to access much larger limits for your transactions. For most cryptocurrency traders, this is the highest level of verification they’ll need.

· Maximum Limit Per Transaction: $3,000 USD

· Daily Maximum Limit: $15,000 USD

· Monthly Maximum Limit: $50,000 USD

· Yearly Maximum Limit: $100,000 USD

Level Three: Enhanced Due Diligence

This final level of KYC verification requires you to submit additional information, such as copies of bank statements or proof of the source of your funds. This is to combat criminal activity such as money laundering, so if you happen to need this higher level of verification, you’ve got nothing to worry about. It will also effectively double the limits that you’ll have at level two.

· Maximum Limit Per Transaction: $6,000 USD

· Daily Maximum Limit: $30,000 USD

· Monthly Maximum Limit: $100,000 USD

· Yearly Maximum Limit: $200,000 USD

What Else You Need to Know

While we’re on the subject of purchase limits, you should bear in mind that purchase limits can vary based on several other factors, including both region and payment method. Transactions also can’t be made from within certain prohibited countries, which applies to PlasBit and other cryptocurrency exchanges. We’ve already covered the maximum limits, but bear in mind that there’s usually a minimum purchase amount, too. For PlasBit, the minimum purchase amount per transaction is $5 worth of crypto. When it comes to spending limits, every purchase that you make will contribute towards your overall limits, so if you have level one verification and you make 20 minimum value purchases of $5 worth of crypto, you’ll hit your $100 limit for the day. These are applied on a per user basis. All purchases are subject to fees, and you’ll be given a full breakdown of any fees to which your purchase will be subjected before you finalize the transaction.

Be sure to check this carefully because once a transaction has been made, it can’t be undone. All purchases are final and non-refundable. The good news is that Germany is a crypto-friendly country, so you’re unlikely to encounter any of the issues you might find elsewhere. In some places, you can even use Bitcoin to pay for your day-to-day purchases. At the time of writing, no crypto-purchasing methods are banned in Germany, and there are no restrictions on using bank transfers to move money from your bank account into a crypto exchange platform and vice versa. In fact, there are even advantages to purchasing cryptocurrency in Germany, such as the relatively low taxation rate, which we’ll talk about in a moment. Another huge advantage to buying crypto in Germany, too, is that it has decent liquidity, so there are plenty of P2P solutions out there.

What is the Tax Rate On Crypto Gains in Germany?

If you’re fortunate enough to make a profit on your cryptocurrency, you’ll be subjected to income tax. This is as true in Germany as it is elsewhere in the world. That raises the question of what is the tax rate on crypto gains in Germany? You’ll be taxed at your personal income tax rate, which ranges from 0% to 45%, depending upon your income, and you’ll pay no tax if your gains are under €1,000 or if you’ve held the assets for longer than a year. That’s because the German government considers cryptocurrencies to be “andere Wirtschaftsgüter”, which means they’re treated similarly to wine, gold, paintings, and other collectibles. This means that Germany is one of the better options for buying crypto because you won’t face as much taxation as you might elsewhere. Just remember that the amount of tax that you have to pay will increase based on your overall income.

Can I Buy Bitcoin with a Debit Card in Germany?

Debit cards and credit cards are similar but slightly different. A debit card is usually linked to a current account, which is the main account that you use for your day-to-day income and expenses. A credit card allows you to pay with borrowed money, meaning you don’t need to have the money in your account before you spend it, but in case you are not able to pay back, you are charged interest. We’ve talked about credit cards, but are you asking, can I buy bitcoin with a debit card in Germany? Yes, you can, go to the deposit section, enter the amount you wish to buy, select deposit via debit card, enter your card details, and you will receive the crypto into your wallet.

Can You Buy Bitcoin in Germany?

Bitcoin is one of the most popular cryptocurrencies on the market. And if you’re wondering, can you buy Bitcoin in Germany? yes, you can buy Bitcoin and other cryptocurrencies in Germany with credit, debit, or prepaid card instantly using PlasBit exchange. We also offer over a hundred different cryptocurrencies, so you’re not just limited to Bitcoin, and it has low fees and world class security, too. Note that some banks decline crypto purchases because their customers can declare the charges as false or fraudulent and request a refund. When that’s the case, you usually just need to contact them to let them know that the charges are genuine. Your bank or credit card company will be able to tell you whether they’ve restricted crypto purchases. They’ll also be able to let you know whether the restriction can be lifted. For example, they may allow crypto purchases if you give them your verbal or written consent, acknowledging the potential risks of these kinds of transactions.

Now, you might be wondering why some banks are taking this step. Well, it’s pretty simple. Some people have started using credit cards to buy more crypto than they can afford in the hope that it will increase in value and allow them to make a quick buck. Their aim is to return the money to their credit card provider and to pocket the profit. The problem is that there are no guarantees when it comes to crypto, and the volatile price of Bitcoin combined with some traders’ limited knowledge when it comes to risk means that some buyers end up losing the money they borrow from the credit card company. When that happens, they’re unable to pay it back and find themselves sinking into debt. Whatever you do, don’t do that.

Conclusion

By now, you should no longer be asking yourself, how can I buy crypto with a credit card in Germany? We’ve taught you everything you need to know. True, using a credit card is one of the most convenient ways to buy crypto, which is also why it’s one of the most common approaches. However, it also has its drawbacks, most notably that it’s not the cheapest option. The truth is that, like most things in life, it’s all about picking the option that works best for you. If you’re looking for a quick and easy method, buying crypto with a credit card can be a good idea. If speed is less important, but you want to make regular purchases on a schedule, you might be better off with bank transfers. Whichever option you go with, the good news is that Germany is crypto-friendly, and there are plenty of benefits to be had from buying crypto, whether you do so with a credit card or not.