In this article, we're going to dissect Apple's payment policies and weigh the potential pros and cons of direct crypto payments, should they be accepted. Does Apple accept Bitcoin? No. Apple does not directly accept Bitcoin for its products or its services; however, there are some alternative services that help you work around this to fork BTC over for what you want from Apple.

Pay for Apple's Products and Services Using a Crypto Card

Does Apple accept Bitcoin? Although Apple does not directly accept Bitcoin, there is a way for crypto enthusiasts to work around this. You can explore the PlasBit crypto card, which allows you to convert your BTC into fiat currency and load it onto a debit card. With this card, you can easily pay for Apple's subscription-based services and devices. It's worth noting that this card isn't confined to digital services; it extends to physical products like iPhones or AirPods when used in Apple stores. Alternatively, users can integrate the physical card details into their Apple accounts, enabling app payments in the app store or subscriptions for services like Apple Music and iCloud storage. From the user's perspective, there won't be any difference since all the conversion happens seamlessly in the background. To get started with converting your cryptocurrency to USD and using it to purchase Apple products and services, simply follow these steps;

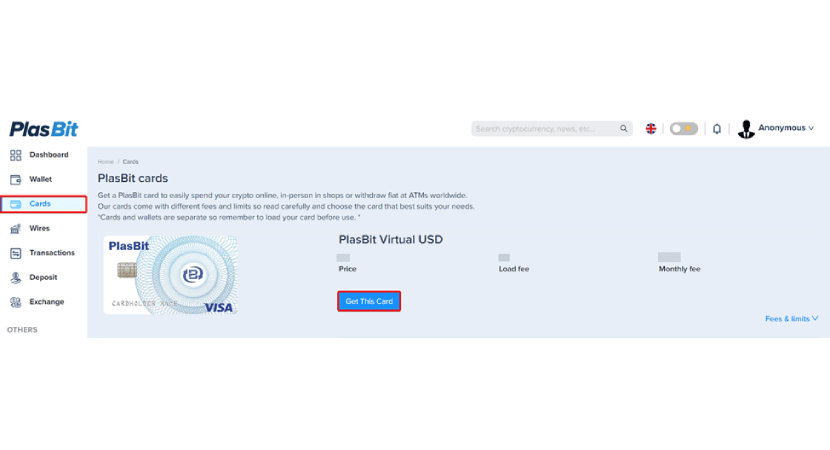

1. Please go to the 'Cards' section on our platform to convert your cryptocurrency into USD.

2. Choose from three types of cards— Virtual USD, Plastic USD, or Metal USD—each with its own pricing and fees. To proceed with the exchange, simply click 'Get This Card'.

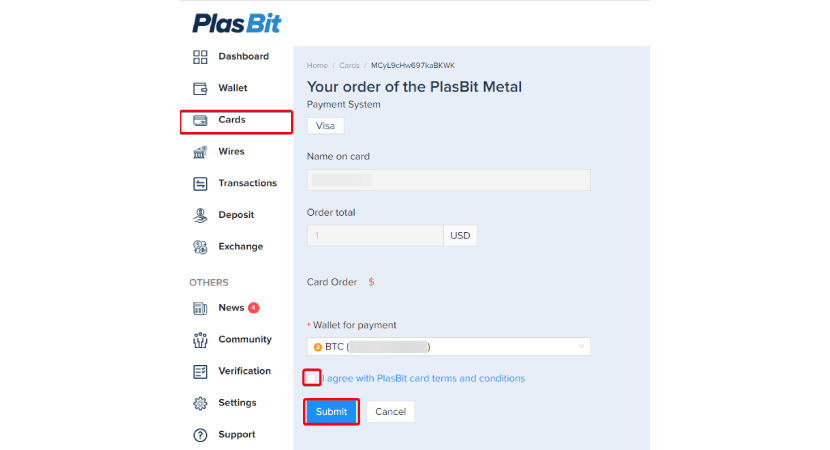

3. Enter the payment details, including the name of your card. Take a moment to review and accept the provided terms, then click 'Submit' to confirm the transaction.

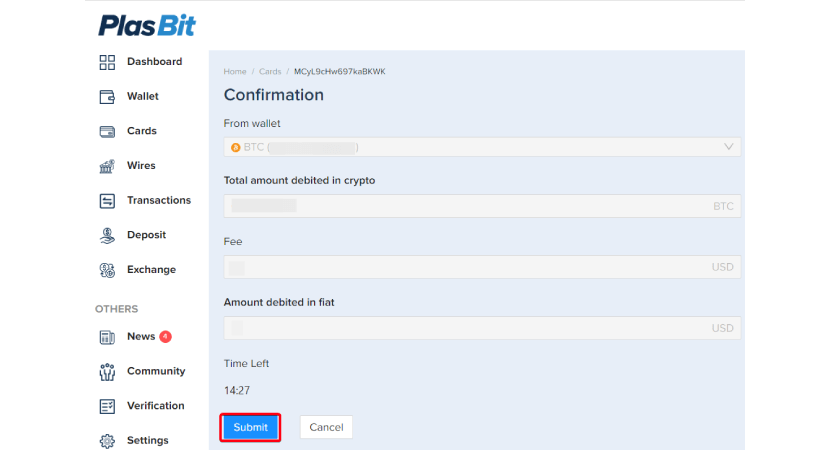

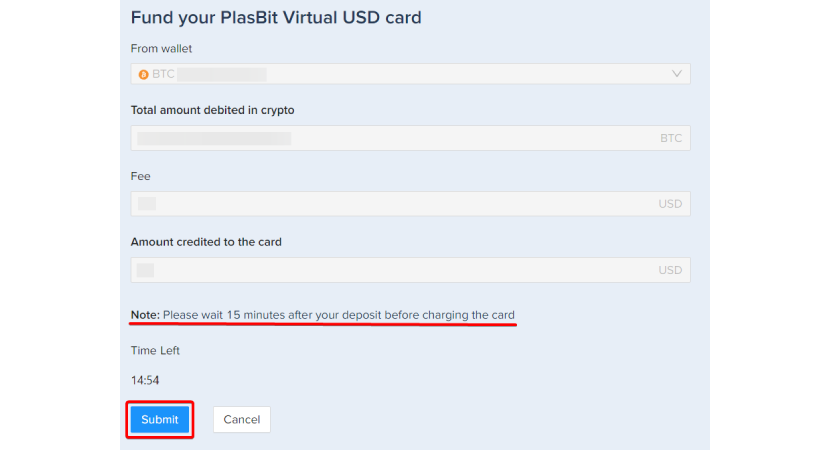

4. Check important information such as your wallet balance, total crypto debited, fees, and the fiat amount. Once everything looks good, click 'Submit'.

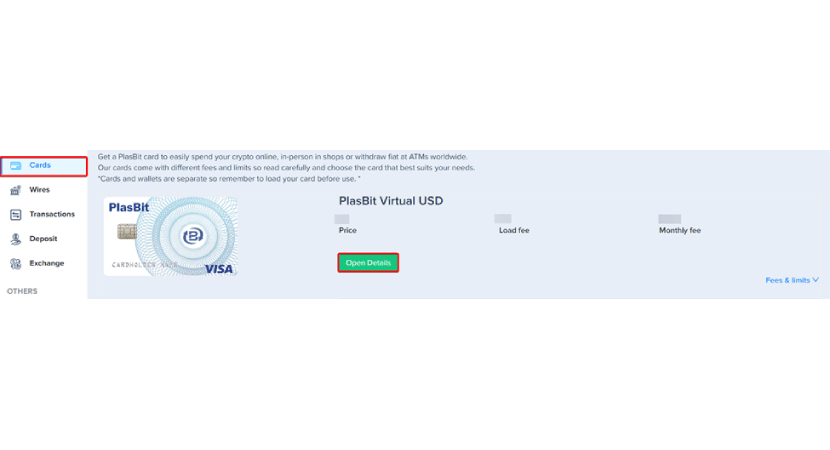

5. If you want information about your selected card, including limits, transaction history, validity period CVV code, and signature requirements, simply click on the 'Open Details button.

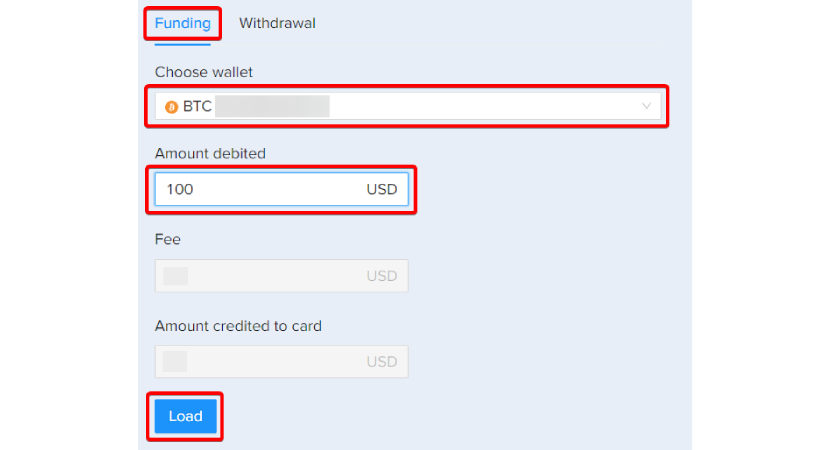

6. Choose to load your debit card with USD through a selected crypto wallet. Indicate the sum of money, check associated rates, and notice the final amount to be received by your debit.

7. Make sure that money has been deducted from the cryptocurrency, fees have been subtracted automatically, and you know the total amount that will be sent to your debit card. Click on Submit after reviewing all details.

8. Funds are now available on your debit card, so you can use them for shopping without any problem, even in businesses where digital currency has not yet been used. Use it as an ordinary bank card for convenient transactions.

.webp)

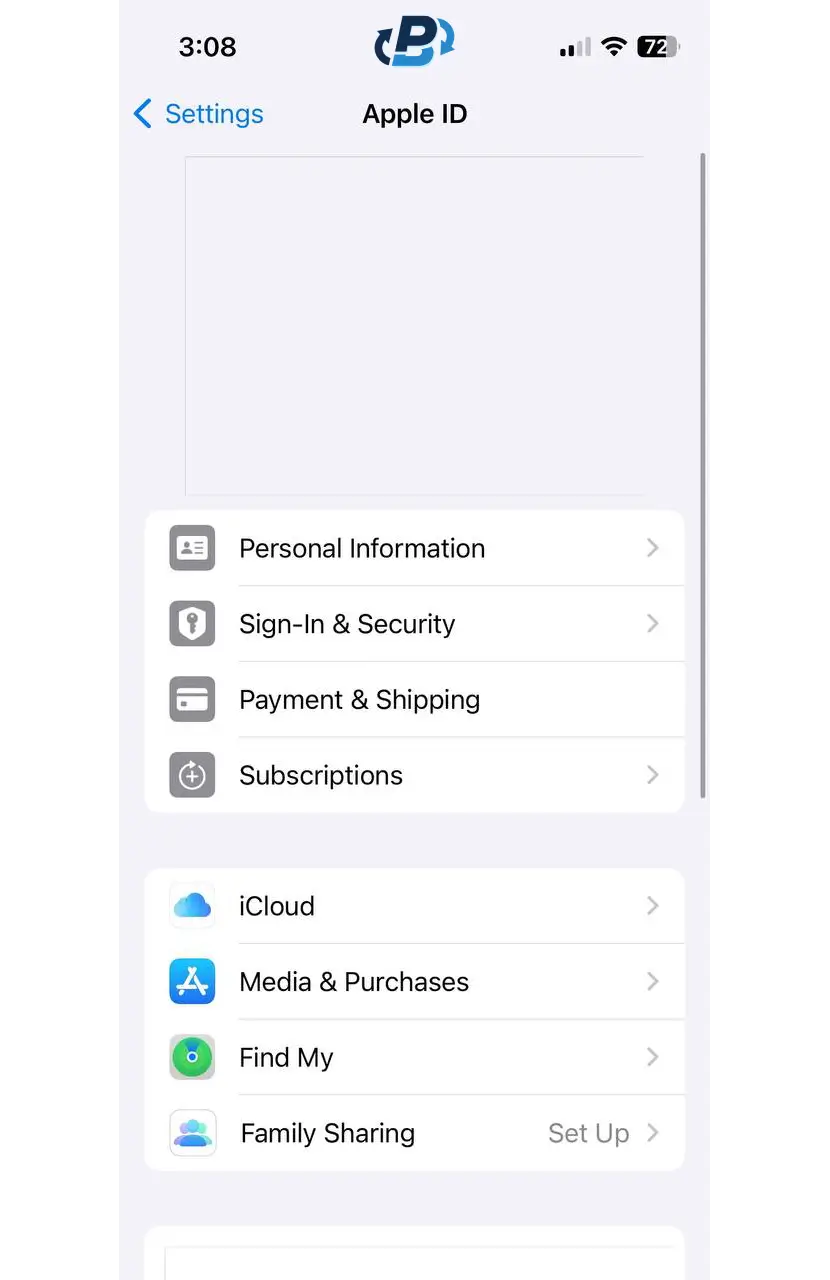

9. To add a payment option on your Apple device, open the Settings app, tap your name, and navigate to Media & Purchases.

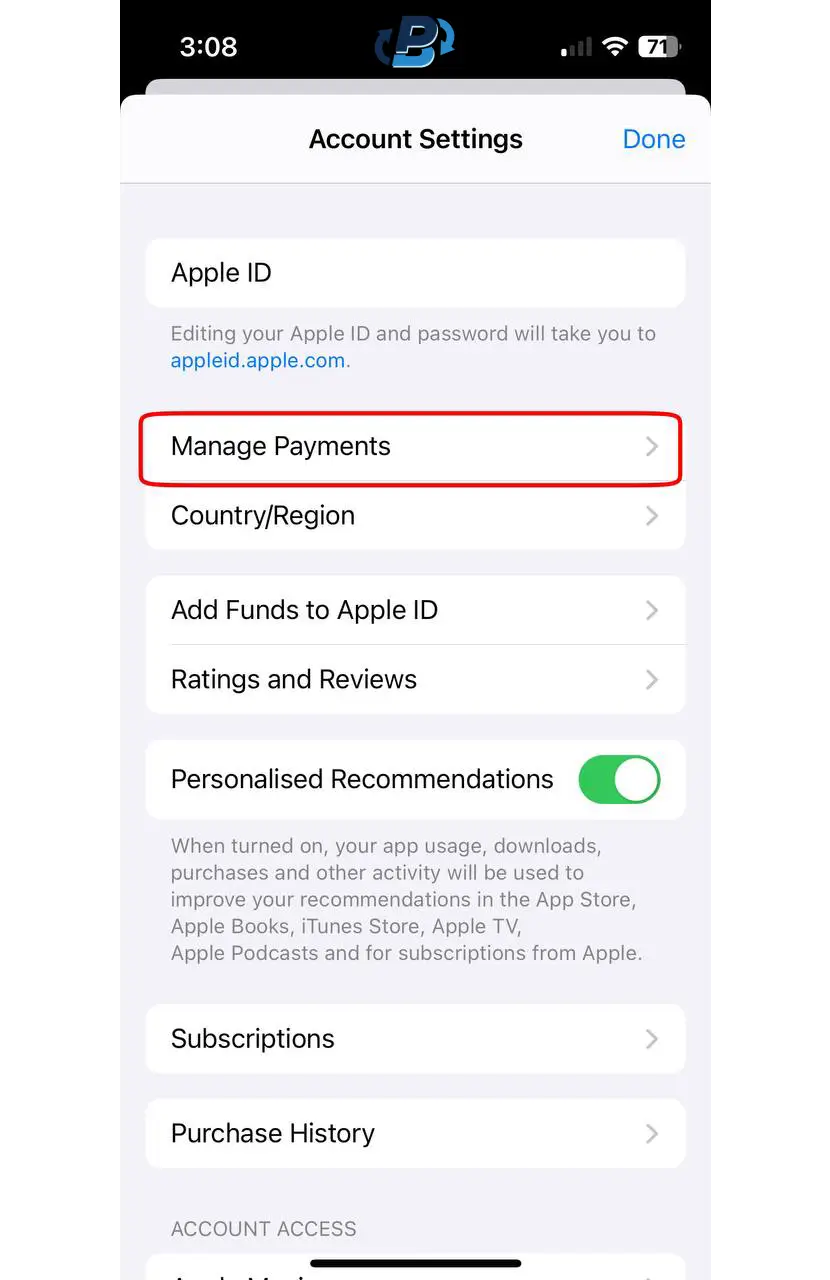

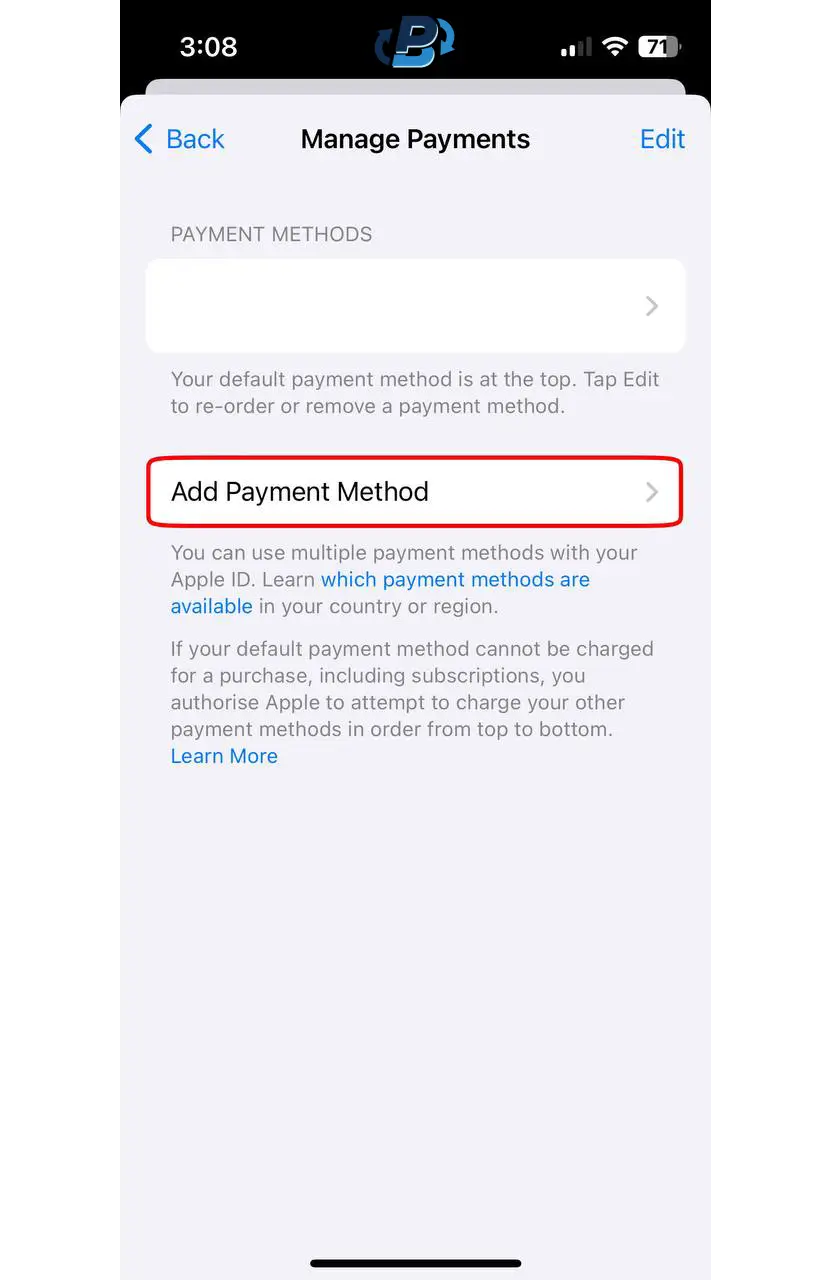

10. Select View Account and tap Manage Payments.

11. Locate the Add A Payment Method button and click on it.

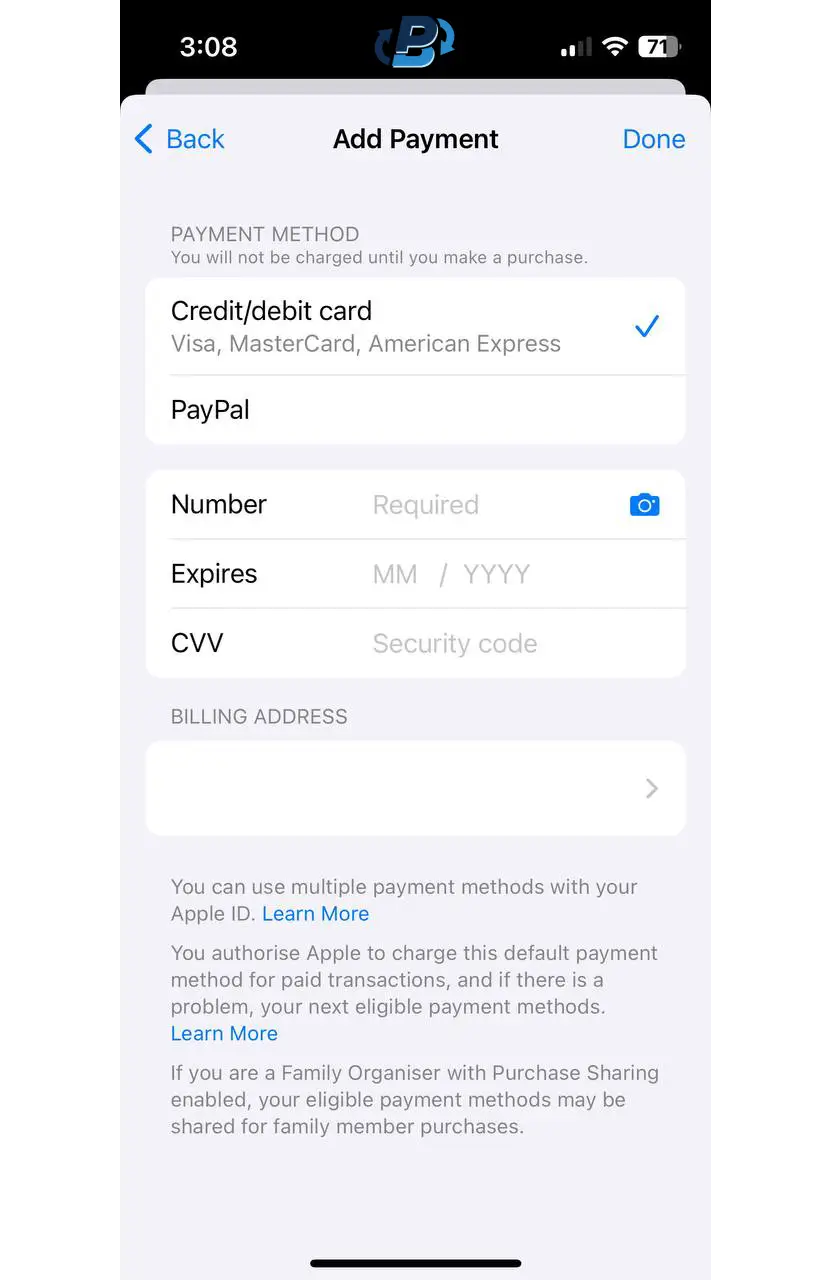

12. Pick the payment method you want to add, update, reorder, or delete your preferred payment methods.

Exploring Options: Buying Apple Gift Cards Using Bitcoin

Does Apple accept Bitcoin? It's been quite a challenge to buy Apple products with cryptocurrency as the company has been cautious about embracing currency for transactions. However, an interesting alternative has emerged: purchasing Apple gift cards with Bitcoin. To do this, you'll need to use third-party platforms that facilitate the exchange. Essentially, you transfer your Bitcoins to these platforms. Receive Apple gift cards with Bitcoin. While this method offers a solution to direct Bitcoin transactions, it does come with its set of drawbacks. Let's dive into the complexities of this approach and explore the downsides and challenges you might encounter when opting for this method.

Concerns Regarding Security;

Buying Apple gift cards with Bitcoin security is a concern. The main drawback lies in the involvement of intermediaries in this transaction process, deviating from the control typically associated with Bitcoin transactions. Entrusting a third-party platform with your Bitcoins and personal information introduces a layer of vulnerability. The increased reliance on platforms can create a breeding ground for activities. These activities can range from hacking attempts aimed at stealing assets to schemes targeting sensitive personal data. At PlasBit, we prioritize the security and privacy of our customers. We ensure protection against threats by storing 100% of user cryptocurrencies offline in cold storage, encrypting account information, and implementing two-factor authentication. Our commitment extends to conducting penetration tests, maintaining internal controls, and providing 24/7 customer support for a secure and reliable crypto experience. As you navigate the balance between convenience and security in this journey, it becomes crucial to evaluate the security protocols of any third-party platform you choose to mitigate the risks of compromising financial and personal information.

Variability in Fees:

When purchasing Apple gift cards using Bitcoin, one encounters a challenge related to fee variability across third-party platforms. The cryptocurrency ecosystem is. Comprises companies that facilitate such transactions, each with its own fee structure. This results in a range of fees, including transaction fees, conversion fees, and platform fees, that collectively impact the value of the transaction. Therefore, engaging in this endeavor requires navigating through a nuanced landscape influenced by these fees. The lack of fee structures adds an element of uncertainty, making it difficult to accurately determine the cost of a transaction in advance. This changing fee situation requires attention, prompting you to carefully assess the associated costs on each platform. By examining these costs, you can make conclusions that align with your economic goals and preferences, ensuring a transparent and financially prudent transactional experience.

Potential Devaluation of Transactions;

Using Bitcoin to purchase Apple products through gift cards presents a landscape that reveals a potential decrease in the overall value of the transaction despite the initial appeal of this alternative method. The convenience promised by this approach must be balanced against fees that can collectively diminish the value of the transaction. Users navigating this territory must not evaluate but meticulously analyze the fee structures embedded within their chosen platform. This analysis extends beyond transaction fees. Explores hidden costs that may secretly erode the overall value of the transaction. The complexity of this journey filled with fees raises the chance that, in some cases, the total burden of these fees could outweigh the perceived benefits of using Bitcoin for the transaction. As you navigate through this terrain, it becomes crucial to have a nuanced grasp of the financial implications and carefully evaluate whether using Bitcoin aligns practically with the inherent value maintained throughout the transaction process.

The Pros and Cons of Apple Accepting Cryptocurrency

Apple's acceptance of cryptocurrencies brings forth an analysis and a possibility of the pros and cons. This examination sheds light on opportunities and factors to be considered that could have an impact on the future course of the tech giant.

Benefits for Apple:

Global Reach Impact:

The idea of incorporating cryptocurrency payments into Apple's ecosystem opens up possibilities for the company's influence. It represents a shift in their market strategy, signaling both evolution and revolution. Imagine a future where Apple's reach is no longer constrained by boundaries. By embracing currencies, transactions enter an era where the limitations of conventional banking systems have become obsolete. Cryptocurrencies, operating on networks, have emerged as tools that allow Apple to transcend boundaries and access markets previously restricted by limited financial services. This new paradigm places importance on inclusion, with Apple positioned to make a global impact in this regard. Expanding into underserved regions not only represents a move but also demonstrates Apple's commitment to reaching a diverse and extensive customer base. By embracing the nature of cryptocurrencies, Apple has become a pioneering force that connects regions where traditional payment methods may be less accessible. This visionary approach sets the stage for Apple to contribute to a thriving economy.

Lowering Transaction Costs:

If Apple were to start accepting cryptocurrency for transactions, it could lead to a change in how financial transactions are handled. Cryptocurrencies are known for their fees compared to payment methods, so this move could have a substantial impact on Apple's financial performance. By saving on transaction costs, Apple would have room for profitability and could potentially offer more competitive prices for its products. This would not benefit Apple internally. It also provides consumers with a more affordable way to get their hands on the latest technology from the company. Ultimately, this increased financial efficiency could create a landscape and influence other companies in the technology and finance industries.

Promoting Innovation and Enhancing Image:

If Apple were to adopt cryptocurrencies, it would showcase its commitment to innovation. Further, it enhances its reputation as a leading tech pioneer. By embracing currencies by implementing blockchain technology, Apple would position itself as an industry trailblazer that not only keeps up with technological trends but actively shapes them. This innovative approach goes beyond transactions and highlights Apple's ability to adapt to ever-evolving technologies. By integrating technologies into its payment system, Apple has the potential to attract a discerning group of tech consumers and traders who are drawn to innovative companies. This positive reception can go beyond the industry. Shape the overall perception of the Apple brand, establishing it as a forward-thinking and technologically advanced entity in the competitive tech sector.

Enhancing Financial Accessibility:

Exploring Apple's acceptance of cryptocurrencies reveals an opportunity for impact in promoting financial inclusion on a global scale. Cryptocurrencies inherently possess the ability to bridge the divide and reach individuals who are unbanked or underbanked. If Apple embraces this payment method, it could play a role in advancing a more inclusive global economy. Offering a payment option for those without access to banking services could empower individuals in regions with limited banking infrastructure to participate in the digital economy while gaining access to Apple's products and services. The envisioned synergy between cryptocurrency adoption and financial inclusion emphasizes its influence, positioning Apple as an agent of positive change in creating a fairer and more accessible global financial landscape.

Security Enhancements:

To bolster the security of Apple's payment system, integrating technology, which forms the foundation of cryptocurrencies, holds great potential. The decentralized nature, immutability, and cryptographic encryption inherent in blockchain offer security features that could significantly enhance the trustworthiness and transparency of cryptocurrency transactions for Apple. By embracing cryptocurrencies, Apple could provide its customers with a transparent way to make purchases, instilling confidence in the integrity of their transactions. This step towards heightened security aligns with Apple's dedication to user privacy. Demonstrates an approach to staying ahead of ever-changing cybersecurity threats in the fast-paced world of digital payments.

Downsides for Apple:

Volatility:

When Apple considers adopting cryptocurrencies, it faces a challenge due to their price volatility. Cryptocurrencies are known for their nature, which exposes Apple to the risk of significant fluctuations in the value of assets received from transactions. Dealing with this volatility could be difficult for Apple as it tries to forecast revenue and plan financial aspects to maintain stability in its operations. The dynamic cryptocurrency markets make it more complex to anticipate and strategize for financial outcomes, which can affect trader confidence in Apple's financial stability. To navigate these challenges successfully, Apple must adopt an adaptable approach to risk management that minimizes any effects on its stability and relationships with traders.

Regulatory Uncertainty:

Integrating cryptocurrencies into Apple's payment ecosystem presents a challenge due to uncertainty. The changing global regulatory landscape surrounding cryptocurrencies requires consideration from Apple. Navigating through occasionally conflicting frameworks is not just a technological matter; it demands significant resources and efforts to ensure compliance with various regulatory requirements. The varying regulatory approaches across jurisdictions create uncertainty, which adds complexity to Apple's planning. It is crucial for Apple to be adaptable and carefully navigate this ambiguity, as it can impact consumer trust in cryptocurrency transactions without legal frameworks. Finding the balance between compliance and innovation becomes imperative for Apple to embrace cryptocurrencies while ensuring adherence to regulations and maintaining the trust of its user base.

Dealing with Challenges:

Integrating cryptocurrency payments into Apple's existing infrastructure poses a challenge with operational intricacies. This process involves addressing complexities, such as implementing wallets and staying compliant with the ever-changing regulatory landscape. The technical hurdles of this integration require the allocation of resources in terms of workforce and advanced technology. Apple would need to develop and maintain secure yet user cryptocurrency wallets, ensuring the protection of user assets and sensitive information. Additionally, they must continuously stay updated on standards across jurisdictions, adjusting their operations accordingly. The amalgamation of regulatory challenges adds complexity that may strain resources, requiring significant investments in employee training, technology infrastructure, and adapting to the rapidly evolving cryptocurrency landscape.

As Apple explores the possibility of entering this venture, it becomes crucial for them to take a comprehensive approach to dealing with the complexities involved. This will ensure a successful integration of cryptocurrency payments.

Educating Consumers:

If Apple decides to adopt cryptocurrencies, it would bring about a change that requires its customer base to have a deep understanding of this new concept. Cryptocurrency adoption often requires knowledge among the general population. In light of this, Apple would not be introducing a payment method but also taking on the responsibility of educating its users. It is essential for Apple to develop materials, user-friendly guides, and interactive platforms that explain the benefits and risks associated with using cryptocurrencies. This educational effort is crucial in ensuring that consumers who are unfamiliar with currencies can transition smoothly, trust the payment method, and make informed decisions. Apple's commitment to educating consumers about cryptocurrencies is key to integrating this payment option into their ecosystem.

Market Acceptance:

The possibility of Apple embracing cryptocurrencies as a form of payment brings up a consideration: market acceptance in an evolving landscape. While there is already a growing community of cryptocurrency enthusiasts due to its nature, broader acceptance still poses challenges. Apple's entry into this field might face opposition from banks, governments, and some consumers who have concerns about the nature of cryptocurrencies. Gaining acceptance in the market will take time. Require strategic marketing and communication efforts. Apple would need to explain the benefits and security measures of cryptocurrency transactions while also addressing any uncertainties or misunderstandings in the market. Collaborating with bodies and financial institutions will be crucial to establish trust and credibility. Successfully navigating this path involves finding a balance between innovation, education, and addressing doubts, ultimately shaping the future of cryptocurrencies as a payment method within Apple's market presence.

Exploring the Range of Apple Products with Cryptocurrency

Navigating Apple products using cryptocurrencies, like Bitcoin, has become easier than before. With MacBooks, state-of-the-art iPhones, immersive Apple Displays, innovative iPads, cutting-edge AirPods, and revolutionary Apple TVs in their lineup, Apple now offers a flexible and inclusive payment option for tech enthusiasts. By embracing currencies, such as Bitcoin, to purchase their products, Apple demonstrates its commitment to adaptability. Keeping up with the changing global financial landscape. This integration does not expand consumer choices. It also adds a sense of modernity and forward-thinking to the overall consumer experience. It sets a precedent for some companies to follow suit and consider incorporating cryptocurrencies into their payment systems.

The move towards cryptocurrency transactions for Apple products acknowledges the shifting preferences and technological advancements that shape how we engage with transactions and technology purchases. It positions Apple as a trailblazer in this regard. By embracing cryptocurrencies, like Bitcoin, as a payment method, they pave the way for other companies to explore options within their own ecosystems. As technology and finance continue to evolve, the acceptance of cryptocurrencies as a means of purchasing Apple products marks a milestone. This decision caters to the growing community of enthusiasts. Demonstrates the increasing integration of digital currencies into mainstream commerce. Apple's innovative approach aligns with the expanding landscape of payments, bridging the gap between cutting-edge technology and the decentralized realm of cryptocurrencies. It provides a glimpse into a future where traditional and digital currencies seamlessly merge, offering a forward-thinking experience.

Conclusion

Does Apple accept Bitcoin? Whether Apple accepts Bitcoin, it's worth noting that they don't directly accept it for their products and services. However, there is an alternative called PlasBit cards that provides a workaround. These crypto cards allow you to convert your Bitcoin into currency and load it onto a debit card. With this card, you can conveniently pay for Apple's subscription-based services and devices. This solution offers practicality for those interested in using cryptocurrency for their Apple transactions. As digital payments continue to evolve, the integration of cryptocurrencies like Bitcoin through solutions such as crypto cards demonstrates the adaptable nature of technology and finance coming together.