In today’s world, the line between traditional finance and digital assets is getting thinner with each passing day. As cryptocurrencies move beyond investment portfolios and into everyday life, many users are looking for more accessible ways to spend their crypto assets. With crypto adoption on the rise, they want to be able to spend their crypto as easily as they would tap a debit or credit card at a terminal and pay. From buying coffee to booking flights, the demand for easy ways to use crypto in daily expenses is there, and digital wallets such as Apple Pay are a prime candidate for making it happen. Apple Pay, in particular, has become one of the easiest and most convenient ways to buy stuff on the go, but can you add crypto card to Apple Pay Yes you can, all you have to do is order a PlasBit card, load it with crypto, add the card details to your Apple Pay account, and choose it as the payment method when you use Apple Pay. Crypto card is just like any other regular debit or prepaid card, and it can be used on Apple as a payment method, same as any bank card.

Apple eases its crypto restrictions

When it comes to crypto, Apple has always been cautious, but that seems to be changing. Several months ago, the company removed the iOS restrictions that were stopping any in-app purchases involving cryptocurrencies. Before this, no third-party links to payments outside the platform were allowed, and the app developers could only use Apple’s system for payments. Now, they can direct app users to a third-party solution that allows paying with crypto. Granted, all of this came into fruition after a federal court in California determined that Apple was guilty of monopolistic practices by preventing any competition within its iOS App Store. With this decision, the tech giant was forced to change its policy, and now developers can create links that redirect app users to external payment processes, or in other words, crypto payments are now possible. However, even with this policy change, you still can’t pay with crypto when using Apple Pay, you can’t just connect your crypto wallet to the service and go on a spending spree. To do that, you need a crypto card like the PlasBit card (more on that later).

When asking can you add crypto card to Apple Pay, do note that these cards work pretty much the same as regular debit cards, but with one key difference. You use the balance in your wallet to load the card with the specific amount you choose, and then you can spend that sum from the card. The entire payment process is rather straightforward, since the conversion happens when you load the card with crypto, then the exchange takes your crypto and loads the card with traditional currencies such as US dollars, Euros, and so on. This way, the seller will get the payment in regular money without needing to handle any crypto transactions on their own. The great thing about crypto cards is their accessibility, especially when compared to regular bank cards that may have regional restrictions. Usually, crypto cards will work anywhere where Visa or Mastercard are accepted. Also, you don’t need a bank account to use a crypto card, which makes them very useful in areas of the world that may have limited banking infrastructure.

Apple Pay’s homepage (Image credit: Apple.com)

Buying and using a PlasBit card

As briefly mentioned earlier, our PlasBit crypto card can help you with Apple Pay crypto payments and remove all the hassle. Here’s the step-by-step guide on how to buy it, add money to it, and then connect it to your Apple Pay.

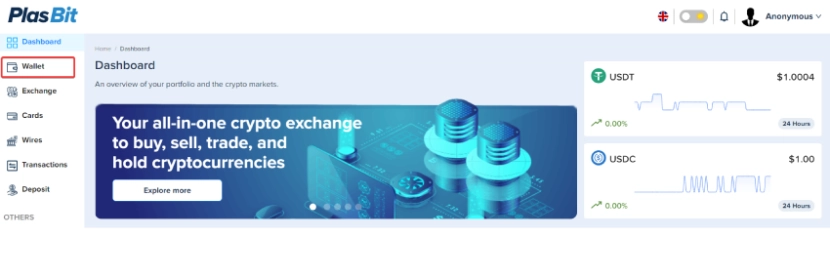

Step 1 - Log in to your Plasbit Dashboard and go to the wallet section.

Step 2 - Deposit your preferred cryptocurrency.

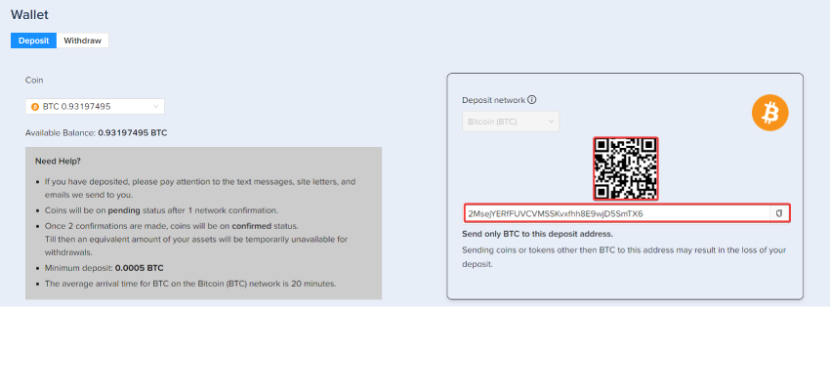

Step 3 - Head over to the Cards section, select your preferred card, and click "Get This Card".

Step 4 - Choose the wallet you want to pay with to issue the card.

After you click “Submit”, you’ll receive a confirmation email for your order, and another one once your virtual card has been successfully issued.

Step 5 - Revisit the Cards section and click the "Open Details" button. Navigate to the Funding tab and choose from which wallet you wish to deposit funds. Then click the "Load" button and press "Submit" once you check that the amount is correct.

Step 6 - You can access the card details and get your card number, expiry date, and CVV by pressing the "View Card Details" button.

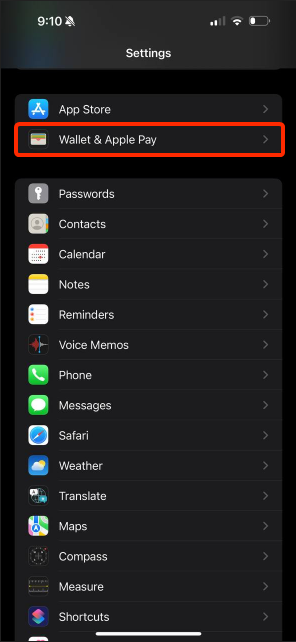

Step 7 - Open the Settings app on your iPhone.

Step 8 - Navigate to Wallet & Apple Pay

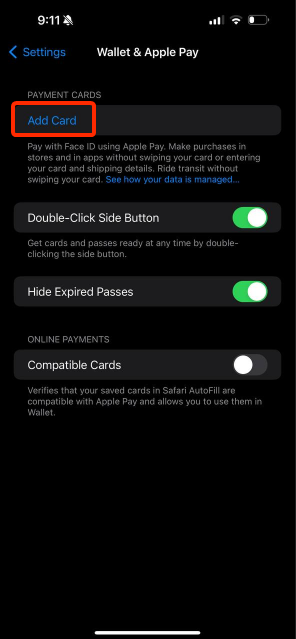

Step 9 - Click on "Add Card".

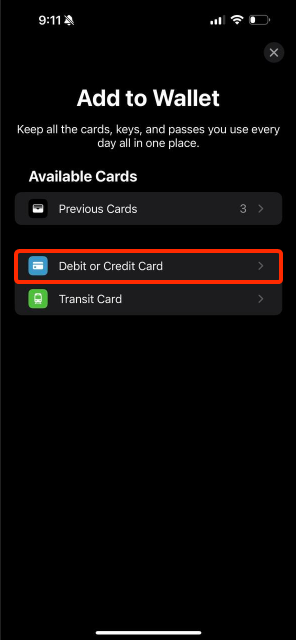

Step 10 - Select "Debit or Credit Card".

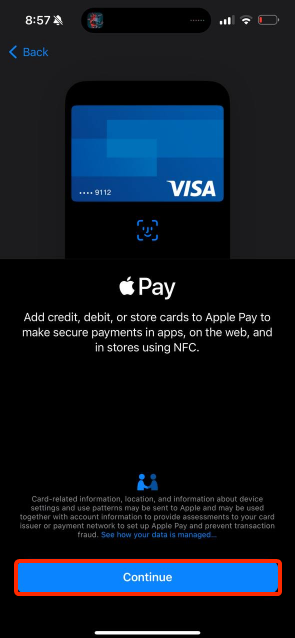

Step 11 - Click on “Continue”.

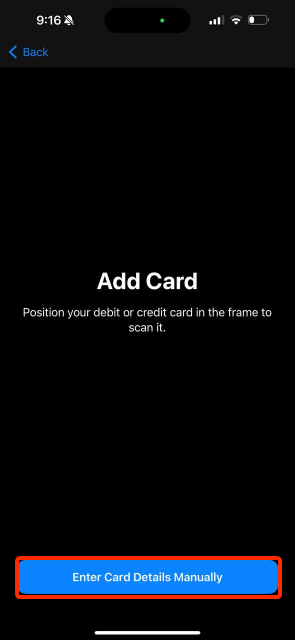

Step 12 - Fill in the card details (you can use the scanning feature to fill in some of the details faster) or add the card details manually without scanning by clicking on the “Enter Card Details Manually” button.

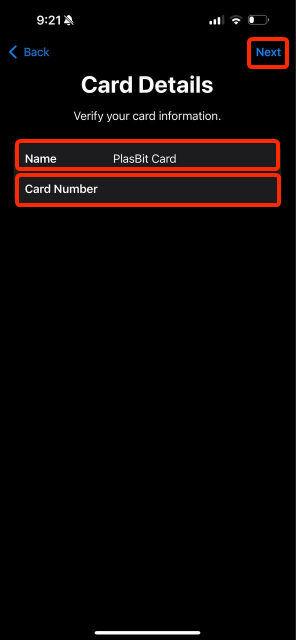

Step 13 - Enter the cardholder's name and card number, then click "Next".

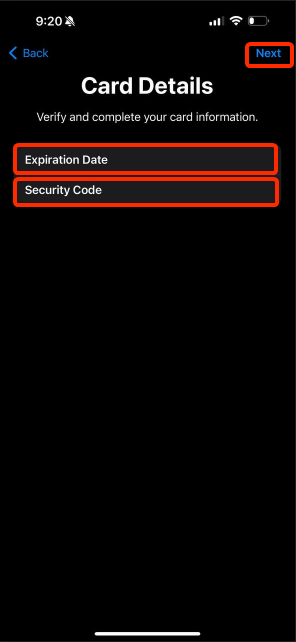

Step 14 - Enter the card expiration date and security code, then click "Next".

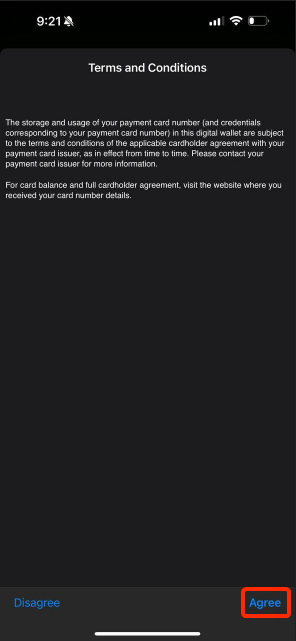

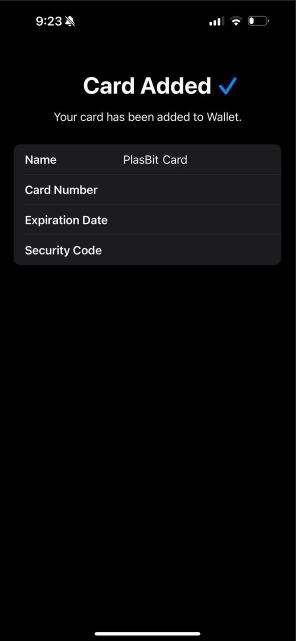

Step 15 - After entering the card details, click "Agree" to accept the Terms and Conditions.

The card will take a few moments to connect as it loads.

Step 16 - Once connected, it will display that your card has been successfully added.

Step 17 - You’ll also be given the option to connect the card to your Apple Watch. If you are not interested, click "Done".

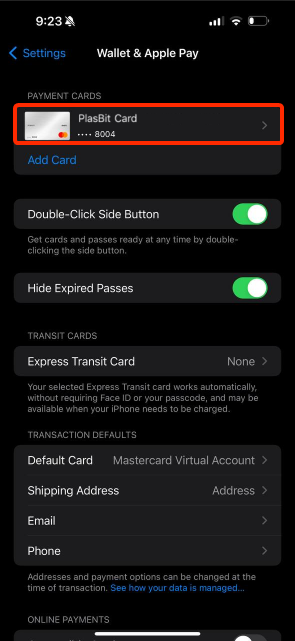

Step 18 - You will return to Wallet & Apple Pay, where you can see your PlasBit card added and ready for use.

Can I use crypto on Apple Pay?

Unfortunately, Apple still hasn’t allowed direct crypto transactions on Apple Pay, and there’s nothing announced indicating the situation will change in the near future. So, at the moment, the answer is simple if you’re asking yourself can I use crypto on Apple Pay No, you can't, but you can use crypto if you order a Plasbit card, load it with crypto, and add it to your Apple Pay account as a payment option. Once added, you can use it like a regular bank card and pay for your everyday expenses with your crypto card via Apple Pay. One of the strongest selling points of crypto cards is their ability to make crypto payments widespread for users all around the world. For instance, with a PlasBit card linked to Apple Pay, you can walk into a coffee shop, get your iPhone at the checkout, and pay with Bitcoin or any other crypto you wish for that black nectar. This is as convenient as it gets because you don't have to deal with the hassle of exchanging crypto for cash. Users can use this method for their daily shopping routines or even larger expenses, such as booking flights, paying for hotels, and so on.

The Apple Pay ecosystem, from credit cards to PayPal

For your everyday payments, you may still be using your physical credit card, or if you’re shopping online, you’re more than familiar with constantly having to fill in the card’s details at the checkout. To save yourself time and add extra convenience, you may want to consider using Apple Pay. It’s a rather handy service that enables people to make secure and contactless payments with a simple tap, without the need for a physical card, and that is probably the main reason why Apple Pay became so popular. In fact, Apple Pay’s popularity extended to retailers as well, since it allows them to give their customers loyalty cards, tickets, and coupons instead of handling them physically like they used to. While Apple Pay doesn’t allow direct crypto transactions (which may be its only real drawback, if you ask us), other, more traditional options are available. These generally include most credit cards, debit cards, and PayPal, while some countries also have support for Apple Card, Apple Cash, or mobile phone billing. Naturally, to use any of these, you need to have an Apple account.

- Credit and debit cards are the most common payment methods linked to Apple Pay, and depending on the region, these can be Mastercard, Visa, American Express, and Discover, alongside some local-specific cards. You can use them in-store through contactless NFC (Near-Field Communication) payments, or online and in apps via Face ID, Touch ID, or a passcode. Do note that when you make a purchase, Apple Pay uses tokenization (a process that replaces important card information with meaningless data to protect users from cybercriminals) to keep your real card number hidden. Security is one of Apple Pay’s biggest selling points, and the company itself positions the service as a privacy-first product with claims that it does not track user transactions for marketing purposes. We must admit, we’re a bit skeptical about this last part, but there’s no doubt that the service takes user protection seriously. Just remember that if you’re trying to figure out can you add crypto card to Apple Pay, the answer is yes.

- PayPal was integrated into Apple Pay two years ago, allowing you to link your PayPal account directly to Apple's service. This is a convenient option if you are a PayPal user, since you can use your PayPal balance or any linked cards on your account, as long as Apple Pay is supported, that is.

- Apple Card and Apple Cash are only available in the United States and are integrated directly into Apple Pay. When you use the Apple Card, you earn cashback as Apple Cash, which you can then spend right away using Apple Pay. Basically, you can think of Apple Cash as the balance on a digital debit card, since it acts like one.

Does Apple Pay accept crypto?

In case you’re wondering if Apple Pay accepts crypto at all, or if there is at least one service offered by Apple that accepts crypto directly, then we've got bad news for you. Unlike other companies that sometimes allow some part of their services to be paid for with crypto, Apple doesn't make an exception, and as such, does Apple Pay accept crypto No, Apple Pay does not accept crypto directly, however, you can order and use Plasbit card, load it with crypto, and add it as a payment method to your Apple Pay account. Another notable use for crypto cards is their usefulness for people who don’t have easy access to standard banking services. It’s a sad reality that in some regions of the world, there is no shortage of people who lack access to traditional bank accounts, so their options are limited if they want to go digital. Luckily, iPhones are spread across the globe, even in countries where economies aren’t doing so well. Take Brazil as an example, whose population began adopting crypto to avoid the country’s monetary issues. By using their smartphones and a crypto card linked to Apple Pay, they can enjoy the benefits of digital payments, online shopping, or anything else that may require a credit or debit card. Once again, convenience and practical use come on top when it comes to crypto cards.

Apple’s logo (Image credit: Finance.Yahoo.com)

Apple loses in court and opens a way for crypto adoption

We briefly mentioned the Cupertino company going to court for forcing all in-app purchases to go through the App Store and losing the case. More precisely, Apple lost the case to Epic Games, creators of Fortnite and the famous Unreal video game engine. The video game company saw Apple’s 30% cut of the revenue as an unfair practice, Epic makes money from in-game purchases of digital customization content they create, and they were giving away almost a third of each purchase due to Apple taking its cut and they considered it unfair. So, the Fortnite creators decided to sue, and eventually the court saw this as a mob-style shakedown, where Apple was extracting revenue from digital goods the developers created without contributing anything to create those goods, and if someone dared rebel, they would instantly ban their app from the platform. Apple’s loss was an app developers' gain, and in the long run, likely the crypto community’s as well, since now with the court’s ruling, iOS developers are able to add third-party payment links to cryptocurrencies such as Bitcoin or Ethereum, in addition to other digital assets like NFTs, without having to pay Apple’s 30% fee. At the end of April, during the court filing, US district judge Yvonne Gonzalez Rogers stated: “The Court finds Apple in willful violation of this Court’s 2021 Injunction, which was issued to restrain and prohibit Apple’s anticompetitive conduct and anticompetitive pricing.

Apple’s continued attempts to interfere with competition will not be tolerated. Effective immediately, Apple will no longer impede developers’ ability to communicate with users, nor will they levy or impose a new commission on off-app purchases.” Shortly afterward, Apple changed and updated its guidelines in line with the court ruling, and many crypto enthusiasts saw this as a big potential for the industry, apps can now link to NFT collections that aren't on Apple's store, link to other websites without special permission, and connect to other payment systems without a special license opens many possibilities. Apple is a tech giant for a reason, and the iOS ecosystem is a massive one with over 2.35 billion active devices worldwide. The access to so many users could open doors to crypto’s mainstream usage. Additionally, app developers can now potentially experiment with crypto and NFT payments, and route users directly to crypto wallets, stablecoin rails, or decentralized exchanges. Simply put, a road to crypto innovation has been paved, where digital asset purchases can now be made more practical.

NFTs and Web3 games could gain popularity as well, considering that prior to the court ruling, all kinds of workarounds had to be made to comply with Apple’s rules. Realistically speaking, it’s likely that stablecoins may be the biggest winners here. They are increasingly getting more popular, and with the ever-present volatility in Bitcoin, Ethereum, and the rest of the cryptocurrencies, stablecoins are far more suited for everyday payments. Whatever the case, the removal of Apple’s crypto restrictions is a huge gain for crypto adoption at the consumer level. Instead of needing separate wallets, crypto payments could become as normal as paying with PayPal, although it’s very likely that we’re still some time away before that actually happens. Still, it’s no secret that the financial world is increasingly moving toward a more hybrid model, one where both traditional finance and decentralized finance overlap and get mixed together. With Apple Pay being highly secure and user-friendly, it represents the best of traditional finance. In contrast, crypto wallets and blockchain rails are all about transparency and decentralization.

As the demand for more mainstream crypto payments grows, combining crypto spending through Apple Pay and similar systems allows users to get the best of both worlds. With that in mind, it’s not hard to imagine that a forward-thinking titan like Apple could strike partnerships with crypto projects or blockchain networks in the future. After all, its CEO Tim Cook stated several years ago that he personally invested in cryptocurrency and that he owns Bitcoin. And let’s not forget that the more traditional financial services such as PayPal, Visa, and Mastercard, are already working with the crypto industry. If Apple decides to directly integrate crypto into one of its services, it could take crypto adoption and mainstream use to new heights. Just imagine that some time from now, instead of wondering can you add crypto card to Apple Pay, you may start to ask how to directly use crypto on Apple Pay. If that day indeed comes any time soon, stablecoins will probably be the best bet for hybrid adoption. As they’re designed to follow the value of regular currencies like US dollars or euros, they are seen as less volatile than Bitcoin and the rest of the cryptocurrency bunch. It’s entirely possible that this reason alone might make them more attractive to both the casual users and the general public.

Plus, stablecoins are gaining more and more traction, now even the European Central Bank (you know, the central bank of all those EU countries that adopted the euro) is looking at using blockchains like Ethereum and Solana to help launch its new digital euro. If the trend continues, Apple may eventually start to align its policies to work with digital assets that have received regulatory approval. Yet, whether Apple will ever allow native crypto support is hard to tell, as right now, the company is relying on third-party cards to do the job. Its competitors could play a big role as well, which may put extra pressure on Apple to expand its offerings. Still, the Big Tech company has historically always been cautious about entering new industries and will likely wait for clearer regulations before making a move. So far, users will simply have to settle for using a crypto card linked to Apple Pay.

Does Apple Pay work with Bitcoin as a payment method?

Considering Apple Pay doesn’t accept any crypto at all, it means that the king of cryptocurrencies, Bitcoin, isn’t accepted either. While we don’t know what the future might hold, we do know the current answer to the question does Apple Pay work with Bitcoin as a payment method No, Apple Pay doesn’t accept Bitcoin directly, but you can bypass this by ordering a Plasbit card, loading it with Bitcoin, adding it to your Apple Pay account, and selecting it as your payment method.

PlasBit card is the way to go

In the end, if you’re still asking can you add crypto card to Apple Pay, remember that not only is the answer yes, but that the PlasBit card is an ideal choice for the job. PlasBit was created with the idea of solving a big problem for crypto users and providing payment solutions, with the ultimate goal of making crypto a practical part of your daily life. Our card is super secure and includes the EMV chip, designated PINs, in addition to the option to instantly lock and unlock your card, which gives you full control over your spending. Also, you receive real-time notifications and easy tracking of your transaction history. Most importantly, it’s extremely easy to get the card, “load” it with money, and start using it, as we’ve explained in our guide earlier. So, in case you’re looking to add crypto to your daily spending via Apple Pay, look no further, as the PlasBit card offers one of the most reliable and user-friendly options you can find.