Cryptocurrencies are the future of digital transactions, proving this to a large extent. Many are fascinated by the benefits of the world's largest crypto asset, Bitcoin. In digital currencies, Bitcoin has emerged as a disruptive force that challenges traditional notions of money. While Bitcoin's journey is affected by volatility and skepticism, there are compelling reasons why it can serve as real money. Amidst other advantages, this crypto token handles faster cross-border payments than most fiat systems we have in place today. That's why many experts and enthusiasts ask the same question: Can Bitcoin be used as real money? Would the world be better with crypto as its legal tender? The answers you need are right here.

Exploring the Concept of Real Money

The concept of 'real money' is fundamental to understand before delving into whether or not Bitcoin can be used as such. Real money, as we commonly understand it, is a form of exchange for goods and services. This form of money, also known as fiat currency, is provided by a government and regulated by a central bank. It holds value because the government maintains its value or because two parties agree. In the history of human civilization, many forms of money have been used, from bartering with goods to gold and silver to the paper and coins we use today. The evolution of money has been driven by the need for a more efficient and standardized way of exchanging value. The introduction of fiat currency was a significant milestone in this evolution. Fiat money does not have physical commodity backing like gold or silver; its value is derived from people's trust and confidence in the government issuing it. Fiat currency was first introduced in China during the Tang Dynasty (618–907 AD). However, it wasn't until the 20th century that it became the norm worldwide, replacing the gold standard. The transition to fiat currency gave governments greater control over economies by controlling the money supply.

Bitcoin's Relationship with Real Money

In contrast, Bitcoin, a digital or virtual currency, operates independently of a central bank and is generated by complex computer algorithms in a process known as crypto mining. Bitcoin's proponents argue that it is real money since it is used in buying goods and services, much like traditional money. However, its value is highly volatile and not universally accepted. Bitcoin challenges the traditional concept of real money in various ways. Its decentralized nature contrasts sharply with the government-controlled fiat currency system. Bitcoin transactions are largely anonymous, which is not the case with traditional banking systems. Lastly, the supply of Bitcoin is limited, contrasting with fiat currencies, which central banks can produce at will. Understanding the concept of 'real money' and its history helps analyze whether Bitcoin can be used as real money. While Bitcoin shares some characteristics with fiat currency, such as being a medium of exchange, it diverges significantly in other characteristics, casting doubt on its ability to replace traditional money fully. As we move forward, it will be interesting to see how the concept of 'real money' continues to evolve.

What Qualifies Bitcoin as Real Money?

Can Bitcoin be used as real money? Let's first look at the facts. Cryptocurrencies, such as Bitcoin, were created to replace fiat money. Crypto tokens inherited some of the features of traditional money and improved them through the blockchain. For several reasons, Bitcoin can be used as real money or a form of currency. So, why can Bitcoin be used as real money? Let's take a detailed look:

Decentralization and Trust

When people debate whether Bitcoin can be used as real money, most cite decentralization as a demerit of Bitcoin. But it's an advantage. Bitcoin functions on a decentralized network known as the blockchain. Without a central authority, this system ensures that no single entity or government can control or manipulate the currency. Traditional fiat currencies place trust in central authorities, which can be susceptible to economic instability, political interference, or fraudulent activities. Conversely, Bitcoin relies on cryptographic algorithms and consensus mechanisms to verify transactions, ensuring transparency, security, and trustworthiness.

Global Accessibility and Financial Inclusion

It cuts across borders. One of the inherent strengths of Bitcoin is its borderless nature. Unlike traditional banking systems, Bitcoin transactions function globally without intermediaries. This accessibility opens doors for financial inclusion, enabling unbanked or underbanked individuals to participate in the global economy. Bitcoin allows individuals in developing countries to access financial services, send and receive remittances at lower costs, and engage in e-commerce worldwide.

Bitcoin Transaction Costs and Speed

Bitcoin transactions offer potential cost advantages compared to traditional payment systems. With Bitcoin, there are typically lower transaction fees, particularly for cross-border transfers. Moreover, the speed of Bitcoin transactions can be significantly faster than traditional banking systems, which often involve multiple intermediaries and cumbersome processes. Bitcoin's decentralized network allows for direct peer-to-peer transfers, reducing the time and costs associated with intermediaries and intermediation.

Store of Value and Inflation Hedge

One of the criticisms of fiat currencies is their susceptibility to inflation and erosion of purchasing power over time. With its finite supply capped at 21 million Bitcoin, it offers potential as a store of value and a hedge against inflation. The scarcity of Bitcoin contributes to its value proposition, as demand continues to grow while supply remains limited. This characteristic has attracted investors seeking alternative assets to preserve wealth and diversify portfolios.

Financial Sovereignty and Security

Bitcoin provides individuals with financial sovereignty and control over their assets. With traditional banking systems, funds can be subject to restrictions, freezes, or seizures by authorities. Bitcoin, however, enables individuals to have direct ownership and control of their funds through private keys. This self-custody empowers individuals to transact and store wealth securely without relying on intermediaries. Furthermore, Bitcoin's cryptographic security measures make it highly resistant to hacking and fraud, providing users with protection.

While the journey toward widespread acceptance of Bitcoin as real money is still ongoing, its unique characteristics and advantages position it as a viable alternative. That's why many experts and enthusiasts are wondering if, one day, Bitcoin can be used as real money. Bitcoin's decentralization, global accessibility, reduced transaction costs, store of value properties, financial sovereignty, and security make it an intriguing option for individuals seeking financial inclusion, protection against inflation, and a more borderless financial system.

Understanding and Using a Bitcoin Wallet

We'll get into that soon enough. Before diving into spending Bitcoin, it's essential to understand the concept of Bitcoin wallets. A Bitcoin wallet is a digital software application that enables you to store and manage your Bitcoin securely. There are various wallets, including mobile, web, desktop, and hardware. Each has its advantages and security considerations. Choosing a reputable wallet provider and following best practices for securing your digital assets is crucial. Bitcoin wallets are compatible with most devices, and several have been developed for these applications worldwide. A good Bitcoin wallet requires high-level security. The web3 world is highly technologically advanced. Hacks are frequent, so your wallet must secure your funds. PlasBit wallet offers real-time protection to users by using private key encryption and PIN code as a second layer of protection. Here is a guide on obtaining and using our secure and user-friendly crypto wallet.

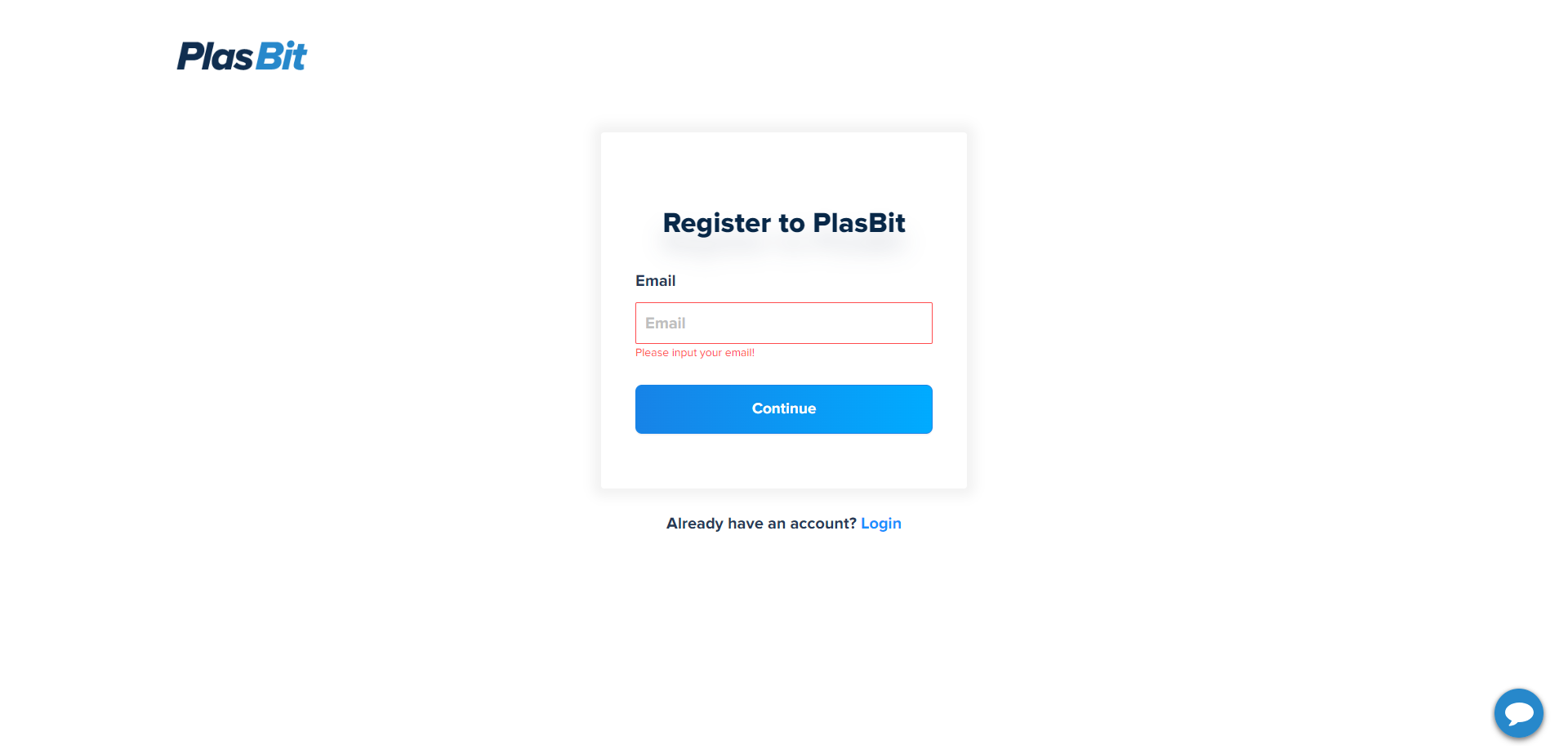

1. Sign up for an account:

Visit our website's signup page or click 'Get Started' (blue button in the top right of the browser).

Registration only requires an email address and for you to select a password.

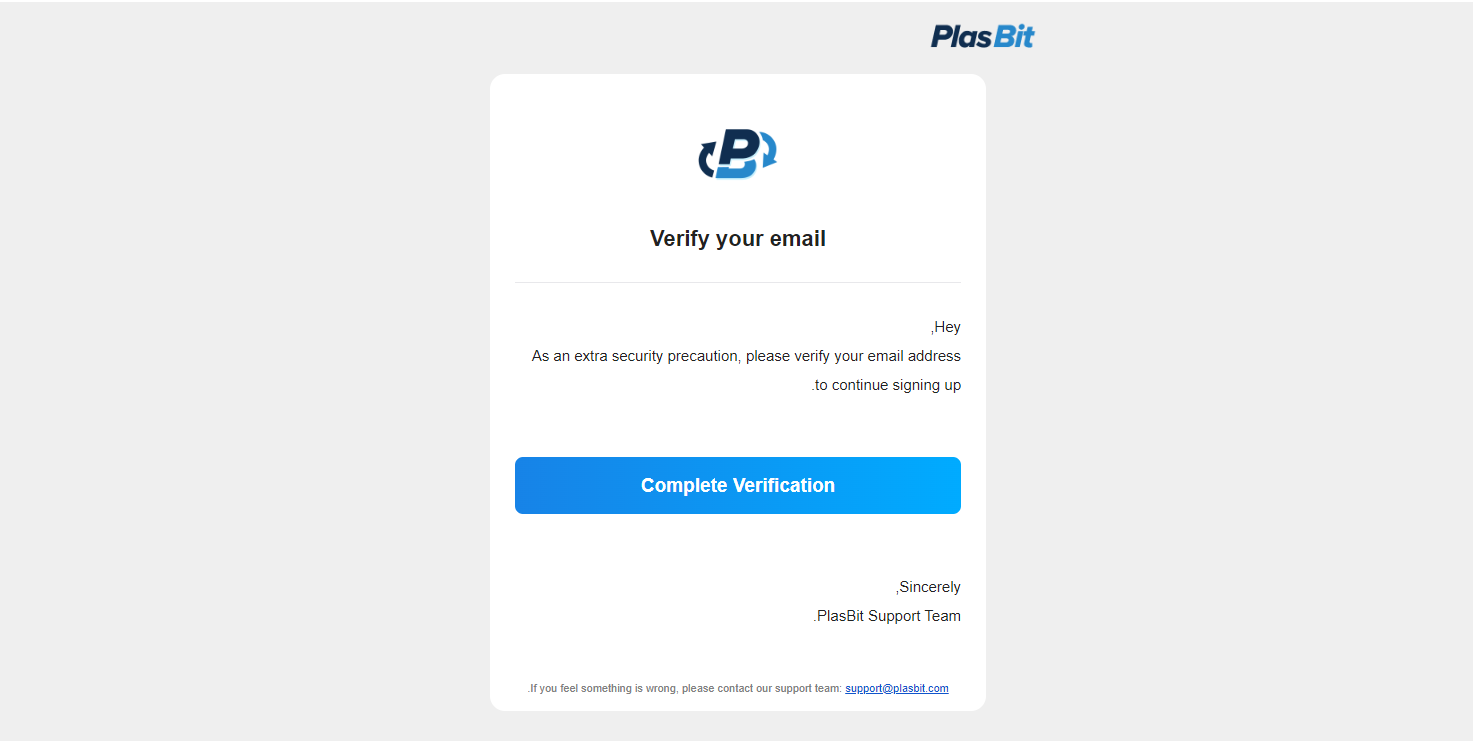

Visit your inbox to verify the email, and then you can access your account dashboard.

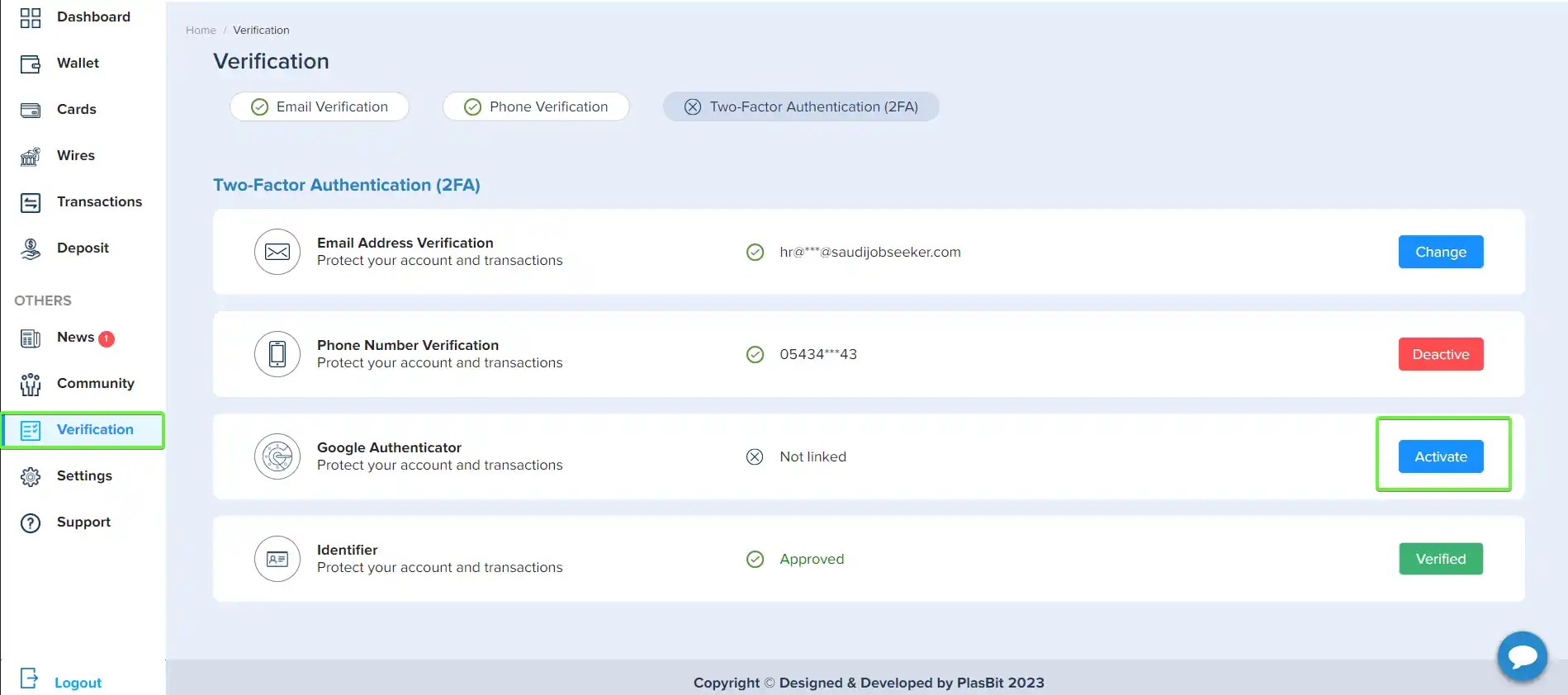

2. Secure your account:

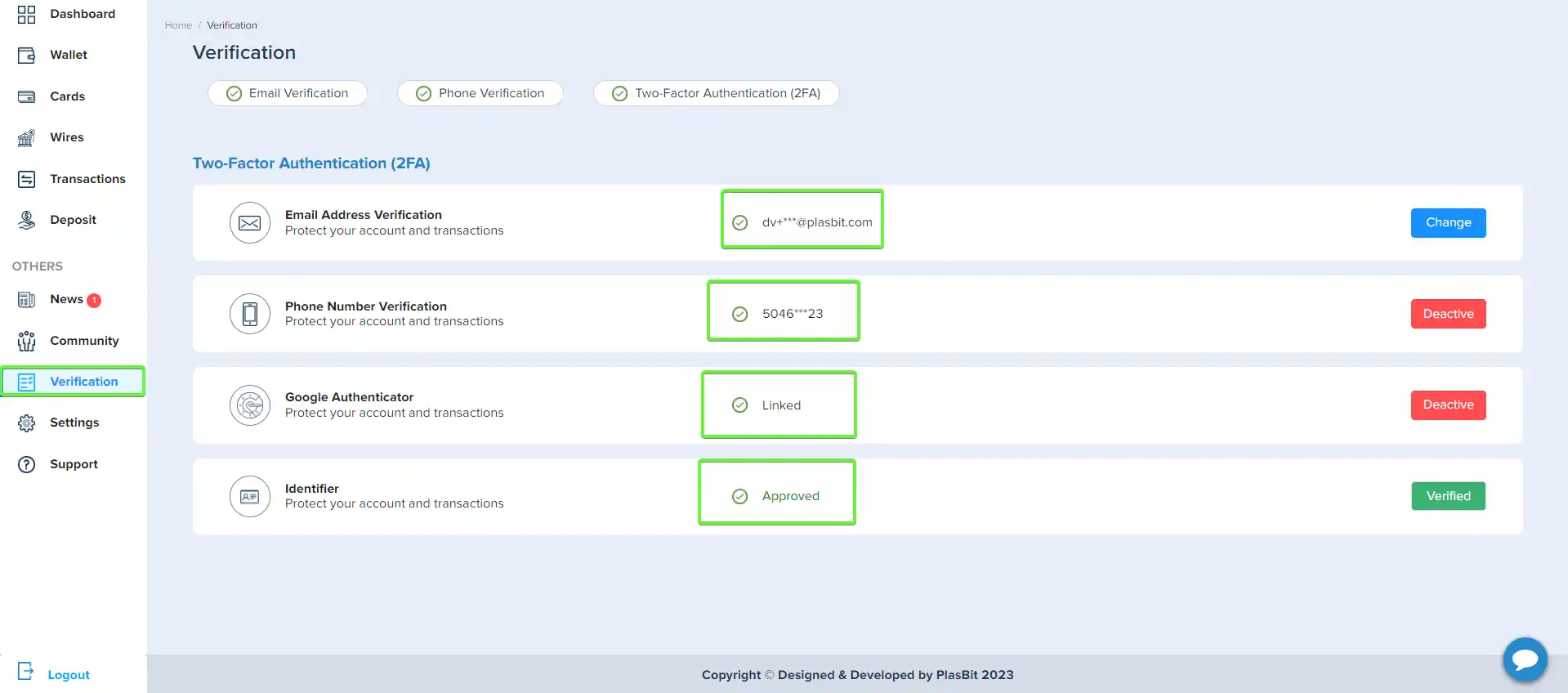

It is recommended to set up two-factor authentication to secure your account. You can verify your login via phone and authenticator app for maximum security.

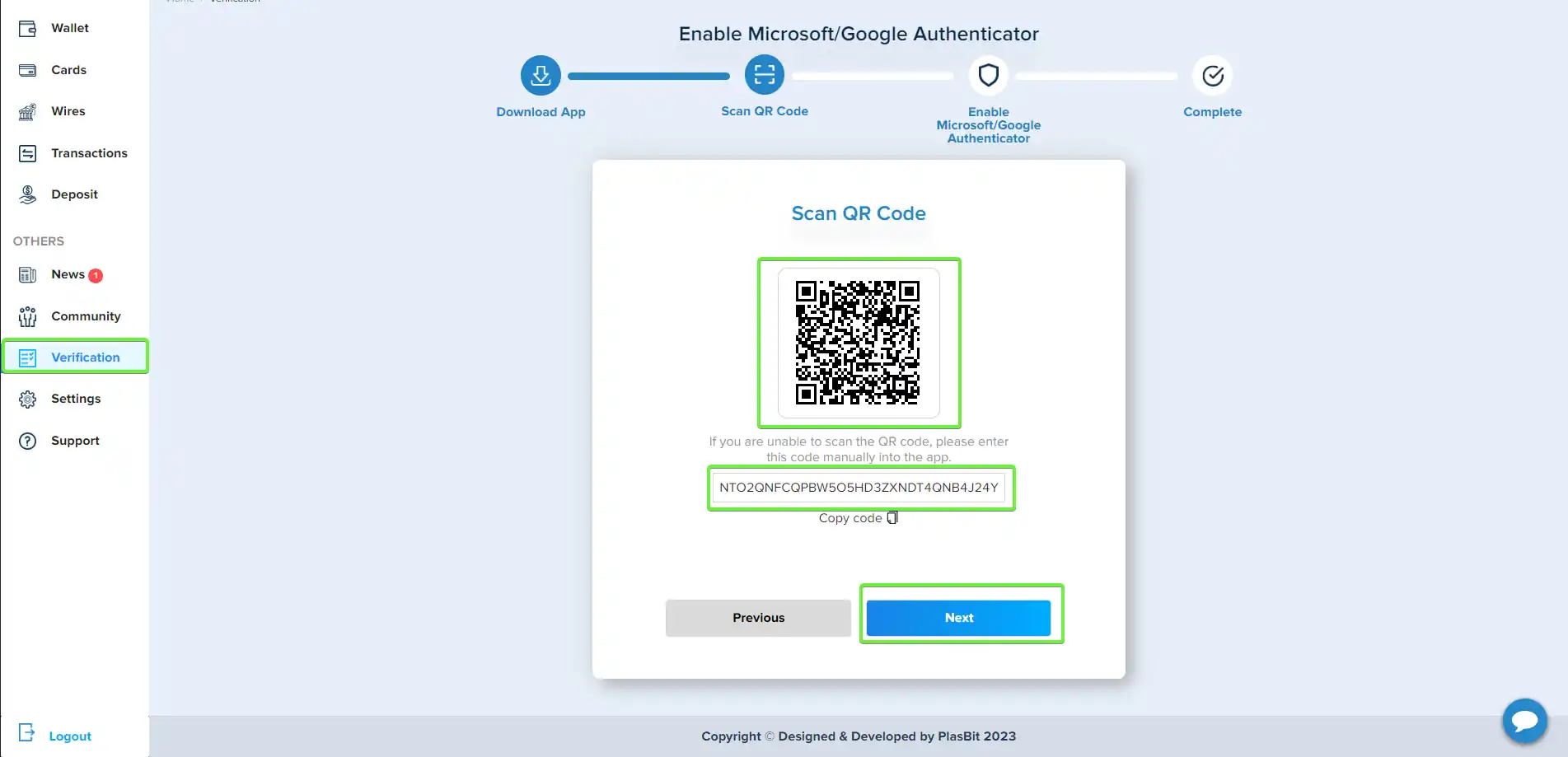

Click on "verification" in the dashboard sidebar and select activate.

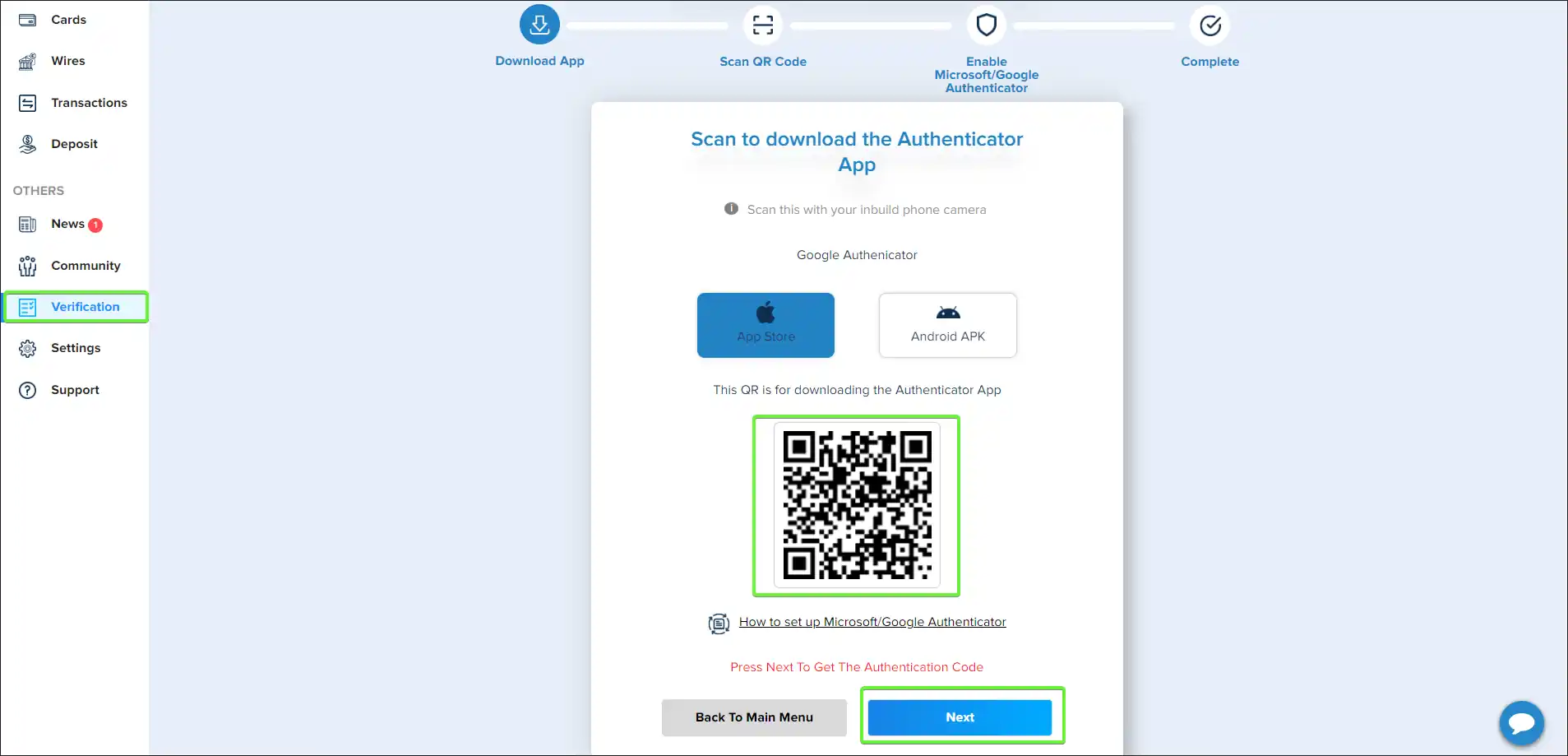

If you don't have the Authenticator App then you need to scan the QR to download it, if you already have the app you can skip this part and click on next.

After you download the app, enter the app and scan the QR/add manually the code to add the Authenticator code.

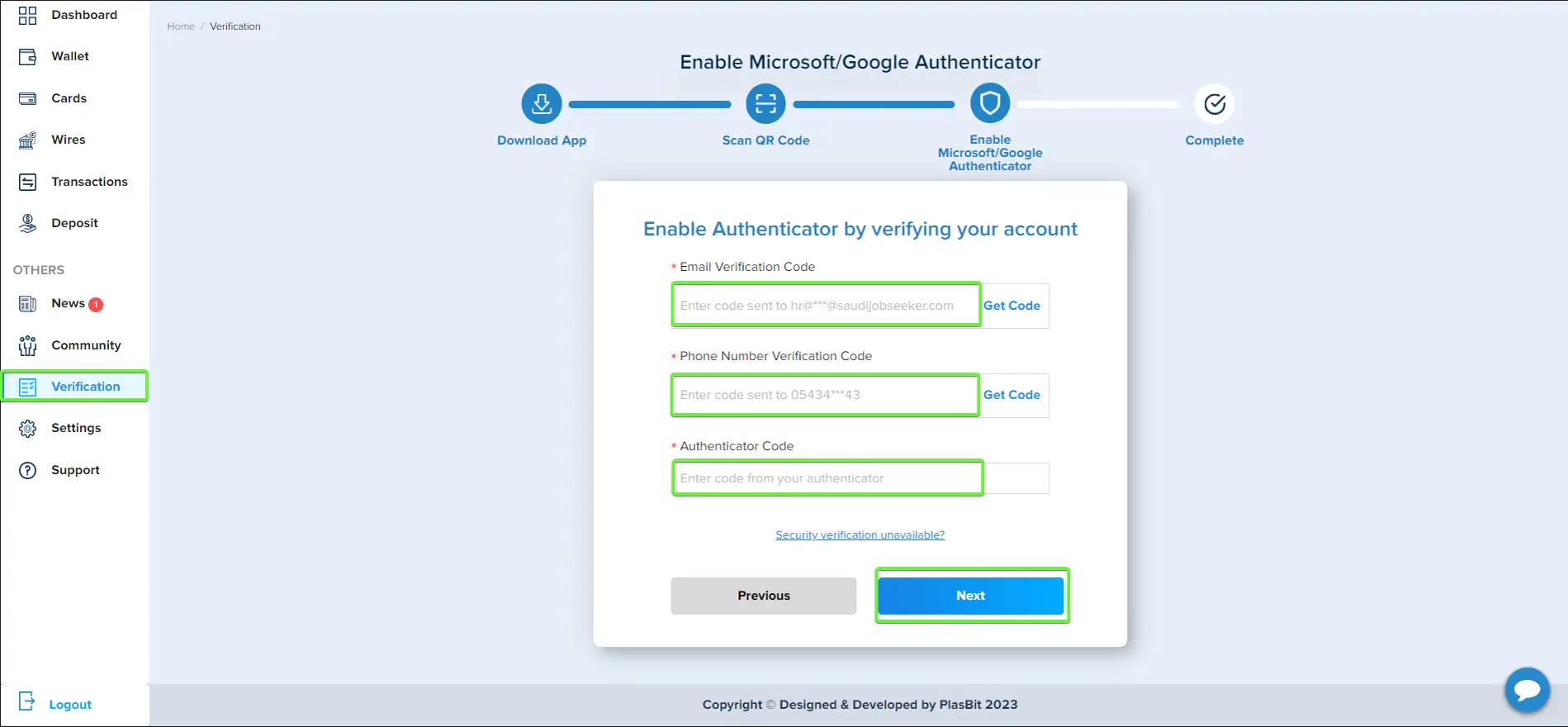

Verify your Authenticator account by getting codes in your Email, Phone number, and the Authenticator code.

After that click "Next" and you finish the Verification.

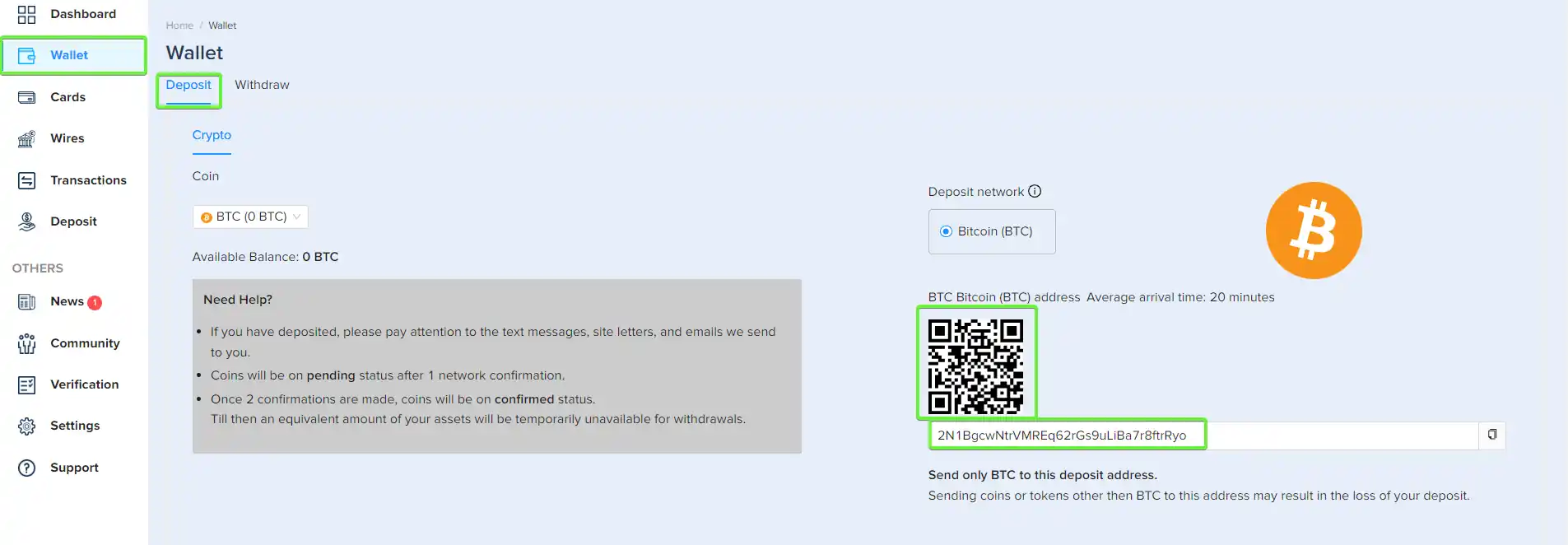

3. Access your BTC wallet:

Once signed in, click 'Wallet' on the dashboard sidebar and select BTC. Here, you can receive Bitcoin using your unique address and QR code. If you want to buy BTC, you can also click on 'Deposit,' make a deposit by Bank Card or Wire Transfer, and then use our crypto Exchange to obtain your BTC.

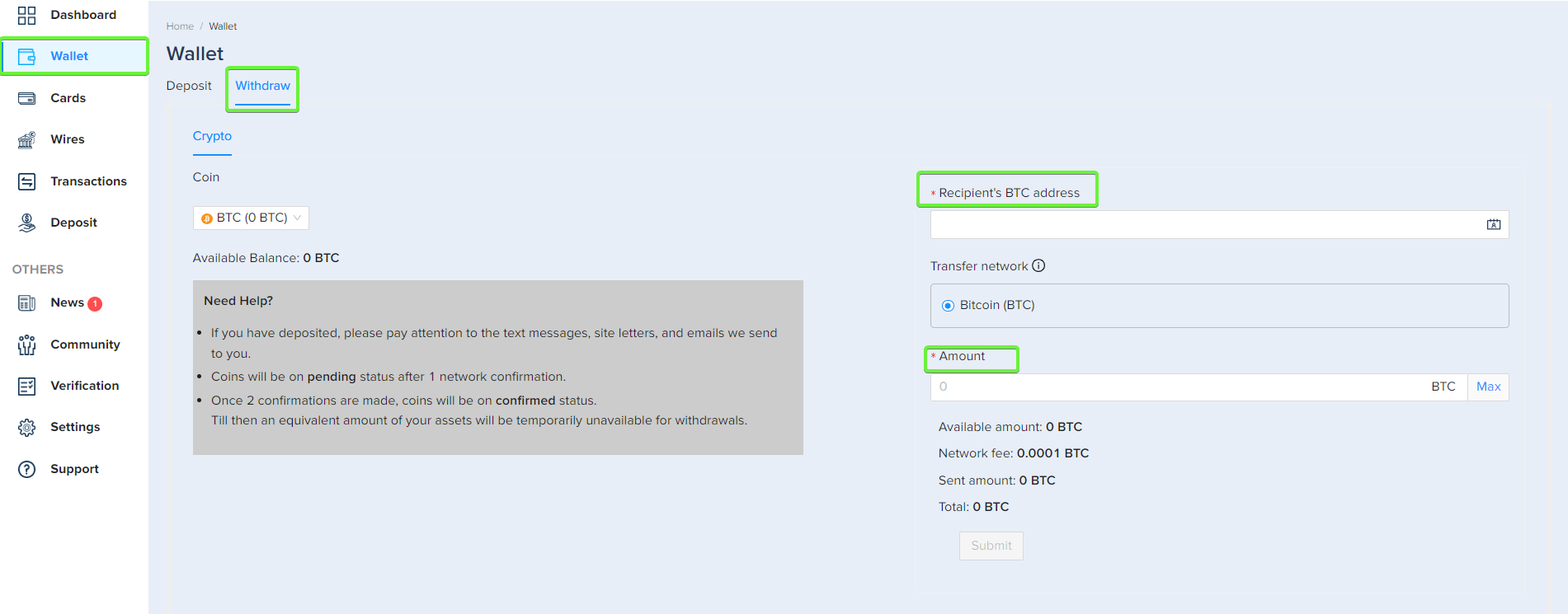

4. Send and make payments with BTC:

In the 'Wallet' section of the dashboard, click 'Withdraw,' where you can enter the recipient address and amount of BTC you wish to send. Transactions are confirmed after two confirmations.

Further Bitcoin Spending Methods: Crypto Debit Card

Our crypto payment card functions like a conventional debit card, meaning you can use it anywhere. It allows you to spend BTC conveniently via instant conversion into the local currency of the transaction. Here is a guide to accessing and using our crypto debit card.

1. Account signup and verification:

Follow the same steps above to register for a PlasBit account. However, to also apply for a payment card, you must achieve full verified status by confirming Email, Phone, and Two-Factor Authentication (2FA).

2. Apply for a payment card:

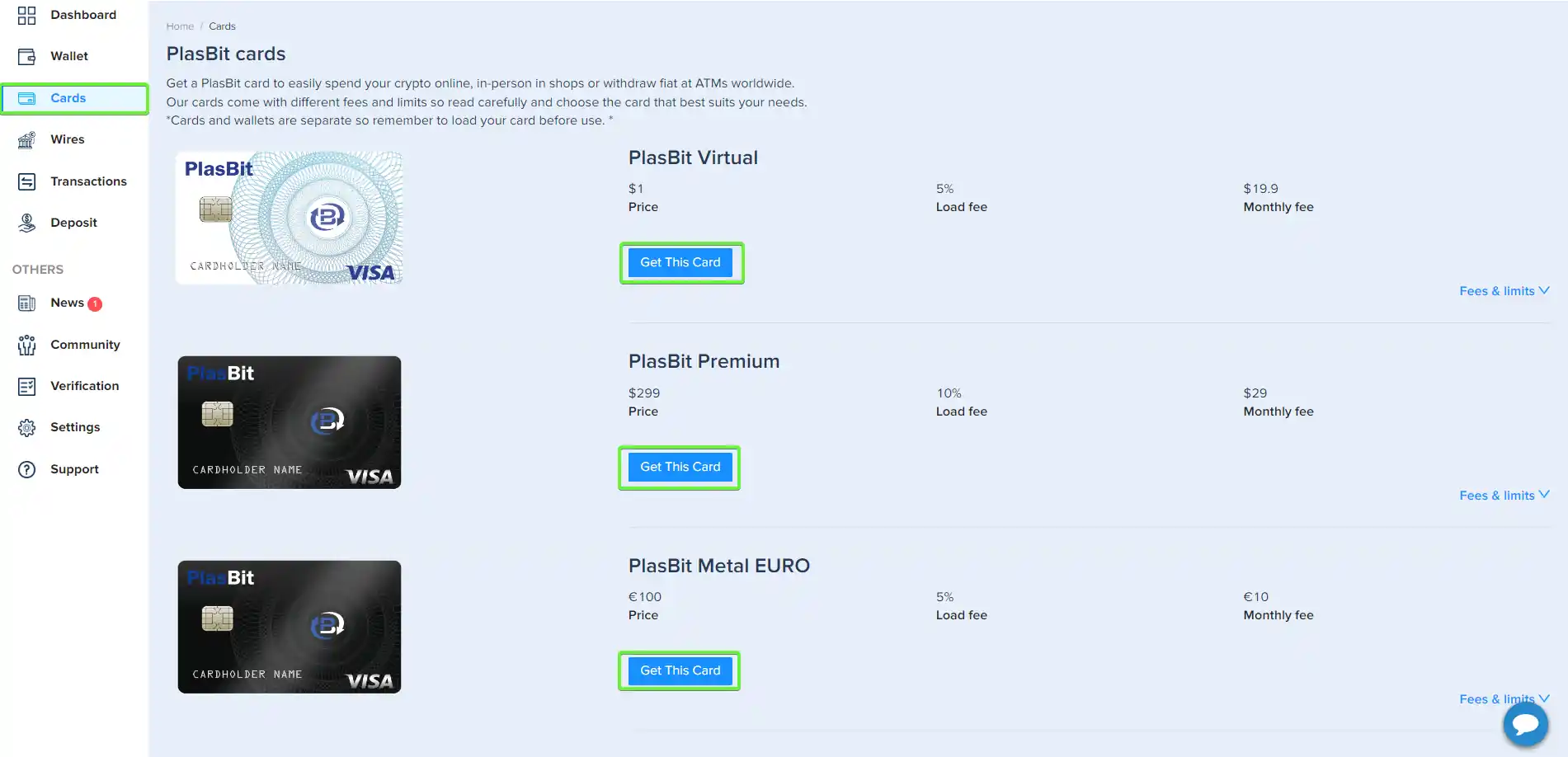

Click on 'Cards' in the dashboard to choose from various card options, including physical and virtual cards. All fees are indicated next to each card type.

3. Activate and fund card:

Once the fee for the card is paid and the card is activated, you need to fund it. Cards and wallets are separate, so you must load the card with the BTC you wish to have available for spending.

4. Spent BTC using your card:

Our crypto payment card can now be used like a traditional debit card. This functionality means it can be used anywhere Visa is accepted, online and in-person. If you opt for a physical card, you can also make cash withdrawals of your Bitcoin from ATMs to convert your BTC into 'real money.

Where You Can Spend Bitcoin As Real Money

There are already a few real-world examples of the use of Bitcoin, starting with online retailers to travel bookings, gift cards, and even physical stores.

Online Retailers and E-commerce

One of the easiest and most popular ways to spend Bitcoin is through online retailers and e-commerce platforms that accept digital currencies. Major retailers like Microsoft, Overstock, and Newegg have embraced Bitcoin as a payment option. When purchasing, select the Bitcoin payment method and follow the instructions provided. You'll get a QR code or a Bitcoin address to send the payment from your wallet. Once transaction confirmation is received, your order will be processed.

Travel and Accommodation

The tourism industry has also embraced Bitcoin as a form of payment. Online travel agencies like Expedia and CheapAir allow you to book hotels, car rentals, and flights using Bitcoin. These platforms usually integrate with third-party payment processors to facilitate Bitcoin transactions. Choose the desired travel services, select Bitcoin as your payment method, and follow the payment instructions. It's worth noting that the availability of Bitcoin payments may vary across different travel platforms, so it's essential to explore and compare options.

Gift Cards and Vouchers

Consider purchasing gift cards or vouchers with Bitcoin to expand your spending options. Numerous platforms, like Bitrefill and Gyft, offer various gift cards for popular retailers, restaurants, entertainment, and online services. Browse the available options, choose the desired gift card, and pay with Bitcoin. The gift card code or voucher will be delivered to your email or wallet. This facility allows you to enjoy the convenience of Bitcoin while gaining access to a broader selection of goods and services.

Physical Stores and Point-of-Sale Systems

While the acceptance of Bitcoin in physical stores is still growing, some merchants and businesses have implemented Bitcoin payment options. Some enterprises use dedicated point-of-sale (POS) systems to process Bitcoin transactions. Inform the cashier or check for signs indicating Bitcoin acceptance when purchasing in a physical store. The cashier will provide the necessary payment details, such as a QR code or a Bitcoin address, which you can scan or enter manually using your mobile wallet app. The payment will be processed once the transaction is confirmed, and you'll receive your purchase.

Merchant Directories and Bitcoin Payment Processors

To discover businesses that accept Bitcoin, you can refer to online directories and maps designed for Bitcoin users. As Bitcoin continues to gain mainstream acceptance, spending it as real money becomes increasingly feasible. With the rise of online retailers, travel platforms, gift card providers, and even physical stores adopting Bitcoin payments, individuals have more opportunities than ever to utilize their digital currency in daily transactions. Embrace the convenience and potential of Bitcoin as a spending tool and unlock the possibilities of a borderless financial future.

What are the obstacles to Spending Bitcoin as Real Money?

Bitcoin's potential as a medium of exchange is expanding, but hurdles still impede its seamless integration into everyday transactions. While Bitcoin offers several advantages as a digital currency, specific obstacles must be addressed to facilitate widespread adoption and spending. Next, let's explore the key challenges currently in spending Bitcoin as real money and discuss potential solutions to overcome these bottlenecks.

Volatility and Price Fluctuations

Bitcoin's price volatility poses a significant challenge when spending it as real money. The value of Bitcoin can experience rapid and substantial fluctuations, making it challenging for both merchants and consumers to determine the exact price of goods and services at the time of purchase. To address this issue, payment processors and merchants can integrate instant conversion services that convert into fiat currency at the moment of the Bitcoin transaction. This feature allows merchants to receive a stable currency, mitigating the risk of Bitcoin's price volatility.

Limited Merchant Adoption

While the number of businesses accepting Bitcoin as a payment method grows, widespread merchant adoption remains a bottleneck. Many merchants hesitate to adopt Bitcoin due to concerns about regulatory compliance, price volatility, and technical complexities. To overcome this challenge, education and awareness initiatives can be employed to showcase the benefits of accepting Bitcoin, such as lower transaction fees, global accessibility, and a potential customer base of Bitcoin holders. Simplifying the integration process for merchants and providing user-friendly payment processing solutions can also encourage broader acceptance.

User Experience and Technical Complexity

A smooth user experience and simplified processes are crucial for the mainstream adoption of Bitcoin as real money. However, the technical complexity of Bitcoin wallets, security practices, and the overall transaction process can be daunting for newcomers. Improving user interfaces, enhancing wallet security features, and streamlining the payment process can go a long way in making Bitcoin more user-friendly. Wallet providers and payment processors can focus on creating intuitive interfaces, offering customer support, and implementing measures to enhance user education and awareness.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies is still evolving, posing a challenge for spending Bitcoin as real money. In this environment, you'll find an honest debate on whether Bitcoin can be used as real money. Different jurisdictions have varying regulations, and businesses may be wary of the legal implications and compliance requirements associated with accepting Bitcoin. Clear and consistent regulatory frameworks can give businesses the confidence to embrace Bitcoin as a payment option. Cooperation between regulators, businesses, and industry associations can foster an environment that balances consumer protection with innovation, promoting the wider acceptance of Bitcoin as a legitimate form of payment.

Crypto Payment Infrastructure Solution

One way we are trying to help crypto adoption and use of Bitcoin for payments is through our crypto Payment Infrastructure as a service option. We provide a complete setup and integration of our crypto payment widget for site owners. This service allows users to pay in crypto on their website. Over 100 cryptocurrencies are available on the payment widget in 125+ countries. This facility is one way to ensure that receiving crypto payments becomes accessible for all types of business.

Final Verdict: Can Bitcoin be Used as Real Money?

While there are still obstacles to spending Bitcoin as real money, the ongoing efforts to address these challenges pave the way for increased adoption and seamless transactions. Today, you can use Bitcoin to purchase many goods and services. Neo Banks like PlasBit make accessing and spending your Bitcoin easier. By addressing issues such as price volatility, limited merchant adoption, transaction processing speed, user experience, and regulatory clarity, Bitcoin can become a more practical and widely accepted medium of exchange. Cryptocurrencies are the future of digital transactions, proving this to a large extent. Many are fascinated by the benefits of the world's largest crypto asset and are exploring what Bitcoin does. In digital currencies, Bitcoin has emerged as a disruptive force that challenges traditional notions of money. While Bitcoin's journey is affected by volatility and skepticism, there are compelling reasons why it can serve as real money. Amidst other advantages, this crypto token handles faster cross-border payments than most fiat systems we have in place today. That's why many experts and enthusiasts ask the same question: can Bitcoin be used as real money? Would the world be better with crypto as its legal tender? The answers you need are right here.