As the crypto industry evolved, its potential for profit has become more obvious. However, for a new player in the field with no experience in long-term investments, finding time or willpower to enroll in a trading course might be challenging. This is where dollar cost (DCA) averaging comes into play. Using DCA allows you to create your investment portfolio with no prior experience, and you don’t even need to keep track of the market. So, how to dollar cost average crypto? If you choose to invest in BTC, you need to invest a specific amount at regular intervals for a set period of at least five years. For example, buying $100 worth of Bitcoin every 1st day of the month. Setting a predetermined amount and time frame minimizes the losses caused by impulsive decisions, the risk of poorly timing the markets, and the overall stress of trading. The DCA process basically “averages” (hence the name) your chosen asset’s buying price on each purchase, turning it into an entirely technical process that minimizes the impact of market volatility. As such, getting the hang of DCA crypto is easy, in addition to being a tried-and-tested method used by both beginners and experienced investors alike.

How to read the DCA table

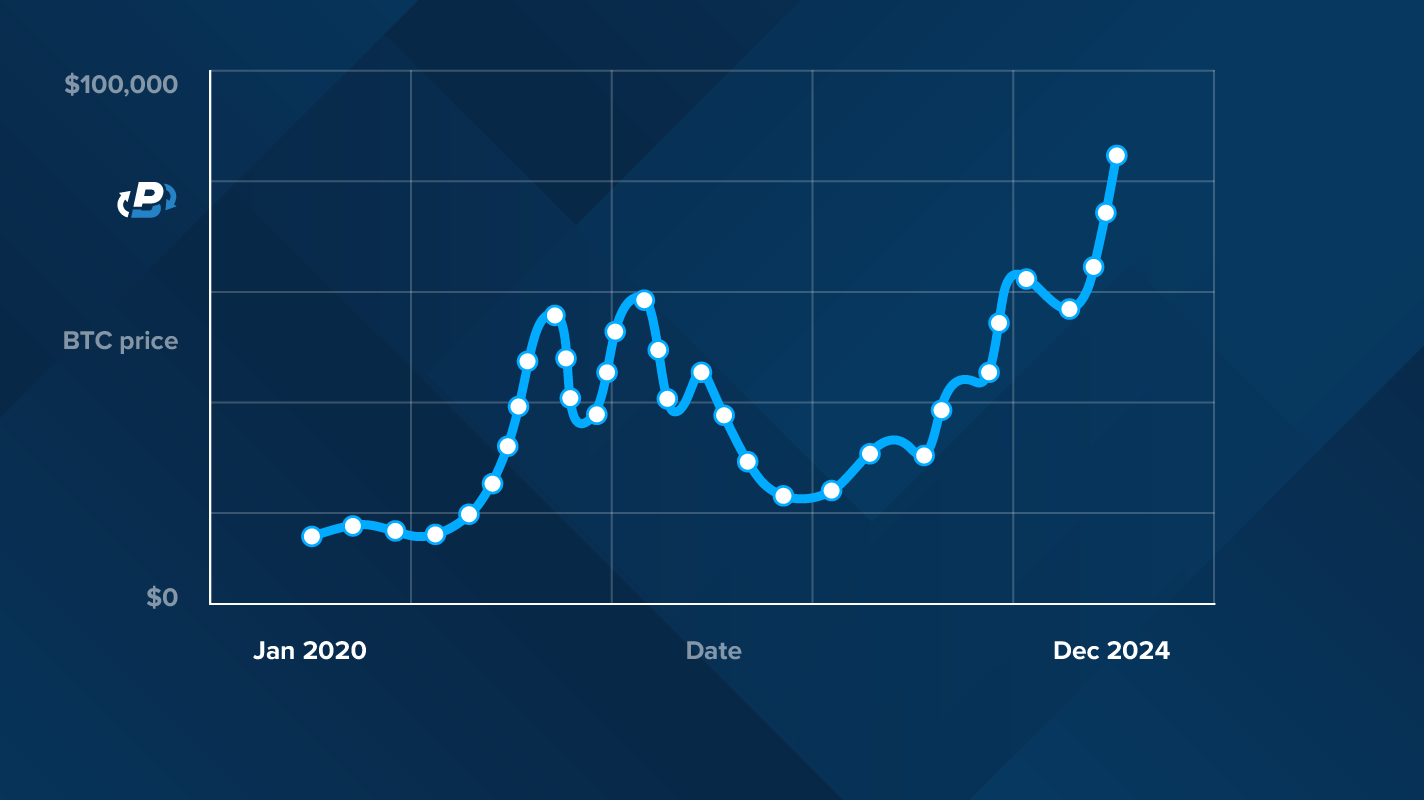

To understand how to dollar cost average crypto in real-world terms, let's take a closer look at this detailed DCA table for Bitcoin. Based on it, you can deduce what your portfolio would look like if you started buying Bitcoin as early as January 2020 and have been using the DCA strategy consistently for the past four years. The columns include:

- Date: Month and year of the investment.

- Amount: Fixed monthly amount invested in USD.

- BTC Price: Price of Bitcoin at the time of investment.

- Total Investment Amount: Cumulative amount invested over time.

- Investment Portfolio Value: Total portfolio value based on the current Bitcoin price.

- AVR Price: Average price paid per Bitcoin.

- Investment Amount in BTC: Quantity of Bitcoin purchased with the fixed amount.

- Total BTC Portfolio: Cumulative Bitcoin holdings.

- P/L: Profit or loss in USD.

- Change in Percentage: Percentage change in portfolio value relative to total investment.

For instance, if you started DCA Bitcoin on January 1, 2021, buying $100 worth of BTC on the first of each month (so a total of $4,800 over time), your portfolio would have grown to $13,298.41 by the last date (December 1, 2024), driven by Bitcoin’s price rally. What’s more, you would’ve gained 177.1% or $8,498.41. A solid return on investment, don’t you think? As the table shows, the price of Bitcoin has fluctuated quite a lot over the selected time frame, ranging from as little as $16,547.91 to as much as $96,461.34. Yet, the DCA approach has lowered the effect of Bitcoin price volatility. In terms of performance trends, the initial investment period has seen negative percentage changes and losses, but this is why consistency is key. As Bitcoin’s price started to increase dramatically, the portfolio would’ve moved into significant profit.

| Date | Amount | BTC Price | Total Investment Amount | Investment Portfolio Value | Change in Percentage | P/L | Average Price | Investment Amount in BTC | Total BTC Portfolio |

|---|---|---|---|---|---|---|---|---|---|

| 1.1.20 | $100 | $7,194 | $100 | $100 | 0% | $0 | $7,194 | 0.01389875 | 0.01389875 |

| 1.2.20 | $100 | $9,346 | $200 | $229 | 15% | $29 | $8,270 | 0.01069935 | 0.02459810 |

| 1.3.20 | $100 | $8,599 | $300 | $311 | 3.8% | $11 | $8,380 | 0.01162823 | 0.03622633 |

| 1.4.20 | $100 | $6,437 | $400 | $333 | -16.7% | -$66 | $7,894 | 0.01553441 | 0.05176075 |

| 1.5.20 | $100 | $8,672 | $500 | $548 | 9.8% | $48 | $8,050 | 0.01153032 | 0.06329108 |

| 1.6.20 | $100 | $9,463 | $600 | $698 | 16.5% | $98 | $8,285 | 0.01056679 | 0.07385787 |

| 1.7.20 | $100 | $9,145 | $700 | $775 | 10.8% | $75 | $8,408 | 0.01093375 | 0.08479162 |

| 1.8.20 | $100 | $11,322 | $800 | $1,060 | 32.5% | $260 | $8,772 | 0.00883191 | 0.09362354 |

| 1.9.20 | $100 | $11,679 | $900 | $1,193 | 32.6% | $293 | $9,095 | 0.00856214 | 0.10218568 |

| 1.10.20 | $100 | $10,795 | $1,000 | $1,203 | 20.3% | $203 | $9,265 | 0.00926333 | 0.11144901 |

| 1.11.20 | $100 | $13,781 | $1,100 | $1,635 | 48.7% | $535 | $9,676 | 0.00725636 | 0.11870538 |

| 1.12.20 | $100 | $19,633 | $1,200 | $2,430 | 102.6% | $1,230 | $10,506 | 0.00509326 | 0.12379865 |

| 1.1.21 | $100 | $28,994 | $1,300 | $3,689 | 183.8% | $2,389 | $11,928 | 0.00344898 | 0.12724763 |

| 1.2.21 | $100 | $33,114 | $1,400 | $4,313 | 208.1% | $2,913 | $13,441 | 0.00301981 | 0.13026745 |

| 1.3.21 | $100 | $45,159 | $1,500 | $5,982 | 298.9% | $4,482 | $15,556 | 0.00221437 | 0.13248183 |

| 1.4.21 | $100 | $58,926 | $1,600 | $7,906 | 394.2% | $6,306 | $18,266 | 0.00169702 | 0.13417885 |

| 1.5.21 | $100 | $57,714 | $1,700 | $7,844 | 361.4% | $6,144 | $20,587 | 0.00173266 | 0.13591152 |

| 1.6.21 | $100 | $37,293 | $1,800 | $5,168 | 187.1% | $3,368 | $21,515 | 0.00268141 | 0.13859293 |

| 1.7.21 | $100 | $35,035 | $1,900 | $4,955 | 160.8% | $3,055 | $22,226 | 0.00285420 | 0.14144714 |

| 1.8.21 | $100 | $41,460 | $2,000 | $5,964 | 198.2% | $3,964 | $23,188 | 0.00241191 | 0.14385905 |

| 1.9.21 | $100 | $47,099 | $2,100 | $6,875 | 227.4% | $4,775 | $24,327 | 0.00212315 | 0.14598220 |

| 1.10.21 | $100 | $43,816 | $2,200 | $6,496 | 195.3% | $4,296 | $25,213 | 0.00228223 | 0.14826444 |

| 1.11.21 | $100 | $61,320 | $2,300 | $9,191 | 299.6% | $6,891 | $26,783 | 0.00163077 | 0.14989521 |

| 1.12.21 | $100 | $56,907 | $2,400 | $8,630 | 259.6% | $6,230 | $28,038 | 0.00175722 | 0.15165244 |

| 1.1.22 | $100 | $46,311 | $2,500 | $7,123 | 184.9% | $4,623 | $28,769 | 0.00215927 | 0.15381172 |

| 1.2.22 | $100 | $38,481 | $2,600 | $6,018 | 131.5% | $3,418 | $29,142 | 0.00259863 | 0.15641035 |

| 1.3.22 | $100 | $43,194 | $2,700 | $6,856 | 153.9% | $4,156 | $29,663 | 0.00231510 | 0.15872546 |

| 1.4.22 | $100 | $45,554 | $2,800 | $7,330 | 161.8% | $4,530 | $30,230 | 0.00219518 | 0.16092065 |

| 1.5.22 | $100 | $38,528 | $2,900 | $6,299 | 117.2% | $3,399 | $30,516 | 0.00259550 | 0.16351616 |

| 1.6.22 | $100 | $31,792 | $3,000 | $5,298 | 76.6% | $2,298 | $30,559 | 0.00314539 | 0.16666155 |

| 1.7.22 | $100 | $19,820 | $3,100 | $3,403 | 9.8% | $303 | $30,212 | 0.00504528 | 0.17170684 |

| 1.8.22 | $100 | $23,336 | $3,200 | $4,107 | 28.3% | $907 | $29,998 | 0.00428509 | 0.17599193 |

| 1.9.22 | $100 | $20,050 | $3,300 | $3,628 | 10% | $328 | $29,696 | 0.00498740 | 0.18097933 |

| 1.10.22 | $100 | $19,431 | $3,400 | $3,616 | 6.4% | $216 | $29,394 | 0.00514638 | 0.18612572 |

| 1.11.22 | $100 | $20,600 | $3,500 | $3,934 | 12.4% | $434 | $29,143 | 0.00485421 | 0.19097993 |

| 1.12.22 | $100 | $17,168 | $3,600 | $3,378 | -6.1% | -$221 | $28,810 | 0.00582479 | 0.19680472 |

| 1.1.23 | $100 | $16,547 | $3,700 | $3,356 | -9.3% | -$343 | $28,479 | 0.00604305 | 0.20284778 |

| 1.2.23 | $100 | $23,137 | $3,800 | $4,793 | 26.1% | $993 | $28,338 | 0.00432192 | 0.20716971 |

| 1.3.23 | $100 | $23,150 | $3,900 | $4,896 | 25.5% | $996 | $28,205 | 0.00431948 | 0.21148919 |

| 1.4.23 | $100 | $28,473 | $4,000 | $6,121 | 53% | $2,121 | $28,212 | 0.00351205 | 0.21500125 |

| 1.5.23 | $100 | $29,227 | $4,100 | $6,383 | 55.7% | $2,283 | $28,237 | 0.00342148 | 0.21842273 |

| 1.6.23 | $100 | $27,218 | $4,200 | $6,045 | 43.9% | $1,845 | $28,212 | 0.00367398 | 0.22209671 |

| 1.7.23 | $100 | $30,471 | $4,300 | $6,867 | 59.7% | $2,567 | $28,265 | 0.00328171 | 0.22537843 |

| 1.8.23 | $100 | $29,230 | $4,400 | $6,688 | 52% | $2,288 | $28,287 | 0.00342104 | 0.22879947 |

| 1.9.23 | $100 | $25,934 | $4,500 | $6,033 | 34.1% | $1,533 | $28,235 | 0.00385593 | 0.23265541 |

| 1.10.23 | $100 | $26,967 | $4,600 | $6,374 | 38.6% | $1,774 | $28,207 | 0.00370818 | 0.23636359 |

| 1.11.23 | $100 | $34,657 | $4,700 | $8,291 | 76.4% | $3,591 | $28,344 | 0.00288539 | 0.23924899 |

| 1.12.23 | $100 | $37,718 | $4,800 | $9,124 | 90.1% | $4,324 | $28,540 | 0.00265125 | 0.24190024 |

| 1.1.24 | $100 | $42,280 | $4,900 | $10,327 | 110.8% | $5,427 | $28,412 | 0.00236517 | 0.24426541 |

| 1.2.24 | $100 | $42,569 | $5,000 | $10,498 | 110% | $5,498 | $28,491 | 0.00234908 | 0.24661450 |

| 1.3.24 | $100 | $61,168 | $5,100 | $15,184 | 197.7% | $10,084 | $29,324 | 0.00163484 | 0.24824934 |

| 1.4.24 | $100 | $71,333 | $5,200 | $17,808 | 242.5% | $12,608 | $30,005 | 0.00140186 | 0.24965120 |

| 1.5.24 | $100 | $60,609 | $5,300 | $15,231 | 187.4% | $9,931 | $29,772 | 0.00164990 | 0.25130111 |

| 1.6.24 | $100 | $67,489 | $5,400 | $17,060 | 215.9% | $11,660 | $30,203 | 0.00148170 | 0.25278282 |

| 1.7.24 | $100 | $62,673 | $5,500 | $15,942 | 189.9% | $10,442 | $29,957 | 0.00159556 | 0.25437839 |

| 1.8.24 | $100 | $64,625 | $5,600 | $16,539 | 195.3% | $10,939 | $30,194 | 0.00154736 | 0.25592576 |

| 1.9.24 | $100 | $58,969 | $5,700 | $15,191 | 166.5% | $9,491 | $29,910 | 0.00169578 | 0.25762154 |

| 1.10.24 | $100 | $63,335 | $5,800 | $16,416 | 183% | $10,616 | $30,193 | 0.00157889 | 0.25920043 |

| 1.11.24 | $100 | $70,216 | $5,900 | $18,300 | 210.2% | $12,400 | $30,597 | 0.00142415 | 0.26062459 |

| 1.12.24 | $100 | $96,461 | $6,000 | $25,240 | 320.7% | $19,240 | $31,053 | 0.00103668 | 0.26166127 |

DCA scenarios

Let’s analyze several potential (and one actual) scenarios of DCA Bitcoin over a multiple-year period. Each case illustrates the rewards and challenges of different approaches to the strategy.

Use case #1: A persistent investor

The first case is of an investor who has strictly adhered to the DCA strategy, investing $100 on the first of every month for five years, no matter how much the Bitcoin price fluctuates. Over the 60 months from January 2020 to January 2025, this investor has shelled out a total of $6,000. During this time, Bitcoin prices have ranged from a low of $7,194.89 in January 2020 to a peak of $96,461.34 in December 2024. Despite the volatility, the investor’s relentless purchases have accumulated them a significant portion of BTC, which has grown in value during market upswings. By December 2024, this investor’s holdings are worth $25,240.20, delivering an impressive profit of $19,240.20 - a 320.7% return on investment. This case underscores the benefits of sticking to a long-term investment strategy, even during (one might say in spite of) periods of market uncertainty.

Use case #2: A discouraged investor

Meanwhile, another investor started their journey with the same strategy but lost confidence during a sharp market downturn halfway through the five-year period. Between January 2020 and June 2022, they invested $3,000, and their portfolio value reached $5,298.60, with 76.6% ROI, as BTC stood at $31,792.55. That said, as the price of Bitcoin was at this point steadily declining, dropping from $61,320.45 in November 2021 to a mere $19,820.47 in July 2022, their portfolio’s value plummeted to $3,403.31. Having invested $3,100 already, he decided to sell all their holdings, locking in a profit of just $303.31, and with a 9.8% ROI. Unfortunately for them (but at the joy of steadfast investors), Bitcoin’s price has recovered massively in the following years, with the portfolio value soaring to $25,240.20 by December 2024. By selling during the downturn, this investor has missed out on $24,936.89 in potential profits, highlighting the drawbacks of emotional decision-making during volatile periods.

Use case #3: An overextended investor

A third investor started with enthusiasm, diligently contributing $100 each month starting on January 1, 2020. However, they failed to properly plan their finances and ran out of funds after 36 months, thus being forced to halt their investments in January 2023 with a total contribution of $3,700. At that time, their portfolio value stood at $3,356.71, reflecting a loss of $343.29 or 9.3% due to Bitcoin’s downturn. Unable to continue investing, this individual has missed out on the dramatic price increases in 2024, which would bring the portfolio value for a consistent investor to $25,240.20. This scenario illustrates how inadequate budgeting when using the DCA strategy (and in general) can result in missed opportunities and amplify the impact of temporary market downturns.

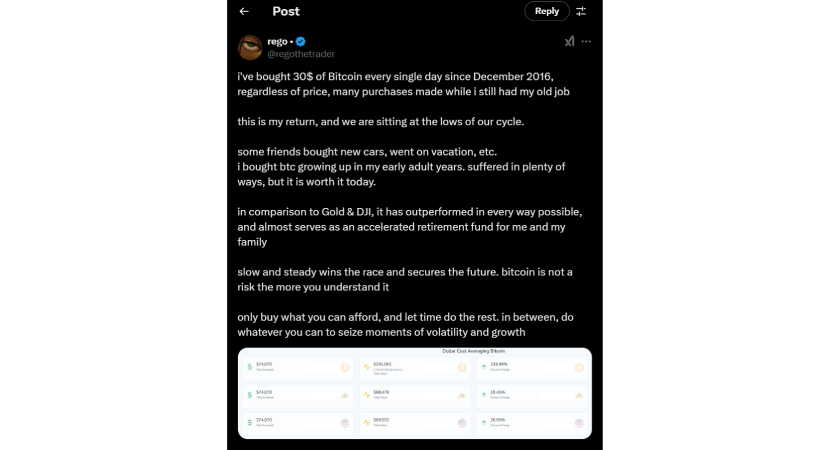

Use case #4: Real-life experience

Finally, in a real-life use case, an X user who goes by the handle @regothetrader has demonstrated the accuracy of the old adage “the proof is in the pudding.” Specifically, they kept buying $30 worth of BTC every single day between December 2016 and October 2023 (that’s almost seven years!). The findings they shared show an impressive total value of $251,092, representing a 238.99% gain from the initial $74,070 investment. At the same time, @regothetrader made a comparison to investing in gold and stock indices (like the Dow Jones Industrial Average), highlighting Bitcoin’s superiority. Additionally, the author candidly shared the personal sacrifices made during this journey. While their friends indulged in new cars and vacations, @regothetrader directed funds to BTC instead. They offered actionable advice for others:

- “Only buy what you can afford” - echoing the principle of financial responsibility, making sure investments don’t overstrain your budget or jeopardize essential expenses like bills, rent or mortgage, groceries, and the like.

- “Slow and steady wins the race” - stressing the importance of patience, as markets can be volatile in the short term, but disciplined long-term strategies like DCA often yield major rewards.

- “Seize moments of volatility and growth” - periods of market downturns are opportunities to accumulate more of the asset at lower prices, further enhancing long-term returns.

This real-life example shows the long-term potential of understanding how to dollar cost average crypto, even through market volatility.

How to create a DCA strategy

By now, if we’ve got you interested enough, you’re probably wondering how to dollar cost average crypto effectively. Let’s break down the strategy into three straightforward steps:

- Pick a specific amount of money to invest. This includes analyzing your budget and ensuring it can handle investing on a regular basis, so you can stay dedicated to the strategy regardless of the changes in the market. You can buy crypto in various ways, including via bank wire through PlasBit. Just don’t invest more than what you’re prepared to lose.

- Decide on a fixed time interval for investing. Picking the right schedule for DCA crypto largely depends on your own preferences and planned budget. The most important thing for this strategy to deliver success is to stick to a consistent plan over time.

- Make sure you can commit to a minimum of five years without cashing out. As demonstrated by the above cases, patience and discipline are the most important psychological qualities for proper DCA. Otherwise, you’ll be missing the point, and the strategy won’t be effective.

How to choose crypto to DCA

But first, how do you select a crypto that is fit for DCA? This is where you’ll need to roll up your proverbial sleeves and do some digging (again, proverbial). You’ll have to be sure that the project behind your chosen asset is reliable and has a future. The parameters to look for include:

- Durability: How long has the asset been around? Since you’ll need to dedicate several years to DCA, your chosen crypto must be able to demonstrate longevity in the market.

- Market trends: Examine and evaluate the trends and the sentiment surrounding your selected crypto before you begin to DCA it. What’s the word out on social media, the news, and the like?

- Metrics: Things like the asset’s trading volume, historical price movements, and liquidity can help in understanding its long-term potential.

- Fundamentals: How reliable, experienced, and professional does the project’s team appear? What are the asset’s tokenomics, and how active the team is on its social media channels?

Typically, the project’s website, social media, reviews, or crypto portals like PlasBit can answer some of these questions. Another, perhaps the most important source is the project’s whitepaper, which should provide a solid overview of what the project offers and how it plans to achieve its goals. On the other hand, there are plenty of scammers in the crypto space, constantly thinking up new ways to part unsuspecting investors from their hard-earned money. Among them are fake crypto projects or pyramid schemes like OneCoin, whose co-founder was sentenced to 20 years in prison after scamming people out of more than $4 billion. There are quite a few reasons why scammers (but also decent people, so no prejudice please!) are attracted to the crypto industry. These include anonymity as transactions on the blockchain generally require no personal data, transaction irreversibility that reduces the risk of changing any details but also makes it difficult to recover stolen funds, lack of regulation, borderless transactions, and ease of access. Criminals may abuse these otherwise positive blockchain characteristics so always be skeptical and wary of any red flags of a potential scam, which may include:

- Unreal promises: Sometimes you may encounter a crypto project that promises - nay, “guarantees” - exceptional returns with little to no risk. The reality is, a risk-free investment doesn’t exist, at least not a legitimate one. In other words, if it sounds too good to be true, then it probably is.

- Free money: Similar to the above, if a project is offering free money, be it in crypto or fiat, or asking you to send a small amount of crypto to get double or triple in return, then *ding ding ding* - it’s almost certainly a scam. There’s no such thing as a free lunch and the project will vanish as soon as you send those funds or provide your sensitive information.

- Secretive details: A legit crypto project is transparent about its operations, team members, business model, and plans for the future. In case you can’t find this information or it’s not clear how the project is supposed to work, then be careful. When there’s no face behind the project, it’s difficult to hold them accountable.

- Pressure to invest ASAP: Familiar with the saying “Haste makes waste”? And it’s true because, if the project is making you feel like you’re missing out on something if you don’t act now, it’s likely trying to get you to make a hasty decision without doing proper research. Akin to when an online shop tells you your wishlisted product is selling out quickly to get you to buy it now.

- Uninvited communication: Got a cold call or message on social media, an app, or in your email inbox from a crypto project out of the blue? You may want to ignore it or at least be suspicious of it, as scammers often use these channels to lure in potential victims. Besides, a legit business wouldn’t typically present itself this way.

- Phony celeb endorsements: Elon Musk said this project was great so of course it must be true, right? Wrong. Well, maybe. We all know which crypto he particularly fancies. But if a celebrity endorsement of a crypto is not coming through official channels or something feels off (like it could be a deepfake or something), it’s better to trust your gut or at least do more thorough investigating.

- Dodgy whitepaper: A whitepaper is the face that a crypto project presents to the world. It contains a brief overview followed by all the technical details about its operations, goals, team members and their background, token supply, and distribution. If this doesn’t sound like the whitepaper of the project you’re checking out, in addition to being weirdly short, full of exaggerated claims, and containing shameful spelling and grammar mistakes - yep, it’s a ginormous no-no.

- Incomprehensible investment strategies: Sometimes scammers use what might be compared to a magician’s trick. They distract you with shiny objects and complicated technical terms while hiding the important details. A legitimate project should be easy to understand for an average Joe or Jane.

- Absence of a clear or feasible roadmap: Any crypto project worth its salt has clear and realistic plans for the future outlined in its roadmap. If it’s not there or its objectives sound a bit far-fetched, then that’s another glaring red flag right there.

Aside from understanding the above, make sure to gain a solid understanding of cryptocurrencies and blockchain, use reputable crypto platforms like PlasBit, double-check any links you visit, regularly consult public crypto scam lists, or look for professional advice.

DCA vs. Learning to Trade: What Works for You?

Learning how to trade takes up a lot of effort and time, as well as money on courses that promise you’ll only spend “30 minutes of your day”. But the truth of the matter is this - you’ll end up constantly monitoring the markets, glued to your screen, trying to time your trades right. Before long, some might get sick of all the fundamentals, technical analysis indicators (“Bollinger” what now?), and staying up all night watching candlestick charts. And it’s not exactly fun to have bought a lump sum of crypto for like $10K when you thought its price had bottomed, only to wake up and see it drop further instead of climbing. It makes more sense to spread it out into 20 smaller monthly portions of $500. Also, for many people, trading crypto this way can easily turn into gambling. They might base their decision-making on limited information and look for short-term gains, buying and selling at the wrong times, and often losing money. Then they’ll lose some more trying to “win back” the losses. All this can take a massive psychological toll, easily avoided by prolonged investing of the same amount on a regular basis. When you DCA, you’re not exactly a “trader,” but rather a manager of your own savings account, if you will, accumulating an asset over time at an average cost. Heck, you can even start to DCA and save up for your children from the moment they’re born until they’re 18. If having kids is your thing, in any case.

The Psychological Edge of Dollar Cost Averaging

“Regular” crypto trading involves different psychological aspects that might be problematic for many users, regardless of their level of expertise, but which DCA helps to mitigate. These include:

- Emotions running the show: Crypto traders sometimes fall into the trap of emotions clouding their judgment and directing their actions through the “fear of missing out” (FOMO) or “fear, uncertainty, and doubt” (FUD). DCA takes emotions out of the equation by favoring detailed planning, order, patience, and discipline through methodical, predetermined investments. Say goodbye to impulsive purchases and panic selling!

- Volatility impacting trading success and confidence: The crypto market can be highly unpredictable (and who better to tell it than those naysayers who pronounced Bitcoin dead hundreds of times so far, only to see it surpass $100,000 per wholecoin?). DCA helps smooth out volatility and lessens the impact of price fluctuations, both psychological and financial.

- Complexity and confusion: Investing in crypto by taking into account all the possible indicators and variables is often difficult and frustrating, even for an experienced trader. DCA is a simpler way to build your crypto portfolio compared to other investing strategies and you don’t need to be a trading wizard, nor keep a sharp eye on market movements.

- Timing the market and stressing about it: Trying to find the right time to invest in crypto and/or withdraw your profits tends to be challenging and emotionally taxing, whether you have experience in trading crypto or not. Allocating a set amount regularly removes the stress of trying to accurately time the market and second-guessing if you made the right call. There’s also this thing called “decision fatigue” (which should also be called the “I have nothing to wear” phenomenon) and it’s very real.

Is DCA crypto right for you?

All things considered, knowing how to dollar cost average crypto is ideal for many traders who wish to avoid the stress and complications of “regular” trading. Having said that, it’s important to remember that it doesn’t guarantee profit nor is it a perfect shield against financial loss. It’s also not suitable for everyone. Some may prefer the “buy the dip” strategy instead, which refers to purchasing a crypto in a large quantity when its price is on its lower end - provided you properly predict the bottom based on monitoring the market and doing technical analysis, that is. So, if you definitely want to try out this strategy, the main thing is to decide which crypto to invest in, how much money to spend on it, and at what interval. Other than that, make sure to assess your financial situation, resource allocation goals, and risk tolerance. In addition to conducting thorough research, you should explore the most cost-effective ways to purchase crypto. You may also consider seeking professional advice if you’re new to the whole crypto and blockchain thing. After all, two heads are smarter than one.