As cryptocurrency evolves, Bitcoin (BTC) remains at the forefront of the digital currency landscape. If you're a new crypto trader in the UK, you're likely eager to explore the legal and secure ways how to buy Bitcoins in the UK. In this article, we'll provide a step-by-step guide on how to buy Bitcoins in the UK, specifically focusing on buying Bitcoins with a credit card and exchanging Ethereum (ETH) for BTC. Additionally, we will address key questions like the legality of Bitcoin trading in the UK, the stance of UK banks on Bitcoin trading, the vitality of Bitcoin as an asset, what you can purchase with BTC, and how to buy BTC with a credit card.

Why Should You Consider Buying Bitcoin?

Bitcoin, often called digital gold, has become a prominent asset in finance. The question of why you should consider buying Bitcoin is multifaceted, and it requires a comprehensive exploration of its various attributes and the opportunities it presents. In this informative discussion, we'll explore the compelling reasons for considering Bitcoin as an asset. We'll avoid redundancy and provide a well-researched perspective on this topic.

Store of Value and Hedge Against Inflation:

Bitcoin is often compared to gold for its potential as a store of value. Unlike conventional fiat currencies, which can be subject to inflation and devaluation due to government policies, Bitcoin operates on a fixed supply schedule. There will only be 21 million Bitcoins, making it a deflationary asset. This scarcity has the potential to protect your wealth against the erosion of purchasing power caused by inflation.

Decentralization and Resistance to Censorship:

Bitcoin's decentralized nature means a central authority or government does not control it. Transactions are stored on a ledger called the blockchain, making it resistant to censorship and interference. This feature particularly appeals to regions with unstable political climates or where financial freedom is restricted.

Global Accessibility:

BTC is available to anyone with an internet connection, offering the opportunity for financial inclusion to people who may not have access to conventional banking services. Its borderless nature allows easy cross-border transactions and the potential to bypass costly international remittance services.

Diversification of Asset Portfolio:

Adding Bitcoin to your asset portfolio can provide diversification benefits. Unlike traditional assets like stocks and bonds, Bitcoin's price movements often do not correlate with those of other assets, making it a valuable addition to mitigate risk.

High Liquidity:

Bitcoin's high liquidity means it can be easily bought or sold on various cryptocurrency exchanges. This liquidity provides flexibility for traders, allowing them to enter or exit positions relatively quickly compared to traditional assets.

Rapid Technological Advancements:

The blockchain technology that underpins Bitcoin continues to evolve and offer exciting opportunities. Bitcoin is at the forefront of the cryptocurrency space, and its continued development can lead to innovations and improvements, potentially increasing its utility and value.

Institutional Adoption:

Over the past few years, institutions, including well-known companies and financial firms, have begun to allocate a portion of their portfolios to Bitcoin. This institutional adoption has provided validation and confidence in Bitcoin as a legitimate asset class.

Security and Control:

With proper security measures, you can have complete control over your Bitcoin holdings. Unlike traditional banks, you are the custodian of your assets, reducing the risk of your funds being frozen or seized.

Innovation in Infrastructure:

The progression of the crypto market has led to significant innovation in infrastructure, making it easier to buy, store, and use Bitcoin. This includes the development of secure wallets, user-friendly exchanges, and merchant adoption.

What Can You Buy With Bitcoin?

Bitcoin, the world's first and most well-known crypto, has come a long way since its inception in 2009. Initially created as a digital alternative to traditional currencies, Bitcoin has evolved into a versatile asset with many use cases. In this discussion, we will explore the diverse and growing list of items and services that can be purchased using Bitcoin.

Online Retailers:

One of the most straightforward uses of Bitcoin is for online shopping. Many e-commerce websites, including Overstock, Newegg, and Shopify stores, accept Bitcoin as payment. You can buy various products, from electronics to clothing, using your Bitcoin holdings.

Travel and Accommodation:

Several travel agencies, airlines, and hotel booking platforms now accept Bitcoin as payment. Expedia, CheapAir, and Destinia, for example, allow you to book flights and accommodations using Bitcoin. This makes it convenient for travelers exploring the world while using their digital assets.

Gift Cards:

Various platforms enable you to purchase gift cards for popular retailers and online services with Bitcoin. This flexibility lets you indirectly spend your Bitcoin on items from stores like Amazon, Starbucks, and iTunes.

Food and Beverages:

An increasing number of restaurants and cafes worldwide have started accepting Bitcoin. This means you can enjoy a meal or coffee and pay with your digital wallet. The adoption of Bitcoin in the food industry is particularly noticeable in large cities.

Subscription Services:

Many online subscription services, such as Microsoft, Namecheap, and Humble Bundle, allow customers to use Bitcoin for payments. This extends to software, domain registration, and digital content.

Real Estate:

The real estate market has seen a growing trend of sellers willing to accept Bitcoin for property transactions. While this is more common in certain regions, it's a notable example of the increasing acceptance of Bitcoin in high-value transactions.

Electronics and Gadgets:

In addition to online retailers, specific electronics and gadget stores now allow customers to pay with Bitcoin. You can buy items like laptops, smartphones, and gaming consoles using your digital currency.

Gaming and Digital Goods:

The gaming industry has embraced Bitcoin, with various online platforms accepting it for in-game purchases, subscriptions, and digital items. Additionally, you can buy gift cards for gaming services like Steam with Bitcoin.

Art and Collectibles:

Some art galleries and collectibles marketplaces accept Bitcoin for artwork, antiques, and rare items. This has created a new dimension for art enthusiasts and collectors.

Sports Tickets and Merchandise:

Sports fans can use Bitcoin to purchase tickets for games and events, as well as official team merchandise. This demonstrates the increasing integration of cryptocurrency in the sports industry.

Online Freelancers and Services:

Freelancers and service providers, such as graphic designers, web developers, and writers, often accept Bitcoin for their work. This global payment method facilitates cross-border transactions in the gig economy.

How to Buy Bitcoins In The UK with a Debit Card?

Start buying Bitcoins using our crypto debit card through our platform by following these straightforward steps.

Register Your PlasBit Account

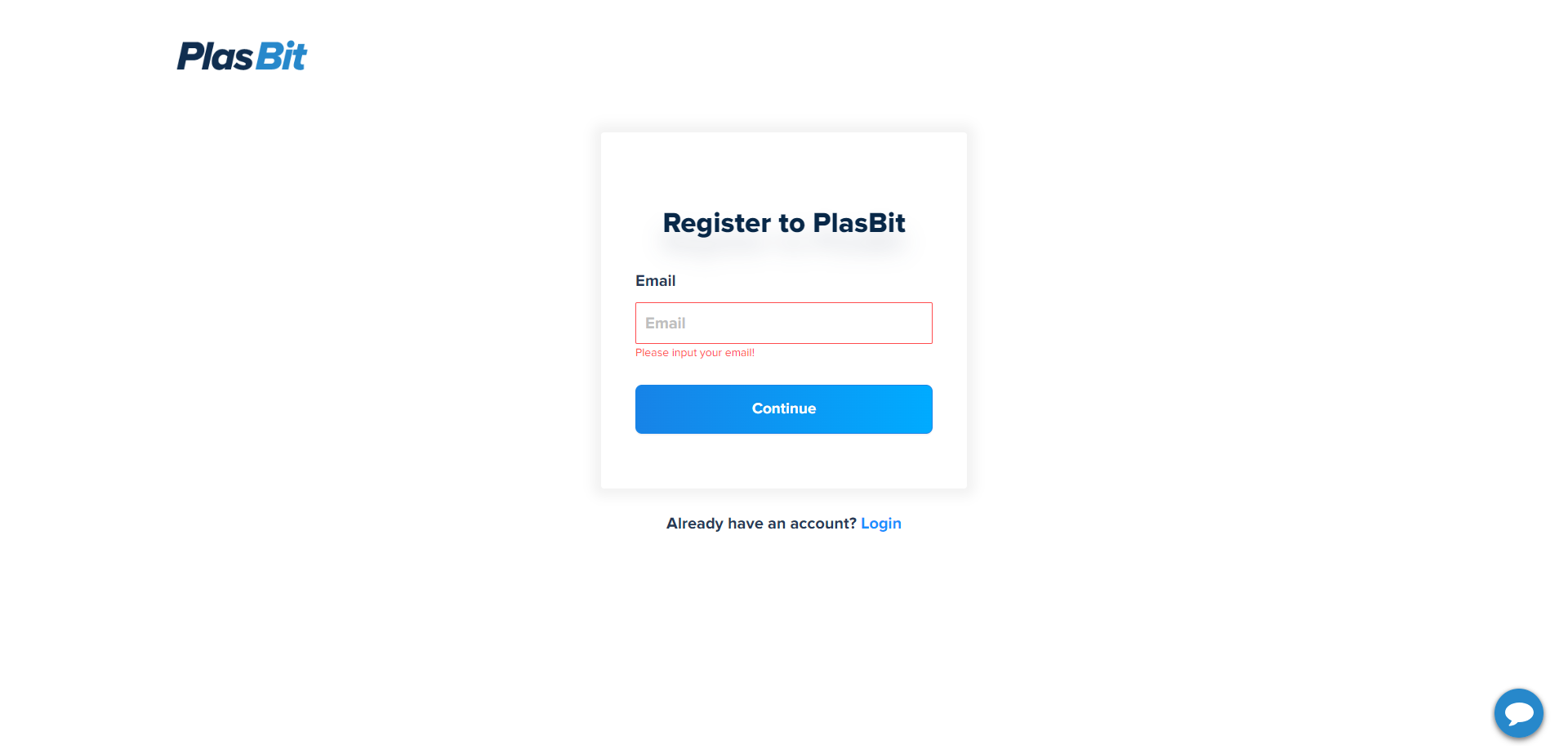

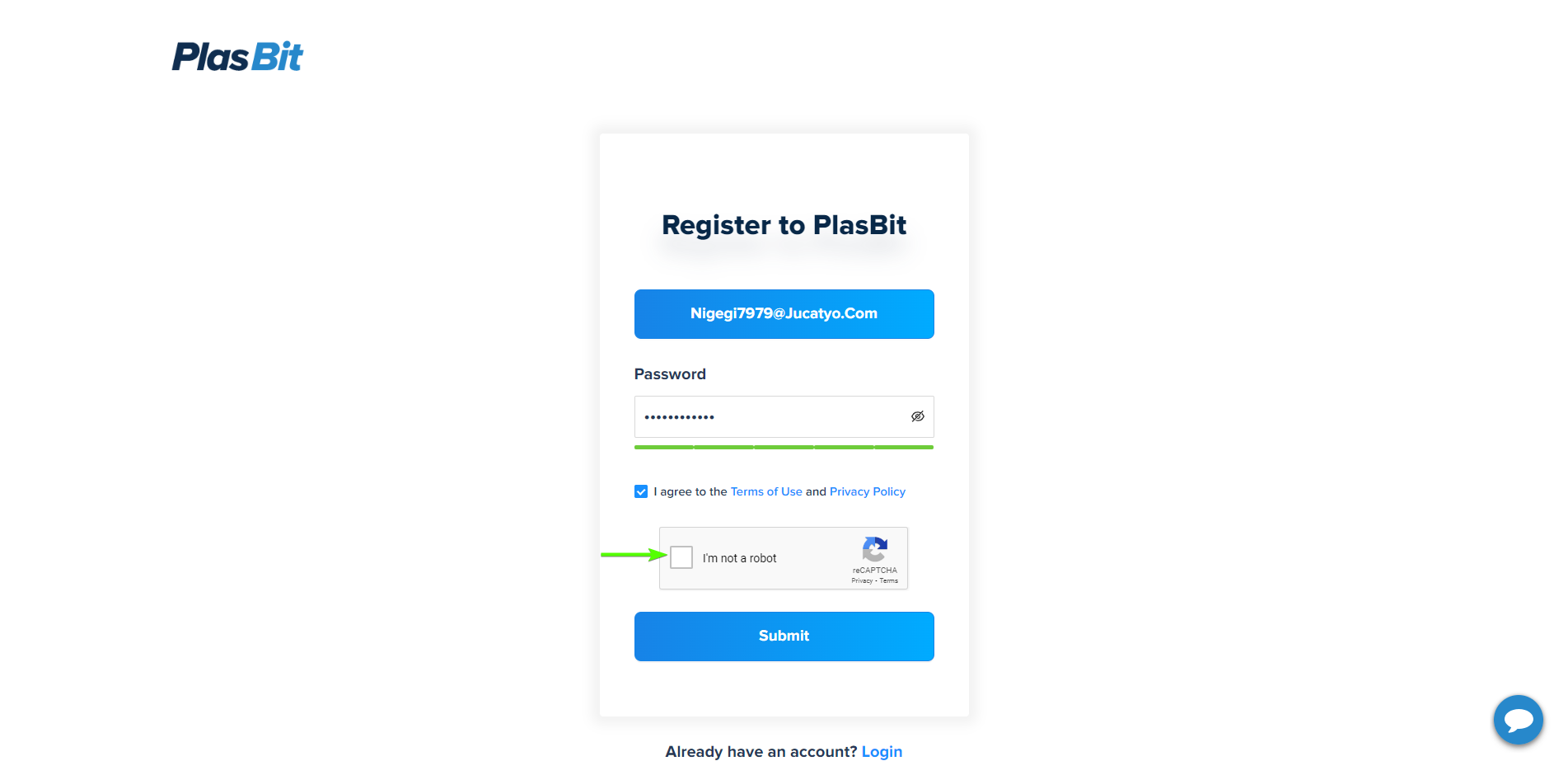

1. In the top right of your browser, click the 'Get Started' button to initiate the registration process.

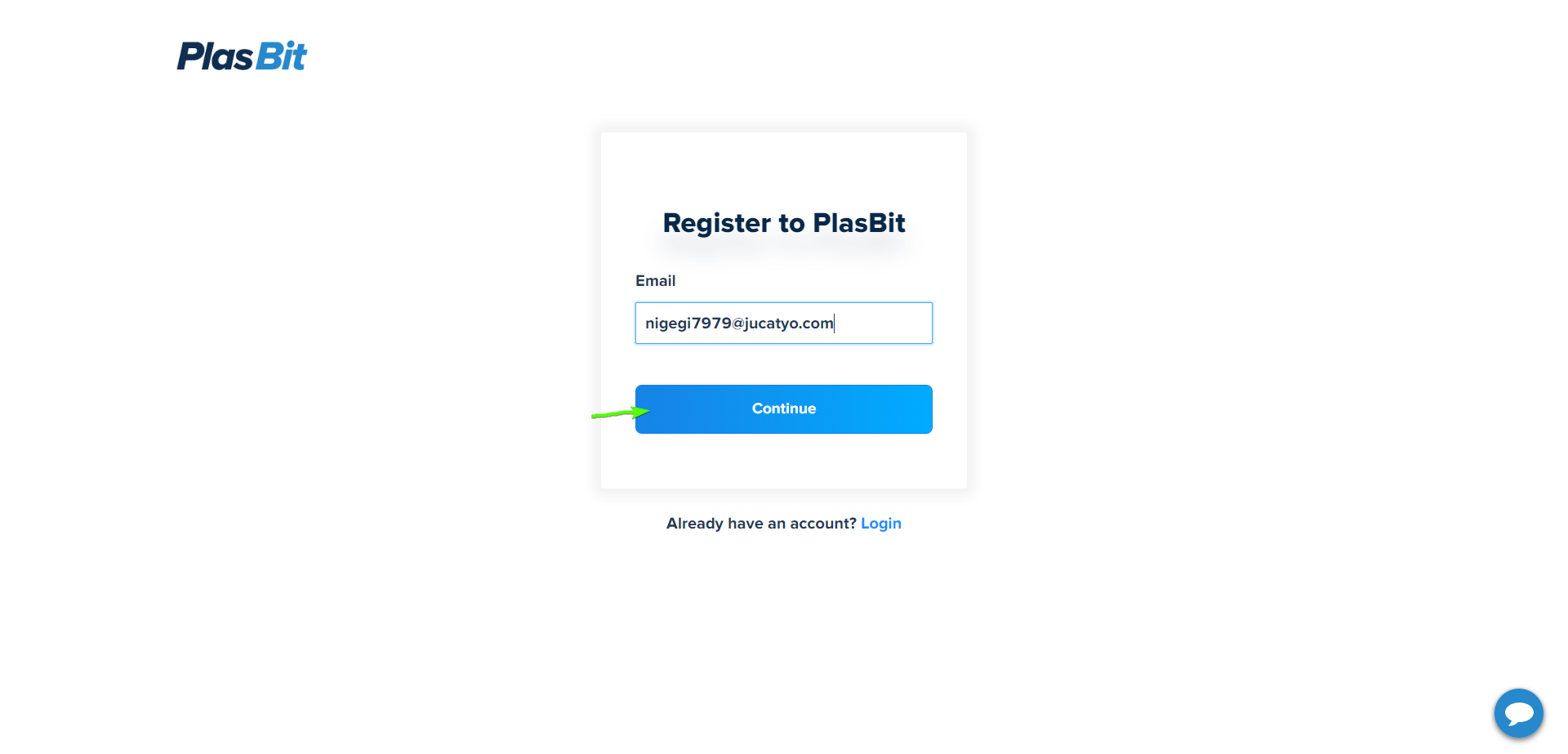

2. Provide your preferred email address for account registration.

3. Select "Continue."

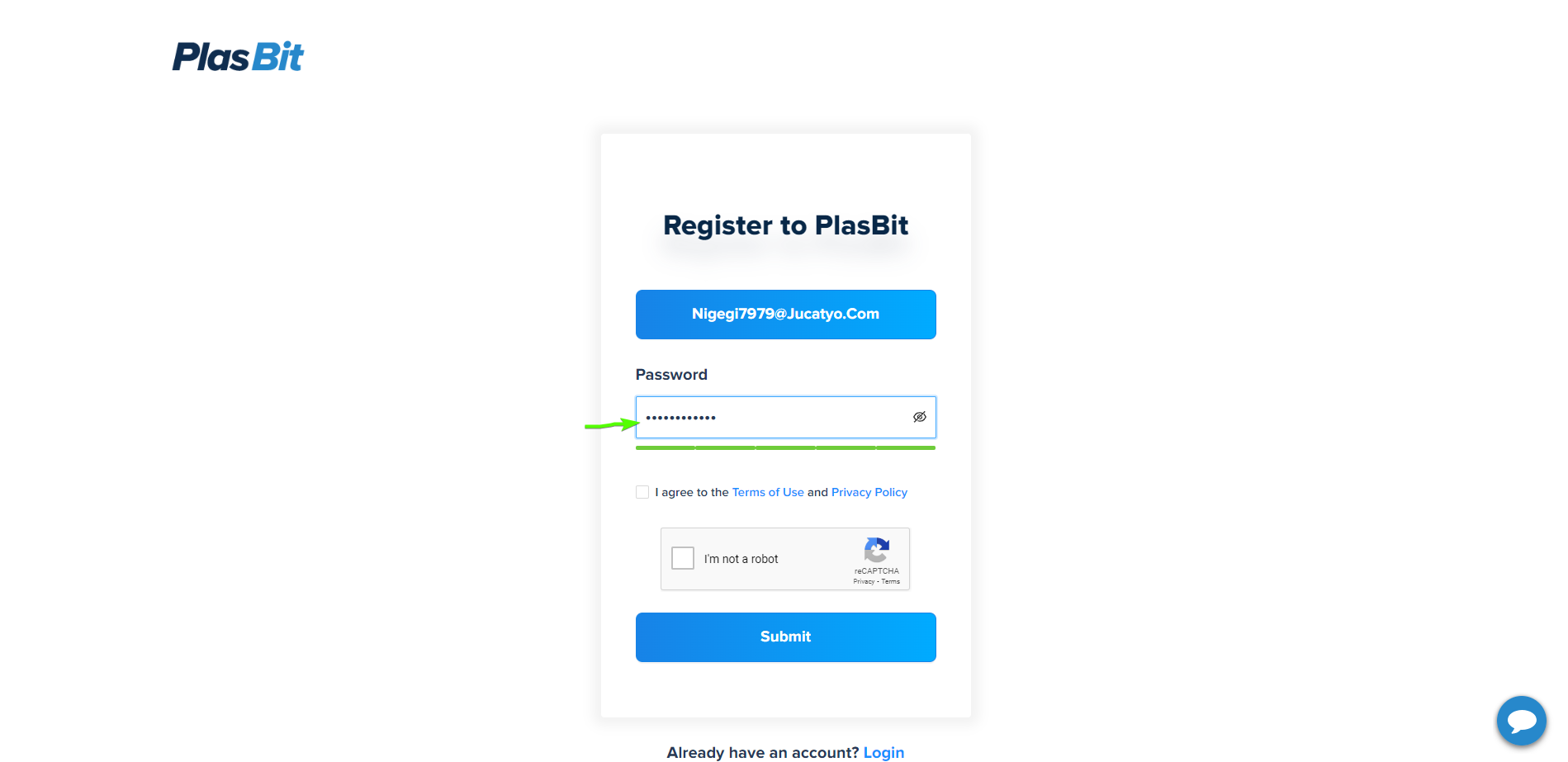

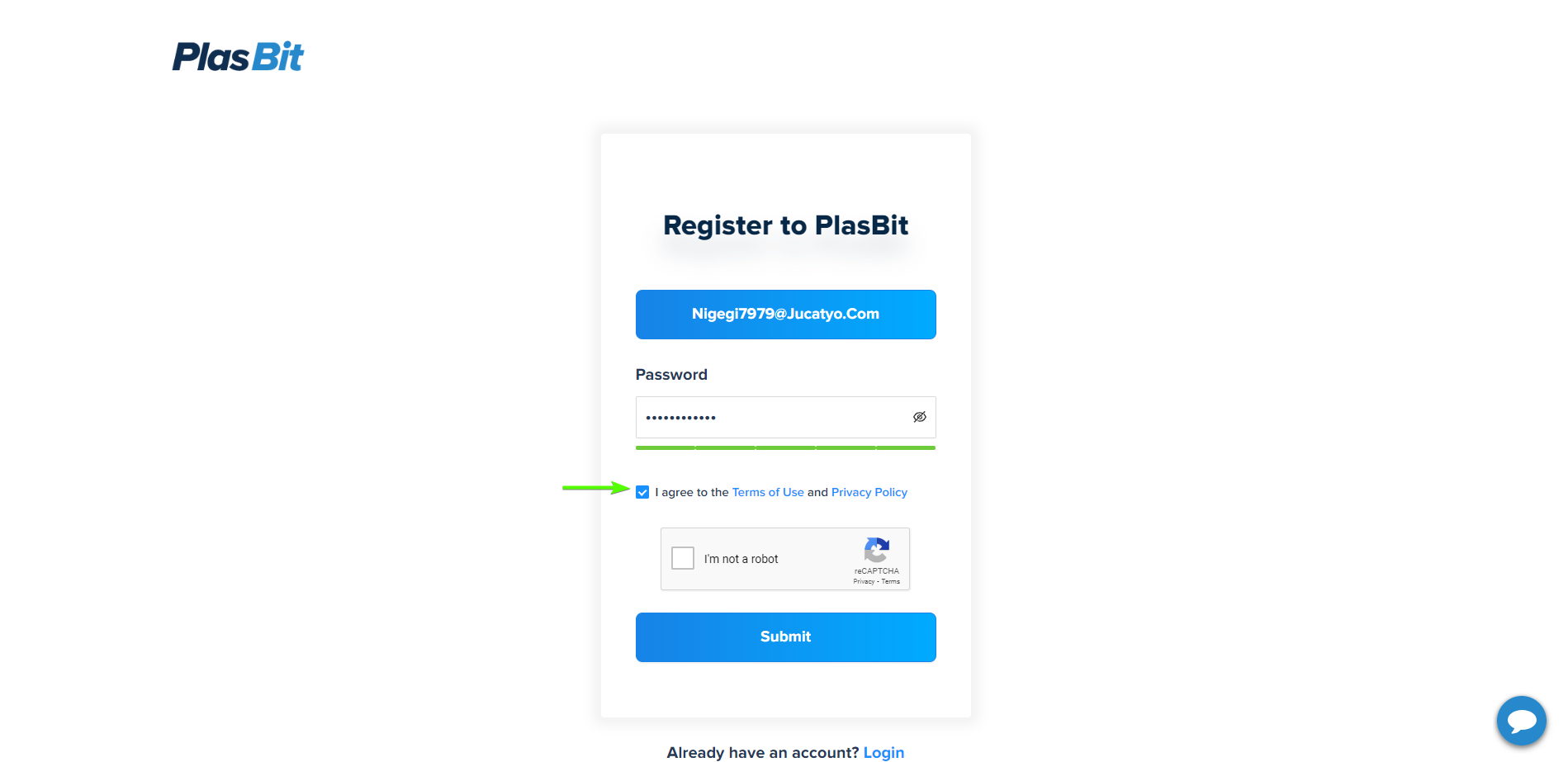

4. Create a strong and secure password for your account.

5. Accept the "Terms of Use and Privacy Policy."

6. Verify that you're not a robot by completing the captcha verification.

7. Select "Submit."

Verify Your Email

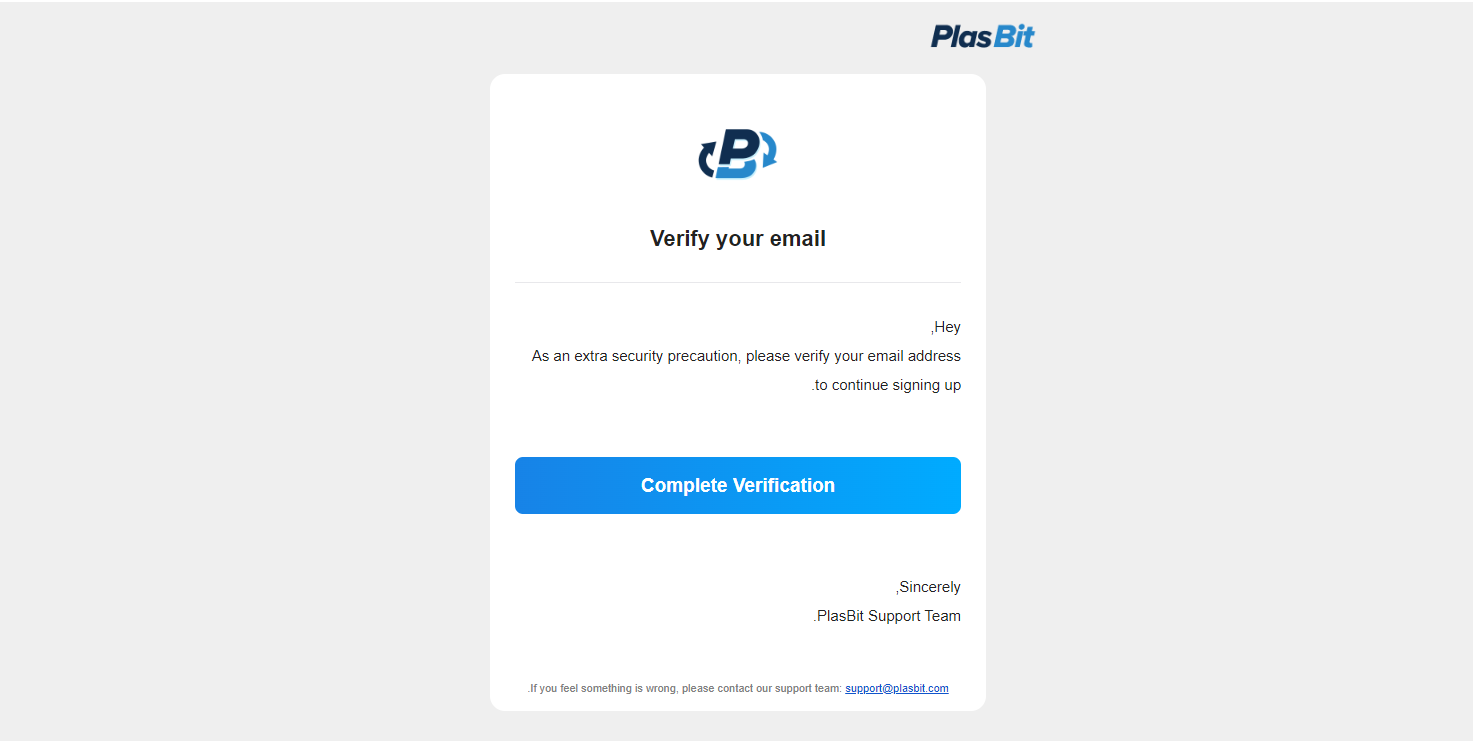

- After registration, check your email for a message from our platform.

- Open the email and choose the verification link to confirm your registration.

- You will be redirected to your "Dashboard."

Depositing Fiat Currency

- Go to your "Deposit" section on the dashboard.

- Specify the amount of fiat currency you intend to deposit.

- Select your preferred payment method. We provide multiple options, including Bank Cards (Visa or Mastercard), Wire Transfers (SEPA or Local Bank), and E-currencies.

- If you plan to use a credit card, choose "Bank Card" and select either Visa or Mastercard as your card payment method.

Take Note of Fees and Completion Time

Make sure to be aware of the associated fees and the estimated completion time for your deposit.

Initiate the Deposit

Click the "Deposit" button to start the deposit process.

Verification Process

- We follow industry-standard security practices, necessitating verification for the cards used for deposits.

- When using a card for the first time, you will receive an email carrying instructions for verification.

- Complete the verification process within specified hours, which includes providing photos of the card you used, a photo ID and following the instructions provided.

- Once verified, subsequent deposits with that card will not require this process.

- What If You Don't Complete Verification

- Please complete verification within the required hours to avoid the cancellation of your card deposit.

- Your bank will unblock the pre-authorized amount on your card within several business days (or longer in some cases).

- If needed, contact your bank for further details.

- With your account now funded, you are ready to engage in transactions and purchase Bitcoins on our cryptocurrency exchange using your credit card. Navigate the exchange platform and follow the steps to acquire the desired amount of Bitcoins.

Where Do You Exchange ETH to BTC?

Exchanging Ethereum for Bitcoin is a common transaction in the cryptocurrency world. Whether you're looking to diversify your crypto holdings, take advantage of market opportunities, or convert one cryptocurrency into another, there are several methods and platforms available for such exchanges. We will explore the various options for exchanging ETH for BTC, including cryptocurrency exchanges, decentralized platforms, and peer-to-peer trading.

Cryptocurrency Exchanges:

Cryptocurrency exchanges serve as the primary and most accessible avenue for trading Ethereum (ETH) for Bitcoin (BTC) and various other digital assets. These platforms offer a user-friendly marketplace where users can trade a wide range of cryptocurrencies, making them the most straightforward means of performing such exchanges. Whether you're a beginner or an experienced trader, these exchanges provide a diverse array of tools and features, facilitating ETH to BTC conversions and vice versa. Cryptocurrency exchanges offer ETH/BTC trading pairs, allowing users to seamlessly transition between these two leading cryptocurrencies while taking advantage of the exchange's features, liquidity, and security measures. PlasBit exchange keeps 100% of users' assets in cold storage, guaranteeing a 1:1 backing. Our user-friendly interface simplifies cryptocurrency trading, and our robust data protection keeps your information secure. We offer 24/7 customer support via live chat, Telegram, ticketing system, or email. Identity verification enhances account security, and flexible funding options are available.

Decentralized Exchanges (DEXs):

Decentralized exchanges, often called DEXs, have witnessed a significant surge in popularity due to their core principles of empowering users with greater control over their digital assets and ensuring enhanced privacy in cryptocurrency trading. DEXs operate on blockchain technology and smart contracts, providing a trustless environment where users can directly swap Ethereum (ETH) for Bitcoin (BTC) and other cryptocurrencies without an intermediary. This decentralized approach eliminates the reliance on a central authority, reducing the risk of data breaches and maintaining the privacy of user information. DEXs enable users to trade securely, maintain self-custody of their funds, and participate in a more democratic and transparent financial ecosystem. The popularity of DEXs underscores the growing demand for greater autonomy and security within the cryptocurrency landscape.

Atomic Swaps:

Atomic swaps, a groundbreaking technology in the cryptocurrency space, enable trustless peer-to-peer exchanges between cryptocurrencies, including ETH and BTC. Unlike traditional exchange methods that require intermediaries, atomic swaps allow users to directly and securely trade their digital assets. This technology relies on smart contracts and cryptographic techniques to ensure the exchange is only executed if both parties fulfill the agreed-upon terms. While atomic swaps are less prevalent than other exchange methods due to their technical complexity and the need for compatible blockchain networks, they represent a significant step towards decentralization and user autonomy in the cryptocurrency world. Atomic swaps have gained attention for their potential to revolutionize how cryptocurrencies are traded, providing users with an added layer of security and control over their assets.

Over-the-Counter (OTC) Services:

Over-the-counter (OTC) services play a pivotal role in cryptocurrency, primarily catering to traders looking to conduct substantial transactions. These services come into play when dealing with large volumes of digital assets, such as Ethereum (ETH) and Bitcoin (BTC), where the traditional order book-based exchanges may need more liquidity or privacy. OTC desks provide a tailored and personalized approach to assist high-value trades, often offering one-on-one consultations with experienced professionals who navigate the complexities of the cryptocurrency market. Additionally, these services may include ETH to BTC conversion options, making it convenient for high-net-worth individuals and institutional clients to efficiently exchange their cryptocurrency holdings while mitigating market impact and slippage. OTC services have become a cornerstone for large-scale cryptocurrency transactions, offering expertise, discretion, and a strategic advantage in managing significant digital asset portfolios.

How to Convert ETH to BTC?

Converting Ethereum (ETH) to Bitcoin (BTC) involves a process that allows you to transition from one cryptocurrency to another. Various factors, including strategy, market conditions, or personal preferences, can drive this conversion. To help you understand how to convert ETH to BTC, we'll explore the general steps and methods involved in this process.

Create an Account:

Create an account on an exchange if you still need to get one. You'll typically need to provide personal information and complete identity verification.

Deposit ETH:

After account creation, deposit your Ethereum into your exchange wallet. This usually involves generating a unique deposit address and transferring your ETH from your wallet to the exchange.

Place an Order:

Once your ETH is in the exchange, you can place an order to convert it into BTC. Common order types include market orders (executed at the current market price) and limit orders (executed at a specific price you set).

Execute the Trade:

After placing your order, the exchange will execute the trade when a suitable match is found. Your ETH will be converted into BTC, and the Bitcoin will be attributed to your account wallet.

Withdraw BTC:

To maintain security and control over your assets, consider withdrawing the BTC to your wallet after the exchange. This step is essential, especially if you plan to hold the BTC long-term.

Bitcoin Storage Options

The security of your Bitcoins is paramount, and it largely depends on how you store them. The cryptocurrency world offers various cryptocurrency wallet options, each with advantages and considerations. Here, we'll explore these options to help you make informed decisions about safeguarding your valuable Bitcoin holdings.

Hot Wallets:

Hot wallets are digital wallets that are connected to the internet. They are convenient for everyday transactions, making them a popular choice for those who frequently use Bitcoin for online purchases or trading. These wallets come in various forms, including web wallets (accessible through web browsers), mobile wallets (apps on your smartphone), and desktop wallets (software installed on your computer). While hot wallets provide quick access to your funds, they are more susceptible to online threats, such as hacking and phishing attacks. Therefore, it's recommended to use hot wallets for small amounts of Bitcoin that you would use in the short term.

Cold Wallets:

Cold wallets, also known as cold storage, are offline methods of storing Bitcoin. These wallets provide enhanced security and are suitable for long-term storage of bigger amounts of crypto. The main advantage of cold wallets is that they are not connected to the internet, making them immune to online threats. Two common types of cold wallets are hardware wallets and paper wallets. PlasBit wallet boasts robust security features for managing a range of cryptos, including BTC, ETH, LTC, ADA, USDC, ERC20 tokens, and more. Your private keys are securely encrypted and protected by Biometric and 2-Factor Authentication. We prioritize security with strong password protocols, offline storage in secure vaults worldwide, and ISO/IEC 27001 certification to provide a secure, all-in-one solution for crypto storage and fiat conversion.

Hardware Wallets:

Hardware wallets are devices designed to store your private keys offline securely. They are one of the safest options for storing significant amounts of Bitcoin. Examples of well-regarded hardware wallet brands include Ledger and Trezor. These devices provide robust security features, including PIN codes, two-factor authentication, and encrypted storage. When you want to make a transaction, you connect the hardware wallet to a computer temporarily to sign the transaction and then disconnect it from the internet. This minimizes the exposure of your private keys to potential threats.

Paper Wallets:

Paper wallets offer an alternative approach to cold storage. They involve generating your Bitcoin addresses and private keys offline and then printing them on a physical document, typically a piece of paper. The advantage of paper wallets is that they are entirely offline, making them immune to online attacks. They are often considered the most secure way to store Bitcoin for the long term. However, it's crucial to keep the paper wallet in a secure location to prevent physical damage or loss. Additionally, if you need to access your Bitcoin, you'll need to sweep or import the private key into a hot or online wallet, which introduces complexity.

Legal Aspects of Bitcoin Trading in the UK

For individuals and traders interested in Bitcoin trading in the United Kingdom, understanding the legal framework and the involvement of financial institutions is crucial. Bitcoin trading in the UK is legal and well-regulated, but it's important to know the legal aspects and any potential restrictions banks impose. In this discussion, we'll delve deeper into these legal considerations.

Is Bitcoin Trading Legal in UK?

Yes, Bitcoin trading is entirely legal in the UK. The UK government, through its regulatory body, the Financial Conduct Authority (FCA), has taken proactive steps to oversee and regulate cryptocurrency activities within the country. The FCA, responsible for ensuring the stability and integrity of financial markets, has implemented a comprehensive regulatory framework for cryptocurrency businesses and exchanges. This framework includes requirements for anti-money laundering (AML) and know-your-customer (KYC) procedures, as well as measures to combat fraud and financial crimes. This regulatory approach ensures that Bitcoin trading in the UK is conducted transparently and securely, providing consumer protection. It also establishes a legal foundation for businesses to operate within the cryptocurrency space, which fosters innovation in the sector.

Are UK Banks Against Bitcoin Trading?

While Bitcoin trading is legal in the UK, the stance of individual banks regarding cryptocurrency activities may vary. Most UK banks do not actively oppose Bitcoin trading, and many individuals and businesses in the country can transact with cryptocurrency without major issues. However, it's important to note that some banks may have specific policies or restrictions related to cryptocurrency transactions. These policies can include limitations on using bank accounts for funding cryptocurrency exchanges or restrictions on transactions involving Bitcoin and other digital assets. The reasons behind such restrictions may include concerns about the high volatility of cryptocurrencies, potential exposure to financial risks, or compliance with their risk management policies.

To navigate this landscape, individuals interested in Bitcoin trading should contact their respective banks to gain a clear understanding of the bank's stance on cryptocurrency-related activities. Additionally, it's a good practice to keep accurate records of your cryptocurrency transactions and maintain transparency with your bank, which can help resolve any potential issues or concerns. It's worth noting that the regulatory and banking landscape in the cryptocurrency industry is continually evolving. As Bitcoin and other cryptocurrencies gain broader adoption and recognition, regulatory authorities and financial institutions may revise their policies to accommodate the changing landscape. Staying informed about these developments and seeking guidance from legal and financial experts can help traders make informed decisions and operate within the bounds of the law.

Taxes and Regulations

In the United Kingdom, the taxation of cryptocurrencies is governed by regulations set forth by Her Majesty's Revenue and Customs (HMRC). Although Bitcoin is not officially recognized as a legal tender, it is categorized as an asset rather than a currency. As a result, capital gains tax (CGT) can be applicable when you sell or exchange Bitcoin, similar to the taxation of other forms of asset. The rate of CGT depends on your overall income and can range from 10% to 20%. It's essential to keep meticulous records of your cryptocurrency transactions, including the acquisition and disposal of Bitcoin, to report your capital gains for tax purposes accurately. Additionally, HMRC guidance suggests that cryptocurrency mining may be subject to income tax, and businesses that accept Bitcoin as payment may need to report it for value-added tax (VAT) purposes.

The regulatory landscape for cryptos is continually evolving, and changes in regulations can significantly impact your tax obligations and venture strategies. Staying well-informed about the latest developments in cryptocurrency regulations is crucial to ensuring compliance with HMRC requirements and making informed financial decisions. Given the complexity of cryptocurrency taxation, consulting with a tax professional specializing in digital assets is advisable. They can provide expert guidance on tax planning, reporting, and strategies to minimize your tax liability while sticking to the legal requirements set forth by HMRC.

Is BTC Dead?

No, Bitcoin is far from dead. Since its inception in 2009, Bitcoin has weathered numerous challenges and skeptics, yet it continues to thrive. Its resilience is attributed to several key factors. First and foremost, Bitcoin has solidified its position as a store of value, similar to traditional assets like gold. This characteristic is particularly relevant in times of economic uncertainty and inflation, as it provides a hedge against the devaluation of fiat currencies. The limited supply of 21 million Bitcoins, the mining process, and the halving events all contribute to the scarcity that underpins its value. Furthermore, Bitcoin's role as a medium of exchange is also evident, with many merchants and businesses accepting it as a form of payment. Its borderless nature and rapid transaction settlement make it appealing for international trade and cross-border remittances. Beyond these attributes, Bitcoin continues to evolve technologically, with advancements such as the Lightning Network improving scalability and transaction efficiency. Its open-source nature and decentralized structure make it resistant to censorship and interference by governments or central authorities. Moreover, growing institutional interest in Bitcoin, marked by assets from prominent companies and the inclusion of Bitcoin in asset portfolios, reflects its maturity as an asset class. These developments demonstrate that Bitcoin remains alive and poised for further growth and adoption in the financial landscape.

Conclusion

Acquiring and trading Bitcoin in the UK is a straightforward process, with cryptocurrency exchange offering secure and convenient services. New crypto traders can buy BTC with a credit card, exchange ETH for BTC, and access to a range of services and products with Bitcoin. The legality of Bitcoin trading in the UK is affirmed, and Bitcoin's vitality as a digital asset remains strong. Traders need to stay informed, adhere to regulations, and explore the vast potential of Bitcoin as both a venture and a means of payment in the modern financial landscape.