Cryptocurrencies have emerged as a transformative force in finance in an era defined by the digital revolution. As the allure of digital assets continues to captivate investors and individuals worldwide, understanding the mechanisms for acquiring cryptocurrencies becomes increasingly vital. Among the myriad options available, one stands out as an efficient and widely-used method for purchasing digital currencies within the Eurozone: SEPA (Single Euro Payments Area) transfers. So, how do I buy crypto with SEPA transfer?

What is SEPA Payment?

SEPA, designed to streamline euro-denominated transactions across 36 European countries, has become integral to the financial landscape. With the ever-growing popularity of cryptocurrencies, it's imperative to comprehend how this kind of payment can be harnessed to enter the world of digital assets seamlessly. We will navigate the intricate terrain of Single Euro Payments Area, demystifying the process step by step. From creating your cryptocurrency wallet to choosing the correct digital currency, executing a SEPA transfer, and managing your investments securely, we will leave no stone unturned. Whether you're a novice seeking to take your first steps into the world of cryptocurrencies or an experienced investor looking for a reliable payment method, this guide is your gateway to making informed and confident decisions.

Understanding SEPA

SEPA, which stands for Single Euro Payments Area, is an initiative introduced by the European Union to harmonize and simplify euro-denominated transactions across European countries. It was launched to create a unified payments market where cross-border and domestic payments could be executed as quickly and efficiently as local transactions. Single Euro Payments Area eliminates many traditional barriers associated with international transfers, making it an attractive choice for individuals and businesses. So, how do I buy crypto with SEPA transfer?

SEPA and Cryptocurrencies

SEPA's significance in cryptocurrencies lies in its ability to facilitate euro-based transactions. Many cryptocurrency exchanges and platforms now accept Single Euro Payments Area transfers as a preferred method for depositing funds. Is buying crypto safe? If you want to buy cryptocurrencies with euros, SEPA can be a secure, cost-effective, and widely supported option.

Advantages of Using Single Euro Payments Area for Crypto Transactions

Widespread Acceptance: SEPA is accepted by many cryptocurrency exchanges and brokers, making it easy to find a platform that accommodates this payment method.

Lower Costs: Single Euro Payments Area transfers often come with lower fees than other international payment methods, making it an economical choice for acquiring cryptocurrencies.

Reliable and Secure: The transactions are regulated by European banking standards, providing a high level of security and confidence in your financial transactions.

Faster Settlement: While SEPA transfers may take longer than local transfers, they are generally faster than traditional international wire transfers and take 2 or 3 business days. In summary, SEPA serves as the bridge between traditional finance and the world of cryptocurrencies. As you embark on your journey to buy cryptocurrencies with Single Euro Payments Area, understanding the core principles and advantages of SEPA will set the stage for a seamless and efficient transaction process.

How do I Buy Crypto with SEPA transfer?

Now that you know what SEPA is and its significance in cryptocurrency, it's time to prepare for your journey into digital assets. So, how do I buy crypto with SEPA transfer? PlasBit is the perfect choice to buy crypto with SEPA, and we'll explore the essential steps before purchasing your first cryptocurrency using SEPA with our platform.

1. Create a Cryptocurrency Wallet

You'll need a digital wallet before you can buy and store cryptocurrencies. A cryptocurrency wallet is a secure digital tool that allows you to store, send, and receive your digital assets. To open a crypto wallet on our platform, you only need to create an account using an e-mail and a strong password.

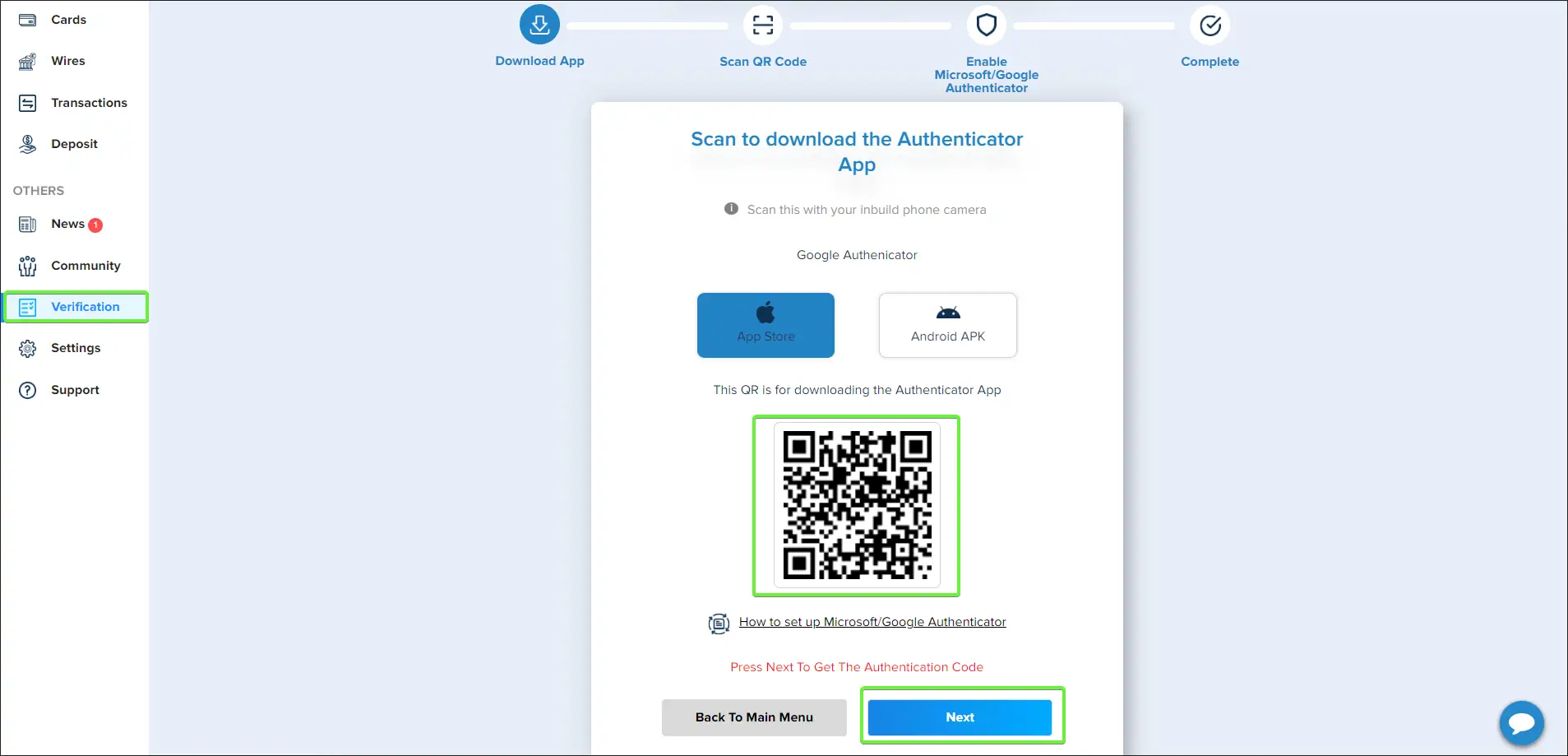

2. Verify your Account with 2FA

Verify your e-mail after registration, and enable two-factor authentication via phone number or Google Authenticator. This will provide an extra layer of security to your account and ensure peace of mind.

3. Fund Your Account

Before you can purchase cryptocurrencies, you need to deposit funds into your account. Single Euro Payments Area transfers take three business days to process, so plan accordingly. Go into our platform's "Deposit" section and choose SEPA in the Wire Transfer section. With your cryptocurrency wallet ready, identification verified, and exchange account funded, you can start buying cryptocurrencies using SEPA.

Can UK Citizens Still Buy Crypto With SEPA Transfers After Brexit?

This comprehensive section is aimed at individuals considering sending significant amounts of money, particularly those exceeding 100,000 GBP or an equivalent amount in their respective currency, to purchase cryptocurrencies through Single Euro Payments Area transfers. Given the unique circumstances surrounding Brexit, it's essential to address the implications of this historic event on UK citizens' ability to utilize SEPA for cryptocurrency purchases. Is UK in SEPA after Brexit? How do I buy crypto with SEPA transfer if I live in UK?

Understanding the Impact of Brexit on SEPA Transfers

Brexit, the United Kingdom's withdrawal from the European Union, has introduced various changes, including alterations in financial services and cross-border transactions. One of the questions that has emerged is whether UK citizens can continue using Single Euro Payments Area transfers to buy cryptocurrencies after Brexit.

Single Euro Payments Area and the UK Post-Brexit

Is UK in SEPA after Brexit? In light of Brexit, Single Euro Payments Area transfers are still a viable option for UK citizens looking to purchase cryptocurrencies. Furthermore, UK banks may still offer SEPA transfer services for euro-denominated transactions, although certain adjustments and considerations come into play.

Critical Considerations for UK Citizens

Choice of the Best Exchange: Only a few exchanges allow SEPA transfers from the UK. PlasBit explicitly states its continued support for Single Euro Payments Area transfers post-Brexit, and our platform allow SEPA transfers from the UK. We will enable you to make worldwide transfers, both crypto and wire transfers, through our services you can operate without limits even if you reside in the UK.

Banking Partnerships: The process of executing this kind of transfers can vary depending on the UK bank you use. Some banks may have established partnerships with EU financial institutions, facilitating the continuation of SEPA transfers. It's advisable to check with your bank to understand the specific terms and conditions governing Single Euro Payments Area transactions.

Currency Exchange Rates: SEPA transfers typically entail the conversion of British Pounds (GBP) to euros (EUR). UK citizens should be mindful of currency exchange rates, which can influence the final amount of euros received. Additionally, consider any associated fees or conversion charges affecting the overall transaction cost.

Regulatory Compliance: Keep abreast of changes in cryptocurrency regulations and compliance requirements in the UK post-Brexit.

Given the dynamic nature of currency exchange regulations and financial services, staying informed about any subsequent developments that may impact your transactions is advisable. Different banks may impose varying limits on the amounts transferred through SEPA. Familiarize yourself with your bank's specific limitations to plan your transaction effectively.

Preparing Your Documents

Depending on the amount you intend to transfer, the platform may request documents as proof of the source of your funds. Having these documents ready can expedite the verification process and reduce potential delays. Besides bank statements, the platform may require supplementary documents based on the source of your funds, including property sales, inheritances, employment, investments, or loans.

Setting Up Your Transfer

So, how do I buy crypto with SEPA transfer in UK? When ready to initiate your transfer, follow these steps:

- Choose your source for the transfer: directly from your bank or using funds already in your account.

- Specify the transfer amount, with fees displayed for your reference.

- Enter the recipient's details with careful verification to ensure accuracy.

- Upload the necessary documents, ensuring they cover all requested points.

- Review the transfer details carefully, as changes may be challenging after confirmation.

- Select your preferred payment method and provide relevant account details.

- Proceed to pay for your transfer, noting the bank details and reference number.

After making a payment, the funds may take up to two days to reach the platform, depending on your source currency and your bank's processing speed. You can track the progress of your transfer by visiting your account and clicking on the transfer details.

Choosing the Cryptocurrency

Selecting the right cryptocurrency is a pivotal decision that can significantly impact your investment journey. We'll explore the multifaceted aspects of choosing a cryptocurrency to purchase using your Single Euro Payments Area transfer.

Define Your Investment Goals

Before you dive into the world of cryptocurrencies, it's crucial to define your investment objectives clearly. Are you looking for a long-term investment, hoping for substantial capital appreciation over time? Or are you interested in short-term trading, capitalizing on price fluctuations within the market? Your investment goals will influence your choice of cryptocurrency. If you aim for long-term growth, you might lean towards established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), which have a track record of consistent performance and widespread adoption. On the other hand, if you're more interested in exploring newer projects with higher growth potential, you might consider altcoins or tokens associated with emerging blockchain technologies.

Research Available Options

The cryptocurrency market is incredibly diverse, with thousands of digital assets available for purchase. While Bitcoin remains the flagship cryptocurrency and a popular choice for investors, numerous other options deserve attention. Ethereum, often called the "world computer" due to its smart contract capabilities, has also gained prominence. Other cryptocurrencies like Litecoin (LTC), Ripple (XRP), and Cardano (ADA) each offer unique features and use cases. To make an informed decision, dedicate time to researching and understanding the cryptocurrencies you're interested in. Dive into whitepapers, explore project websites, and analyze community sentiment. Consider factors such as the technology behind the cryptocurrency, the team and developers involved, and the real-world problems it aims to solve.

Consider the Market Conditions

Cryptocurrency markets are known for their volatility. Prices can experience rapid fluctuations, making market timing crucial. Look closely at the current market conditions, including price trends, trading volumes, and overall market sentiment. Technical analysis, which involves studying price charts and patterns, and fundamental analysis, which assesses the underlying factors influencing a cryptocurrency's value, can aid in making informed decisions. Avoiding impulsive decisions based solely on short-term market fluctuations is essential. A well-thought-out investment strategy often combines technical and fundamental analysis backed by a clear understanding of your crypto trading goals.

Diversify Your Portfolio

Diversification is a risk management strategy that's equally relevant in the world of cryptocurrencies. Consider spreading your investment across several assets rather than putting all your funds into a single cryptocurrency. This approach can mitigate risk by balancing potential gains and losses. While Bitcoin is often considered a safe bet due to its historical performance and market dominance, diversifying your portfolio with a mix of established and promising altcoins can provide a more well-rounded investment strategy.

Stay Informed and Engage with the Community

The cryptocurrency landscape is ever-evolving. To make informed decisions and stay ahead of developments, actively follow reputable crypto news sources, engage with cryptocurrency communities, and participate in online forums and social media discussions. Staying informed about market trends, technological advancements, and potential regulatory changes will empower you to navigate the dynamic crypto market confidently. Choosing the right cryptocurrency is a pivotal step in your journey to buy digital assets using SEPA. By thoughtfully considering your investment goals, conducting thorough research, analyzing market conditions, diversifying your portfolio, ensuring wallet compatibility, and staying informed, you'll be well-prepared to make a cryptocurrency selection that aligns with your aspirations.

Monitoring and Managing Your Investment

Congratulations on your cryptocurrency investments! Monitoring and managing your holdings effectively is crucial as you continue your journey to maximize returns and mitigate risks. We'll explore essential aspects of overseeing your investment.

Tracking Cryptocurrency Values

Market Analysis: Regularly analyze the cryptocurrency market to stay informed about price movements, trends, and emerging opportunities. Utilize reputable cryptocurrency tracking websites, news sources, and market analysis tools to monitor your assets.

Portfolio Tracking: Consider using portfolio tracking applications or tools to monitor the performance of your cryptocurrency investments in real-time. These tools provide a consolidated view of your investments, including current values and historical performance.

Considerations for Selling or Long-Term Holding

Profit-Taking Strategy: Determine a profit-taking strategy that aligns with your financial goals. Decide at what price point or percentage gain you'll consider selling a portion of your holdings to realize profits.

Long-Term Holding: Assess which cryptocurrencies you intend to hold for the long term in your portfolio. Factors to include are the project's fundamentals, technology, team, and the potential for future growth.

Exit Strategy: Establish an exit strategy for your investments. Determine under what circumstances you would sell all or a significant portion of your holdings, such as in the event of a market downturn or achieving specific financial objectives.

Risk Management Strategies

Diversification: Continue to diversify your portfolio to spread risk across different assets. Avoid overconcentration in a single cryptocurrency to reduce vulnerability to price fluctuations.

Stop-Loss Orders: Implement stop-loss orders to limit potential losses. These automated orders trigger a sale if the cryptocurrency's price reaches a predetermined level, helping you manage downside risk.

Secure Storage: Ensure the security of your investments by using secure cryptocurrency wallets, especially for long-term holdings. Hardware wallets provide an extra layer of protection against online threats.

Stay Informed: Stay updated on regulatory changes and news that could impact your investments. Being well-informed allows you to make timely decisions in response to market developments.

Monitoring and managing your cryptocurrency investments is an ongoing process that requires diligence and adaptability. Regularly assess the performance of your portfolio, make informed decisions about buying or selling, and employ risk management strategies to safeguard your assets. Remember that the cryptocurrency market is dynamic, and staying educated and disciplined is vital to achieving your investment goals.

Navigating the Cryptocurrency Journey

As we conclude this comprehensive guide on buying cryptocurrencies with SEPA transfers and managing your cryptocurrency investments, reflecting on the knowledge and strategies you've gained throughout this journey is essential. Cryptocurrency investments represent a dynamic and evolving asset class with opportunities and challenges. This concluding chapter will provide a comprehensive overview of key takeaways and valuable insights for your continued cryptocurrency journey.

The Power of SEPA Transfers for Cryptocurrency Purchase

We began this guide by highlighting the significance of SEPA transfers in enabling individuals, including UK citizens, to enter the cryptocurrency market seamlessly. SEPA transfers offer a convenient and efficient means of funding your cryptocurrency investments, and the process can be straightforward when executed with careful planning.

Understanding the Impact of Brexit

We addressed the impact of Brexit on Single Euro Payments Area transfers. How to buy crypto in the UK? Despite the UK's withdrawal from the European Union, we clarified that SEPA transfers remain a viable option for UK citizens interested in purchasing cryptocurrencies. The key lies in selecting cryptocurrency exchanges and platforms supporting SEPA transfers post-Brexit.

Initiating and Managing SEPA Transfers

We guided you through initiating SEPA transfers, including setting up your account, checking your bank's limits, and ensuring compliance with document requirements. Tracking your transfer's progress and adhering to security measures was emphasized.

Advanced Strategies for Management

We explored advanced strategies for cryptocurrency management, from portfolio diversification to long-term asset management. You learned about the benefits of diversifying your cryptocurrency holdings, asset allocation, and the importance of staying informed about market trends. For those interested in actively trading cryptocurrencies, we discussed advanced trading strategies like day trading, swing trading, and arbitrage. Additionally, we emphasized the significance of risk management through tools such as stop-loss and take-profit orders. To maximize returns, we introduced concepts like staking, yield farming, leverage trading, and the importance of tax compliance. Staying aware of regulatory changes and adhering to local laws is crucial to avoid legal issues related to cryptocurrency investments. Maintaining psychological discipline in the face of market volatility is paramount. We encouraged you to avoid emotional trading decisions and focus on your investment goals. Continuous learning was highlighted as a fundamental aspect of success in the ever-evolving cryptocurrency space. We discussed the importance of tracking cryptocurrency values, considerations for selling or holding long-term, and risk management strategies. You learned about tools for portfolio tracking and establishing exit strategies for your investments.

Parting Words of Advice

As you continue your cryptocurrency journey, here are some parting words of advice:

Stay Informed: Cryptocurrency markets are fast-moving and subject to change. Stay informed about market developments, technological advancements, and regulatory changes.

Diversify Wisely: Diversification can help manage risk, but do so wisely. Conduct thorough research before adding new cryptocurrencies to your portfolio.

Risk Management: Implement risk management strategies to protect your investments. Use stop-loss orders, maintain secure storage, and follow sound security practices.

Long-Term Perspective: Approach your investments with a long-term perspective. Avoid making impulsive decisions based on short-term market fluctuations.

Continuous Learning: Commit to constant learning. The cryptocurrency space continually evolves, and staying up-to-date is crucial for success.

Legal Compliance: Be aware of and adhere to cryptocurrency regulations in your jurisdiction. Seek professional advice on tax compliance to avoid legal issues.

Your Cryptocurrency Journey Continues

Your journey in the world of cryptocurrencies has only just begun. The skills and knowledge you've acquired in this guide will serve as a solid foundation, but remember that the cryptocurrency market is dynamic and full of opportunities. Continue to explore, learn, and adapt to the ever-changing landscape of digital assets. Remember that not all platforms allow Single Euro Payments Area transfers from the UK. So, choose the exchange that supports this while still considering maximizing the security of assets and privacy. Our platform offers everything you need to buy crypto in the UK and all European countries supporting SEPA transfers. PlasBit will empower you with reliability and security: users' funds are stored in multiple cold wallets, protected by multi-signatures, and kept in secure locations. Thank you for embarking on this cryptocurrency journey with us. We wish you success and prosperity in your endeavors, and may your investments yield fruitful returns in the exciting world of cryptocurrencies.