This comprehensive guide will delve into Euro to BTC conversion, explaining how it works, why it's essential, and the tools available for seamless conversions. Traders and enthusiasts often wonder about the value of their holdings in traditional currencies, such as the Euro.

Why Convert Euro to BTC?

The decision to convert Euro to Bitcoin is multifaceted and influenced by various factors. Bitcoin, the pioneer of cryptocurrencies, has gained significant traction since its inception in 2009. This guide will explore the motivations behind converting the Euro to BTC, highlighting the key reasons and benefits.

Asset and Speculation

One of the primary reasons individuals and institutions opt to convert Euro to Bitcoin is the potential for asset and speculation. Bitcoin has witnessed remarkable price growth over the years, and many see it as a digital asset with the potential for substantial returns. Here's why:

Store of Value:

The comparison of Bitcoin to "digital gold" is rooted in its intrinsic properties, making it a compelling value store. With a supply of 21 million coins, Bitcoin's scarcity is a significant factor in its ability to retain and increase value over time. This scarcity, combined with its decentralized nature and global accessibility, positions Bitcoin as a unique asset for individuals and institutions seeking to hedge against inflation, economic instability, or traditional financial assets' volatility.

Price Appreciation:

Bitcoin's historical price appreciation has been a defining characteristic of its existence, capturing the attention of traders and investors alike. Over the years, Bitcoin's price has displayed remarkable growth, with notable bull markets fueling substantial increases in value. This price volatility creates opportunities for traders who seek to capitalize on market movements, buying when they anticipate bullish trends and selling for profit during periods of price surges. The potential for substantial returns has made Bitcoin an attractive asset for those actively participating in the cryptocurrency market, driving enthusiasm and trading activity while contributing to its reputation as a digital investment option with the potential for significant gains.

Diversification:

Converting the Euro to Bitcoin is a valuable tool for diversifying one's asset portfolio. Diversification is a fundamental principle of investment strategy that aims to spread risk across different asset classes, reducing the impact of a poor-performing asset on the overall portfolio. Investors can achieve a more balanced and resilient portfolio by incorporating Bitcoin, distinct from traditional assets like stocks, bonds, and real estate. This diversification safeguards against potential economic and market volatility, offering the opportunity to capitalize on the unique attributes of cryptocurrencies, such as their decentralization and limited supply, in the pursuit of long-term financial stability and growth.

Financial Inclusion and Access to Emerging Markets

Another motivation for Euro to BTC conversion is the potential to provide financial inclusion and access to emerging markets. Bitcoin's borderless nature and accessibility offer unique advantages:

Cross-Border Transactions:

Bitcoin's capacity to streamline cross-border transactions has revolutionized the world of global finance, providing a borderless and cost-effective alternative to traditional payment methods. By eliminating the need for intermediaries and reducing fees associated with currency conversion and international transfers, Bitcoin has become a go-to solution for remittances and international trade. This transformation has had a profound impact, enabling individuals to send money across borders more easily and efficiently, especially in regions where traditional banking infrastructure may be limited or expensive. For businesses engaged in international trade, Bitcoin offers the potential to reduce overhead costs, expedite transactions, and navigate the complexities of currency exchange, ultimately fostering a more interconnected and efficient global economy.

Access to the Unbanked:

In regions where conventional banking infrastructure is limited or inaccessible, Bitcoin is a critical gateway to financial inclusion, empowering individuals otherwise excluded from the formal financial system. With a smartphone and an internet connection, the unbanked and underbanked populations can access essential financial services, such as savings, remittances, and secure value storage. This accessibility breaks down the barriers imposed by traditional banking, opening up opportunities for people to participate in the global economy, save for the future, and engage in economic activities they were previously excluded from. Bitcoin's borderless and decentralized nature makes it a powerful tool for addressing financial inequalities and broadening access to financial services. It is a significant step toward a more inclusive and equitable financial landscape.

Cryptocurrency as a Universal Currency:

The concept of Bitcoin as a world reserve currency has captured the imagination of many, offering a vision of a non-sovereign unit of account that transcends national borders. This idea suggests that Bitcoin could serve as a universally accepted store of value and currency for exchange, free from the influence of any single government or central authority. If realized, such a global reserve currency could reduce dependency on national currencies and alleviate concerns related to currency devaluation, inflation, or geopolitical instability. With a cap of 21 million coins, Bitcoin's decentralization and finite supply contribute to its appeal as a neutral and borderless monetary system that might reshape the international financial landscape, fostering economic stability and trust among nations in an increasingly interconnected world.

Privacy and Security

Privacy-conscious individuals often convert the Euro to Bitcoin due to the enhanced privacy and security features offered by cryptocurrencies:

Pseudonymity:

The pseudonymity of Bitcoin transactions is a hallmark feature, offering a degree of privacy and anonymity unparalleled in traditional financial transactions. Unlike traditional banking systems, where personal identification is often a prerequisite for transactions, Bitcoin transactions are stored on a ledger known as the blockchain, with addresses that do not directly link to an individual's identity. While this privacy feature benefits individuals who value financial discretion, it's essential to note that Bitcoin's pseudonymity is not synonymous with complete anonymity. In cases where individuals fail to take additional privacy measures, such as using mixing services or practicing proper security, their transaction history may be linked to their real-world identity. Nevertheless, Bitcoin's inherent privacy attributes provide financial confidentiality that is not easily achievable in traditional finance. It is an important tool for individuals seeking control over their financial information and transactions.

Security and Ownership:

The security and ownership attributes of Bitcoin are central to its appeal as a digital asset. Bitcoin holders have full control over their funds, as they possess the private keys that enable access to their cryptocurrency holdings. This ownership structure reduces the risk of fraud or identity theft, as individuals are not reliant on third parties to manage their assets. Moreover, properly secured Bitcoin holdings can be highly resilient to hacking attempts. They store Bitcoin in a secure wallet, whether a hardware wallet, a paper, or a well-protected digital wallet, which provides a robust defense against unauthorized access. This self-custody feature of Bitcoin empowers users to maintain control over their financial resources. It reinforces its reputation as a secure and trustworthy store of value in the digital age.

Censorship Resistance:

The censorship resistance of Bitcoin is a critical attribute that sets it apart from traditional financial systems. Bitcoin's decentralized nature, built on a distributed ledger, ensures that governments or institutions cannot easily freeze or confiscate assets. This quality provides a vital safety net for individuals in regions affected by political or economic instability, where traditional financial systems might be subject to government control or interference. Bitcoin's borderless accessibility allows individuals to securely move their wealth across borders, avoiding potential asset seizures and restrictions on their financial freedom. This feature has garnered significant attention from those seeking to protect their wealth and financial sovereignty, particularly in volatile political climates, making Bitcoin a valuable tool for safeguarding assets and preserving financial autonomy.

Technological Advancement and Innovation

For tech enthusiasts, converting the Euro to Bitcoin can be a way to participate in the ongoing evolution of financial technology:

Blockchain Technology:

Bitcoin's underlying technology, the blockchain, is a decentralized and immutable ledger with far-reaching implications beyond its use as a cryptocurrency. The blockchain's core innovation lies in its ability to provide a secure, transparent, and tamper-resistant record of transactions. This technology's versatility has spurred interest across various industries, with applications extending to supply chain management, healthcare, and more. In supply chain management, blockchain can enhance transparency and traceability, reducing fraud and counterfeit products. In healthcare, it can improve patient data security and streamline record-keeping. These applications showcase the potential for blockchain to revolutionize data management and accountability across diverse sectors, creating more efficient and reliable systems while reducing the risk of fraud and errors.

Smart Contracts:

The advent of Ethereum, a prominent cryptocurrency and blockchain platform, has introduced the concept of smart contracts to decentralized technologies. Smart contracts are self-executing agreements with programmable capabilities that can automate and enforce contractual terms without intermediaries. These digital contracts offer immense potential, extending beyond the financial realm to applications in law, supply chain management, insurance, and more. For instance, in the legal sector, smart contracts can facilitate the automatic execution of legal agreements, simplifying advanced processes and reducing the need for costly legal intermediaries. They can automate lending and borrowing processes in finance, offering secure, efficient, and trustless solutions. The versatility of smart contracts has generated interest across various industries, underscoring their capacity to enhance efficiency and transparency while reducing reliance on traditional intermediaries.

What Can You Buy With Bitcoin?

Bitcoin's evolution from a speculative asset to a legitimate means of making purchases and transactions has been significant. The versatility of Bitcoin as a digital currency allows individuals to use it in various ways, reflecting the growing acceptance of cryptocurrency in different sectors.

Online and Offline Retailers:

Many online and offline businesses now accept Bitcoin as a payment method. You can buy various products and services, from electronics and clothing to food and travel. For instance, companies like Overstock, Newegg, and even certain Starbucks locations allow you to buy their products using Bitcoin.

Travel and Accommodation:

Travel agencies, airlines, and hotels recognize Bitcoin as a payment form. This allows travelers to book flights, reserve hotel rooms, and plan their vacations using Bitcoin. Websites like Expedia and CheapAir have integrated Bitcoin payments.

Donations:

Many non-profit organizations and charities accept Bitcoin donations. This offers a transparent and secure way for individuals to support the causes they believe in. The BitGive Foundation and the Electronic Frontier Foundation are examples of organizations that welcome Bitcoin donations.

Venture:

Some individuals choose to spend their Bitcoin holdings in various ways. They can trade in other cryptocurrencies through cryptocurrency exchanges, participate in Initial Coin Offerings, or engage in decentralized finance (DeFi) platforms to earn interest on their Bitcoin holdings.

Gaming and Gambling:

The gaming industry, including online casinos and platforms, often accepts Bitcoin for in-game purchases and betting. This provides an additional option for gamers to enjoy their favorite games using cryptocurrency.

Gift Cards:

Various platforms allow users to purchase gift cards with Bitcoin. These gift cards can be used at popular retailers and restaurants, providing flexibility in spending Bitcoin.

Remittances:

Bitcoin can also be used for cross-border remittances, allowing individuals to send funds to family or friends in different countries with reduced fees compared to traditional remittance services.

Art and Collectibles:

Some art galleries and platforms sell art and collectibles in exchange for Bitcoin. This can be an exciting avenue for art enthusiasts and collectors.

Education and Online Courses:

Many online educational platforms and course providers accept Bitcoin for payment. This can be a convenient way for individuals to access valuable educational content.

How to Buy BTC with a Debit Card?

The process is simple and efficient if looking to buy BTC with a debit card on our exchange. Here's a step-by-step guide:

How to Buy Bitcoin with a Debit Card?

Start buying Bitcoin using our crypto debit card through our platform by following these straightforward steps.

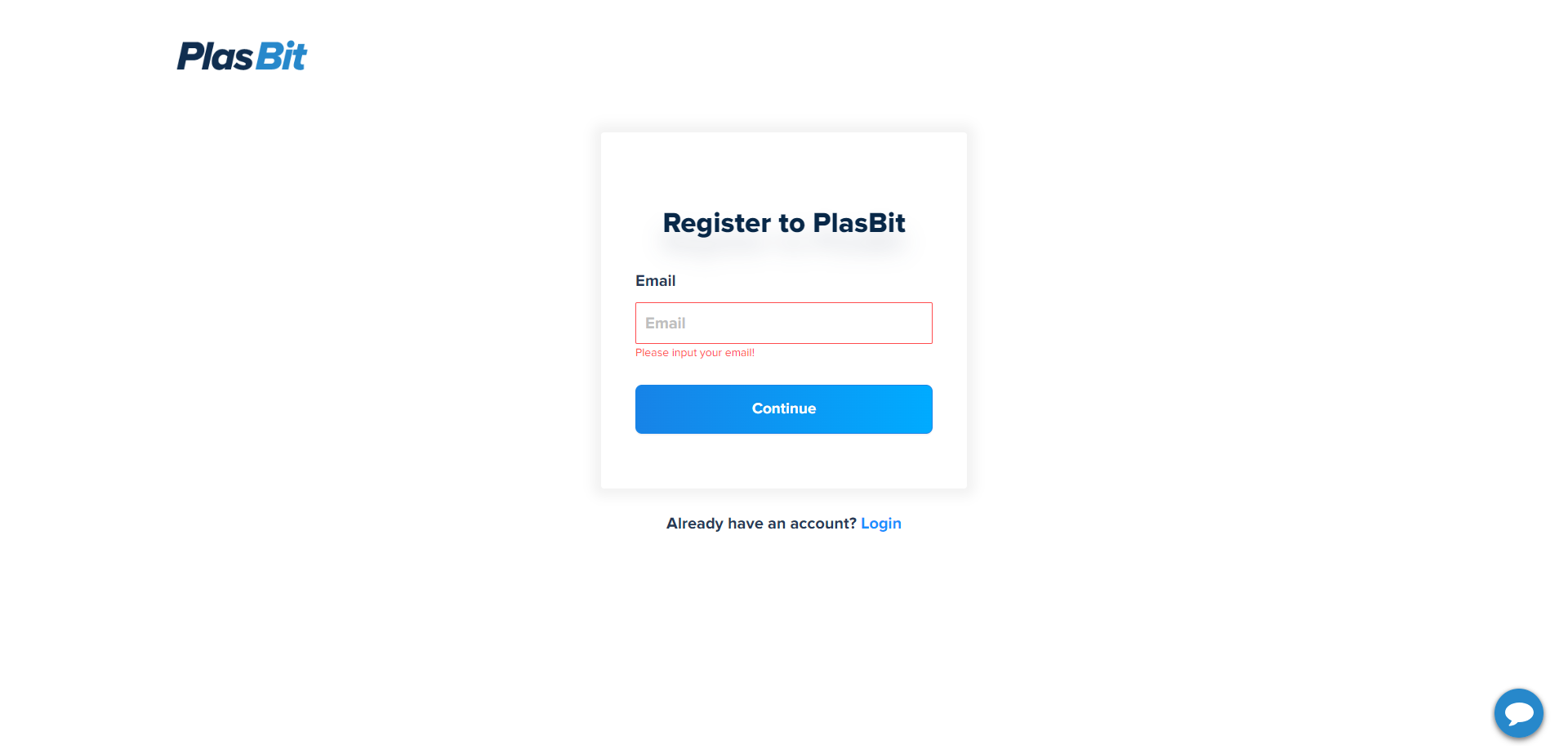

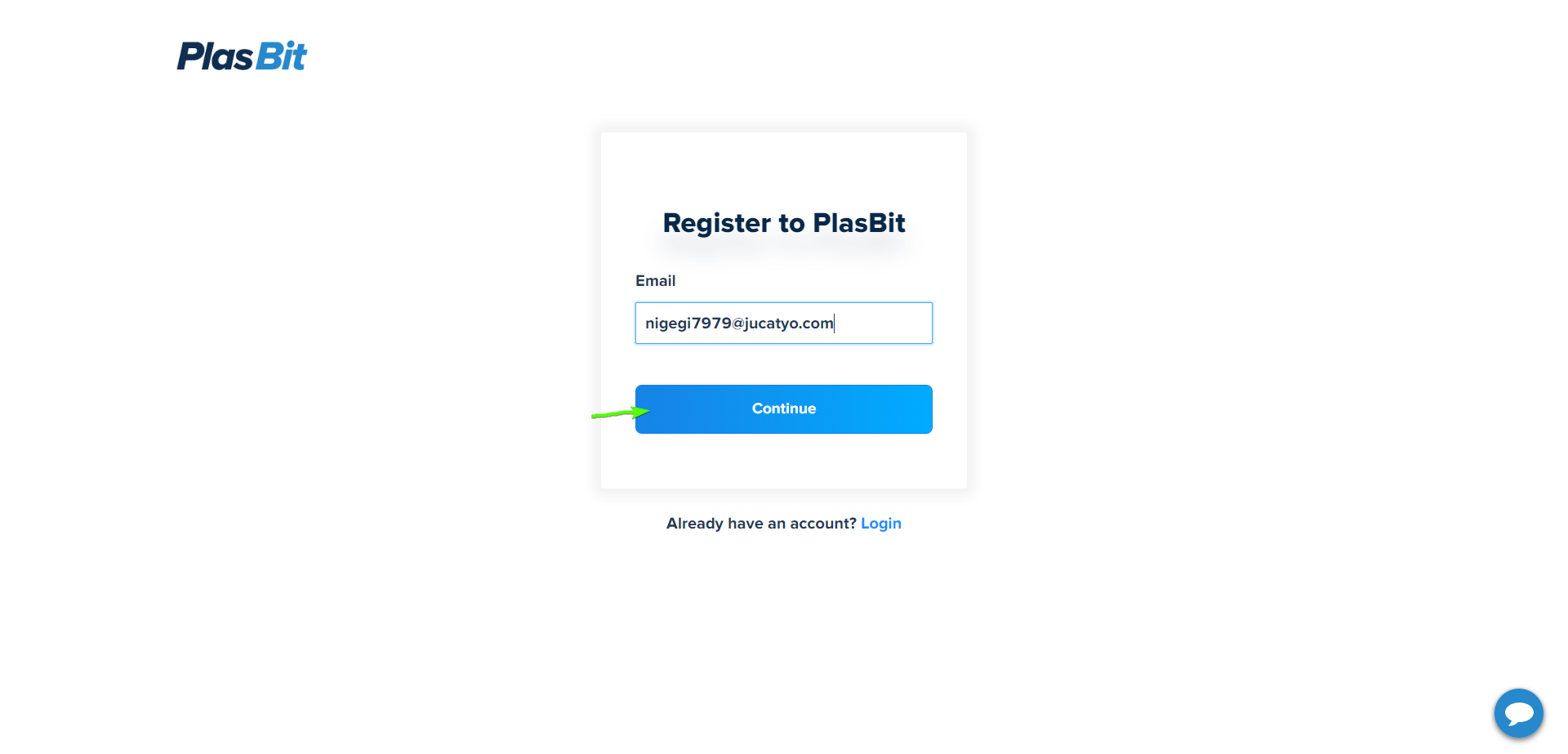

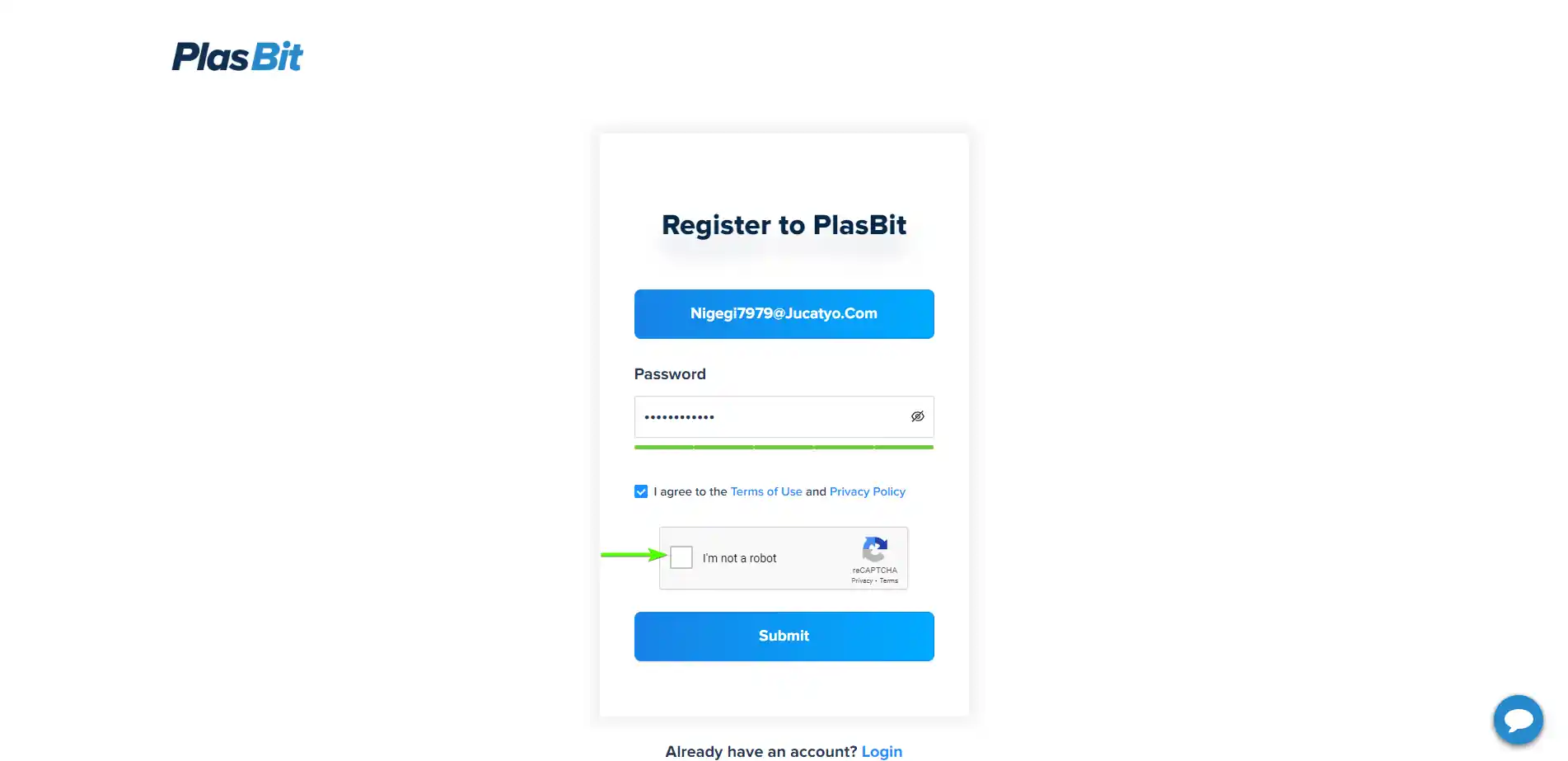

Register Your PlasBit Account

1. In the top right of your browser, click the 'Get Started' button to initiate the registration process.

2. Provide your preferred email address for account registration.

3. Select "Continue."

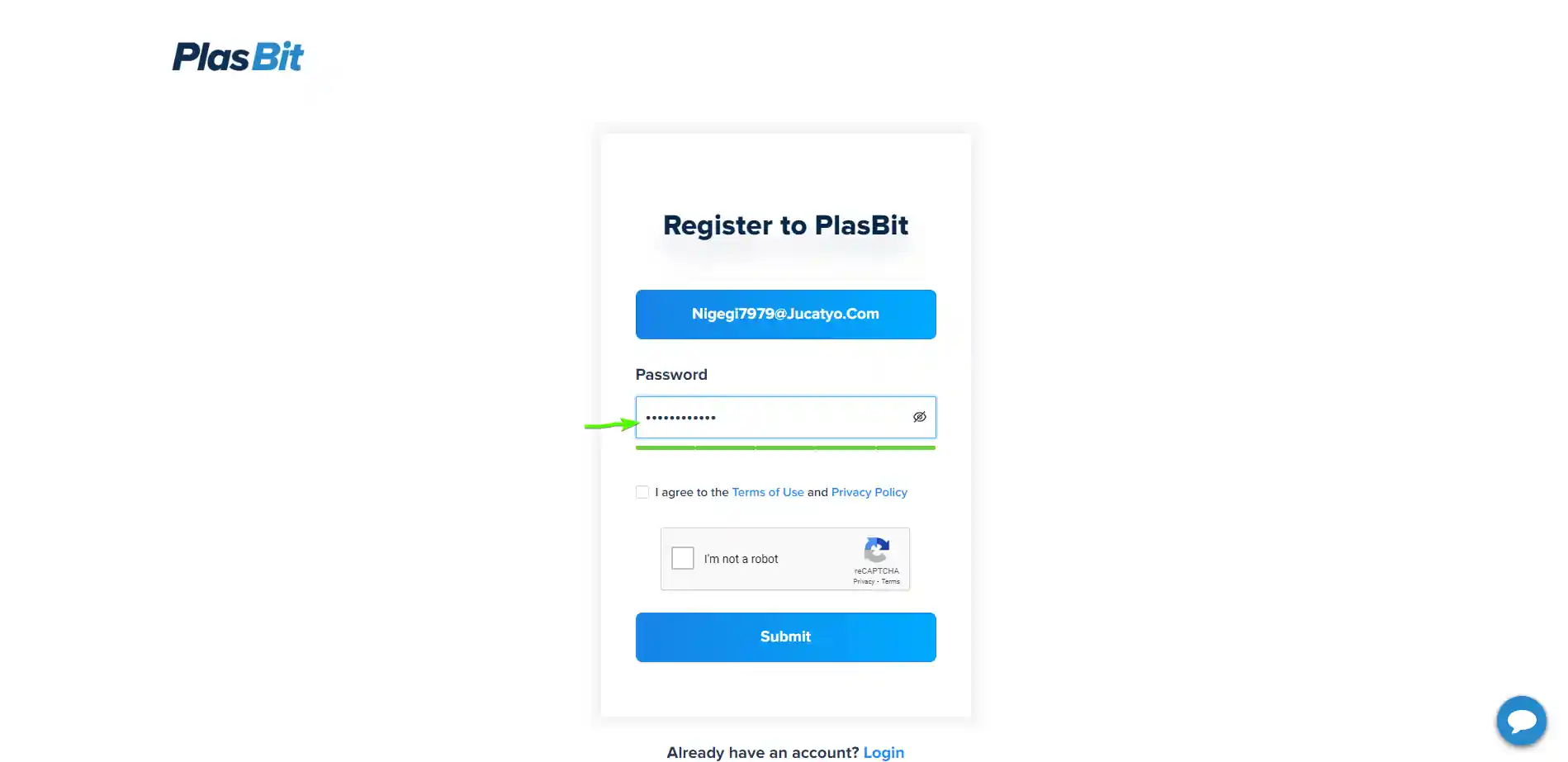

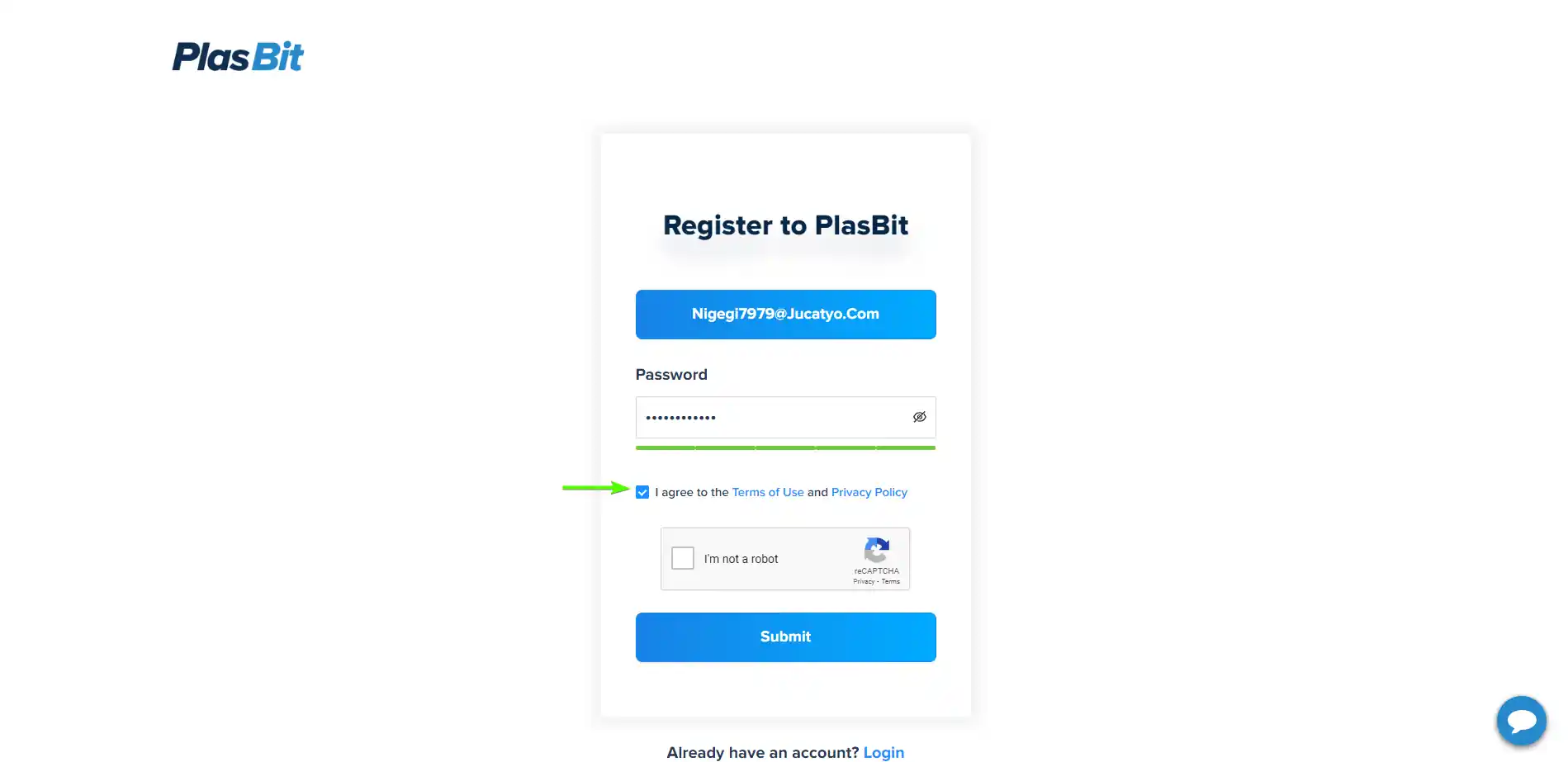

4. Create a strong and secure password for your account.

5. Accept the "Terms of Use and Privacy Policy."

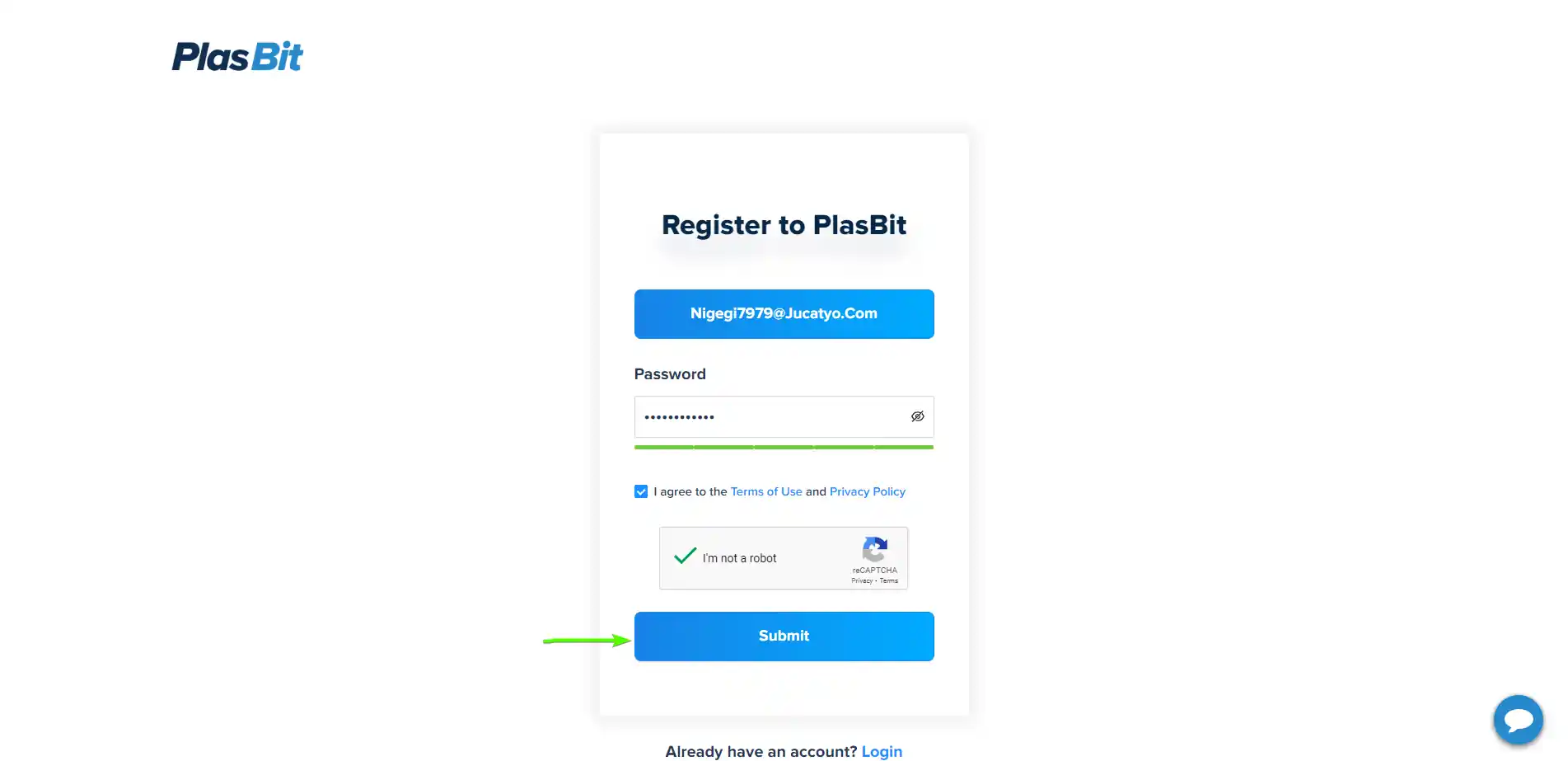

6. Verify that you're not a robot by completing the captcha verification.

7. Select "Submit."

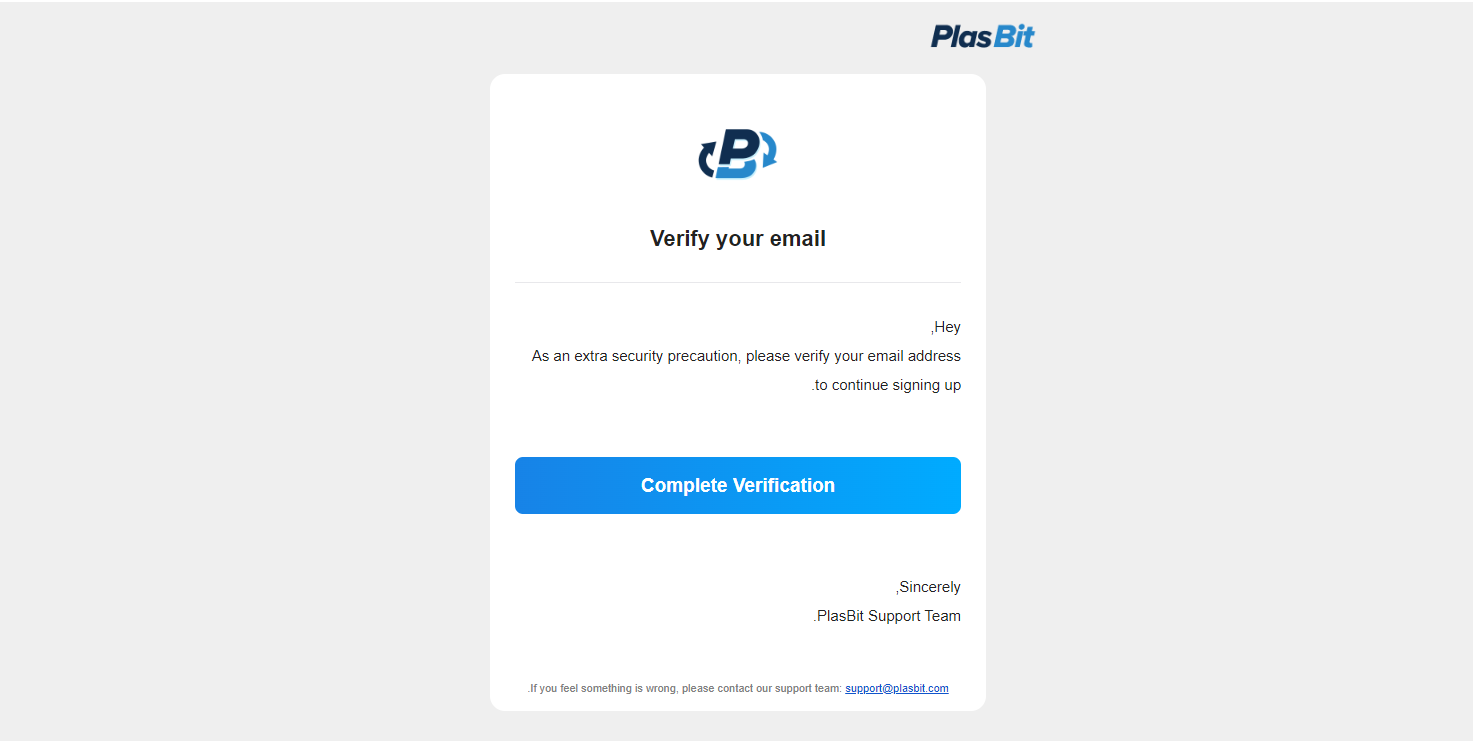

Verify Your Email

- After registration, check your email for a message from our platform.

- Open the email and choose the verification link to confirm your registration.

- You will be redirected to your "Dashboard."

Depositing Fiat Currency:

- Head to the "Deposit" section within your dashboard.

- Specify the amount of fiat currency you want to deposit.

- Select your preferred payment process; in this case, choose "Bank Card" and select either Visa or Mastercard.

Note the Fees and Completion Time:

It's important to know the fees associated with using a debit card, and note the estimated completion time for your deposit.

Initiate the Deposit:

Click the "Deposit" button to initiate the deposit process.

Verification Process:

- We prioritize security and require card verification for deposits.

- Upon using your card for the first time, you will acquire an email with directions for card verification.

- Complete the verification process within the allotted time. This typically involves providing photos of your card, and photo ID and following the instructions.

- Once your card is verified, future deposits using the same card will not require this process.

What Happens If You Don't Complete Verification:

- Please complete verification within the specified time frame to avoid the cancellation of your card deposit.

- Any pre-authorized funds on your card will be released by your bank within specified business days. If you have questions, contact your bank for further information. With your account now funded, you can purchase Bitcoin on our exchange. Navigate the platform, choose Bitcoin (BTC) as your desired crypto, specify the amount you wish to purchase, and follow the prompts to finish your acquisition. Be mindful of any transaction fees associated with buying Bitcoin using your debit card.

What is the All-Time High Euro for Bitcoin?

The all-time high (ATH) price of 1 Bitcoin in Euros is a crucial metric for cryptocurrency enthusiasts and traders. The ATH for 1 BTC in EUR was recorded at an impressive €59,716.82 on November 10, 2021. This milestone marked a significant moment in the history of Bitcoin and highlighted the growing recognition and adoption of the cryptocurrency. The journey to this ATH was characterized by remarkable price volatility and several significant market cycles. Bitcoin's early days saw it trading for mere cents, and it gradually gained attention as a decentralized digital currency and store of value. It experienced notable price increases during the 2013 and 2017 bull markets before reaching the record-breaking ATH in 2021. This surge includes institutional interest, growing acceptance among mainstream businesses, and increased awareness of Bitcoin's potential as a hedge against economic instability. It remains to be seen whether the value of 1 BTC in EUR will exceed the recorded ATH. The cryptocurrency market is known for its fluctuations, and various factors, including macroeconomic conditions, regulatory developments, and market sentiment, can influence Bitcoin's price. Staying informed about these factors is crucial for anyone involved in cryptocurrency, as it can help them make informed decisions about their assets and trading strategies.

Is Crypto Regulated?

Yes, cryptocurrency regulation in the European Union has undergone a significant transformation with the approval of the Markets in Crypto-Assets Regulation (MiCA) in June 2023. This landmark development places the EU at the forefront of cryptocurrency regulation worldwide. MiCA represents a comprehensive framework that provides legal certainty and consumer protection in the rapidly evolving world of digital assets. MiCA covers many regulatory aspects, including Know Your Customer (KYC) procedures, anti-money laundering (AML) requirements, and licensing for cryptocurrency service providers. These regulations are vital to safeguard the interests of both consumers and the broader financial market. By imposing stricter rules and standards on cryptocurrency businesses and service providers, it aims to mitigate the risks associated with money laundering, fraud, and other illicit activities in the crypto space. This level of regulation also provides greater transparency and accountability within the industry, fostering a more secure environment for cryptocurrency traders and users. Individuals and businesses involved in cryptocurrency activities within the EU must stay informed about and comply with regulations. This includes using cryptocurrency exchanges and services compliant with the new rules. The EU's proactive approach to cryptocurrency regulation demonstrates a commitment to ensuring the integrity and stability of the market while fostering innovation in the digital asset space. It will be interesting to observe how these regulations continue to shape the landscape of cryptocurrency in the European Union and set a precedent for regulatory frameworks worldwide.

What is the Markets in Crypto Assets Regulation?

The Markets in Crypto-Assets Regulation (MiCA) represents a groundbreaking regulatory framework the European Union (EU) implemented to establish consistent and comprehensive crypto-assets market rules. Introduced in June 2023, MiCA addresses a critical need for regulatory clarity in the fast-evolving world of digital assets. The framework primarily focuses on crypto-assets that fall outside the scope of existing financial legislation, aiming to create a level playing field for businesses and consumers in the crypto space. One of the central objectives of MiCA is to ensure transparency and market integrity in the issuance and trading of crypto-assets. It imposes stringent requirements on those issuing and trading crypto-assets, including asset-reference and e-money tokens. These requirements include disclosure, authorization, and supervision of transactions. By setting clear rules and standards for crypto-asset offerings, MiCA seeks to mitigate potential risks associated with market manipulation, fraud, and illicit activities, ultimately enhancing financial stability.

Moreover, MiCA strongly emphasizes consumer protection by ensuring individuals can access accurate and comprehensive information about crypto-asset risks. This fosters informed decision-making among traders and aligns with the EU's commitment to safeguarding consumer interests. MiCA represents a huge step forward in the EU's approach to cryptocurrency regulation, providing a robust and harmonized framework that supports the growth of the crypto market while maintaining the security and trustworthiness of financial transactions in the digital asset space.

How to Convert ETH to BTC?

Converting Ethereum to Bitcoin is a straightforward process within the cryptocurrency ecosystem, but executing it with care and attention to various factors is essential. This guide will walk you through converting ETH to BTC, highlighting key considerations to ensure a seamless transaction.

Create a PlasBit Account:

Here's how to create an account on our crypto exchange:

Select the "Get Started" Button:

Locate and click the "Get Started" button to initiate the registration process.

Register:

You will then be prompted to provide the following information:

- Your preferred email address for registration.

- Click "Continue" to proceed.

- Create a safe and unique password for your account.

- Agree to the "Terms of Use and Privacy Policy" to acknowledge and accept the platform's terms.

- To confirm that you are not a robot, check the captcha box.

- Finally, click "Submit" to complete your registration.

Email Verification:

- After successfully registering, check your email inbox for a message from our platform.

- Open the email and look for a verification link. Select this link to verify your account.

- Once you press the verification link, you will be redirected to your "Dashboard." You are now registered and can use your account for cryptocurrency-related activities, including trading, deposits, and more. Please keep your login credentials secure and follow any additional security measures recommended to protect your account.

Deposit Ethereum (ETH):

Once your exchange account is set up, you must deposit Ethereum into your wallet. This involves navigating the deposit section, selecting Ethereum as the asset, and generating a deposit address. Transfer your ETH from your wallet to this address, ensuring accuracy to avoid any loss of funds.

Place a Trade Order:

After your ETH deposit is confirmed, you can proceed to the trading section of the exchange. Here, you'll place an order to exchange your ETH for BTC. There are two classifications of orders: market and limit orders. A market order executes instantly at the current price, while a limit order enables users to specify the price at which they'd like the trade to occur. Review the exchange's trading interface for these options, set your preferences, and confirm the transaction.

Securely Store Your Bitcoin:

Once the trade is executed, you'll have Bitcoin in your exchange wallet. However, it's essential to understand that exchange wallets are only some of the most secure places for long-term storage. To safeguard your newly acquired BTC, transferring it to a personal cryptocurrency wallet is recommended. Hardware wallets provide an additional security for your assets. Always back up your wallet's recovery seed phrase and follow best practices for wallet security.

Monitor the Market:

The crypto market is highly volatile, so monitoring market conditions and exchange rates is advisable. You can use various financial news sources and cryptocurrency tracking websites to stay informed. This information can help you decide when to execute your conversion and ensure you get the best value for your assets.

Consider Fees:

Pay close attention to the fees associated with the conversion. We offer competitive fees for trading and withdrawal, which can vary significantly. Understanding these fees is crucial for calculating the actual cost of the conversion and maximizing the value you receive.

Calculating Euro to Bitcoin Conversion

Calculating Euro to Bitcoin conversion is a fundamental skill for anyone dealing with cryptocurrencies. Whether you're a user, trader, or simply interested in understanding the value of your Euros in Bitcoin, this process can provide valuable insights into the dynamic cryptocurrency market. To perform this calculation accurately, you can utilize a simple formula and consider several essential factors. Or you can use our PlasBit crypto calculator, which enables you to select the cryptocurrency and the fiat currency you'd like to convert prices. We've created this user-friendly tool to empower users, whether you're a seasoned trader or just getting started, so you can easily keep track of cryptocurrency prices in a way most relevant to your financial goals.

The Formula:

The formula for calculating the amount of Bitcoin you'll receive for a specific amount of Euros is straightforward:

BTC Amount = Euro Amount / Bitcoin Price

Here's how it works:

Euro Amount:

This is the number of Euros you want to convert into Bitcoin. It's the starting point for your calculation and can be any amount you wish to convert.

Bitcoin Price:

The Bitcoin price is the rate at which 1 Bitcoin is valued in Euros. This price is not constant; it fluctuates continually due to market dynamics, including supply and demand, trading activity, news events, and consumer sentiment. You can obtain the Bitcoin price from various cryptocurrency market data providers, such as financial news websites, cryptocurrency exchanges, or dedicated cryptocurrency price tracking platforms. Using a reliable source for this information is crucial to ensure accuracy.

Conclusion

Navigating the cryptocurrency world, especially in the European Union, requires knowledge of regulations and market dynamics. Understanding Bitcoin's ATH in Euros, the EU's crypto regulations, and MiCA is crucial as a trader or enthusiast. Additionally, knowing what you can buy with Bitcoin, how to buy BTC with a debit card, and how to convert ETH to BTC will enhance your cryptocurrency journey.