Snapchat Ads is a fast-moving platform with a vibrant, mobile-first audience where marketers must leverage agile tools in every part of their campaigns to succeed, including payments. Traditional options like PayPal and bank transfers fall short, making it harder to track spending on multiple campaigns and delegate accounts to team members. Virtual cards don’t come with any of these setbacks, letting advertisers fully capitalize on Snapchat’s ad potential.

But does Snapchat Ads accept virtual cards? Yes, just deposit crypto into your wallet, choose the preferred currency to pay for your card, fund it with the crypto of your choice, and add it as your new Snapchat payment method. You can generate as many cards as needed, assigning one to each client or team member for worry-free expense tracking. And if a card is running low, you’ll be notified immediately so you can reload it in minutes to keep all your campaigns running smoothly.

Why Virtual Cards Are Hailed as a Lifehack for Snapchat Ads?

This guide covers everything from Snapchat case studies and advertiser best practices to practical step-by-step instructions for implementing the virtual cards method. Before we get to all that thought, it’s important to understand why virtual cards are so in-demand by marketers who use Snapchat Ads.

Traditional payment methods simply aren’t built for the fast-paced world of digital advertising. If you’re an affiliate marketer or agency running multiple Snapchat ad campaigns, keeping payments organized is just as crucial as optimizing creatives and targeting. Relying on old-school payment methods often means setting yourself up for a long list of headaches. Here are some of the most common ones:

1. Traditional Cards Take Forever to Issue

Need a dedicated card for a new campaign? Good luck with getting that from your bank in time for launch. It usually takes 7-10 business days to issue a new debit card, which translates to lost time if you're scaling or testing new ad sets.

The Solution: Once you’re working with a verified account, virtual cards can be generated almost instantly, allowing you to create new campaigns on the fly.

2. Foreign Transaction Fees Drain Your Profits

Mixing traditional payments and international ad campaigns is a recipe for allowing banks to nibble away at your profits with foreign transaction fees and laughable exchange rates.

The Solution: Virtual cards allow you to transact in multiple currencies and even fund accounts with crypto at times, allowing you to have more control over costs and avoiding unnecessary fees.

3. Banks Limit How Many Cards You Can Open

Operating multiple Snapchat ad accounts? Most banks restrict how many cards you can open, making you combine multiple clients or campaigns under one payment method. That's a bookkeeping nightmare in the making.

The Solution: With virtual cards, you can issue as many as you need, keeping any potential payment-related issues from impacting multiple accounts.

4. Risk of Spending Limits Undermining Your Campaign

For affiliate marketers, nothing packs quite the same gut punch as seeing a campaign take off and then hit a credit/debit card spending limit, closing down your ads during a hot streak.

The Solution: Virtual cards tend to have higher or adjustable limits, so you can scale without having to wonder if your payment method can keep up.

5. Delegating Any Single Campaign Requires Sharing Access to All Funds

If your team uses a single debit card, it's a logistical nightmare to keep track of who spent what on which campaign. Worse, accidental overspending or unauthorized transactions can too easily occur.

The Solution: Virtual cards enable you to issue unique cards to individual team members, providing each with controlled access to only the campaigns they oversee.

6. Bank Have Fraud Triggers That Can Freeze Payments & Require Manual Approvals

Running high ad spend across multiple campaigns can trigger fraud detection systems at banks, leading to annoying security holds or declined transactions. Snapchat and other ad platforms sometimes flag payments from the same card used across multiple ad accounts, leading to account restrictions.

The Solution: Virtual cards enable the compartmentalization of ad spend, making it less risky for a platform-wide freeze in case one account encounters problems.

How Simple Payment Oversights Can Ruin Entire Campaigns

Picture this: you’re a marketing agency handling Snapchat ad campaigns for multiple clients. A rising-star SaaS startup signs with you for a three-month campaign. They provide their Snapchat Ads credentials, and you get to work optimizing creatives, testing different targeting options, and refining ad copy to maximize conversions.

As usual, you spend the first few days analyzing data and staying up late to make last-minute adjustments. Around day five you hit the right configuration with a particular ad variation so, naturally, you rush to scale it up. Another few days later, the campaign is driving signups at below the target cost per acquisition, and your client is so impressed he’s floating the idea of a long-term contract.

But the next day you login to see the dreaded payment failure notice.

Snapchat suspends all running campaigns tied to your company credit card. Has your card hit its limit or did the Snapchat transactions trigger an automated fraud lock? It doesn’t matter – either way, all of you active campaigns are now shut down, including the one you just spent a week optimizing to perfection.

Soon enough, the dreaded call comes in from the client. Their momentum is gone, and their praise turns to frustration. Worried they put their trust in the wrong marketers, they demand an accounting of how much of their funds have been spent before the card lock.

This is where the real panic sets in. You open your credit card statement, only to find a chaotic mess of transactions. You know the client is getting more frustrated with each minute they wait on hold, but you have no way to quickly determine how much Snapchat billed for their specific campaign. You ask for some time to get your records straight, but all the client hears is that you don’t even know how much your mistake cost them. And if you know anything about client retention, you know that at this point the client already has a foot out the door.

How Virtual Cards Fix This Mess Before It Even Happens

Now, imagine an alternate timeline where you stopped to think does Snapchat Ads accept virtual cards.

Instead of lumping multiple ad campaigns under a single company credit card, you generate a dedicated virtual card specifically for the SaaS company’s campaign. Their full prepaid budget is loaded onto the card, meaning every transaction is cleanly separated from other clients’ campaigns.

If the balance starts running low, you get an instant alert, giving you time to either top up the funds or notify the client before their ads get paused. And if the client turns out to be a paranoid micromanager who calls with concerns anyway, you can pull up their dedicated card’s transaction history in seconds and provide a precise breakdown in real time.

Why Finding a Reliable Virtual Card Provider Is Harder Than You Think

With all the rumors swirling around regarding the state of today’s virtual card market, we decided to investigate for ourselves. After weeks of researching and testing various providers, we were shocked to discover how common underperforming products and outright scams really are. Here’s what we found and why you should be cautious before choosing a card issuer.

Onboarding Almost As Dragged Out As Banks

One of the biggest pain points with virtual card providers is the onboarding process. You’d expect a web-centric service provider to have a smooth and straightforward sign-up process. But in reality, the market is rampant with confusing interfaces, unreasonable wait times, and unclear pricing schemes. Worse, some companies lure you in by letting you purchase a card first, only to spring an unexpected KYC (Know Your Customer) process on you after they’ve taken your money.

You’ll never find any of that on PlasBit. In fact, we won’t let you pay anything for your card before your KYC confirmation is complete. Even beyond onboarding, we’re upfront about every step of the process because we know handing over your private information isn’t something you do lightly, and that trust goes both ways.

Customer “Support” (In Name Only)

When a campaign goes down on a fast-paced platform like Snapchat, you need answers fast. Unfortunately, most virtual card providers force customers into support ticket systems, which usually means a wait time of around five business days. To make things worse, the customer support is usually outsourced to giant overseas call centers, where agents “work hard” to avoid dealing with difficult issues.

Here at PlasBit, customer support is a core part of our service. If you ever encounter an issue with your card, you won’t be left waiting for days and you’ll get real help from a real human, instead of the usual AI chatbot run-around.

Hidden Fees That Drain Your Balance

A common borderline-scam in the virtual card industry is the lack of fee transparency. Many providers advertise low upfront costs but bury outrageous fees in the fine print so that by the time you actually use your card, you’ve spent nearly double what you loaded onto it. Even worse, these hidden fees are often only revealed after you’ve already paid.

After hearing stories of people who’ve had to deal with sketchy issuers, we made sure PlasBit has a strict policy of what you see is what you pay. While our fees may seem high to some, we offer a niche, hard-to-find product, and our pricing is 100% transparent.

Cards That Don’t Even Work

Perhaps the most shocking discovery from our research was that many virtual cards are outright rejected by major merchants despite being advertised as universally accepted. Worse, some issuers falsely claimed that their cards were compatible with Apple Pay or Google Pay, only to reveal that it’s an “upcoming” feature after the purchase has already been finalized.

At PlasBit, we stand by our product. We provide clear information on where and how our cards can be used so you’ll never be left guessing.

How to Purchase and Load a PlasBit Virtual Debit Card

Now that you’ve got a solid grasp on how does Snapchat Ads accept virtual cards, the next logical step is to go over how to buy a compatible virtual card.

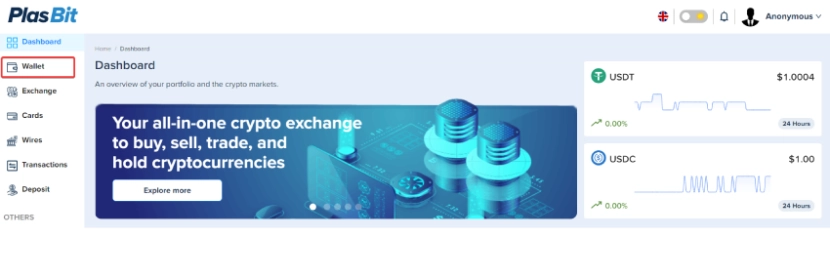

Step 1 – Log Into Your PlasBit Dashboard

Begin by heading to PlasBit.com and logging in. Once inside your account, look for the Wallet section.

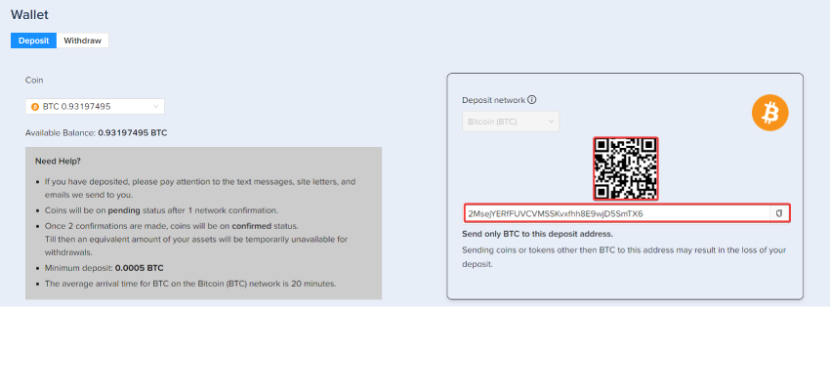

Step 2 – Deposit The Desired Cryptocurrency

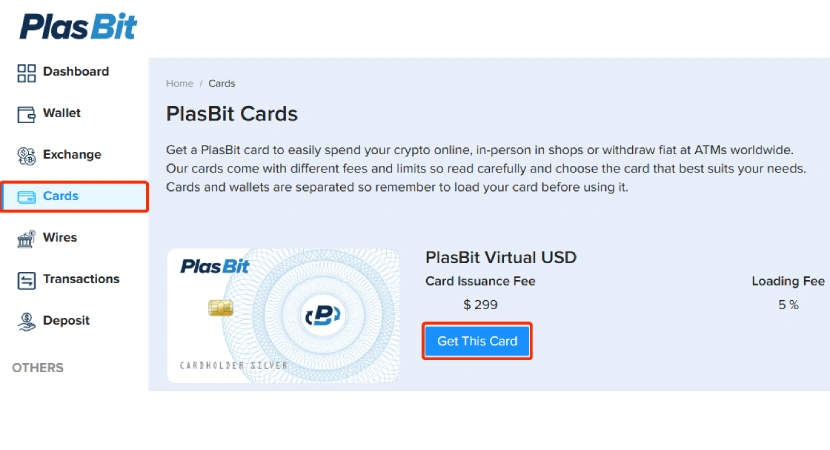

Step 3 – Choose Your Virtual Card Currency

Once your transaction is fully confirmed, find the Cards section. Here, you get to choose a USD or a EUR virtual card. Once you’ve decided on a currency, give the "Get This Card" button a click.

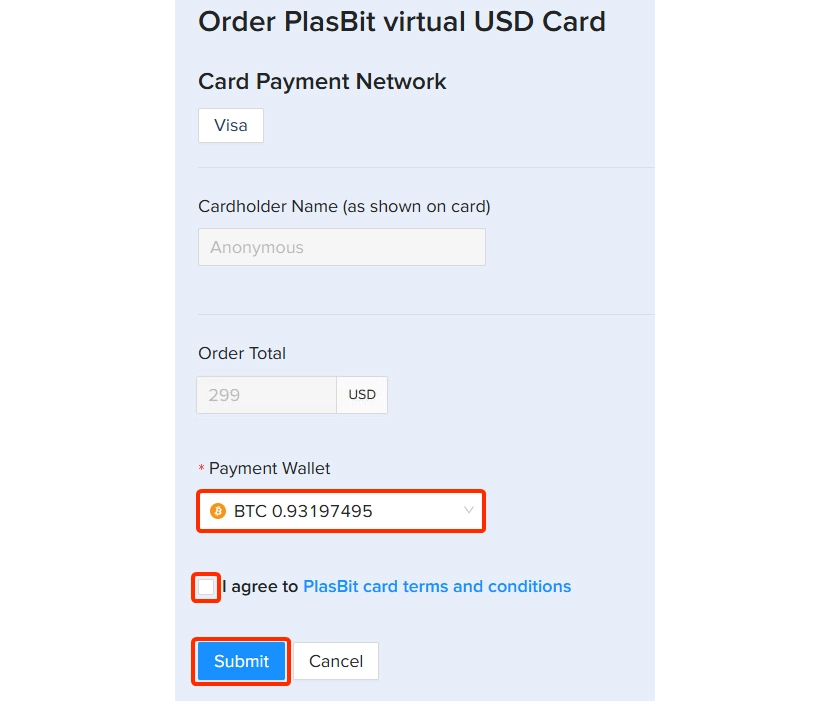

Step 4 – Choose a Payment Wallet

Make sure the correct wallet is selected for the virtual card issuance.

Step 5 – Wait for Confirmation

Once you've made your purchase, your request will be processed by PlasBit. You'll get an email confirmation as soon as your virtual card has been issued successfully.

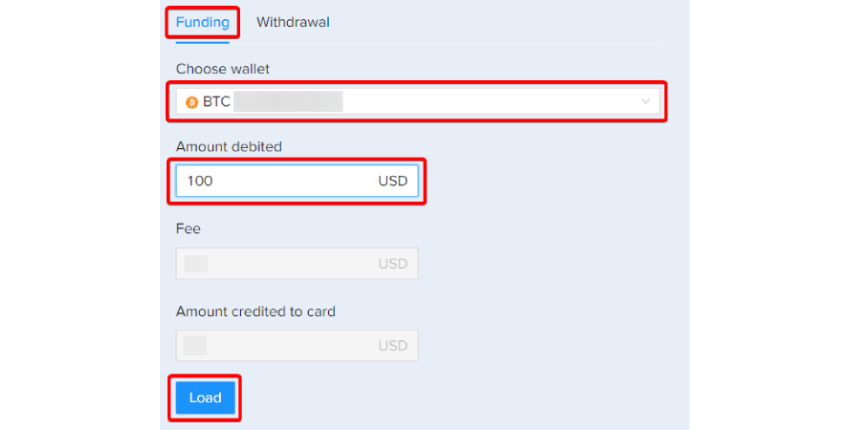

Step 6 – Load Funds Onto Your Card

Go back to the Cards section and click on "Open Details." Under the Funding tab, choose the wallet from which you'd like to load funds onto your virtual card. Once you indicate the amount, go ahead and hit "Load," followed by "Submit."

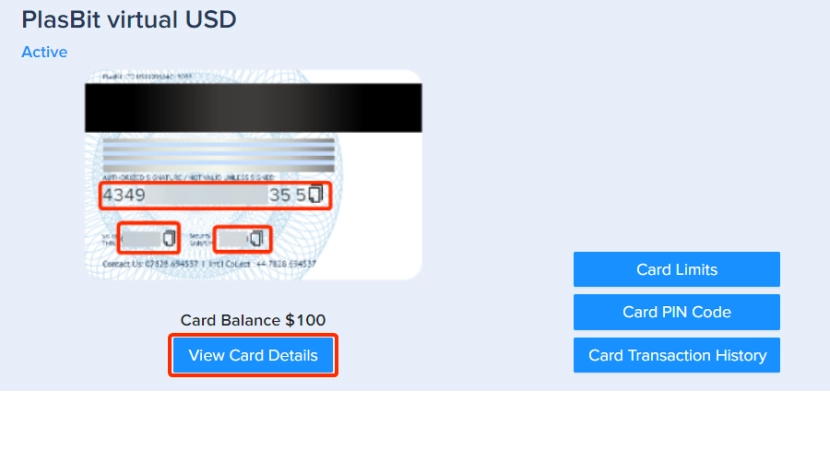

Step 7 – Access Your PlasBit Virtual Card Details

After loading your card, you can see your card number, expiry date, and CVV by clicking on "View Card Details." Your virtual debit card is now available for use!

Why Marketers Everywhere Are Asking Does Snapchat Ads Accept Virtual Cards?

Beyond all else, affiliate marketers need payment methods that offer flexibility, control, and easy expense tracking, which traditional options often fail to provide. But can you use Snapchat ads payment methods virtual card? Snapchat fully supports virtual cards, allowing you to deposit crypto into your wallet, navigate to the card section, order a virtual card that fits your marketing budget, load it with funds, and add it to Snapchat Ads as your payment method. This makes it easy to separate budgets by campaign or client, reload funds instantly, and ensure uninterrupted ad spending—all essential for scaling affiliate campaigns efficiently.

How to Set Up Your Virtual Cards & Payments For Snapchat Ads

If you already have an active PlasBit card, follow this step-by-step guide to set up the virtual card as your Snapchat ads payment method.

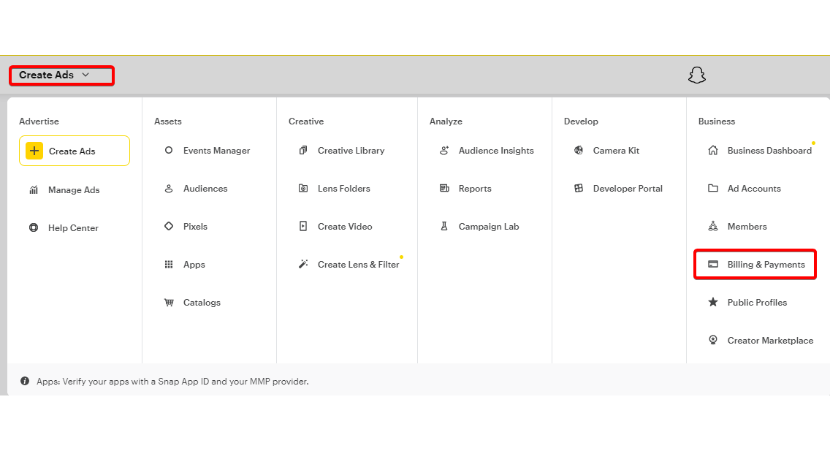

Step 1 – Access Billing & Payments

Log in to your Snapchat Ads Manager account. Click on the menu in the top corner and select "Billing & Payments" to enter the payment settings.

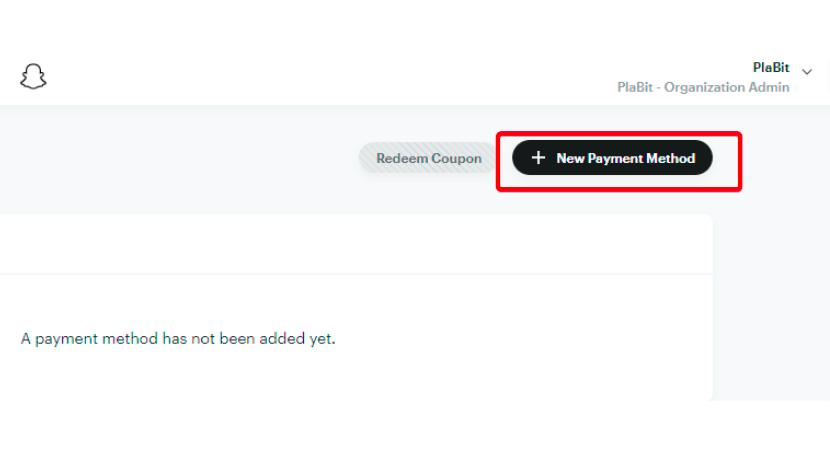

Step 2 – Add a New Payment Method

Once inside the Billing & Payments section, click on "New Payment Method" to begin adding your PlasBit virtual card.

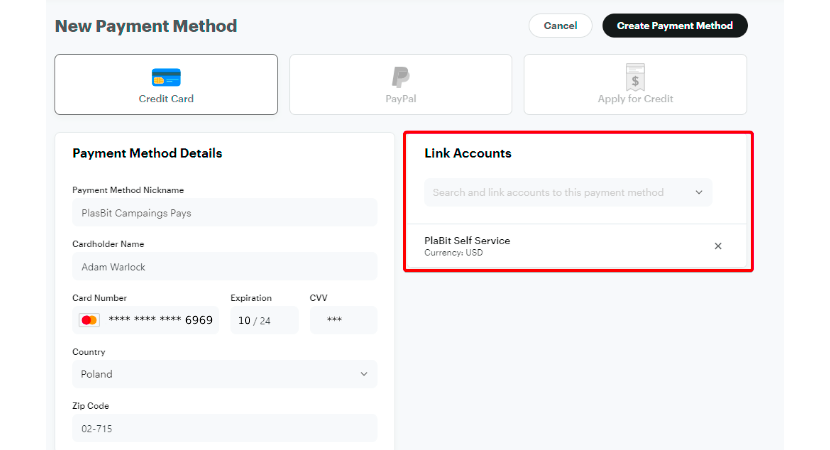

Step 3 – Enter Your PlasBit Card Details

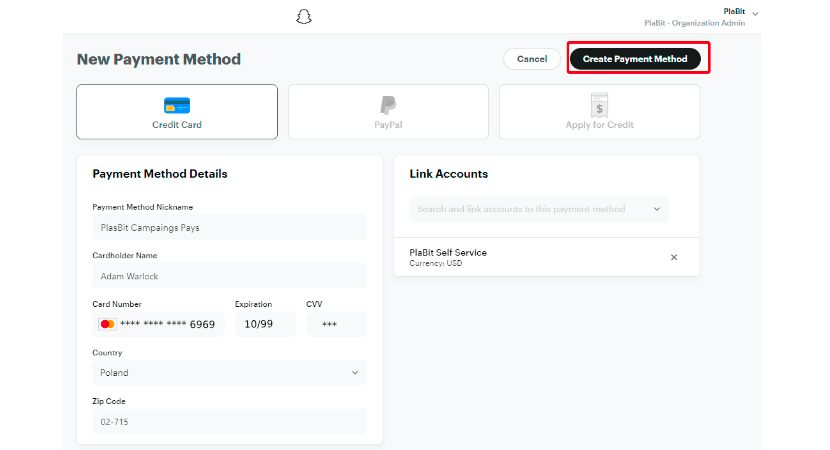

Now, set the payment type to "Credit Card” and fill out the usual details, all of which are visible in your PlasBit dashboard. Double-check all the details and click "Create Payment Method."

FYI: Snapchat does not accept prepaid cards or cards already linked to another organization.

Step 4 – Link the Card to Your Ad Accounts

Snapchat Ads lets you use a payment method for multiple accounts. If you’re already running a bunch of unrelated campaigns, this is the time to choose which ones you’d like to fund with the selected virtual card.

Step 5 – Finalize and Confirm

Choose "Create a Payment Method" to finish the setup.

And just like that, you’re ready to take Snapchat by storm.

Optional – Add a Backup Payment Method

For extra security, you can add a secondary credit card as a backup. Simply fill in the additional card details and click "Add" to set up an alternative payment source.

Can You Use a Backup VCC for Snapchat Ads?

Running Snapchat ad campaigns using credit card or PayPal payments without a backup payment method can be catastrophic if your primary card runs out of funds or encounters a processing issue. Can you use a Backup VCC for Snapchat Ads? Yes, Snapchat accepts virtual cards for all payments, so you can deposit crypto into your wallet, order an additional virtual card that fits your budget, load it with funds, and add it as a primary or a secondary payment method in Snapchat Ads.

But should you be using your virtual card this way? Though they would work as back-ups, virtual cards are far more advantageous for marketers when used as the primary payment method.

Our Snapchat Ads Case Study: What Do You Get for Your Money?

Snapchat has long been a go-to platform for younger audiences, but is it actually worth advertising on? To answer this, we ran a $1,000 campaign to test how much value you can get for your money.

Here’s what our campaign yielded:

● 69 phone calls

● 31,619 website visitors

● 395,236 ad views

● 1,713 Swipe Ups

● CPM (Cost per 1000 Impressions): $3.16

● Effective Cost per Swipe Up: $0.58

We also came away with two major insights:

1. The Demographics Are Heavily Skewed

First and foremost, Snapchat’s user base is young, and that’s the most important factor to consider before running an ad campaign. The platform is dominated by Gen Z and younger Millennials, with 48% of users between the ages of 15-25 and another 30% between 26-35. That means nearly 80% of Snapchat’s audience is under 35. In contrast, those 36-45 make up just 18%, and the numbers drop even further for older age groups, with only 11% of users being between 46-55, and just 5% being 56 or older.

So if you’re selling mobile-first, visually-driven, impulse-friendly products like fashion, gaming, beauty, or subscription services, Snapchat can deliver huge engagement for a relatively low cost. But if your product requires a longer decision-making process, targets professionals, or appeals to older demographics, you’ll likely struggle to convert users into buyers.

2. "Ugly" Sells On Snapchat

The biggest mistake marketers make on Snapchat is treating it like every other ad platform. High-production, polished ads might work on YouTube or Instagram, but on Snapchat, they stick out in the worst way possible.

People send each other low-effort, unfiltered snaps all day, so when an over-produced, high-gloss ad pops up, it immediately feels out of place. Users see it, recognize it’s an ad, and instantly swipe away. But when an ad feels native to the platform, some users are bound to watch for a few seconds out of curiosity, and that’s all it takes to hook them in.

The more your ad looks like something a real Snapchat user would post, the better it performs.

● Shoot handheld videos on phone cameras. No need for special lighting, expensive cameras, or tripods.

● Always go for unscripted, casual conversation.And no second takes! (This isn’t a Hollywood production).

● There’s no such thing as “Bad” graphic elements. In the Snap-o-sphere, a multitude of text overlays, stickers, and doodles is a staple of a native aesthetic.

● Record messy, real product demos. Instead of a professional-looking showcase, record someone casually unboxing, using, or reacting to the product makes it feel relatable.

Targeting: How to Get the Most Out of Your Snap Efforts

Snapchat’s targeting features can be categorized into three buckets: standard targeting, lookalike audiences, and custom audiences. If you’re not closely familiar with all three, don’t skip this run-down of each category.

Standard Targeting

● Demographics Targeting

Basic filters like age, gender, language, and location.

● Interests & Behaviors

Snapchat tracks what users engage with—from fitness and gaming to beauty and travel.

● Advanced Demographics

More refined targeting, like household income, parental status, or purchase behavior.

● Device & Carrier Targeting

An iOS-exclusive finance app could restrict its campaign to iPhone users, while a data plan provider could target users based on their current mobile carrier.

Custom Audiences

Retargeting is one of the most effective forms of advertising. Snapchat’s Custom Audiences feature helps you create and engage returning customers from both on and off the platform.

● Mobile App Audiences

MAA is a simple, efficient method for tracking details of users’ in-app activity to boost the cost-effectiveness of your retargeting campaigns. The feature is compatible with any app ads platform configured with an MMP (mobile measurement partner). Fair warning though, you won’t be able to use this feature until you configure a Snap App ID and link it to your ad account in Ads Manager.

● Website Events Audiences

This feature utilizes Snap Pixel to track activity on your website (page views, cart adds, purchases).

● Ad/Profile Engagement Audiences

Engagement Audiences simplify reaching users who previously interacted with your ads or landed on your brand’s Snapchat profile organically.

Lookalike Audiences

This feature is basically the cold-calling equivalent of Snapchat marketing. It expands your reach by letting you serve content to users similar to your best customers. If a subscription box brand knows that its top customers are 22-30-year-old women interested in wellness, a Lookalike Audience lets Snapchat find similar users who are likely to convert.

Can I Use Virtual Cards for Snapchat Ads Multi-Account Funding?

Most payment methods can be denied when you attempt to link them to multiple brands’ campaigns, and not all ad platforms allow you to assign a card to more than one account. Luckily, Snapchat’s advertising interface lets you pay for a specific campaign with any verified method you choose, while virtual cards don’t carry the risk of being flagged when used for different brand accounts. Can I use virtual cards for Snapchat Ads? Yes, virtual cards are accepted at Snapchat Ads, and the process is as simple as loading crypto to your wallet, ordering the card that matches your ad spend needs, and adding it as a payment method via your Snapchat Ads dashboard.

In short, you can order as many virtual cards as you want, and you can assign as many ad campaign accounts as needed to a single card.

In Conclusion

Does Snapchat ads accept virtual cards? We’d go a step further: if you’re dealing with multiple clients, they may be the best payment method to use for Snapchat. With instant issuance, better budget tracking, and seamless reloading, virtual cards eliminate the usual payment-related messes so you can focus on what you do best – scaling profitable ad campaigns.