For those seeking the best ways to convert crypto to fiat is by using a regulated crypto exchange to process a bank wire cause this method is secure and cheap, with fees as low as 1%, making it ideal for converting large amounts of fiat, such as euros, directly to your bank account. Another way to convert crypto and send it to your bank is by using peer-to-peer platforms and trying to find a buyer for your crypto at a reasonable rate. Some exchanges can also convert your crypto and credit your bank card by topping up your card, but this method is limited in that not all credit card acquirers can process acquittal. It's important to understand the key differences for each way before you convert your cryptocurrencies to fiat currencies so you can make informed decisions.

Difference Between Cryptocurrencies and Fiat Currencies

Cryptocurrencies and fiat currencies represent two distinct forms of currency in the financial market, and understanding the best ways to convert crypto to fiat is crucial in navigating their differences. Cryptocurrencies leverage cryptography and decentralized networks for secure, peer-to-peer transactions. In contrast, fiat currencies are traditional currencies issued by governments, lacking physical backing, and regulated by central authorities. Exploring the nuances between these two currency types is essential for individuals looking to optimize their conversions from crypto to fiat, as it provides insights into the fundamental contrasts of the financial market.

Decentralization:

Cryptocurrencies, known for their decentralization, operate on a peer-to-peer network, bypassing the need for intermediaries and central control. This decentralized model is achieved through blockchain technology, a distributed ledger preserved by a network of computers. Each participant in the network, known as a node, has a copy of the blockchain, making certain of transparency and security. Transactions are validated through consensus mechanisms, such as proof-of-work or proof-of-stake, reducing the risk of fraud and manipulation. In contrast, fiat currencies operate in centralized systems. Central banks and governments wield authority over issuing, circulating, and policies governing these traditional currencies. This centralized control allows for the implementation of monetary policies to stabilize economies. However, it also introduces dependencies on central authorities, making fiat currencies susceptible to external influences. The contrast between the decentralized nature of cryptocurrencies and the centralized control of fiat currencies reflects a fundamental difference in their underlying structures and governance models, influencing aspects like transparency, autonomy, and resistance to censorship.

Anonymity and Transparency:

Anonymity and transparency represent distinct aspects of financial transactions in cryptocurrencies and fiat currencies. In the case of cryptocurrencies, transactions offer a degree of privacy as they are pseudonymous. This pseudonymity means that while user identities are not directly tied to transactions, the transaction history is recorded on a public ledger known as the blockchain. This decentralized and transparent factor of blockchain ensures that all transactions are verifiable, providing trust and security within the network. On the other hand, fiat currency transactions conducted through traditional banking systems often entail a higher degree of traceability. Financial institutions maintain records of transactions, including the identities of the transacting parties. This transparency is a crucial component of regulatory frameworks designed to ensure compliance with legal standards. While it enhances accountability, it also raises concerns regarding user privacy, as individuals' financial histories can be subject to scrutiny. The trade-off between the privacy offered by pseudonymous cryptocurrency transactions and the traceability inherent in fiat currency transactions reflects the nuance of financial privacy in the digital age.

Supply Control:

Supply control is a fundamental distinction between cryptocurrencies and fiat currencies, reflecting their contrasting approaches to managing monetary circulation. Cryptocurrencies, epitomized by Bitcoin, often adopt a fixed supply mechanism to promote scarcity and, consequently, the potential for value appreciation. Bitcoin, the pioneering cryptocurrency launched in 2009, is capped at 21 million coins. This predetermined limit is encoded in its protocol, creating a controlled and predictable issuance model. The finite supply aligns with principles reminiscent of precious metals, fostering a sense of digital scarcity that has contributed to Bitcoin's perception as "digital gold." In contrast, fiat currencies are subject to dynamic supply adjustments facilitated by central banks. Centralized authorities, such as banks, can influence the money supply based on prevailing economic conditions. This flexibility enables them to implement measures aimed at managing inflation or deflation. Central banks may adjust interest rates, engage in open market operations, or utilize other monetary policy tools to regulate the supply in the economy. The malleability of fiat currency supply allows for responsive interventions, but it also introduces complexities tied to economic stability and inflationary pressures.

Accessibility and Borders:

The accessibility and borderless nature of cryptocurrencies stand as a feature that sets them apart from traditional fiat currencies. Cryptocurrencies operate on decentralized networks, enabling transactions without geographical restrictions. This borderless characteristic is particularly advantageous for international transactions, as it circumvents the reliance on traditional banking infrastructure. Whether sending funds across continents or engaging in cross-border commerce, cryptocurrencies offer a streamlined and efficient alternative, independent of the intricacies of currency exchange mechanisms. In contrast, geopolitical borders often constrain fiat currencies, relying on established banking systems and currency exchange protocols for international transactions. Sending fiat currency across borders typically involves intermediary banks and currency conversion services and may incur additional fees and delays. The dependence on these conventional systems can result in complexities and inefficiencies, especially compared to the seamless and direct nature of cryptocurrency transactions. Cryptocurrencies' borderless nature fosters financial inclusion and aligns with modern commerce's globalized nature, providing a decentralized alternative for those seeking efficient cross-border financial interactions.

Methods to Convert Crypto to Fiat

When exploring the best ways to convert crypto to fiat, the choice of method is crucial for an efficient process. Wire transfers, card transactions, and peer-to-peer transactions each have their own set of pros and cons. Evaluating these factors is essential for users to make informed decisions based on their preferences, transaction sizes, and urgency. Understanding the nuances of each method allows individuals to navigate the conversion process effectively.

Wire Transfers

Wire transfers are a secure and direct channel for converting cryptocurrencies to fiat, particularly well-suited for larger transactions. The key advantage lies in the direct transfer to a bank account, instilling a sense of security. It's essential to note that wire transfers, like any method, come with considerations. These include fees, processing times, and potential regulatory scrutiny. While the direct transfer to a bank account provides added security, individuals seeking rapid and cost-effective transactions might find other methods more favorable.

Card Transactions (Debit/Credit Cards)

Card transactions, including debit and credit cards, offer a quick and user-friendly way to convert cryptocurrency to fiat, especially for smaller transactions due to the widespread acceptance of cards in everyday financial dealings. The simplicity of using cards makes it a convenient choice for you to swiftly turn your digital assets into traditional currency. However, it's crucial to be aware of certain limitations associated with card transactions, such as fees compared to alternative methods. The ease and speed of card transactions may come at a cost, affecting the overall value gained when converting cryptocurrencies to fiat. Additionally, transaction limits imposed by card providers may restrict the amount that can be converted in a single transaction, making cards less suitable for larger cryptocurrency-to-fiat conversions.

Peer-to-Peer (P2P) Transactions

Peer-to-peer (P2P) transactions present a direct avenue for cryptocurrency conversion, fostering direct engagement between buyers and sellers with room for negotiation and flexibility. This method accommodates diverse payment options, catering to user preferences and enabling a personalized transaction experience. However, the decentralized and less-regulated nature of P2P transactions introduces higher risks of scams. Compared to more secure and regulated conversion methods, institutional oversight in P2P transactions necessitates users to exercise heightened caution. Thorough vetting of counterparts becomes imperative to mitigate potential risks, emphasizing the importance of due diligence in verifying the legitimacy and trustworthiness of the involved parties. While P2P transactions offer flexibility, users must weigh these benefits against the elevated risk factors inherent in this less-structured conversion approach.

Convert Crypto to Fiat via PlasBit Card

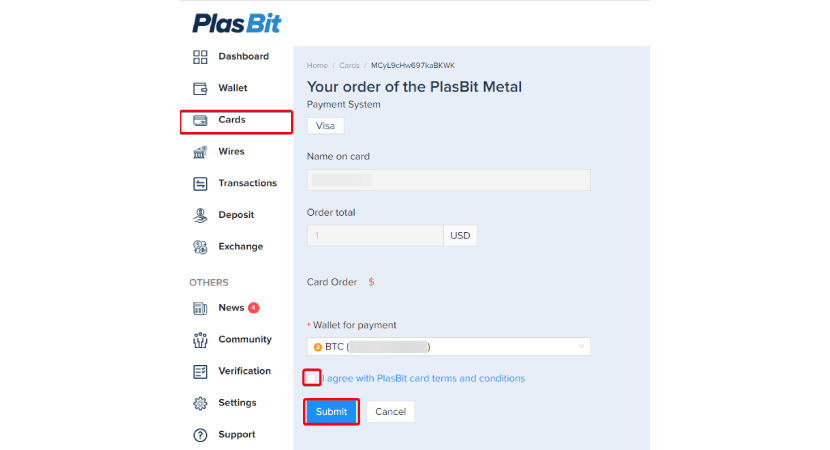

1. Visit the 'Cards' section, choose your preferred card type (Virtual USD, Plastic USD, or Metal USD), and click 'Get This Card.'

2. Confirm payment details, provide your card name, agree to terms, and submit for verification.

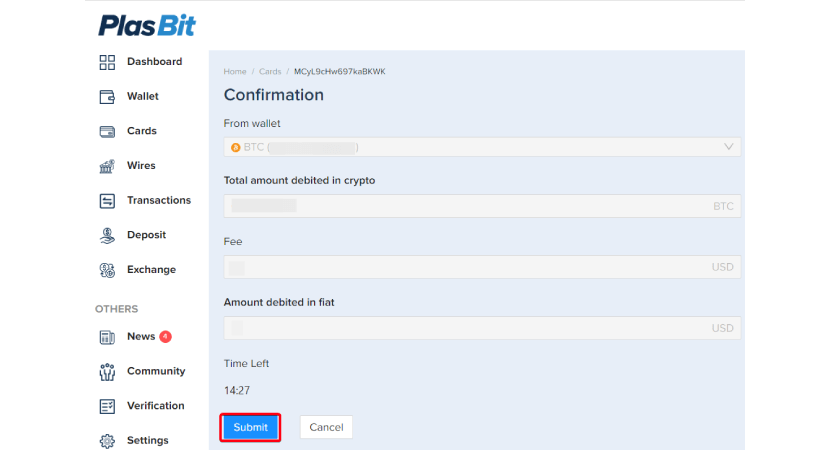

3. Verify wallet balance, debited crypto amount, associated fees, and fiat amount on the verification page. Proceed by clicking 'Submit.'

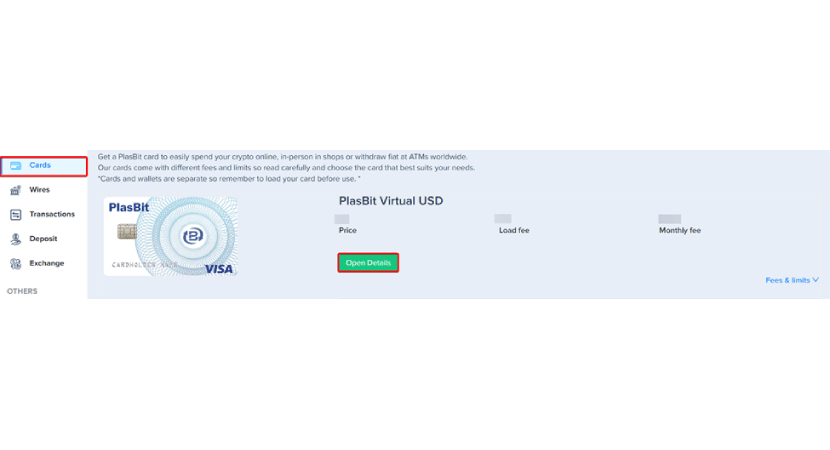

4. For additional details, inspect your card by clicking 'Open Details.'

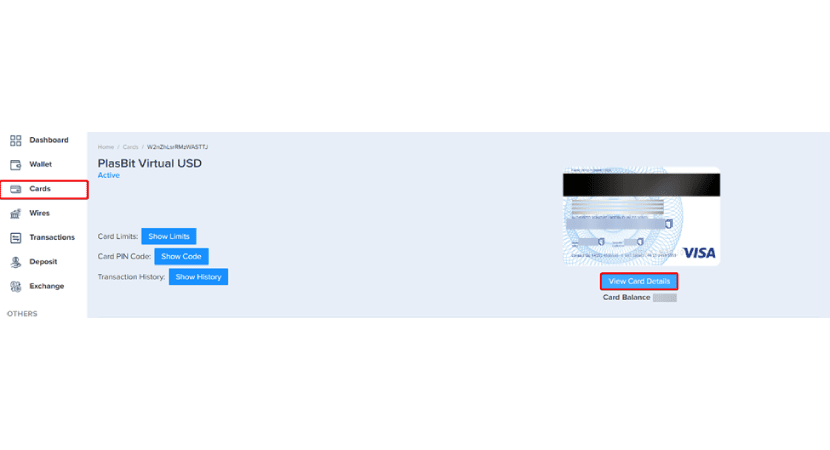

5. Explore the "Debit Card" section to review card limits, PIN code, transaction history, validity, CVV, and signature. Note: Virtual cards lack a PIN for ATM use.

6. Choose to fund your debit card with USD, and select the crypto wallet source.

7. Choose the debit card, specify the load amount, review fees, and the final USD amount.

8. Confirm and submit. Your deducted cryptocurrencies, minus fees, are now loaded onto your debit card.

Crypto to Fiat Via PlasBit Exchange

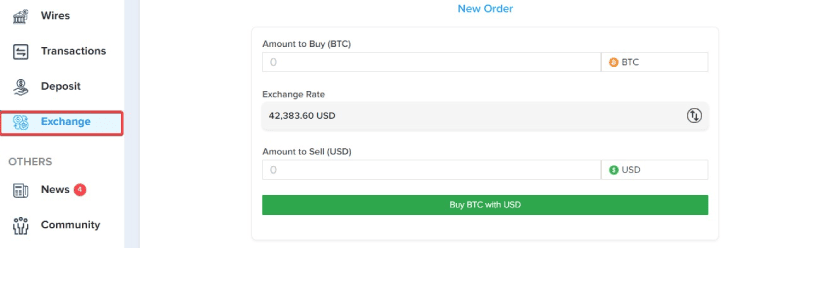

1. Navigate to the "Exchange" section.

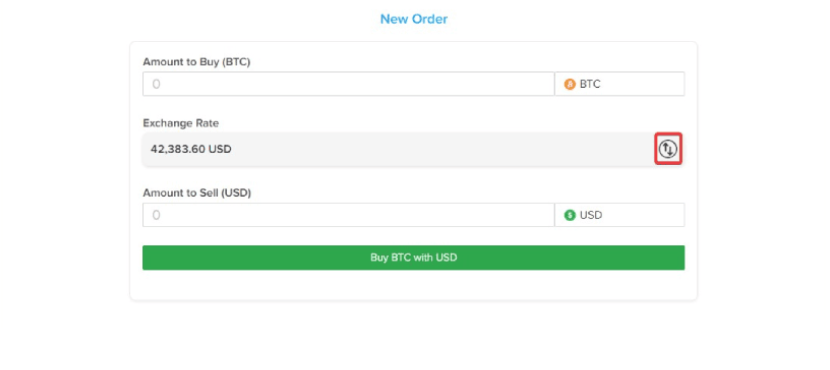

2. Choose USD as your desired currency.

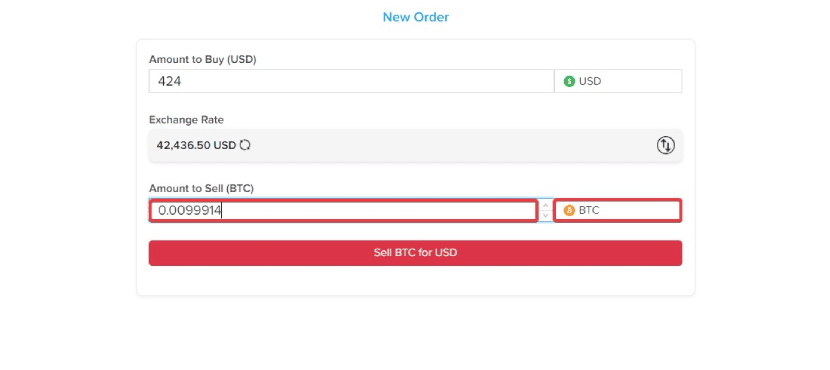

3. Enter the amount of crypto you intend to sell.

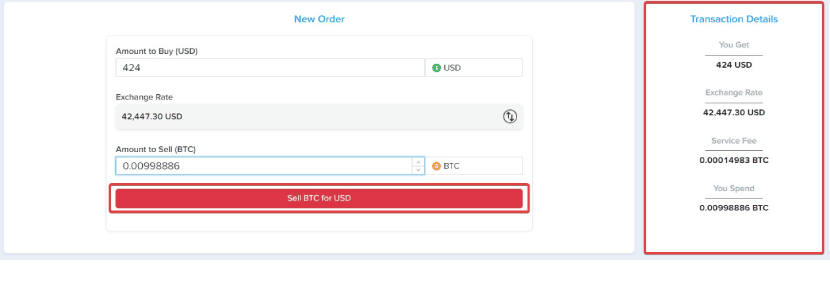

4. Confirm the transaction amount and click "Sell for USD."

5. Once confirmed, the USD you received will be reflected in your wallet.

Follow these steps for a crypto-to-fiat conversion through our exchange.

Exchange Crypto to Fiat Through Wire Transfer

1. Explore the PlasBit "Wire Transfers" section for details on crypto to USD bank transactions, including transfer time, fees, and limits.

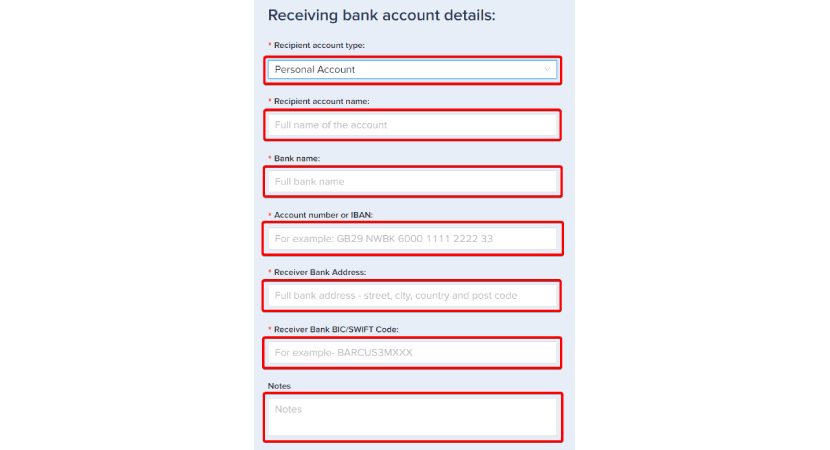

2. Input recipient bank details: account name, type, number or IBAN, bank name, BIC/SWIFT code, and address.

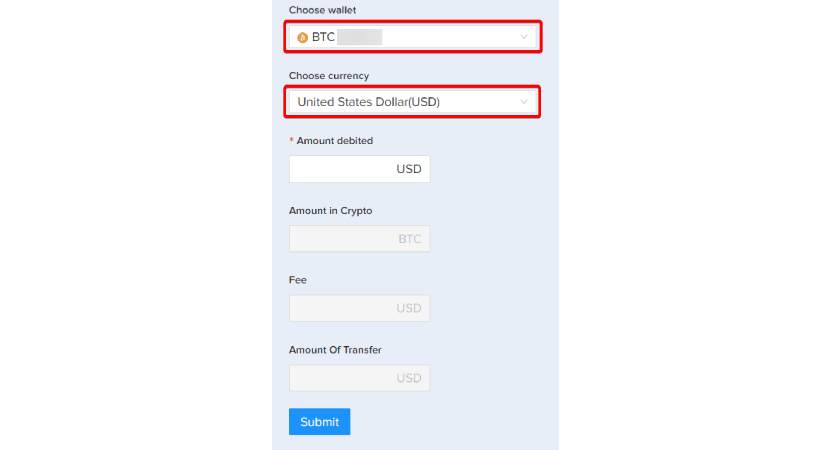

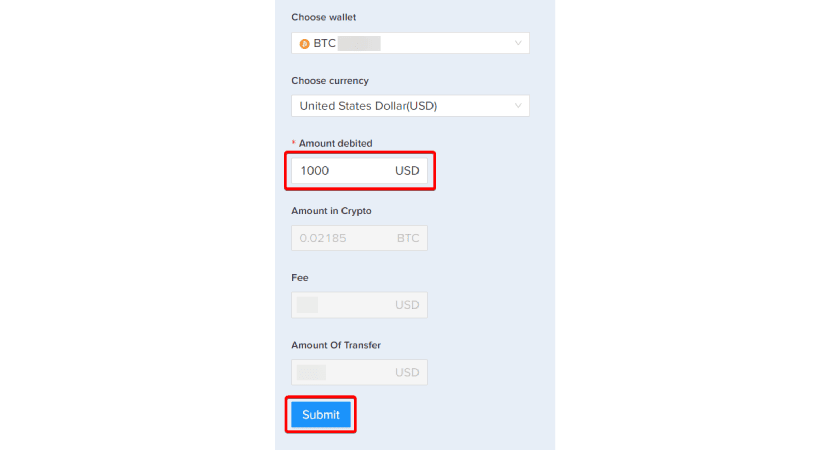

3. Choose the preferred crypto for conversion into USD, and our system will automatically calculate fees and total transfer amounts. Ensure sufficient crypto in your account.

4. Click the "Submit" button, receive a prompt confirming the deducted crypto, and track the wire transfer's progress in your account.

Why Convert Crypto To Fiat?

Converting cryptocurrency to fiat currency is a common practice in the digital asset space, driven by various reasons ranging from practicality and accessibility to regulatory compliance. Let's explore the motivations behind this conversion process, shedding light on the factors influencing individuals and businesses to transition from digital to traditional currency.

Practical Usage and Spending:

In practical usage and spending, fiat currency remains the predominant medium of exchange in our daily lives. Despite the rising prominence of cryptocurrencies, many businesses and service providers still primarily transact in traditional currencies. This prevalence makes converting cryptocurrency to fiat an essential step for individuals looking to integrate their digital assets into routine activities seamlessly. Whether it's grocery shopping, dining at a local restaurant, or settling utility bills, the ability to convert crypto to fiat opens the door to a broader spectrum of transactions, ensuring a smooth and uninterrupted experience in the physical and digital marketplace. Moreover, the utility of converting cryptocurrency to fiat extends beyond the immediacy of day-to-day transactions. It is pivotal in accessing many goods and services that might still need to embrace digital currencies. From traditional brick-and-mortar establishments to online platforms, the widespread acceptance of fiat makes it the preferred means of payment. The seamless integration of cryptocurrency into these conventional spending channels hinges on the ability to convert to fiat, bridging the gap between the innovative world of digital assets and the established landscape of everyday commerce. In essence, the conversion process enables users to navigate both realms effortlessly, enjoying the benefits of cryptocurrency while ensuring practicality and accessibility in their financial interactions.

Market Volatility Mitigation:

Navigating the cryptocurrency markets requires a keen understanding of the inherent volatility that characterizes these digital assets. The decision to convert cryptocurrency to fiat emerges as a strategic approach to mitigate the impact of rapid price fluctuations. Cryptocurrencies, known for their inherent volatility, can experience substantial price swings within short timeframes, creating challenges for investors and traders. In response to this market characteristic, converting crypto to fiat is a protective measure, allowing individuals to insulate their holdings from the unpredictable nature of digital asset valuations. By opting to hold funds in fiat during periods of market uncertainty, investors can safeguard the value of their assets and reduce exposure to potential losses. This risk management strategy becomes particularly pertinent during heightened market turbulence or when anticipating adverse price movements. Holding assets in fiat provides a stable financial anchor, allowing users to navigate the peaks and troughs of cryptocurrency markets with greater confidence. In essence, the ability to convert crypto to fiat acts as a risk-mitigation tool, empowering individuals to maintain a more secure and resilient financial position in the face of the ever-changing dynamics of the cryptocurrency landscape.

Access to Traditional Financial Services:

As the acceptance of cryptocurrencies continues to expand, a fundamental bridge between the digital and traditional financial realms becomes increasingly essential. Converting cryptocurrency to fiat emerges as a strategic facilitator, enabling individuals to access various conventional financial services seamlessly. Despite the transformative potential of digital currencies, many established financial institutions, including banks and investment entities, still predominantly operate in fiat currencies. As a result, converting crypto to fiat becomes a pragmatic necessity for users seeking to engage with these traditional financial services, creating a harmonious integration between the innovative world of cryptocurrencies and the established economic infrastructure. The need to convert cryptocurrency to fiat is underscored by numerous financial transactions, such as opening bank accounts, securing loans, or participating in conventional investment avenues, often necessitating using traditional currencies. This requirement aligns with established financial institutions' prevailing regulatory frameworks and operational models. By facilitating interactions in fiat, the conversion process makes sure that you can harness the benefits of both digital and traditional financial ecosystems, leveraging the strengths of cryptocurrencies while seamlessly participating in the broader economic landscape. In essence, the ability to convert crypto to fiat serves as a gateway, empowering users to navigate and leverage the diverse array of services offered by traditional financial entities, thereby fostering a more inclusive and integrated financial experience.

Hedging Against Market Risks:

In cryptocurrency trading, the strategic conversion of crypto to fiat stands out as a critical risk management tool employed by traders and investors. The decision to hold funds in fiat becomes a deliberate and prudent strategy, particularly during market downturns or in anticipation of unfavorable price movements. Individuals can minimize potential losses during heightened market volatility by converting crypto to fiat, shielding their portfolios from adverse price fluctuations. This defensive approach allows traders and investors to weather turbulent market conditions while positioning them to capitalize on favorable buying opportunities when cryptocurrency prices are more conducive. In essence, the tactical conversion of crypto to fiat becomes a dynamic maneuver, allowing market participants to navigate the unpredictable terrain of digital asset valuations with a strategic edge, enhancing their overall risk-adjusted investment strategies.

Regulatory Compliance:

Regulatory compliance is a critical factor influencing the decision to convert crypto to fiat. The global regulatory environment surrounding cryptocurrencies exhibits significant diversity, with varying approaches and attitudes from different jurisdictions. Converting crypto to fiat becomes imperative to align with local regulations, meet tax obligations, and adhere to reporting requirements imposed by authorities. Fiat transactions remain the predominant mode of financial interaction recognized by regulatory bodies in numerous jurisdictions. Consequently, individuals are often required to report gains or losses in their native currency, necessitating the conversion of cryptocurrencies to fiat for accurate and transparent compliance. This adherence to regulatory frameworks ensures legal conformity and contributes to the broader integration of cryptocurrencies into established financial systems, fostering a harmonious coexistence between digital assets and regulatory imperatives.

Stable Value for Transactions:

The quest for stability in value becomes a pivotal consideration in international trade and cross-border transactions, driving the rationale behind converting cryptocurrency to fiat. Fiat currencies, characterized by relative stability compared to their digital counterparts, offer a dependable reference point for pricing goods and services. Businesses and individuals involved in global commerce often seek the reassurance of a stable currency to mitigate the inherent volatility associated with cryptocurrencies. By converting crypto to fiat, stakeholders gain a secure footing, ensuring that the value of transactions remains consistent and predictable. This strategic move not only shields participants from the fluctuations common in the cryptocurrency market but also streamlines the pricing dynamics in international trade, fostering a conducive environment for economic exchanges that demand reliability and stability in currency values. In essence, converting crypto to fiat emerges as a pragmatic strategy, providing a stable foundation for facilitating cross-border transactions, thereby contributing to the efficiency and predictability of global commerce.

Loan Collateral and Financing:

The conversion of cryptocurrency to fiat presents a strategic avenue for individuals seeking liquidity without divesting their digital assets entirely. This approach becomes particularly relevant in using crypto holdings as collateral for loans or financing. Traditional financial institutions often exhibit a greater inclination to accept fiat-backed collateral due to its stability and widespread recognition. By converting crypto to fiat, users can unlock the potential to leverage their digital assets for securing loans, offering a pathway to liquidity while retaining ownership of their cryptocurrency holdings. This symbiotic relationship between the digital and traditional financial realms provides a practical solution for immediate financial needs. It serves as a testament to the evolving integration of cryptocurrencies into established financial practices, offering users a versatile and pragmatic approach to managing their financial portfolios.

Easier Tax Reporting:

The complexity of tax reporting for cryptocurrency transactions underscores the significance of converting crypto to fiat as a strategic move for simplifying financial compliance. The intricate nature of digital asset taxation, marked by capital gains and losses, creates a challenging landscape for individuals navigating the crypto space and converting crypto to fiat streamlines calculating these gains or losses, as tax authorities frequently mandate reporting in the local fiat currency. This not only eases the burden on individuals by aligning with established reporting norms but also ensures a more straightforward and transparent engagement with tax regulations. As the regulatory framework surrounding cryptocurrency taxation continues to evolve, converting crypto to fiat emerges as a practical solution, contributing to a more seamless combination of digital assets into the broader financial and regulatory landscape.

Emergency Funds and Liquidity:

The importance of holding funds in fiat for emergencies cannot be overstated, and the conversion of cryptocurrency to fiat plays a crucial role in providing rapid access to liquidity. In times of unforeseen expenses or sudden investment opportunities, having a readily available source of funds is paramount. Converting crypto to fiat is a strategic financial maneuver, allowing individuals to address unexpected financial needs or seize time-sensitive investment prospects quickly. The swiftness and reliability of access to fiat liquidity during emergencies underscore the practicality of this approach, ensuring that individuals can navigate unforeseen circumstances without the delays associated with converting digital assets to cash. This proactive use of the conversion process enhances financial preparedness. It highlights the versatility of cryptocurrencies in serving both long-term investment goals and immediate liquidity needs, contributing to a more resilient and dynamic financial strategy.

Conclusion

The inherent differences between cryptocurrencies, characterized by decentralization and borderless accessibility, and fiat currencies, regulated by governments and central banks, underscore the need for informed decision-making, especially when considering the best ways to convert crypto to fiat. Exploring specific cryptocurrencies like Bitcoin, Ethereum, Ripple, Litecoin, and Cardano provides a nuanced view of the digital currency landscape, each serving unique purposes. When converting crypto to fiat, users can choose from methods like wire transfers, card transactions, and peer-to-peer interactions, each with advantages and considerations. Understanding these options is important for individuals seeking efficient and tailored approaches to navigate the dynamic intersection of cryptocurrency and traditional fiat currencies.

.png)