Affiliate marketing agencies usually pay for online campaigns using credit cards. However, corporate or personal cards are not the best way to pay for them. Virtual cards for advertising are regular debit cards that you can buy online, where you get the card details and use them as your payment method to pay for campaigns on Google ads, Facebook ads, or Twitter, for example. There are also virtual cards that can be loaded in crypto, Which is the preferred payment method by affiliates. At PlasBit, we offer virtual cards that can be used as payment methods for various ad platforms, such as Google Ads, TikTok, Instagram, Facebook Ads, X, Snapchat, Outbrain, Taboola, Quora, Reddit, Pinterest, and LinkedIn.

How does one get a Plasbit Virtual Card?

If you like the idea of using virtual cards for advertising, you can buy one or more Plasbit virtual cards in a few straightforward steps.

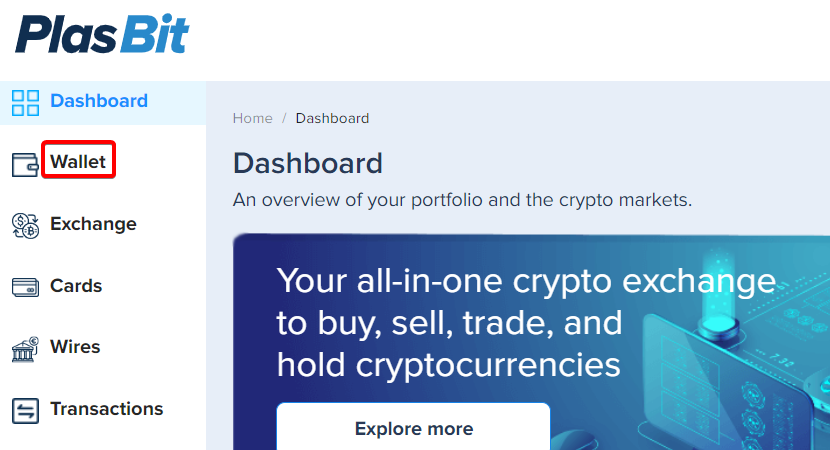

1. Log in to your PlasBit Dashboard and go to your wallet section

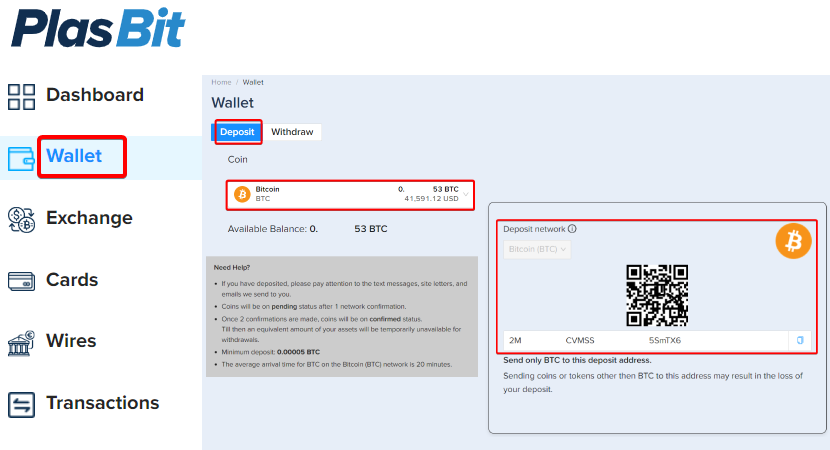

2. Deposit your preferred cryptocurrency.

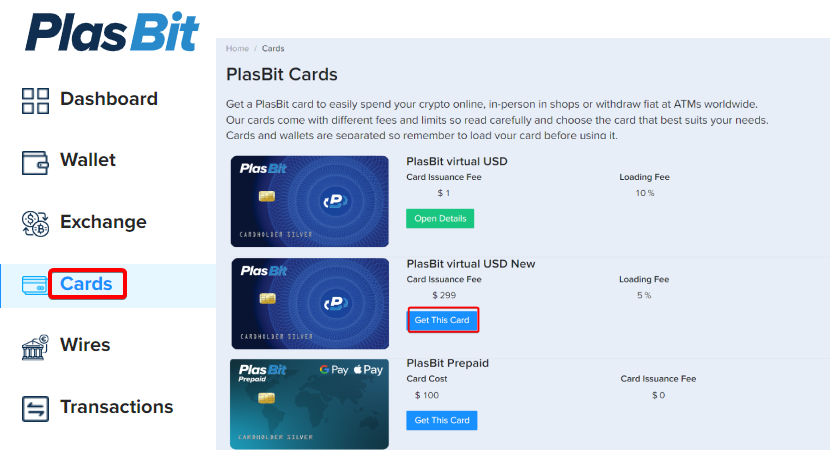

3. Go to the card section. Select the virtual card in your preferred currency (USD or EUR) and click "Get this card."

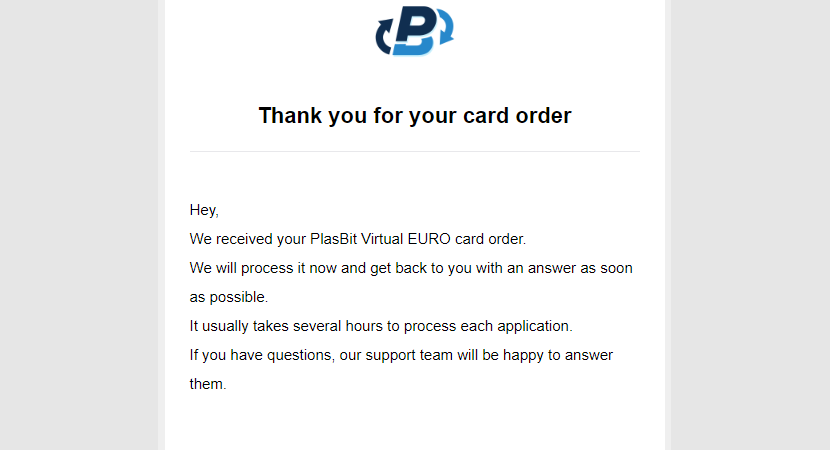

4. Wait for the card confirmation. You will receive a notification via e-mail once your virtual card has been successfully issued.

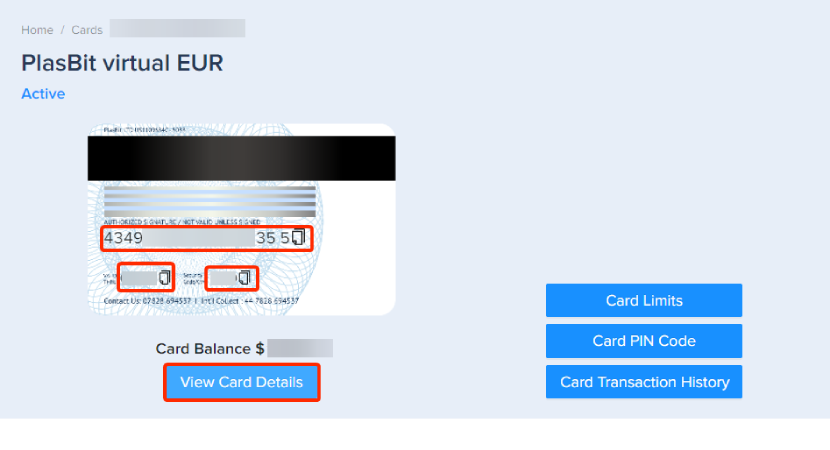

5. Get your Plasbit card details. You can get your card number, expiry date, and CVV from the "View Card Details" button.

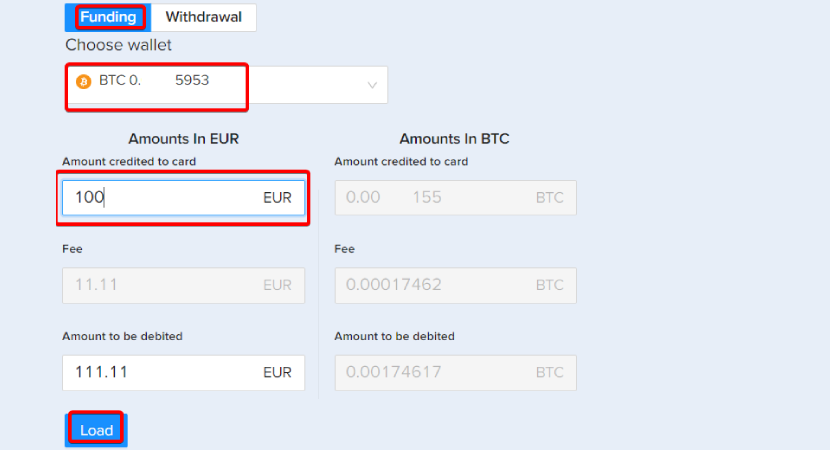

6. Load funds onto the card. Revisit the "Cards" section and click the "Open Details" button. Navigate to the "Funding" tab and choose from which wallet you wish to deposit funds, then press the "Load" button and press 'Submit' once you check the amount is correct.

If you are purchasing more than one virtual card, repeat steps (3) to (6) for each card. If your wallet runs out of funds, repeat step (2) to deposit more of your preferred cryptocurrency in your wallet.

Once you have loaded each card, you can connect it to any advertising platform of your choice.

Fees and limits.

These are the costs associated with purchasing a PlasBit virtual card and the limits associated with its use, bearing in mind that they are debit cards and can only be used up to the available amount.

· Card creation fee, a fixed amount.

· The fee to load a card from a PlasBit wallet is a percentage of the amount loaded.

· The currency exchange fee is a percentage of the amount converted into the card's currency.

You can have Plasbit cards in USD or EUR. For instance, if you have several transactions in EUR, you can save on currency exchange fees by buying a EUR-designated card.

The amounts subject to limits are:

· Daily load from Plasbit e-wallet to the card.

· Daily Limit for ePos Purchases

· The monthly amount that can be loaded from a PlasBit wallet

Plasbit virtual cards are valid for three years.

Why use a virtual card?

There are several advantages to using virtual cards for advertising. They could be divided into two groups. You do not use personal or business cards, which you could also use for other purposes, and you can make budgeting and client reporting so much easier.

Advantages of a Virtual Card over a Corporate Card

An affiliate marketing agency places adverts on behalf of clients. Whatever the details of the arrangements, there is always a budget for the advertising campaign. It takes constant monitoring to ensure the costs for each platform are within budget.

Your card won't be blocked.

Budgets can run away pretty quickly, especially if you are in a pay-per-click contract. A card used for other purchases could also easily reach its credit limit. If that happens, your card is blocked until you make a payment. You may not be able to make the purchase you were planning, or you might have to tell your clients that their adverts will be paused for however long your card issuer needs to process the payment that brings your card balance below its credit limit. Both scenarios lead to problems. Problems are amplified if you use a personal rather than a corporate card. Virtual cards for advertising are a tool to avoid the risk of other purchases blocking your card.

Faster client reporting.

If you use your corporate card, client reporting at the end of the month is time-consuming. It takes time to extract the charges related to the purchase of advertising from the card statement. If you use a personal card, you also have the problem of sorting out an expense refund. The statement of a virtual card used for advertising only shows charges from the media platform. You do not waste time separating them from other purchases.

Easier to manage your budget.

Virtual cards for advertising simplify your life. First of all, you do not run the risk of going over budget. You load the equivalent of your monthly budget for media purchases on the card,which is the limit. When you have spent all your budget, the card is blocked. Loading more money on the card will increase your budget. It turns a blocked card from an inconvenience to a sign that you have to go back to your clients and ask them to increase the budget if they want to continue advertising till the end of the month.

Improved security

A virtual card is more secure than a corporate card your agency staff can use to buy adverts on several media platforms like Facebook, Google Ads, and more because:

1 You only use the card to buy advertising. The card's limit (i.e., what you loaded) can only be used for advertising.

2 It protects your corporate bank account from data leaks. Even if a hacker gets hold of a virtual card number, you can only lose the whole balance, nothing more, nothing less. There is no indirect access to your corporate bank account through your Plasbit virtual card.

3 When you prepare a client report, you do not run the risk of missing a charge. All the expenses charged to the card relate to the purchase of advertising in one of the media platforms

Save on currency conversion fees

Last but not least, your corporate card was issued in the currency of the country where you have your corporate bank account. A virtual card can be issued in a different currency, allowing you to pay for media with no fees for currency conversion. Plasbit virtual cards can be issued in USD and EUR.

There is another advantage to having a virtual card in a different currency. Often, costs are not converted into another currency. They just keep the exact figure and change the currency. For instance, USD 10 becomes GBP 10 rather than GBP 7.57 (Exchange rate effective when writing this post). So, your clients do not just save on currency conversion fees. They may also save on advertising costs.

Ring fence client money

Virtual cards for advertising allow the management of client money in a completely separate way from corporate money. An affiliate marketer will never miss an overspend on behalf of a client. Corporate funds will never be 'accidentally' used to pay for clients' advertising.

Multiple virtual cards are even better.

When you use one virtual card, you have one total budget for all your clients, and you still have to separate each client's advertising spending from the card statements. One client may go over budget (but within the sum of all budget clients), and another client may have to be left with less media buying capability. Multiple virtual cards can solve this problem.

One card per client

This solution presents the basic advantage of not mixing up budgets. Each client has its cards, and each card is loaded with the monthly budget of that specific client. Managing media spending becomes more straightforward, and monthly client reporting becomes faster. All the charges are in that card statement and are not mixed with anything else.

There is also no need to devise a system to distribute the cost of running the cards among more than one client. One virtual card per client means allocating all the relevant costs to that client. Managing the budget and the client reporting is easy and straightforward.

One card per media platform

Using one card per media platform works if there is a considerable disparity between the budget allocation on each one of the advertising platforms. For instance, a card for Facebook and one for LinkedIn would work if the two have widely different monthly budgets, so different that you have to manage them independently.

One card for each media platform where the client wants to advertise.

Setting up multiple cards for one client is the most complex, but it doesn't need much time to manage. For instance, a client wants to advertise on six platforms: Facebook, Google Ads, Instagram, TikTok, Pinterest, and LinkedIn. Each has a different monthly budget rather than a cumulative one divided by six. Loading each card with the monthly budget for each platform would ensure against going over budget in any of them. If that happens, advertising would not need to be withdrawn from others. Client reporting could be organized at the end of the month per the advertising platform. If the affiliate marketing agency has the monitoring framework, it could also facilitate an assessment of which platform is more cost-effective.

Different cards for different currencies

Plasbit virtual cards can be issued in USD or EUR. You can minimize currency exchange fees using a USD or EUR card, depending on where you, your clients, or the media platforms are based.

Overall advantages of using several cards

It is easier to run many Plasbit virtual cards. You can monitor the cash flow of each card from the Plasbit Dashboard on your phone. During the month, monitoring your advertising spending becomes straightforward. You can separate your budget as you see fit. The advertising budget of large or important clients, or those with large budgets, can be managed and monitored using multiple cards. Smaller clients, or clients with smaller budgets, can all be covered by the same card. It is entirely up to you. Plasbit allows you to manage your virtual cards and gives you all the flexibility you need.

The importance of a BIN, or why you must pick the right virtual card.

The Bank Identification Number (BIN) is the most important part of a payment card. It consists of the credit card number's first four to six digits. A BIN is assigned to the issuing bank. Financial institutions, merchants, and card networks use the BIN number to verify the authenticity of a card and route the transaction to the appropriate bank for processing.

Payment systems use BINs to classify banks and card issuers. For instance, payment systems do not accept free anonymous loadable cards, whether virtual or not. They are often linked to fraudulent activities. Using them may cause an account ban on Google Ads, Facebook Ads, and similar platforms.

How could this work? A case study.

Let us consider an agency with six clients:

Client 1 is an e-commerce platform selling 'vintage' products. They have a budget of $45000 a month to be divided between Facebook, Google Ads, and TikTok ($10,000 each); the remaining budget ($15,000) is allocated to Pinterest, Quora, and LinkedIn.

Client 2 is a hotel chain with a budget of $15000 a month and a budget of €18000 a month. The dollar budget will be divided equally among Facebook, Google Ads, Instagram, and TikTok. The euro budget will be divided among travel websites based in the Euro area.

Client 3 is an accountancy firm and has a budget of $10,000 to spend on Google ads

Clients 4, 5, and 6 have budgets below $6,000 each to spread among various platforms. They are all small businesses. One sells clothes, one sells man shoes; and the third sells swimwear.

The agency could organize Virtual Cards to meet each client's requirements.

Client 1- The e-commerce platform

Most of the platform's first buyers come from social media. They have a considerable budget that must be divided among several platforms in different parts. The agency could organize three cards, one for each platform with a large budget, i.e., Facebook, Google Ads, and TikTok. Each platform has a card with a monthly limit for loading money into it. In practical terms, their budgets are separate. The agency can discuss with the client how to increase spending on one with no risk of overspending on the other two. Client reporting for each of those platforms is separate. If the advertising is organized correctly, the client or the agency can measure how effective each of the three platforms is. Advertising on the other three platforms (Pinterest, Quora, and LinkedIn) could be purchased using a fourth card. Their combined budget is $15,000 a month, well within the amount that can be loaded on a Plasbit virtual card each month.

Client 2 – The Hotel Chain

This client has two budgets. One in US Dollars dedicated to those platforms that charge in US Dollars, i.e., Facebook, Instagram, TikTok, Google Ads, LinkedIn, and more. Those platforms. The budget in euros is used for various European travel websites, which charge in euros. Every media purchase might face a currency conversion fee and will be subject to currency fluctuation during the month, making the budget more complicated to manage. The agency can buy a Plasbit Virtual Card in US dollars and another in Euros. In this way, all the transactions will be in the relevant card's currency. There are no currency conversion fees and no exchange risk. Each budget is managed in the appropriate currency.

Client 3 – The Accountancy firm

The firm only targets companies, so they have chosen to advertise on Google Ads and LinkedIn. They have given the agency a budget well within the monthly limit to load the card from an e-wallet. One Plasbit virtual card for that client is enough: one client, one budget, one card, and one platform. The card statement is the client report.

Client 4, 5, and 6 – The three SMEs

The apparel company, the small shoe factory, and the company that only sells swimsuits have a low budget. The sum of all their budgets is well within the maximum amount of money that can be loaded on the card each month. One Plasbit Virtual Card can be used for all the advertising purchases of the three clients combined. Budgets must be monitored to prevent one client from going over budget to the detriment of the other two. Overall, one card is enough. This solution may be temporary, and each one of those clients could transition to its virtual card or its own set of virtual cards as they grow.

True flexibility, easy to manage.

The agency has the flexibility to use the best solution for advertising purchases for each client. The agency would run eight cards in the case study we have just outlined: four for client 1, two for client 2, one for client 3, and a common one for the remaining three.

They can manage all those cards from the Plasbit Dashboard. The advantages are enough to compensate for the added costs. The fees to load the card from the wallet do not create added costs. $45,000 loaded on four cards, and there is a total fee identical to the one you would have if you loaded all the money in one card. The only cost difference is the card creation, but it is a one-off cost.

A great tool for affiliate marketing agencies

Virtual cards can give affiliate marketers a lot of flexibility. They can tailor how they run their client campaigns to their clients' size and budget. They can assign one card per media platform if they have clients with a large budget and complex campaigns. They can even split the cards according to the most convenient currency to pay for specific media platforms if relevant. Clients with smaller budgets or basic advertising requirements can be 'lumped' together in one card.

Any variations of the two 'bookends example' are possible. Flexibility is the key to defining an affiliate marketer's virtual card strategy.

Virtual cards ring-fence client money, make monitoring an advertising spend budget more straightforward, and minimize the risk of cards getting blocked while dealing with media buying. Using virtual cards also protects corporate funds from data leaks. There is no way a hacker can get to the corporate bank account if one of the platforms has a data leak. At worst, they can find the Plasbit account associated with the specific cards. In that case, Plasbit security provisions stop them from going further and drain your Plasbit wallet.