In recent years, bitcoin has gone from being known only by crypto enthusiasts to a globally known investment option. But despite this popularity, many investors wonder is Bitcoin riskier than stocks? Yes, bitcoin is a riskier investment compared to traditional stocks. This is because the price of Bitcoin is highly volatile. Moreover, Bitcoin is anonymous and private, while stocks are associated with well-known companies. Companies have financial reporting and well-defined assets and revenues, which makes their stocks less risky and easier to research.

With anonymity also comes the potential for misuse. You, as an investor, should research the many risks and benefits of investing in cryptocurrencies and try to decide whether you want to have the anonymity Bitcoin provides, which also involves shady individuals in the community. Or go with the more State-controlled investment option. Either way, this PlasBit article can help you decide.

In this article, we explore the key differences between Bitcoin and stocks, examining their specific risks and benefits. We cover topics such as volatility, regulation, and the advantages of long-term Bitcoin investments. Additionally, we compare Bitcoin’s decentralized nature and limited supply with the stability and regulation of stocks.

Dangers of Trading Bitcoin vs Trading Stocks

Investing in Bitcoin can result in bigger gains, but Because of its decentralized nature, it exposes you to many risks. Investing in stocks also involves many risks, mainly because of how connected their price is to companies.

Volatility

A well-known characteristic of Bitcoin is its high Price fluctuations. Due to news and hype, in a day or even in hours, Bitcoin's price can have thousands of dollars fluctuations. Many investors do not take into consideration the fact that they may lose a large part of their money when a drop happens in Bitcoin's price. These investors are affected by many well-known success stories and buy Bitcoins without research and in a hurry to achieve profits. On the other hand, stocks provide comparatively smaller and steadier earnings with less volatility in price. This is because their price movement is based on economic factors and the financial status of the company.

Lack of Regulation

If you invest in the stock market, it is unlikely for you to fall victim to scams and other criminal activities. This is because the stock market is well controlled and is under check by regulatory bodies such as the SEC. This agency implements laws that provide a secure financial environment for the investors. On the other hand, although it is much easier to enter this market as an investor, the crypto market is much less regulated. Due to this reason and because of its decentralized nature, when you invest in Bitcoin, you are much more exposed to scams and market manipulation.

Security Risks

The anonymity that cryptocurrency transactions provide attracts the wrong type of people, and crypto exchanges and digital wallets are frequently targeted by scammers and hackers. Moreover, because there are no regulatory bodies with the power and authority to reverse these transactions, any asset lost to hackers and scammers is lost until they are arrested. So, nearly all stolen Bitcoins cannot be recovered. In contrast, the stock market is regulated in a way that if your assets are stolen in case of hack or fraud, brokers are mandated to provide insurance.

Corporate Downturns

Stocks are actually an investment in a company’s future growth. Therefore, a stock’s price is closely associated with the financial status of the company and its future growth. Thus, a wrong financial decision by the CEO or a poor profit quarter results in a significant drop in that particular stock’s price. In addition, changes in industries, poor management, and reduction in sales also lead to a lowered stock price. In contrast, the value of Bitcoin depends mainly on the market sentiment.

Economic Downturn and Market Crashes

Another risk for the stock traders is fluctuations of the economic cycles such as recessions or crashes. This is because Bitcoin is less connected to economic cycles, but the stock market directly depends on the general economic situation. In recessions or financial crises, stock prices crash. As with the crypto prices, they also may be influenced by the global market situation, but it is known that the stock market is more sensitive to the health of the economy and in the long run, market declines more severely affect stock value growth.

Although Bitcoin has high fluctuation in value, regulation problems, and security threats, stocks also have their risks, such as company-specific risks and general economic risks. When trying to answer the question of whether is Bitcoin riskier than stocks, you should look at the risks associated with each asset and understand that the choice is based on your personal views. So choose the one you have the risk tolerance for that best fits your investment plan.

The Importance of Risk Management and Risk Tolerance in Bitcoin Trading

As we discussed before, Bitcoin’s price is very volatile and has big swings in short periods of time. To protect your capital from being lost in such fluctuations, you should practice risk management and know your risk tolerance. There are many risk management strategies; some examples are stop-loss orders, position sizing, and diversifying. Furthermore, by finding your own risk tolerance, you can understand that at what level of volatility you start to make emotional and illogical decisions. Doing so you can make sure you do not invest in assets that have a risk level higher than your tolerance. So, risk management and risk tolerance are the foundation for a stress-free and profitable investment.

Set Clear Trading Goals

Before investing, you need to make your goals clear. By doing so, you will have an easier time finding your entry and exit points when trading Bitcoin. Having a goal also gives you an idea of your risk tolerance. Furthermore, when you have clear objectives, you make strategic and logical decisions to reach your goal, which means you will not make emotional decisions.

Use Stop-Loss Orders

Stop-loss orders are predetermined price points where your Bitcoin is sold automatically. This limits your losses in case of a drop in value. So, stop-loss orders are a simple but effective way to manage risks in trading.

Diversify Your Portfolio

If you have a low-risk tolerance, you should not put all your eggs in one basket. This means you need to diversify your capital among many assets and limit your losses by investing in different sectors. This way, in case of unfortunate events and market crashes, you will not lose all of your capital.

Limit Leverage

Using a lot of leverage in the cryptocurrency market, which is known to be highly unstable and volatile, can lead to both big profits and losses. And statistically, more people lose money trading, so in almost all cases, you should limit your leverage when trading Bitcoin.

Stay Informed

To correctly predict price changes on top analytic knowledge, you need to follow important events and news that might affect Bitcoin’s price. Many swings and trends start because of important events, so by keeping aware, you can change your trading strategy and reduce your losses.

By employing these strategies, traders can limit the risks associated with Bitcoin’s volatility, creating a more controlled and logical way of trading.

Comparing Bitcoin and Stocks

To understand why the answer to is Bitcoin riskier than stocks is yes, and to choose your investment sector correctly, you need to learn the differences between Bitcoin and stocks. In a general view, Bitcoin, a decentralized currency, represents privacy and anonymity, and on the complete opposite side is stock, which represents publicly owning part of a company. Furthermore, while investing in both can generate profit, they have many differences in regulation, risk level accessibility, etc.

Nature of the Asset: Bitcoin vs. Stocks

Limited Supply

Bitcoin is a scarce currency with a fixed amount of 21 million coins. Thus, as demand for Bitcoin increases, the price will increase too. Unlike Bitcoin, which has limited supplies, companies can issue more shares whenever they need additional capital, but it decreases the value of existing shares. This process of issuing new shares is typically referred to as a stock offering.

Trading Hours

Bitcoin’s 24/7 Market

The traditional stock markets have an opening and closing time and are usually closed during holidays. But Bitcoin can be traded at all hours, no matter holiday or not. This feature gives traders the ability to change trading strategy or close their positions based on the newest developments in the market. This feature makes Bitcoin the more flexible option in comparison to stock.

Stock Market’s Limited Trading Hours

Stock traders do not have the ability to respond to sudden market developments because the stock market is only open in the normal working hours. The hours are different depending on country and region; for example, the United States stock market is open between 9.30 AM to 4 PM Eastern Time. There are also some after-hour trading.

Accessibility

Global Accessibility of Bitcoin

Bitcoin can be traded by anyone with an internet connection. This is a key feature of Bitcoin because it makes it easy to access and very useful for various groups of people. Individuals like citizens of countries with weak or unstable currencies and people who are under economic restrictions. One other accessibility feature of Bitcoin is its peer-to-peer trade capability; this means that the presence of an intermediary like a broker is not needed.

Stock Market Accessibility

The barriers of entry for trading stocks are generally higher than for Bitcoin. This is because, to trade stocks, you usually need a brokerage account, and such accounts are region-locked and are issued based on nationality and regulations. There are online brokerages that give clients easier access to the stock market, especially through fractional shares. However, such platforms are still heavily regulated.

Transaction Costs and Fees

Bitcoin’s Exchange and Network Fees

Trading Bitcoin involves various fees, such as deposit or withdrawal transaction fees. Moreover, exchanges will charge commissions per trade. These fees and commissions can vary depending on which platform you use and how much activity there is on the Bitcoin network at any given time. Bitcoin trading fees can increase a lot if the network is too busy. So, the cost of Bitcoin trading can be unpredictable.

Stockbroker Fees

Nowadays, stock trading is really affordable because many brokers have moved toward a zero-commission business model. However, this model is usually only for standard users, and more specialized services and products will incur additional costs. Unlike Bitcoin trading, there are no network fees, resulting in more predictable trading costs.

Tax complexity

Tax Complexity with Bitcoin

Just like stocks, you are taxed when you sell your Bitcoins. However, in contrast to stocks, the taxing process for Bitcoin is more complex. This is because governments and regulatory bodies are still developing new laws and taxing frameworks for cryptocurrencies. Furthermore, the rules might be completely different based on the region and country, which creates more complexity.

Clear Tax Guidance for Stocks

The government and regularity bodies have put in place clear tax rules. So, when compared to Bitcoin, planning for tax payments is much easier for stock traders.

So, with your newly gained knowledge, you can now consider your priorities and choose your desired investment sector with certainty.

Bitcoin Price vs. Amazon Stock Price

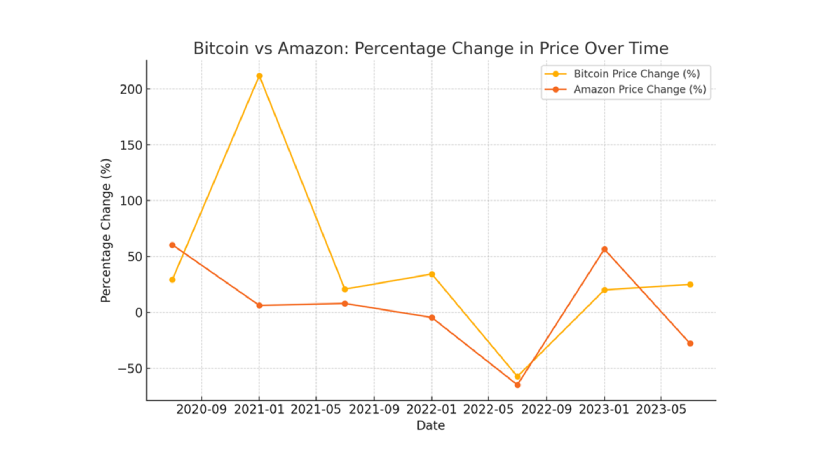

The graph below shows the price changes based on the percentage of Bitcoin and Amazon stock from January 2020 to July 2023. Bitcoin is many times more volatile than Amazon stock, showing severe fluctuations in its price. Bitcoin's price, for example, went up quite drastically in 2021 but also plummeted rather harshly at the start of 2022. To compare, Amazon stock experienced mild changes in price even during downturn market events. These smaller percentage changes for Amazon show that it is a relatively stable asset when compared to Bitcoin.

This comparison implies that Bitcoin has high returns but very high risk levels as well. This is because it swings in large price ranges. By comparison, Amazon stock is a much safer investment to make. While Bitcoin may be a valuable investment for those pursuing incredibly high returns, Amazon is a better choice for the average investor who wants to own shares for long-term growth.

What Happened During the 2008 Market Crash?

The 2008 financial crisis, or the Great Recession, was one of the most severe economic downturns since the Great Depression. It was mostly triggered by the crash of U.S. housing sales following a fall in home prices, as well as an increase in mortgage lending standards and unavailability of funds for mortgages. And here is how it all played out.

Subprime Mortgage Crisis

Banks and financial institutions had given out subprime mortgages to individuals with a poor credit history. Prices on housing continued to rise, and it looked like a sure winner. However, because housing prices started falling in 2007, many homeowners who had taken out subprime loans backed out of their mortgages.

Financial Institutions Collapse

Banks and financial institutions that had invested heavily in these risky mortgage-backed securities ran into huge losses, resulting in their collapse. Lehman Brothers went bankrupt, Bear Stearns and AIG had to be bailed out by the government.

Global Economic Impact

After the financial crisis hit the U.S., it quickly spread across the world, leading to a global economic downturn. This caused job losses and a crash in stock markets. The collapse of the U.S. housing market triggered a global banking crisis because financial systems were so interconnected that when one part failed, the whole system was affected.

Government Intervention

To protect economies from total collapse, governments and central banks stepped in with rescue packages. In the U.S., the Federal Reserve cut interest rates and spent trillions through programs like TARP (Troubled Asset Relief Program) to support the economy. While this helped stabilize things, it also increased debt and sparked debate about whether the government should bail out failing institutions.

Is Bitcoin safe in a Future Market Crash?

Yes, Bitcoin can be a safe haven in another market crash but it depends on several factors.

Decentralization

Bitcoin runs on a decentralized network without being associated with any government or financial entity. This design aims to remove reliance on traditional financial systems and could theoretically make Bitcoin less likely to collapse.

Limited Supply

With its 21 million coin supply, Bitcoin is naturally deflationary. Unlike fiat currencies, which can be printed in large amounts during a crisis, Bitcoin's limited supply becomes an advantage during economic crashes.

Volatility

One of the drawbacks is Bitcoin's unpredictable nature, given its history of massive price swings. Investors usually prefer stable assets, like gold, during financial crises because they don’t change value too quickly. However, Bitcoin's price has been very volatile. For example, in March 2020, at the start of the COVID-19 crisis, both the stock market and Bitcoin crashed. However, Bitcoin quickly recovered.

Adoption and Liquidity

What Bitcoin needs is more widespread adoption and strong liquidity. While it's a big market, it isn't accepted like gold or government bonds. If the global financial system crashes and demand for Bitcoin spikes, its network could struggle, especially with panic selling.

Bitcoin ETFs

It's important to note that many people don't directly own Bitcoin; instead, they invest in it through Bitcoin Exchange-Traded Funds (ETFs), which are traded like regular stocks. In a market crash, these Bitcoin ETFs might be sold off just like other stocks, which could affect Bitcoin’s ability to act as a stable safe haven during turbulent times

Bitcoin has the potential to be a safe haven, but its volatility and regulatory concerns make it less reliable. As it grows, its role in a crisis will become clearer.

How and Why Bitcoin Was Made

Bitcoin was created by Satoshi Nakamoto, an unknown person or group of people under the name. The idea originated from the 2008 financial crisis as an attempt to correct flaws in central banking and remove middleman agents such as banks. The objective was to make a digital currency which would be independent of the government and authorities so that people can do payments directly between them without any validation from the government.

How Bitcoin Works

Bitcoin is powered by the blockchain. A record of each and every Bitcoin transaction that has ever occurred is known as the blockchain. Once a block of transactions, known as a "block," has been added to this chain, the block cannot be changed or deleted. This system is managed by many computers around the world, known as nodes, that validate each transaction together. These computers use special codes to ensure everything is in order. Bitcoin miners solve these puzzles, and after solving a puzzle, they add a block into the chain while earning new Bitcoin.

Why Bitcoin Was Created

Bitcoin was designed to solve several problems in the traditional financial system, such as:

Double Spending

The blockchain ensures that the same Bitcoin can't be used in two transactions at the same time.

Trust Issues

Traditional finance relies on banks and other institutions to act as middlemen, whereas Bitcoin enables peer-to-peer transactions without needing a middleman.

According to our research in PlasBit, while Bitcoin has the potential to be a safe haven due to its structure, it is not without risks. You may wonder Is Bitcoin riskier than stocks? In many ways, yes, its volatility and regulatory uncertainties make it less stable. However, as the market matures and more people adopt it, Bitcoin could become a more reliable investment option during financial crises.

The Benefits of HODLing Bitcoin in the Long Term

HODLing is a term used by the cryptocurrency community (Hold On for Dear Life), consisting of buying Bitcoin and keeping it for a long period of time instead of selling during market price changes. For those convinced of Bitcoin's future role as a currency alternative, this long-term strategy could bring many advantages.

Protection Against Short-Term Volatility

Bitcoin is famous for its extremely high price volatility. Nonetheless, those who trust in the HODL long-term strategy can withstand these dips and profit from Bitcoin's history of increasing in value as time goes by. although day traders might lose money to market volatility, but long-term holders are more likely to see gains as Bitcoin becomes more widely accepted.

No Inflation

While traditional fiat money is being devalued daily, with central banks printing more and more units, Bitcoin can save you from losing your purchasing power over time. Investors by HODLing shield their wealth against inflation in the world economy.

You may ask whether investors that have a HODLing strategy know if is bitcoin riskier than stocks? Yes, they know. Still, these investors are willing to accept the risk that Bitcoin brings with it, and they will see long-term inflation-free growth in the value of their capital.

Conclusion

In this PlasBit article, we have discussed the history and invention of Bitcoin, the purposes for which it was created, and the advantages of HODLing Bitcoin. We also talked about how Bitcoin and stock are similar. We also discussed that Bitcoin may be an important investment in the future when digital currency gains dominance in the global economy.

The fact that investing in Bitcoin Bitcoin carries immense risk should not be overlooked. This is because Bitcoin has higher volatility and can have massive price fluctuations in short durations. Investors must have a good market insight and also be able to predict these events beforehand so that they are prepared. Also, note that this market takes time to deliver returns, and it is not a get-rich-quick scheme.

Each investment sector brings different benefits and risks. Each person should decide what's best for them based on their financial goals and risk tolerance. Investing in Bitcoin also requires belief in the technology and the principles behind it, such as decentralization and a future where digital assets may play a bigger role in the global economy.