Introduction to Bitcoin: How Much Is $100 Bitcoin Worth Right Now

Since its 2009 launch, Bitcoin (BTC) has been the central focus of attention in cryptocurrencies. Created by Satoshi Nakamoto, an anonymous person or group, Bitcoin emerged as a decentralized digital currency that operates without requiring a central bank or authority. Over the years, it has grown significantly in popularity, becoming widely accepted as a form of payment. As a result, it has also greatly impacted the global financial landscape, and one question is commonly asked: How much is $100 Bitcoin worth right now? As the first of its kind, Bitcoin pioneered the concept of cryptocurrency, which is now a growing market teeming with various digital currencies like Ethereum, Ripple, and Litecoin. However, Bitcoin remains the most popular and valuable cryptocurrency to date. Its remarkable growth and staying power have attracted investors and sparked numerous debates on the future of money. In this crypto guide, we will explore how to understand the value of Bitcoin and the factors affecting its value. We will also explore predictions for its future value and the challenges and benefits of investing in Bitcoin. Finally, we will touch on alternatives to investing in Bitcoin, providing you with a well-rounded understanding of this digital asset.

Understanding Bitcoin's Value

Before discussing the current value of $100 worth of Bitcoin, it is essential to understand what determines the value of the leading cryptocurrency. The value of any currency, including Bitcoin, is primarily driven by supply and demand. As more people demand a currency, its value will generally increase and drop as demand decreases. In the case of Bitcoin, its supply is capped at 21 million BTC, making it a scarce resource. Therefore, this scarcity factor plays a significant role in determining its value. Another crucial factor that affects the value of Bitcoin is its utility. Bitcoin was created to serve as a decentralized digital currency, allowing users to transact without intermediaries like banks or other financial institutions. A growing number of businesses and individuals are accepting Bitcoin as a payment type for goods and services, so its utility and, consequently, its value increases. Moreover, the public's perception of Bitcoin's value also plays an essential role in its valuation. If people believe that Bitcoin is valuable, they are more likely to buy and hold it, increasing its price. Media coverage, regulatory developments, and technological advancements can influence public perception. Therefore, it is crucial to stay informed and updated on these factors to understand the value of Bitcoin better.

Factors That Affect the Value of Bitcoin

Many factors, ranging from market demand, government regulation, technological advancements, security concerns, and competition, can influence the value of Bitcoin. These factors interplay to determine Bitcoin's value at any given time, making it a dynamic and exciting field of study and investment. Knowing about these factors can provide valuable insights for investors and anyone interested in the evolving world of cryptocurrencies and wanting an answer to how much is $100 Bitcoin worth right now.

Market demand:

Market demand is a pivotal force in determining the value of Bitcoin. The demand rises as interest in Bitcoin grows, whether for its utility as a medium of exchange or investment. This increased demand, when coupled with a limited crypto supply (as is the case of BTC, which has a capped supply of 21 million), often leads to an increase in price. As more people adopt and accept Bitcoin, its value is likely to grow in the future.

Regulation:

The regulatory environment for Bitcoin varies drastically across different countries. Government regulations can significantly impact Bitcoin's value as they can influence public acceptance and adoption. Countries that ban Bitcoin can trigger a decrease in demand, causing a decline in value. Conversely, countries that embrace Bitcoin and provide a favorable regulatory environment can stimulate public confidence, increasing demand and value.

Technological advancements:

Technological advancements significantly influence the value of Bitcoin. As the technology behind Bitcoin evolves, it can increase its value. An example is the ongoing development of the Lightning Network, a layer-two solution that aims to enhance the speed and scalability of Bitcoin transactions. Enabling faster and cheaper transactions can make Bitcoin more practical and valuable. Such technological advancements can potentially attract more users, increasing demand and, subsequently, the value of Bitcoin.

Security concerns:

Security remains a critical issue in the cryptocurrency market. High-profile hacks and thefts can drastically impact the value of Bitcoin. When a cryptocurrency exchange is hacked and coins are stolen, it can cause a decline in public confidence, decreasing Bitcoin's value. Ensuring robust and adequate security measures are in place, as we do with our crypto wallet, is crucial for maintaining and enhancing the value of Bitcoin.

Competition:

The cryptocurrency market is incredibly competitive, with numerous digital currencies striving for attention and investment. The emergence of new cryptocurrencies with innovative features can draw interest away from Bitcoin. As investors seek potential high returns from these new entrants, Bitcoin's demand could decrease, subsequently impacting its value. However, it's important to note that Bitcoin's established status and widespread recognition often help it retain its value despite the competition.

How Much Is $100 Bitcoin Worth Right Now?

The value of Bitcoin is highly volatile, experiencing significant swings in value within short periods. As such, how much Bitcoin $100 currently buys can fluctuate dramatically, depending on the timing of the purchase. For example, when this article was written, $100 Bitcoin was worth approximately 0.0035 BTC. It is worthwhile to note that the value of Bitcoin can change rapidly, even within a day. Therefore, if you plan to buy Bitcoin, keeping a close eye on the market and making informed decisions is highly recommended.

Predictions for the Future Value of Bitcoin

The future value of Bitcoin is a topic of much debate, with numerous experts providing different predictions. Some believe that Bitcoin's value will continue increasing, while others think it will eventually decline. One factor that could impact Bitcoin's future value is its increasing adoption as a payment method. If more businesses and individuals use Bitcoin for transactions, its demand and value could increase. In addition, by regularly using your PlasBit virtual crypto card and wallet, you are helping to support and build this ecosystem. Moreover, the continued development of the technology that underpins Bitcoin, such as the Lightning Network, could make it more useful and valuable. On the other hand, regulatory crackdowns or security breaches could hurt Bitcoin's value. Additionally, the emergence of new cryptocurrencies that offer more advanced features and functionalities could draw attention away from Bitcoin, potentially decreasing its value. The answer to "How much is $100 Bitcoin worth right now?" will indeed be interesting in the future.

Bitcoin Price: Using Crypto Widgets

At PlasBit, we provide a range of online tools that allow you to instantly answer the question, How much is $100 Bitcoin worth right now? These include:

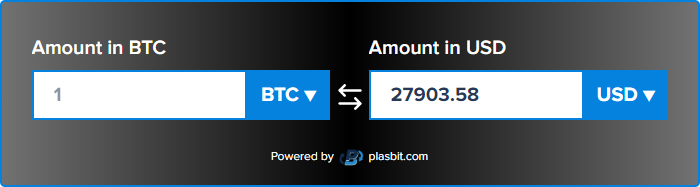

Crypto Calculator:

The default cryptocurrency for this calculator is Bitcoin, so it is a fast and easy way to work out the US dollar value of Bitcoin and its value in other currencies.

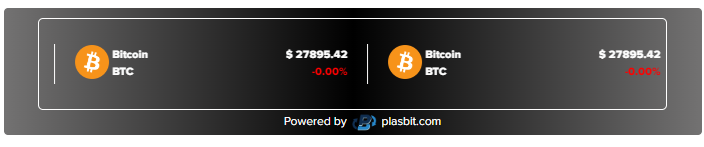

Price Ticker:

By adding Bitcoin to our Price Ticker widget display, you can see the value of BTC at a glance and know the value of the amount you hold.

Coin List:

You can customize our crypto Price Coin List widget to ensure that Bitcoin is visible and other price data relating to value can be accessed quickly, for example, Market Volume and 7-Day Trend.

At PlasBit, our freely available crypto widgets make it easy for you to assess Bitcoin's value and share this functionality with your website visitors if you so choose.

Making an Investment in Bitcoin

Bitcoin investment can be lucrative for those willing to take the risk. However, it is essential to understand the risks and benefits before investing. One significant benefit of such crypto investment is its potential for high returns. As Bitcoin's value has shown, it can experience significant growth within short periods, providing investors with substantial returns. Moreover, Bitcoin is decentralized, meaning it is not governed by a central authority such as a bank or government. This decentralization gives investors enhanced control over their investments and reduces the risk of government interference.

However, investing in Bitcoin also comes with challenges, such as a lack of regulation, potentially increasing the risk of scams and fraud.

Benefits of Investing in Bitcoin

It is essential to weigh Bitcoin investment's various risks and rewards before making any decisions. Some of the benefits include:

High potential returns:

One of the most significant benefits of investing in BTC is the potential for impressive returns. Bitcoin's price is known for its notorious volatility, which, while it may cause drastic price swings, also offers the opportunity for substantial returns on investment. In the past few years, Bitcoin has repeatedly demonstrated its capacity to provide exceptional returns, outperforming traditional investments like stocks and bonds. However, it is crucial to remember that the potential for high returns comes with considerable risk. Any prospective investors must be prepared to weather these dramatic market fluctuations.

Decentralization:

Another advantage of Bitcoin is its decentralization. Unlike traditional fiat currencies, which central banks or governments regulate, Bitcoin operates on a decentralized network. This decentralization means no central authority can manipulate BTC's value or cause inflation by producing more. As a result, investors have more control over their investments and are less susceptible to government interference. This feature also makes Bitcoin a potentially attractive investment in countries where the local currency is unstable or the government is untrustworthy.

Diversification:

Bitcoin offers a unique opportunity for portfolio diversification. With its unique characteristics and minimal correlation to other asset classes, Bitcoin can provide a hedge against the traditional financial market. Especially in turbulent times, adding Bitcoin to one's portfolio can potentially reduce risk and increase returns. This concept is because Bitcoin returns have shown to be independent of traditional market returns, providing a diversification option that can be beneficial in volatile market conditions.

Challenges of Investing in Bitcoin

Investing in Bitcoin, the world-renowned cryptocurrency, presents a unique set of challenges, a significant departure from traditional investment avenues. These challenges stem from factors inherent to the Bitcoin mechanism and the broader cryptocurrency market environment.

Volatility:

Volatility, the first and most prominent challenge, refers to the dramatic price fluctuations that Bitcoin investors often face. Unlike classical fiat currencies, the total number of Bitcoins is limited, making it susceptible to large swings in value. Influences such as media outlets, industry moguls, and market sentiment can significantly sway the price of Bitcoin, often leading to sharp increases or decreases within short periods. This high volatility can result in substantial losses and makes it difficult for investors to predict and plan for the future.

Lack of regulation:

The second challenge is the lack of precise regulation in the crypto market. Cryptocurrencies, including Bitcoin, operate in a decentralized system, meaning no central authority, such as a government or financial institution, controls their production or distribution. This lack of crypto regulation and oversight increases the risk of fraudulent activities and scams. Investors must navigate this unregulated landscape cautiously, using due diligence to avoid falling prey to malicious actors.

Security concerns:

Thirdly, security concerns in the Bitcoin market cannot be understated. Due to the digital nature of cryptocurrencies, they are susceptible to hacks and thefts. High-profile incidents of cryptocurrency theft have previously led to a drop in public confidence and, consequently, a decline in value and how much is $100 Bitcoin worth right now. The security of transactions, wallets, and exchanges is a significant issue that impacts the perceived value of Bitcoin. We help users overcome these challenges by providing a completely safe and secure Bitcoin experience whether you manage your transactions via card, crypto wallet, or money transfer.

Expert Opinions on the Future Value of Bitcoin

The future of Bitcoin continues to be a hot topic among financial experts. Though the cryptocurrency market is known for its volatility, these experts are staunch in their optimistic outlook. For example, Wences Casares, CEO of Xapo and board member at PayPal, has previously predicted that Bitcoin could reach $1 million in the next 20 years. Tim Draper, a renowned venture capitalist, maintains his forecast that Bitcoin will hit $250,000 in the future. His prediction is based on the belief that Bitcoin's decentralized nature and convenience will continue attracting more users. Chamath Palihapitiya, the founder of Social Capital, agrees with this positive outlook. He believes that Bitcoin's potential as insurance against the traditional banking system will continue to drive its value up. Anthony Pompliano, co-founder of Morgan Creek Digital, shares a similar view. He posits that Bitcoin may become a global standard of value, and this could propel its value to unprecedented heights. However, amidst this optimism, it's important to remember that the cryptocurrency market is highly unpredictable. For instance, this year, Bitcoin experienced a significant rally. Some experts had predicted a fall to much lower levels, illustrating the uncertainty inherent in this market. Despite the contrasting views, these predictions offer a glimpse into the potential future of Bitcoin. They reflect the belief that its convenience, decentralization, and potential role as a hedge against traditional banking systems could secure its place in the financial landscape in the years to come.

Using a Crypto Calculator

A crypto calculator is a powerful tool designed to convert cryptocurrencies to various fiat currencies, providing real-time financial insights for crypto investors. PlasBit crypto calculator is simple to use and offers considerable benefits for anyone engaged in the crypto world. To use our calculator, you select the type of cryptocurrency you wish to convert. In this case, it would be Bitcoin BTC, but it could be Ethereum (ETH) or any of our platform's wide range of cryptocurrencies. Next, choose the fiat currency you want to calculate, such as USD, EUR, or GBP. Input the amount of cryptocurrency, and the calculator will instantly provide the equivalent value in the selected fiat currency. The benefits of using our calculator are manifold. It provides up-to-date conversion rates, ensuring you always have the most accurate and current financial data. This data can be vital when making investment decisions or when trading cryptocurrencies. Additionally, it supports a wide range of crypto and fiat currencies, making it a versatile tool for global investors.

More to Bitcoin Than Simply US Dollar Value

Many people view it as a mistake to value Bitcoin solely in USD, which can lead to misconceptions about its true worth. One of the main reasons not to value Bitcoin in USD is that the dollar's value constantly changes. In addition, the dollar's value can be affected by various factors, including inflation, interest rates, and economic policies. Therefore, valuing Bitcoin in USD can lead to a skewed perspective on its actual value. The unique characteristics we have already explored make Bitcoin a valuable asset in its own right, separate from any traditional currency. Moreover, Bitcoin is safe to use and is increasingly being used as a means of exchange, with more and more businesses accepting it as payment. As its use as a currency grows, its value will likely be more accurately reflected by its purchasing power rather than its exchange rate with the dollar. Therefore, valuing Bitcoin solely in USD can be misleading and does not fully capture its actual worth as a global, decentralized, and limited asset. For example, it could be argued that 1 BTC in your PlasBit wallet is worth exactly that, 1 BTC.

Staying Up-To-Date With the Value of Bitcoin

Bitcoin's introduction has undeniably caused waves in the global financial landscape, offering a credible alternative to conventional currencies and transaction systems. Thus, comprehending Bitcoin's value and the factors influencing it is critical for any potential investor contemplating this virtual asset. As we've delved into throughout this cryptocurrency guide, the value of a $100 Bitcoin can see substantial fluctuations, making investments in Bitcoin both risky and rewarding. Consequently, it's crucial to undertake Bitcoin investments with a certain level of caution and to consider other avenues for investing in digital currencies indirectly. Moreover, it's paramount to maintain a well-informed understanding of the latest trends and developments within the cryptocurrency market, which can help navigate its inherent volatility and uncertainty.