The global cryptocurrency market has grown significantly in the last few years, and Latvia has become a prominent player in this changing field. Understanding the process, regulations, and community dynamics is crucial for individuals seeking to exchange their Bitcoin for Fiat currency like the euro and wire it to their bank accounts in Latvia. So, how do I sell Bitcoin in Latvia? For instance, our website offers a great “bank wire” feature that allows users to exchange their Bitcoin for cash. Latvia is one of the countries that is supported by PlasBit, giving Latvian consumers a simple way to transfer their digital assets into fiat money. This article will cover several topics, including the answer to the question “How to sell Bitcoin in Latvia,” regulatory frameworks, insights into the thriving community, the adoption history of Latvia, and alternate ways to convert Bitcoin to money.

Can you exchange Bitcoin in Latvia?

Users can buy, sell, and trade their digital assets, including Bitcoin on cryptocurrency exchanges. But, how to transfer crypto to a bank account is a question many crypto users have. A straightforward response to this question is to use the “Wire” feature in PlasBit. Below is a detailed explanation that will walk you through the process of successfully exchanging Bitcoin to a bank account using this designated feature. To ensure a successful wire, kindly confirm that you currently have Bitcoin in your PlasBit wallet.

How to exchange Bitcoin for Fiat currency using Plasbit’s Wire?

Step 1: Log in to your PlasBit account

Open your web browser and go to the official website of PlasBit. Go to the login page and insert your username and password to gain access to your account. Start the procedure of cashing out the Bitcoin in your bank account.

Step 2: Locate the “Wires” section

After completing the logging process, locate the “Wires” section towards the left side of the page. You are then automatically redirected to a page that handles and manages bank wire transfers. You can find all the information and tools needed to complete the wiring process on this page.

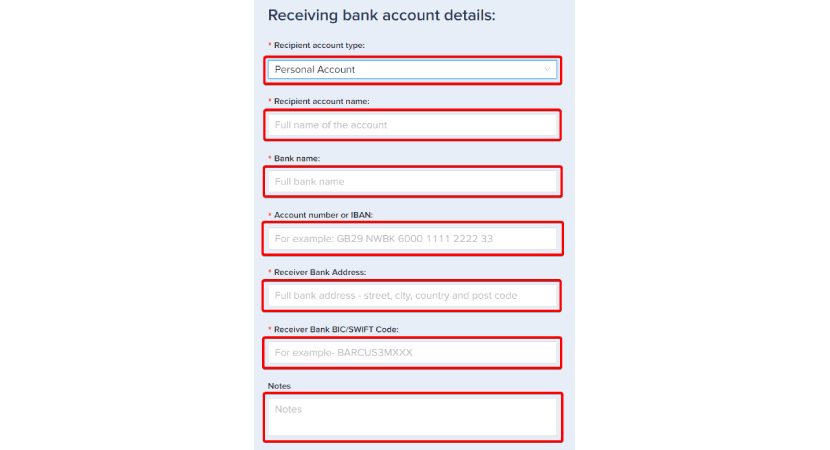

Step 3: Providing the Recipient’s Bank Account Details:

Enter the recipient's bank account information in the Bank Wire Transfer section, including the account number or IBAN, account type, bank name, receiver bank address, receiver bank BIC/SWIFT code, and other pertinent transfer notes.

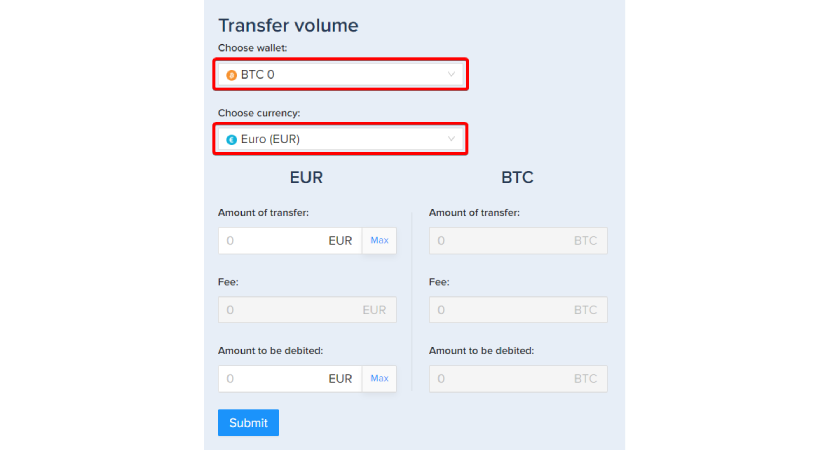

Step 4: Selecting the Token and the Fiat Currency:

To sell Bitcoin for euros, navigate to the "Wires" section and choose a token (in this case Bitcoin) and the desired fiat currency (euros) in which it should be converted and transferred to your bank account. Our system will calculate the amount, number of Bitcoins, fees, and total money received. To complete the wire, ensure you have enough Bitcoin in your PlasBit wallet to cover the required transfer amount.

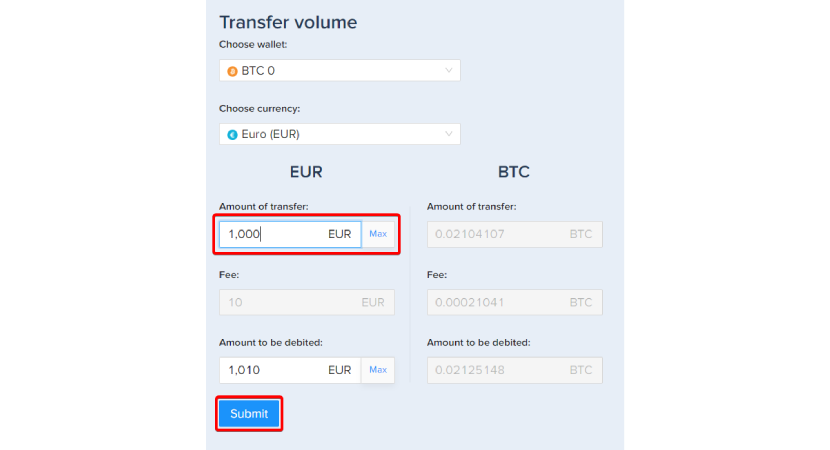

Step 5: Providing the Amount You Want Transferred:

After selecting the token and the fiat currency, select the amount you want to transfer to your bank account and click the "Submit" button to receive confirmation of the deducted cryptocurrency amount. You can enter the amount you wish to transfer, in which case the fees will be applied, or the amount you wish to deduct from your balance (including fees), in which case the amount you enter will be the amount that is transferred to your account after the fees are subtracted.

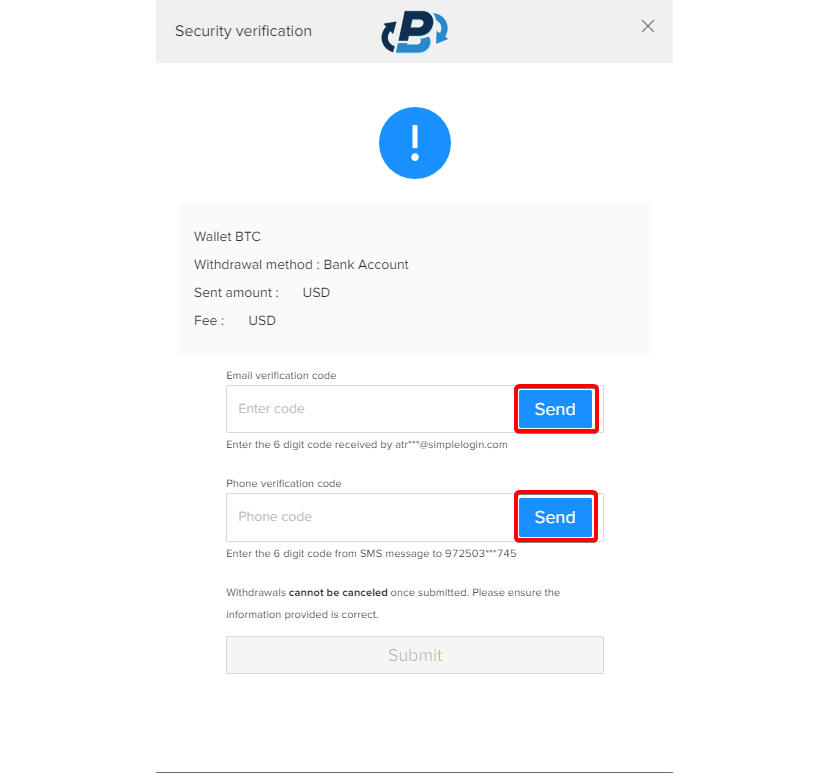

Step 6: Security Verification:

You will get a verification code depending on the type of security verification procedures you have enabled. It can be a code delivered to your phone number or can reach you via email. Get the verification code, then enter it precisely in the designated space on the verification page. Click “Submit” to send the wire transfer request.

Step 7: Confirmation of Wire Transfer:

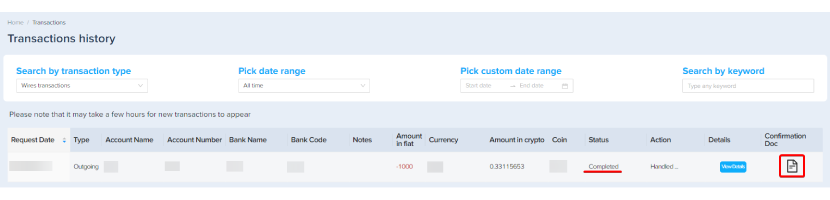

Once your wire has been successfully validated, you will receive an email about submitting the request for a bank wire to our website. Once we approve the wire from our side, you’ll receive another email showing the confirmation of the same.

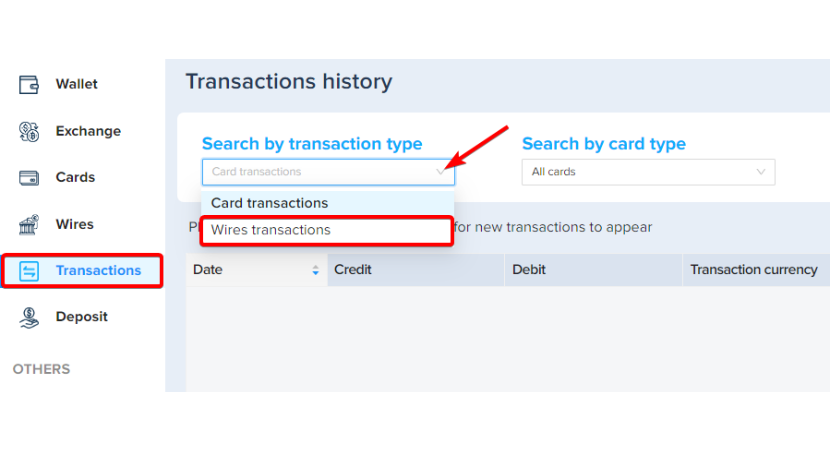

You can visit the transaction section to check the status of the transaction and to see the confirmation document from the bank.

Is crypto regulated in Latvia?

After covering the crust of this article, i.e., “How do I sell Bitcoin in Latvia? '', let’s learn about the regulations on crypto in this country. In Latvia, cryptocurrency regulations seek a balance between encouraging innovation and protecting investors from the risks connected with digital assets. Every business in Latvia must follow the protocols provided by AML and KYC.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations:

All cryptocurrency exchanges and service providers in Latvia must abide by strict KYC and AML guidelines. That means putting in place procedures for customers' due diligence, confirming users' identities, and keeping an eye out for unusual conduct in transactions. Following these guidelines contributes to less illicit activity, such as money laundering and funding for terrorism. Customer due diligence, transaction monitoring, suspicious activity reporting, and the creation of internal controls and processes to prevent money laundering are all critical components of AML compliance. Similarly, financial institutions and cryptocurrency exchanges may verify their customers' identities, analyze their risk levels, and detect any potential red flags or suspicious activity by implementing the KYC processes.

European Union Directives:

As a state member of the European Union (EU), Latvia aligns its cryptocurrency regulations with EU directives and guidelines. The EU has been proactive in addressing the regulatory challenges posed by cryptocurrencies, particularly in combating the financing of terrorism (CFT). CFT procedures are implemented by regulatory authorities and financial institutions through risk assessments, transaction monitoring, and collaboration with law enforcement agencies to detect and prevent suspicious financial activities related to terrorism.

Overall, Latvia's legal framework for cryptocurrencies indicates a commitment to fostering innovation while reducing risks and maintaining conformity with international norms. Latvia intends to provide a favorable environment for the cryptocurrency sector to establish and develop within its borders by providing clear regulatory frameworks and encouraging discussion between industry players and regulatory agencies.

Taxation on Bitcoin in Latvia

Many individuals all over the world refrain from paying taxes not only on cryptos but also on their regular income as well. There are indeed some crypto-friendly countries in terms of taxation, but Latvia is not one of them. Cryptocurrency transactions in Latvia are taxed, with the tax treatment varying according to the type of the transaction and the taxpayer's status. Capital gains from cryptocurrency trading are generally taxed as personal income, although firms engaging in cryptocurrency-related activities may be subject to corporate income tax. Furthermore, VAT (value-added tax) may be levied on certain cryptocurrency transactions, even though the EU has said that traditional cash conversion for cryptocurrency or vice versa is free from VAT.

Capital Gains Tax:

In Latvia, profits from the exchange or sale of cryptocurrencies, such as Bitcoin, are subject to capital gains tax. The capital gains tax rate varies depending on the cryptocurrency's holding term and the taxpayer's income tax rate. Any capital gains will be taxed at the taxpayer's ordinary rate if the cryptocurrency is held for less than a year before being sold or exchanged. Similarly, the capital gains may be subject to a lower tax rate if the cryptocurrency is held for more than a year before being sold or traded.

Corporate Income Tax:

Businesses participating in cryptocurrency-related activities, such as cryptocurrency exchanges, mining operations, or blockchain technology research, may be subject to corporate income tax in Latvia. Corporate income tax is charged on the taxable gains made by the company, including income from bitcoin trades and operations. Latvia's statutory corporate income tax rate is 20%; however, qualifying enterprises may benefit from tax breaks and deductions.

Value-Added Tax:

The European Union has issued recommendations on the VAT treatment of cryptocurrencies, including Bitcoin. According to EU laws, the traditional cash conversion into cryptocurrencies and vice versa is generally VAT-exempt. VAT may still apply to certain cryptocurrency-related transactions, such as the selling of products or services in exchange for cryptocurrencies, depending on the circumstances and applicable Latvian regulations. VAT may also apply to fees or charges by Bitcoin exchanges or service providers to facilitate cryptocurrency transactions.

To summarize, Bitcoin taxes in Latvia include capital gains tax, corporate income tax for firms, and possible VAT consequences. Understanding and adhering to Bitcoin tax legislation is critical for people and organizations engaging in cryptocurrency transactions to meet their tax obligations and avoid potential penalties or legal implications.

How big is the crypto community in Latvia

The crypto community in Latvia is diverse and developing. Latvia has an active crypto community that communicates via numerous internet platforms, such as Telegram and Twitter. These forums act as conversation, knowledge-sharing, and networking hubs for cryptocurrency enthusiasts, traders, and developers passionate about blockchain technology and cryptocurrencies. Here's a detailed overview of the crypto community in Latvia, along with specific examples of notable initiatives and activities:

CryptoLatvia :

The “CryptoLatvia” Telegram group serves as a central hub for cryptocurrency enthusiasts in Latvia to connect, share knowledge, discuss market trends, and organize local meetups. The CryptoLatvia group's members have active conversations about several topics related to cryptocurrencies, such as investment prospects, trading tactics, and regulatory developments.

For those interested in cryptocurrencies and blockchain technology, the club offers a great networking possibility and cultivates a community feeling among its members.

Blockchain Startups :

Blockchain Startups is a small Facebook group that enthusiasts of cryptocurrencies in Latvia can join to share their market analysis and charts about current trends. The best thing about the group is that they occasionally host events to connect with other enthusiasts and people who share their ideas. This group also helps the newly joined members get settled in the crypto environment and the group. They also encourage the newbies to take part in all the conversations and meetups so that they can have the opportunity to learn new things.

Latvian Crypto Events and Meetup:

The Latvian crypto community hosts frequent events, seminars, and meetups to encourage industry stakeholders to network, learn from one another, and work together. Blockchain conferences, cryptocurrency seminars, and developer meetups are among the events that draw people from Latvia and its neighboring countries, promoting innovation and information sharing within the crypto ecosystem. The “Blockchain Innovation Conference” and the “CryptoLatvia Meetup Series,” which include talks by professionals in the field, panel discussions, and interactive workshops on blockchain technology and cryptocurrency-related subjects, are noteworthy examples.

Cryptocurrency Adoption Initiatives:

The Latvian cryptocurrency community is actively pushing for using cryptocurrencies in e-commerce, retail, and hospitality, among other areas of the economy. Businesses in Latvia, from internet retailers to restaurants and cafés, have begun accepting Bitcoin payments, providing customers additional options and encouraging broader use of cryptos. Projects like the “Crypto-friendly Merchant Directory” and the “Crypto Payments” platform highlight companies that take cryptocurrencies and contribute to the public's understanding of the advantages of utilizing digital assets in regular transactions.

Blockchain and Cryptocurrency Startups:

Latvia is home to blockchain and cryptocurrency businesses that are upending and revolutionizing long-standing industries. Startups in these industries, such as non-fungible tokens (NFTs), decentralized finance (DeFi), and blockchain-based supply chain management, are emerging as key players in the global blockchain ecosystem. Payment processors, tokenization platforms, and decentralized applications (DApps) that use blockchain technology to develop novel business strategies and solutions are a few examples of blockchain firms in Latvia.

The Latvian crypto community is distinguished by its vibrancy, inventiveness, and spirit of cooperation, as people and institutions cooperate to promote the acceptance and comprehension of blockchain technology and cryptocurrencies. The Latvian crypto community contributes to the expansion and development of the worldwide blockchain ecosystem through events, meetups, adoption campaigns, startups, and online communities. Aside from all these communities, some university courses educate the students in Latvia about the basics of cryptocurrencies, their advantages and disadvantages, and topics like crypto investments and crypto trading.

The History of Cryptocurrency Adoption in Latvia

Several variables, including shifts in consumer attitudes toward digital assets, technological breakthroughs, and legislative changes influence the increasing acceptance of cryptocurrencies in Latvia. Although Latvia's adoption of cryptocurrencies may not have progressed as quickly as in some other nations, there has been a noticeable increase in interest in and advancement of cryptocurrencies.

The evolution is easily visible since, in the beginning, there were very few firms or perhaps no companies in Latvia that would accept cryptocurrency payments. But now, from small coffee shops to large real estate firms, they have begun to take cryptocurrency payments, suggesting a slow but steady assimilation of digital assets into the national economy.

When Bitcoin first debuted in 2009, there wasn't much knowledge or comprehension of cryptocurrencies in Latvia throughout the first few years. A few computer enthusiasts and early adopters started playing around with Bitcoin mining and trading, attracted by the promise of decentralized digital currency and blockchain technology. However, there was no widespread acceptance of cryptocurrencies, and they were considered a risky investment with a murky legal landscape.

After a few years (2016-19), it became apparent that advancements and regulatory clarity had started to influence Latvia's cryptocurrency adoption environment. To reduce the dangers connected with digital assets, the Financial and Capital Market Commission (FCMC) and other regulatory bodies in Latvia, with the government, began addressing the legal status of cryptocurrencies. The implementation of know-your-customer (KYC) and anti-money laundering (AML) standards for cryptocurrency exchanges and service providers occurred, even while specific rules regarding cryptocurrencies were still under development. On a small scale, companies and entrepreneurs in Latvia began looking into accepting cryptocurrency as payment for goods and services.

Talking about the present situation, the acceptance and development of cryptocurrency infrastructure have increased in Latvia in line with the global boom in interest in cryptocurrencies. Exchanges and platforms for cryptocurrencies have extended their offerings to include Latvian consumers, allowing them to purchase, sell, and trade their digital assets. Companies in Latvia have started accepting cryptocurrency payments, including real estate agents, hotels, and internet merchants, indicating how digital assets are becoming increasingly accepted in traditional trade. The growth of the cryptocurrency ecosystem has been aided by the rise of blockchain startups and tech firms in Latvia, emphasizing innovation in fields like decentralized finance (DeFi), non-fungible tokens (NFTs), and blockchain-based apps.

In conclusion, Latvia's acceptance of cryptocurrencies has come a long way, from early experimentation and unclear regulations to rising interest, expanding infrastructure, and well-defined rules and regulations. Despite ongoing difficulties, Latvia is well-positioned to incorporate blockchain technology and cryptocurrencies into its expanding digital economy.

Other alternatives for selling Bitcoin in Latvia

When it comes to selling Bitcoin in Latvia, apart from conventional cryptocurrency exchanges, other alternative approaches provide customers with ease and flexibility. Peer-to-peer (P2P) networks, Bitcoin ATMs, and cryptocurrency debit cards are some of these substitute techniques.

Crypto ATMs:

Users may purchase or sell Bitcoin with cash, debit, or credit cards at Bitcoin ATMs, commonly referred to as BTMs or cryptocurrency ATMs. The availability of Bitcoin ATMs, which are present in public spaces like shopping malls, convenience stores, and airports, enables easy access to cryptocurrency transactions. Users must choose the "sell Bitcoin" option on the machine, input the desired selling quantity, and then follow the on-screen instructions to complete the transaction to sell Bitcoin at a Bitcoin ATM. For customers in Latvia who would have their cryptos trade in actual currency, Bitcoin ATMs provide instantaneous cash transactions and anonymity, even if their costs may be higher than those of online exchanges.

Peer-to-Peer (P2P) Trading Platforms:

Peer-to-peer networks allow buyers and sellers to deal directly with each other without the need for a middleman. Users may set up ads to sell Bitcoin at the price and with the payment method of their choice— for example, online bank transfer or cash deposit. P2P networks typically incorporate escrow services, which hold Bitcoin in custody until both parties agree the transaction is complete, ensuring transaction security.

Crypto Cards:

With cryptocurrency debit cards, customers may exchange their Bitcoin for fiat money (like euros) and use it at any retailer that accepts credit or debit cards. Like regular debit cards, users may load their cryptocurrency debit card with Bitcoin via an exchange account or connected wallet and use it to make transactions. Debit cards with cryptocurrency integration come with extra features, including worldwide spending capabilities, cashback incentives, and easy connection with mobile applications for balance and transaction management. Companies who give crypto cards provide worldwide debit cards branded with the Visa or Mastercard logos. You can also use these cards to pay your bills, which is a great advantage of having them.

In conclusion, users in Latvia now have more choices for converting their Bitcoin into fiat money thanks to new, user-friendly options adaptable to several needs and preferences. Sellers can utilize any method that best satisfies their needs for speed, confidentiality, and user-friendliness, including debit cards, peer-to-peer networks, and Bitcoin ATMs.

Factors to consider when choosing a method:

There are a few crucial things that people should think about before selling Bitcoin in Latvia to guarantee a seamless and profitable transaction. These variables include security, legality, costs, taxes, and individual preferences.

Security and Safety:

Give security measures a priority to safeguard your data and Bitcoin holdings. You can use reliable and secure channels, like dependable OTC brokers, P2P networks with escrow services, or trustworthy cryptocurrency exchanges while selling Bitcoin. Adopt robust account security procedures, such as storing private keys safely, utilizing two-factor authentication (2FA), and keeping distinct wallets for transactions and storage. Watch out for phishing efforts, fraud schemes, and scams that might target Bitcoin users. Before completing a transaction, confirm the platforms' authenticity, the counterparties' identities, and the results of your due diligence.

Fees and Costs:

Consider all the costs involved with selling Bitcoin, such as exchange fees, withdrawal fees, conversion fees, and other charges imposed by the platform or technique of choice. Examine fee schedules on many platforms to determine which selling Bitcoin option is the most economical, accounting for variables like the number of transactions, currency pairings, and modes of payment. Keep an eye out for additional expenses or hidden fees that can affect the transaction's overall profitability.

Tax Implications:

Apart from several crypto tax-friendly countries, recognize the financial implications of selling Bitcoin in Latvia since there are different types of taxes charged in this country, including the capital gains tax that applies to any profit made from the venture. By speaking with an accountant or tax expert, find out what taxes you owe and that you're in line with local tax rules and regulations. To make tax reporting and capital gains or losses computation easier, keep thorough records of all your Bitcoin transactions, including buy and sell prices, dates, and volume of transactions.

Conclusion:

In conclusion, PlasBit's "Wire" feature can be one of the most convenient and efficient answers to the question, "How do I sell Bitcoin in Latvia?"For those wishing to sell their Bitcoin holdings for euros or USD, Latvia offers a welcoming environment with a legal structure, a thriving cryptocurrency industry, and several selling alternatives. People can confidently and quickly navigate the landscape of cryptocurrency by adhering to the above-described systematic counsel and continuing their knowledge of legislative improvements and taxation tactics.