In the world of the dark web and cybercrime, one of the most intriguing stories is that of the early Bitcoin figure known under the pseudonym ‘Loaded’. He is remembered for his presence on Bitcointalk forums, flaunting his wealth, and engaging in bold verbal exchanges, including a bet with ‘Bitcoin Jesus’ Roger Ver during the Bitcoin blocksize war. So, the question arises, who is Loaded Bitcointalk? A trail of Bitcoin transactions shows it was, in fact, Jimmy Zhong, the so-called hacker who was arrested for stealing over 50,000 Bitcoin from the infamous Silk Road marketplace. The revelation of his real identity was a result of technical missteps, a flashy lifestyle, and a bloated ego, which led to a historic wager with Roger Ver in 2013. The wager eventually contributed to the creation of Bitcoin’s fork called Bitcoin Cash (BCH) and other projects, which continue to capture the attention of crypto enthusiasts.

Who is Loaded Bitcointalk: The Mystery Uncovered

Jimmy Zhong might not ring a bell for many dabbling in Bitcoin’s history, but you could say that his likely pseudonym, ‘Loaded,’ is a bit legendary. Active in the early days of the first-ever cryptocurrency, Loaded used to boast about his wealth and frequently voice opinions that polarized the community.

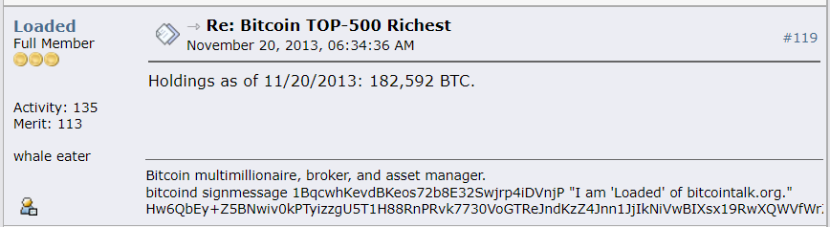

(Image credit: Bitcointalk)

On Bitcointalk, Loaded wasn’t shy about displaying his influence. He presented himself as a “Bitcoin multimillionaire, broker, and asset manager.” Per FBI investigations (and Zhong’s own guilty plea), however, most of his wealth came from a daring Silk Road hack, where he exploited vulnerabilities to swipe a whopping 51,680 Bitcoin in 2012. His posts would often hint at intense involvement in the crypto world, offering wisdom laced with bravado. The revelation of who is Loaded Bitcointalk shocked the crypto community, adding an extra layer of intrigue to his forum persona.

The posting history reveals a sharp wit and an understanding of Bitcoin’s potential, even as his criminal activities eventually caught up to him thanks to the mistakes he made while trying to fit in and impress people, particularly women.According to U.S. Attorney Damian Williams, who announced the historic $3.36 billion cryptocurrency seizure in 2021 and Zhong’s conviction in November 2022 “James Zhong committed wire fraud over a decade ago when he stole approximately 50,000 Bitcoin from Silk Road. For almost ten years, the whereabouts of this massive chunk of missing Bitcoin had ballooned into an over $3.3 billion mystery. Thanks to state-of-the-art cryptocurrency tracing and good old-fashioned police work, law enforcement located and recovered this impressive cache of crime proceeds. This case shows that we won’t stop following the money, no matter how expertly hidden, even to a circuit board in the bottom of a popcorn tin.”

“Hold on, what’s this about a popcorn tin?” - you may ask. Well, thanks to Zhong’s series of technical mistakes and a flamboyant lifestyle that included careless association with whomever, the law enforcement managed to find a single-board computer with private keys for stolen Bitcoin hidden inside - wait for it - a Cheetos popcorn tin. Furthermore, the Special Agent in Charge of an IRS Criminal Investigation unit, Tyler Hatcher, explained at that time that Zhong had “executed a sophisticated scheme designed to steal bitcoin from the notorious Silk Road Marketplace.” After this, Hatcher said that Zhong had “attempted to hide his spoils through a series of complex transactions which he hoped would be enhanced as he hid behind the mystery of the ‘darknet.’ Zhong hacked Silk Road by discovering a glitch that allowed him to withdraw more funds than what was initially deposited. This was activated by repeatedly double-clicking the withdraw button, which confused the site’s system and further abused it by creating multiple accounts on the platform and repeating the process. Exploiting this glitch is called a Race Condition attack, as well as a Time of Check to Time of Use, or TOCTTOU attack. It takes advantage of the requirement for computing systems to execute certain tasks in a specific sequence, which involves a small period of time between them. Thanks to his technical expertise, Zhong seized the opportunity and managed to siphon massive amounts of Bitcoin from Silk Road between 2012 and 2014.

For more on Jimmy Zhong’s Silk Road escapade, check out PlasBit’s deep dive into the 51,680 Bitcoin heist. Alas, Zhong’s lifestyle and association with questionable individuals played a role in his eventual demise. On the night of March 13, 2019, he called the local police department in panic because someone had stolen hundreds of thousands of crypto (irony can be pretty ironic sometimes) from his house in Athens, Georgia. Per a recording obtained by CNBC, the then 28-year-old computer scientist told the Athens-Clarke County Police dispatcher, “I’m having a panic attack” upon discovering the theft, even though he turned down an ambulance. Instead, he tried to explain the situation by saying he was an “investor in Bitcoin, which is like an online thing.” As Athens police failed to make any progress in the case (remember, this industry was still a mystery to many in the mainstream), Zhong turned to local private investigator Robin Martinelli. A former sheriff’s deputy and owner of Martinelli Investigations in nearby Loganville, Georgia, she wasn’t exactly a crypto expert.

The surveillance video of the thief (Image source: CNBC / Athens-Clarke County Police)

But she did her best - and eventually succeeded. Carefully examining Zhong’s massive video surveillance archive for his home, especially the footage from the night of the crime, she spotted a slender male figure breaking in. The man seemed to know his way around Zhong’s house, leading Martinelli to conclude it was someone known to him.

The thief entered Zhong’s home through a window (Image source: CNBC / Athens-Clarke County Police)

Martinelli proceeded by surveilling Zhong’s friends, scouring their social media, conducting background checks, following them, and even putting trackers on their cars. She described these people as “very, very casual, plastic, not really caring, maybe using Jimmy a little bit.”Eventually, she zeroed in on one suspect in particular, who she believed had stolen 150 Bitcoin (worth close to $600,000 at the time) from Zhong, but he didn’t want to accept that someone close to him could have betrayed him. As the PI recalled “He would get upset when I would kind of mention somebody would had to have known where this cash was. (...) Jimmy wanted to be loved. Jimmy wanted friends.”

How Loaded got caught

Zhong’s 2012 hack captured the attention of IRS investigators, but they couldn’t deduce his identity. This was because he transferred funds from one account to another, scraped some away, and pushed portions of it through tools like cryptocurrency ‘mixers.’ These tools jumbled the tokens together, making it harder to trace his transactions while obscuring the origin of the Bitcoin he spent. Finally, Zhong made a tiny yet catastrophic mistake - transferring around $800 worth of crypto to a crypto exchange that followed established banking standards, which included the KYC (know-your-customer) processes requiring account holders’ real names and addresses. This transaction was picked up by Chainalysis, a blockchain analytics company that was tracing the wallets containing the stolen Silk Road assets. Although the transaction took place six months after Zhong’s call to the local police, this still wasn’t enough to connect him to the Silk Road heist.

To this end, the IRS CI special agent Trevor McAleenan and Shaun MaGruder, the CEO of a cyber intelligence company BlockTrace, joined forces with Lt. Jody Thompson of the Athens-Clarke County Police Department, who told CNBC that “I got a call from an IRS agent. And he said, ‘Can I come by and speak to you about Jimmy?’ And I was like, sure, I remember this case.” Together, they hatched a plan that involved telling Zhong they were investigating the theft he reported. He let them into his house and even opened his laptop for them, showing them the millions of dollars in Bitcoin he owned. In MaGruder’s words “Lo and behold, he had $60 or $70 million worth of Bitcoins right there next to us.”

This was the evidence that the investigators were on the right track and enough for a federal search warrant for Zhong’s lakefront home in Gainesville, Georgia. On November 9, 2021, they returned, but this time, they had a large squad of officers with them and discovered a popcorn tin with a computer hidden inside that held millions of dollars worth of Bitcoin. Using sniffer dogs trained to detect electronics, they also found a safe buried in concrete under a basement floor tile, containing bars of silver and gold, stacks of cash, physical bitcoins minted in the early years of the crypto industry, and what is arguably the best part - a wallet with Bitcoin from the original hack of Silk Road in 2012.

Zhong’s basement floor safe (Image source: Gulf News)

But aside from the evidence they were looking for, agents discovered something else about Zhong. Back in the early days of Bitcoin, as far as 2009, he was among a small group of early coders who worked to develop and improve the technology. As part of this group, he contributed to the original Bitcoin code and provided ideas to the early developers on important topics like how to reduce blockchain size. As special agent McAleenan stated “He is one of the, as we dubbed it, the original gangsters, OGs, as far as Bitcoin core software developers. He had been in this space for quite a while.” As his lawyers explained, Zhong had successfully mined “a couple of hundred coins per day” in and around 2009, having learned about Bitcoin mining when he entered the University of Georgia on a prestigious HOPE Scholarship. This way, he made his first substantial income.

Ultimately, Zhong was charged with wire fraud, pleaded guilty, and sentenced to one year and a day in federal prison. In court, he expressed “shame and remorse”, and told the judge that he “always knew what I did was wrong.” Commenting on the fact that he hid his crimes as Bitcoin soared in value, he said, “I think I buried my head in the sand. (...) It made me feel important and worth something.” Zhong’s request for no jail time was denied, but the Justice Department agreed on the lenient sentence due in part to his autism spectrum disorder diagnosis (confirmed by a doctor), troubled upbringing, young age, and the assistance he provided in recovering the billions of dollars in Bitcoin. In their sentencing memo, his lawyers argued that while he had no right to the stolen Bitcoin, neither did Silk Road.

According to them, the marketplace wasn’t a victim “in the true sense of the word” under the Mandatory Victims Restitution Act. On top of that, they pointed out that Silk Road’s imprisoned founder, Ross Ulbricht, had contacted Zhong over the platform’s messaging service to ask him how he took the cryptocurrency. Ulbricht never asked for him to return it - and sent more, unsolicited. However, U.S. District Judge Paul Gardephe begged to differ with such an interpretation of a victimless crime. As he pointed out, although he was granting leniency to Zhong because of the “truly unique circumstances” in the case, he still wanted to deter other would-be crypto criminals “While the victim in this case happened to be a criminal enterprise, the victim tomorrow could be a legitimate business.”

The Bet That Shook Bitcointalk

One of ‘Loaded’s’ most interesting moments came during the height of the Bitcoin blocksize debate. The forum was abuzz with discussions about scalability, and Bitcoin Unlimited, a protocol designed to increase blocksize limits dynamically, emerged as a proposed solution to transaction bottlenecks and rising fees. Indeed, Bitcoin Unlimited was imagined as a fork from the Bitcoin blockchain, one that would facilitate the processing of more transactions and lower fees.

It would make this happen by allowing for an increase in the blocksize and miners stepping up to increase capacity. It was never initiated, though continued discussion later resulted in other forks. Among Bitcoin Unlimited’s most vocal proponents was Roger Ver, also known as ‘Bitcoin Jesus.’ His advocacy sparked a discourse on the issue, with feverish arguments exchanged and critics questioning whether BU could deliver on its promises. Amid the heated debate, ‘Loaded’ challenged Ver to put his money where his mouth was.

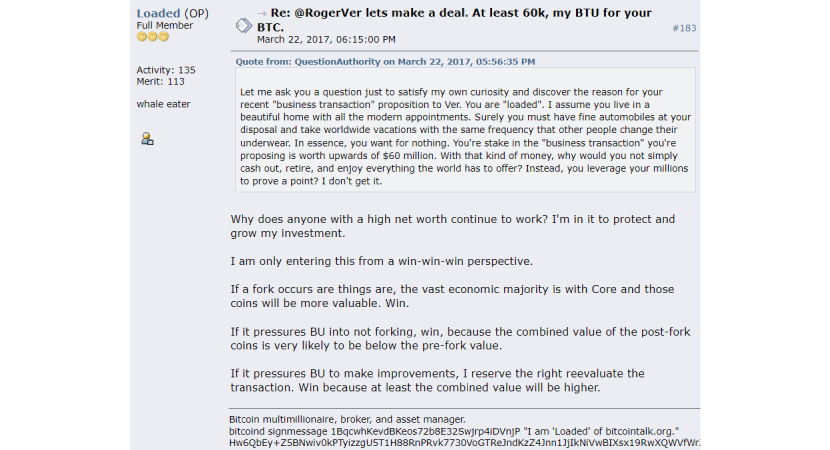

Namely, he would trade “at least” 60,000 BTU for 60,000 BTC. The proposal, posted on the Bitcointalk forum, was simple “@RogerVer lets make a deal. At least 60k, my BTU for your BTC.” Shortly after, he further explained, “60K is personal holdings, possibly up to an additional 70K in client funds depending on their sentiment, which pretty strongly leans Core.” He also asked for ideas on escrow and “an atomic swap method,” adding “no split, no transaction. If there is a split, I’d love to double up.” Interestingly, Loaded also extended his offer to Jihan Wu, the CEO of Antpool, one of Bitcoin’s largest single mining pools, stating that it was a “vote of no confidence in the Bitcoin Unlimited software and development team as it currently stands.”

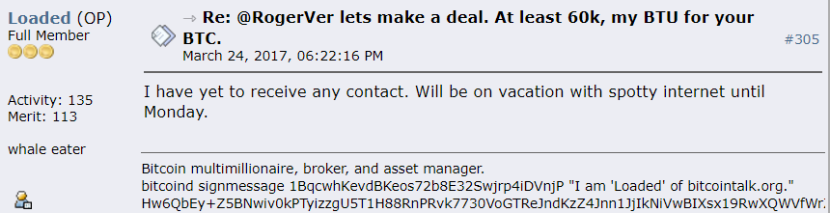

(Image credit: Bitcointalk)

The community’s response was electric. Some saw it as a bluff, others a calculated power move, and some as a trolling spectacle. Reddit threads exploded with debates and speculation as everyone wondered who ‘Loaded’ really was. On Ver’s part, he seemed to be open to the wager, replying to Loaded “This sounds like a great deal for both of us. I look forward to ironing out the exact details and terms. I'm super busy for the next 48 hours, but would love to connect after that.” However, Zhong didn’t appear to follow up on the offer and vanished from the forum after stating he was going on a vacation but never returning.

(Image credit: Bitcointalk)

Some believe this was due to getting scared after a post on Reddit seemed to point in the right direction, threatening to unravel his real identity.

Roger Ver’s Role in the Blocksize War

To fully comprehend the importance of this wager, we first must dive into Roger Ver’s role in the blocksize war. A libertarian and early Bitcoin investor, Ver advocated the idea of Bitcoin as ‘peer-to-peer electronic cash.’ When it became apparent that Bitcoin’s scalability issues had to be addressed, Ver threw his weight behind Bitcoin Unlimited. At one point, he even publicly stated he would dump his Bitcoin holdings to buy “more useful” Bitcoin Unlimited, dismissing the Core chain and all other proposals, including SegWit - the alternative capacity solution.

In an interview with MadBitcoins in March 2017, he said “I will sell my coins on the slow, expensive Core chain and use the proceeds from that [...] to buy some of the more useful Bitcoins because Bitcoin Unlimited coins will be so much more useful.” In addition to accusing Bitcoin Core of being sluggish and expensive, Ver also likened SegWit to “going to a barber shop” instead of drinking water when dehydrated. As he told Bloomberg “Say you haven’t had any water to drink for a day and a half, and you also need a haircut. Do you drink some water or go to the barber shop? SegWit is like going to the barber shop.” To learn more about the crypto industry’s pioneers like Roger Ver, explore PlasBit’s profiles of key Bitcoin figures.

The Blocksize War and Bitcoin Unlimited

The concept of Bitcoin Unlimited, seeking to address Bitcoin’s scalability issues by allowing miners to set their own blocksize limits, originated in 2015 when Peter Rizun introduced it on Bitcoin Forum. Seeing the interest and support it received, he continued working on and promoting it, as evident from his blog posts from 2016 to 2019. In time, BU managed to gain traction among miners, at one point even overtaking SegWit as a favored solution, but not without deeply dividing the Bitcoin community. Supporters saw it as a practical solution to network congestion, while the other side feared significant security, instability, and centralization risks. For instance, Jihan Wu announced at the time that his platform planned to support only Bitcoin Unlimited in the future. Meanwhile, the former Bitcoin COO, Samson Mow, argued that BU was “essentially someone jumping off a train in hopes of getting the train to change it’s [sic] direction.”

(Image credit: X)

More than just a technical debate, this battle over Bitcoin’s future eventually led to the creation of Bitcoin Cash (BCH) in August 2017, with Ver as its de facto spokesperson. And Bitcoin Unlimited? It joined the BCH project and created a client for BCH, changing its name to BCH Unlimited. Though Bitcoin Unlimited ultimately failed to gain widespread adoption, its principles lived on in Bitcoin Cash. With an 8 MB blocksize at launch, BCH embodied the vision of fast, low-fee transactions that Ver and others championed, while most other miners remained on the network that retained its blocksize limit at 1 MB. In November 2018, BCH underwent another fork (not without criticism itself) and split into Bitcoin Cash ABC (BCHA) and Bitcoin Cash SV (Satoshi Vision).

The Unlimited team went with the former, which was fully rebranded to eCash (XEC) in July 2021 and modified its default unit so that 1,000,000 XEC equals 1 BCHA but without any other changes to the blockchain. Therefore, Bitcoin Unlimited today supports XEC, the native and utility token for the eCash ecosystem. Fun fact: In 2022, Bitcoin Unlimited launched Nexa (NEXA), a “programmable digital value protocol pushing the limits of traditional blockchain.” Specifically, Nexa relies on ‘Nexapow,’ a unique algorithm based on the proof-of-work (PoW) protocol, and operates using a similar block reward structure as Bitcoin, including halvings every four years. If you’d like to learn more about Bitcoin’s early years, then PlasBit’s article on Martti Malmi should find its way to your reading list.

Legacy of ‘Loaded’ and the Wager

The saga around who is Loaded Bitcointalk and his wager with Roger Ver gives a brief insight into Bitcoin’s chaotic formative years. Its early history is marked by controversy, verbal skirmishes, and larger-than-life (often ending up as notorious) personalities. Zhong’s audacious bet and the controversy it sparked also illustrate the ideological divides that intertwined with Bitcoin’s turbulent path, from the blocksize debates to the emergence of Bitcoin forks like Bitcoin Cash and beyond. For those intrigued by the ever-changing and constantly growing world of cryptocurrencies and curious to learn more about its history, you can do so in the different articles on our blog.

Disclaimer: This article is intended solely for educational and informational purposes. It should not be considered financial, investment, or legal advice.