Despite using crypto mixers to obscure the stolen Silk Road Bitcoins, his fatal error of mixing clean and stolen funds, extravagant lifestyle, and sharing easily recognizable wallet addresses linked Jimmy Zhong to the stolen funds and led to his capture. But how did the IRS catch Jimmy Zhong? It all started when Jimmy reported a burglary in 2019 that triggered a deeper look into his undeclared wealth and financial activities, and their breakthrough came from a detailed blockchain forensic investigation, ultimately leading to his arrest. In 2012, Jimmy Zhong used a glitch in the Silk Road's withdrawal system to take off with 51,680 Bitcoins, first valued at $620,000, later over $3.4 billion when arrested in 2021. To avoid tracing the sources of the stolen money, Zhong employed the services of crypto mixers to mix his Bitcoins with others, which made it hard to track the source of the funds. However, all that effort came to nothing as he made critical mistakes through his desire to boast about his newfound wealth.Jimmy Zhong's downfall was also due to his extravagance and flaunting of wealth.

He posted about his wealth on online forums, where he provided identifiable Bitcoin addresses connected to his accounts. Accidentally, he mingled the stolen Bitcoins with those he legally earned, which provided investigators with a direct connection. The probe into Zhong’s activities intensified in 2019 following a report of a house break-in with $400,000 in cash. For this reason, the IRS had to investigate further when there was an apparent disparity between what he declared he earned and what he could afford to display. With the help of blockchain analysis, they followed the path of his money, going through several mixers and wallets and linking him to the Silk Road. Zhong’s blunders and elaborate methods of concealing his criminal activities contributed to his apprehension.

IRS Involvement and the Investigation

Jimmy Zhong's scheme first began to unravel through a burglary report. In March 2019, Zhong filed a police report that his home in Georgia was burglarized, and a briefcase filled with $400,000 was taken. The IRS noticed the large quantity of unrecorded money as it pointed to financial misrepresentation. Here's how the investigation unfolded:

Suspicious Cash and Financial Irregularities

The enormous amount of cash Jimmy Zhong claimed to have lost made the IRS suspicious. The IRS started to investigate his money transactions more seriously as he had no legitimate means to acquire such vast amounts of money. It was apparent that Zhong's flashy lifestyle did not correlate with any reported income.

Blockchain Forensic Analysis

Initial Focus

To understand how did the IRS catch Jimmy Zhong, first you need to know that the IRS has a criminal investigation division that focuses on cybercrime and digital assets. They decided to investigate Zhong’s financial past. They concentrated on his use of cryptocurrency, for his reported wealth aligned with the rise of the prices of Bitcoin.

Tracing Transactions

Using advanced blockchain forensic tools, investigators can easily track the flow of funds across the blockchain. The forensics tools permitted investigating patterns of transactions and tracing how Zhong's Bitcoins had moved between wallets and mixers. Blockchain forensic activity entails the creation of detailed transaction graphs and patterns, identifying clusters of related addresses, and recognizing outputs of mixing services.

Link to Silk Road

When creating the flowchart of Zhong’s transactions, the investigators observed considerable amounts of money going through the wallets associated with the Silk Road. Years ago, the FBI seized the Silk Road database, which records transactions, deposits, and withdrawals. This historical data became the link that tied Zhong’s Bitcoins to the criminal activity of the Silk Road.

Combining Traditional Financial Tracking with Digital Techniques

Subpoenaing Records

The IRS also used conventional investigative methods. They demanded records from the exchanges where Zhong had an account and obtained comprehensive transaction histories that tied his online activities to his real life.

Analyzing Spending Patterns

Authorities also focused on Zhong’s spending habits. His expensive purchases, large deposits to his accounts, and other operations indicated that he had more money than his declared income, which only strengthened the authorities’ suspicions of money laundering and other unlawful actions.

Integrated Approach

In addition to the above tracking techniques, the IRS incorporated blockchain analysis into traditional financial transaction tracking methods to compile sufficient evidence against Zhong. This allowed them to trace the movement of the stolen Bitcoins from the Silk Road through various mixers and exchanges to Zhong.

Jimmy Zhong's Early Life and Connection to Silk Road

Zhong was born to immigrant parents in Georgia, often experiencing financial struggles. He was an Asian-American child in the 1990s, and he experienced a lot of bullying and rejection by his peers. Getting very little support from his parents, who could not provide for his needs, Jimmy sought solace in computers. His passion for technology developed from an early age, and by middle school, he had learned several programming languages independently. This passion led him to the University of Georgia to pursue a degree in computer science. Jimmy Zhong came across Bitcoin in 2010 when he was still in school. Fascinated by the idea of such an innovation, he started mining Bitcoins on his laptop and storing them as a form of currency before everyone realized their potential.

Jimmy Zhong's Introduction to Silk Road

Jimmy’s social difficulties persisted into college, and he began resorting to drugs and alcohol as a coping mechanism. It did not take him long to discover the Silk Road, an online black market. At first, he ordered drugs from the site, but as he continued to engage with the site, he discovered the vulnerabilities. His technical skills, his requirement for funds to maintain his lifestyle, and the opportunity afforded by the Silk Road's loose security prepared the crime scene for the future.

The Silk Road and Its Infamy

Founded in 2011 by Ross Ulbricht, also known as "Dread Pirate Roberts," the Silk Road quickly became the darknet's most infamous marketplace. Available only through the Tor network, it provided free illegal commerce, and people could find drugs, prohibited weapons, and forged documents. Buyers and sellers made transactions anonymously, free from law enforcement or regulatory imposition. The case of the Silk Road and its success and subsequent shutdown demonstrated the opportunities and risks of unfettered online marketplaces.

Bitcoin’s Role in Facilitating Anonymous Transactions

Bitcoin was crucial in the operations of the Silk Road. It was a way of making pseudo-anonymous payments. Unlike fiat money, bitcoin transactions get recorded in a public ledger called the blockchain, with no identities behind the alphanumeric addresses. This property of Bitcoin made it the most preferred currency on the Silk Road, where people transact without directly revealing their entities to others. This feature was further boosted by the ability to mix and obscure the flow of funds, rendering Bitcoin the perfect tool for illicit dealings on the Silk Road.

The Heist

Discovering the Vulnerability

Jimmy Zhong’s discovery of the vulnerability in the Silk Road was a combination of luck and expertise. In September 2012, while buying drugs on the Silk Road, he identified a race condition in the Bitcoin withdrawal system of the platform. A race condition occurs when a system attempts to execute several operations simultaneously but does not handle them appropriately. Here’s how Zhong exploited this flaw:

Initial Discovery

Through a routine transaction, Jimmy Zhong observed that the system credited him more Bitcoins than he had deposited after he accidentally clicked the withdrawal button a few times. This was due to a failure to update the balance of the transaction, and several withdrawal requests were approved before the first one was recorded on the blockchain ledger.

Testing the Exploit

Realizing this loophole on the Silk Road, Jimmy took the opportunity to try it more. He invested a small amount of Bitcoin and employed scripts that would make requests for withdrawal at a very high rate. The scripts were intended to issue several withdrawal requests in less than a second fraction, exploiting the system's inability to sync those requests properly.

Scaling the Exploit

Confident in the results of his first few experiments, Zhong scaled up his operations. He created multiple accounts and used the same withdrawal process with the scripts to run dozens of withdrawal requests before the system could update his account balance. This allowed him to withdraw much more Bitcoin than he had deposited.

Efforts to Launder the Stolen Bitcoins

To hide the source of his stolen money and make Bitcoins usable without drawing attention, Zhong used several money laundering methods, but the most popular with him were crypto mixers.

Using Crypto Mixers

Anonymizing Transactions

Crypto mixers or tumblers enabled Zhong to launder his stolen Bitcoins with those of other users. This process involved transferring his Bitcoins to a large pool and mixing them with others, routing the Bitcoins through several transactions, and finally dispersing them to new addresses. The objective was to blur the connection between the stolen Bitcoins and any recognizable track record.

Multiple Mixers and Layers

Jimmy layered his transactions by sending them through several mixers one after another. This multi-step process was designed to make the trail complicated and challenging to follow. It added complexity to the transaction history, with each mixer adding a new level of anonymity.

Limitations of Mixers

Volume and Traceability

Despite the relative anonymity offered by crypto mixers, they were not working efficiently in this case. The scale of Bitcoins Jimmy tried to launder became problematic because significant transactions could be detected and monitored even when passing through mixers. The general flow of a considerable amount of Bitcoin could still be noticed and traced back to a common source.

Blockchain Forensics

Technological developments in the analysis of blockchains also contributed to the collapse of Zhong’s plans. The forensic experts de-anonymized his transactions by analyzing the algorithms and linking the mixed and clean funds transactions. These tools helped the investigators follow the flow of the Bitcoins back to the criminal source of the money despite the multiple layers made by the mixers.

Critical Mistakes and Exposure

Several vital mistakes compounded Zhong’s misfortune. In September 2019, he exchanged 118 Bitcoins from one of the wallets holding both clean and stolen Bitcoins. This transaction that unwittingly connected his legal and criminal money was the beginning of how did the IRS catch Jimmy Zhong. Also, Zhong’s endless requirement to exchange his Bitcoins for fiat money to fund his extravagant lifestyle gave the authorities more chances to track his actions. Zhong’s efforts in money laundering were well-developed but could not sustain him living a lavish lifestyle. With the ever-improving techniques in tracking blockchain-related crimes, he was arrested. The gaps between his public displays of wealth and no legitimate source of income made him a suspicious case before the IRS and other investigating agencies.

Life After the Heist

Jimmy Zhong became a millionaire after he stole 51,680 Bitcoins from the Silk Road. At first, he was very discreet, but as Bitcoin became a valuable commodity, Jimmy’s urge to live a lavish lifestyle increased.

Extravagant Spending

Jimmy quickly bought many luxurious houses, such as a one-million-dollar house in Gainesville, Georgia, which he used to host parties. He also owned several luxurious cars, including a few Lamborghinis and sports bikes, which indicated his financial status. He frequently used private jets to travel for lavish vacations, indicating his dream of being among the affluent.

High-Profile Purchases

Zhong spent a lot of money to attain social popularity and status. He would often send large amounts of Bitcoin to friends and strangers, all in the endeavor to win their favor. His social media profiles and forum postings were full of high-spending activities, from buying luxuries to expensive dinners.

Attention-Grabbing Lifestyle

Zhong's flamboyant lifestyle could not escape the public eye. Though he tried to remain incognito in his financial transactions, his lifestyle spending indicated that massive wealth was at his disposal. This visibility and a compulsive desire to show off his newly acquired wealth put him on the radar of the police and investigation agencies, thus making him a subject of interest.

Critical Mistakes Leading to His Capture

Jimmy Zhong failed to anonymize his transactions in several ways, ultimately costing him his freedom. These mistakes, along with the efforts of the IRS investigators, contributed to the revelation of his fraud.

Mixing Clean and Stolen Bitcoins

The Key Transaction

In September 2019, the same year he reported the burglary, Zhong made one of the biggest mistakes when he sold 118 Bitcoins from a wallet with both legal and stolen ones. This transaction, made through a cryptocurrency exchange, created a “change address” in the process.

What is a Change Address?

Suppose you are paying for a cup of coffee that is $4, and you offer a $10. Instead of handing the same bill back to you, the cashier returns $6 in change to you. In the world of Bitcoin, a change address serves the same purpose. When you use more Bitcoins than required for a transaction, the Bitcoin network sends the extra amount to a new address in your wallet, known as a change address. For instance, if you pay 2 Bitcoins to a person but send 3, the extra 1 will be refunded to a new address in the wallet. This process helps to maintain the transactions’ order and security, but it also generates a new address associated with the wallet, which can be used to track the funds’ source, as how did the IRS catch Jimmy Zhong in the case of Jimmy Zhong’s stolen Bitcoins.

Traceable Link

Investigators were given a much-needed breakthrough: Jimmy's verified wallet address included the stolen Bitcoins along with legally obtained ones. They could track these funds back to the Silk Road from the transaction history linked to the change address. This mistake created a path that connected Jimmy’s legal operations to his crime proceeds.

Identifiable Bitcoin Addresses and Bragging on Forums:

Public Boasting

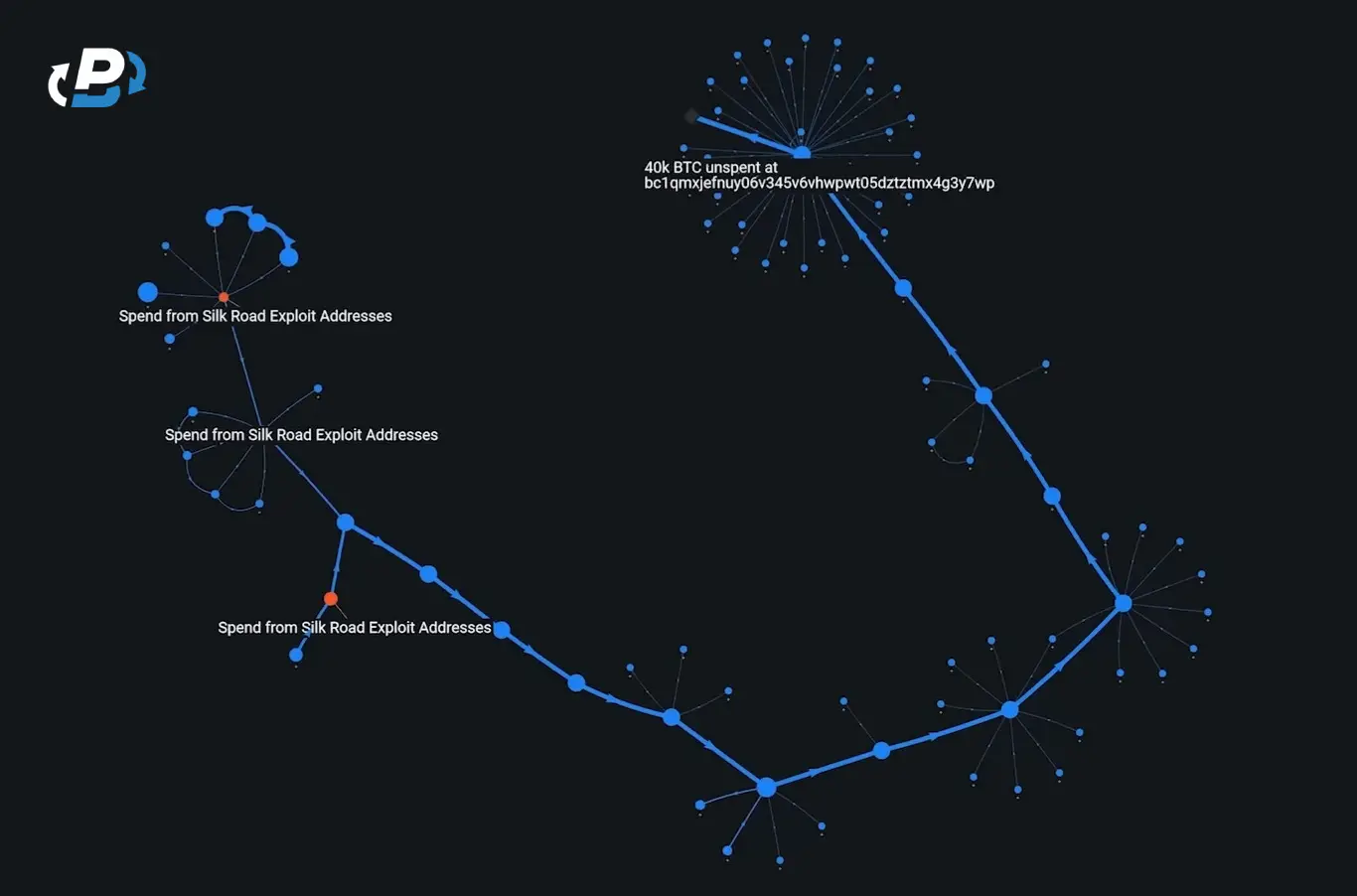

Jimmy Zhong’s desire for approval and affirmation pushed him to brag about his riches to different groups he encountered online. Under different accounts, he often boasted about being a Bitcoin millionaire and having many coins. He even signed his messages on one of the forums with his 40,000 Bitcoin address to demonstrate his financial status.

Reusing Addresses

Another major blow to Zhong’s anonymity was that he reused the same Bitcoin addresses in different transactions and platforms. This reuse made it easier for investigators to associate several transactions and addresses with him, counterproductive to his efforts to have a distinct identity for unlawful deals. These critical mistakes and the constant probe by the IRS and other agencies unveiled Zhong’s complex transaction structure and how did the IRS catch Jimmy Zhong. His use of mixing services, public bragging, and poor accounting practices led to his arrest and the retrieval of the Bitcoins.

Lessons Learned and Implications for the Crypto World

The case of Jimmy Zhong shows that blockchain analysis is essential for identifying and connecting transactions. Today's tools can map transaction flows and pinpoint suspicious activities even when the transactions pass through mixing services. Like in Zhong’s case, these advancements assist in removing users' anonymity and linking criminal activities to real people. Security and compliance are two critical aspects that cryptocurrency platform operators must ensure. This entails proper auditing, safe transaction methods, and compliance with authorities to prevent weaknesses and gain customers’ confidence.

PlasBit The Trusted Name in the World of Crypto

Reflecting on the story of Jimmy Zhong and the Silk Road, it's clear how far the cryptocurrency world has come. In the early days, platforms like Silk Road operated in the shadows, with little regard for security and regulation. The absence of robust safety measures made them fertile ground for exploits, as evidenced by Zhong's massive heist. Today, regulated and secure exchanges like PlasBit represent a significant evolution. During Jimmy Zhong's time, the Silk Road epitomized early cryptocurrency exchanges' chaotic and unregulated nature. It lacked the basic security protocols and oversight needed to protect user assets. Vulnerabilities like the race condition that Zhong exploited were all too common, and the use of mixers to obscure illicit funds further complicated the landscape. The absence of regulatory frameworks allowed such platforms to operate with impunity, leading to significant user risks. In stark contrast, PlasBit has emerged as a leader in creating a secure and regulated environment for cryptocurrency transactions. Since our inception in 2020, we have been committed to reshaping the crypto world by prioritizing security and user trust. Our platform operates under the stringent regulations of the Polish government, ensuring that all activities are transparent and compliant with the highest standards.

PlasBit's Security Enhancements

Security and confidentiality are two of the key principles that are implemented at PlasBit. That is how we differentiate ourselves. We aim to guarantee that your details and money are secure when using our exchange. Here’s how we safeguard our users:

Two-factor authentication (2FA)

In PlasBit, we have implemented two-factor authentication, which accepts two forms of SMS and email verification that strengthen your account security, along with authenticator apps.

24/7 Customer Support

Our exchange is available for our customers at any time of the day through chat and email. If you have a question or face a problem, our qualified staff will be happy to assist you. This means that at PlasBit, we ensure you get the help you need.

Login Alerts and Withdrawal Confirmations

We also have additional control measures for withdrawal confirmation and login notification. These features afford you full control of your account’s activities and guarantee that all actions on the account are secure.

Cold Storage Solutions

We keep users’ cryptocurrencies in cold storage to reduce the risk of hacking. This means that your assets are kept offline and are protected from potential online threats. This commitment to cold storage ensures that your funds are always safe with us. As for the future perspectives, PlasBit will remain the company with the highest levels of exclusivity and privacy. We are more than just a crypto exchange; we are a platform where people with similar values and goals unite. Choosing PlasBit is choosing a safe and responsible platform that protects your money and does not disclose your information.

Conclusion

Summarizing Zhong’s Journey

Jimmy Zhong’s story of becoming a billionaire hacker and a socially awkward computer enthusiast is one of brilliance and despair. His childhood was difficult; he was born into an unstable family in Georgia, bullied at school, and had no parental support. This forced him to escape into the digital world, become engrossed with computers, and develop an early interest in Bitcoin. His technical knowledge pinpointed a significant weakness in the Silk Road’s withdrawal system, which led to one of the largest thefts of Bitcoin in history. However, Zhong’s path to infamy was also connected with his need for social recognition and appreciation. Even though he became wealthy after the robbery, his greed to show his newly acquired wealth and attract people’s admiration was his biggest downfall. Hence, his spending sprees and boastful behaviors brought attention to his activities and revealed the loneliness and desperation behind them.

The Importance of Security and Regulation in Crypto

Jimmy Zhong’s story underscores a critical lesson for the cryptocurrency world: the centrality of security and regulation are the most vital issues. The problems of the Silk Road and Jimmy Zhong’s exploitation of these issues demonstrate the dangers of uncontrolled and insufficiently protected networks. Adequate security and compliance measures become more critical as the digital finance environment develops.

PlasBit’s Role in Leading the Way:

Our platform demonstrates the direction the crypto industry must take to become more secure and trustworthy after incidents like the Silk Road heist. Our commitment to user security and regulatory compliance safeguards our users from possible risks and helps to develop a stable and safe environment for cryptocurrency. Our platforms will remain valuable as the industry progresses and show how innovation can be achieved without compromising security.