While the cryptocurrency market offers massive potential for innovation and financial growth, it’s unfortunately also plagued by scams. From elaborate Ponzi schemes to pump and dumps and rug pulls, investors face substantial risks. Sometimes, these frauds may exploit influencers to widen their victim pool. The HAWK Tuah crypto scam, is a “sophisticated” pump and dump scheme orchestrated by influencer Haliey Welch and her team, in which 17% of the tokens in circulation were pre sold at $16.6 million valuation, netting the team $2.8 million before the launch, in an attempt to disguise their involvement in the scheme, and as soon as the coin launched and reached a $490 million market cap peak, all the presold tokens were cashed out, dropping the value by over 90%.

In addition to that, the high fees implemented to “prevent people from crashing the coin” ended up making the team behind $HAWK almost $2 million in the 24 hours after the launch. This scheme resulted in significant losses for Welch’s fans, accusations of insider trading, troubles with the law, and finally, remorse from the Hawk Tuah Girl herself. Here at PlasBit, we’re aware of such hazards, which is why this article will delve into the finer points of the scam, including the presale allocation, the launch, its aftermath, the devastating financial impact that threw fans in disarray, as well as the potential legal consequences the Hawk Tuah team may face.

Life before the HAWK Tuah crypto scam

Before the official launch of the HAWK Tuah crypto scam (as it turned out to be), Haliey Welch was just a regular 21-year-old girl working at a bedspring factory in a small town of Belfast, Tennessee. But her life turned upside down in the summer of 2024 when she became an internet meme. Specifically, on June 11, 2024, a vox pop YouTube channel called Tim & Dee TV, owned by Tim Dickerson and DeArius Marlow, posted a video featuring Welch in the Broadway district of Nashville, Tennessee. Welch and her friend approached the hosts and asked to talk to them for the video. Following a series of questions, the interviewer eventually asked Welch, “What’s one move in bed that makes a man go crazy every time?” She responded, in a strong Southern accent, “You gotta give ‘em that ‘hawk tuah’ and spit on that thang,” referring to an action when performing fellatio.

Shortly after Marlow uploaded the clip to TikTok, countless other accounts on social media started reposting it, some even without the “Tim & Dee TV” watermark. It quickly went viral, receiving millions of views across TikTok, YouTube, and Instagram, and giving rise to various memes and remixes. Welch herself became widely known as the “Hawk Tuah Girl,” and decided to capitalize on it (although she said she was originally mortified by the situation). She created an Instagram account that soon attracted a massive following and media attention, as well as quit her job at the bedspring factory. On top of that, she started getting invited to podcasts, got asked to join the stage at a Zach Bryan concert, and threw the first ceremonial pitch at a Mets game.

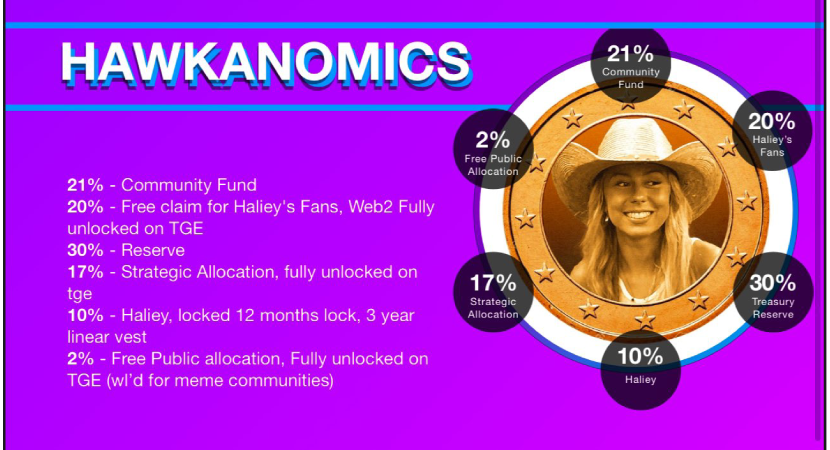

Eventually, she launched a podcast called Talk Tuah with Jake Paul’s company Betr, and released a dating advice app Pookie Tools. Naturally, the next step was to create a crypto memecoin. Welch partnered with social media influencer Doc Hollywood and company overHere Ltd. to help her launch HAWK, a memecoin on the Solana blockchain. On December 4, she announced the release on social media. According to the “hawkanomics,” 21% of the token was for the ‘community fund,’ 20% was to be claimed freely by “Haliey’s Fans, Web 2 Fully unlocked on TGE,” 30% was for the “reserve,” 17% was a “strategic allocation, fully unlocked on tge.” Haliey was to get 10% with a “12 months lock, 3 year linear vest,” and 2% for the “Free Public allocation, Fully unlocked on TGE (wl’d for meme communities).” If you’re not so familiar with all the crypto lingo, ‘TGE’ refers to ‘token generation event,’ and ‘wl’ is short for ‘whitelisted.’

(Image credit: X)

Hawk Tuah launches… and crashes

At first, the token’s value skyrocketed, nearing a market cap of $490 million in a matter of hours. But then it dove by more than 90% not long after reaching the top, ending up at roughly $25 million, leading to huge losses for investors, and raising lots of uncomfortable questions. During the whole ordeal, the crypto community noticed a glaring red flag - 96% of the token’s supply was controlled by one giant cluster of top 10 holders upon launch. These entities seem to have quickly sold off their holdings upon the price surge, leading to concerns of a rug pull by the HAWK team.

(Image credit: X )

As a matter of fact, it looked a lot like a pump and dump scheme, in which developers or promoters holding a large percentage of the total token supply sell off their holdings at an inflated price. The price becomes inflated in the first place thanks to buyers investing in the promoted token by exchanging their valuable crypto assets like Bitcoin or Ethereum. Once the developers or promoters (or both) sell off all their tokens, they cause the price to plummet, leaving unaware investors out in the cold. Obviously, the practice is considered extremely unethical and even opens up the possibility of legal action against the perpetrators (but more on that later). Having said that, unlike in a typical pump and dump scheme, the pumping and the dumping here seems to have been carried out by the wallets that had received the token for free, and not the developers or promoters directly. As one X user noted on a Spaces call, most tokens were owned by related wallets, possibly “friends of friends of friends of friends.” When called out, the team got hostile and tried to blame everything on snipers.

These are users (or bots) that automatically buy a token in bulk, looking to profit from a quick price increase as more traders discover the token. According to Welch’s post, they “tried to stop snipers as best we could,” including through exorbitant fees. Trying to further justify herself and the team, the ‘Hawk Tuah Girl’ copied and pasted the “hawkanomics” arguing that the “team hasn’t sold one token and not 1 KOL [key opinion leader] was given 1 free token.” She also wrote that high fees (15%), which had been there to discourage snipers, were now removed. Notwithstanding, the community responded by adding a note that said: “The ‘team’ and insiders have actually been selling their token since launch. A majority have never even purchased anything and have only sold the tokens they were given. Hailey is lying and will likely have to ‘talk tuah’ judge about this.” They also linked an X post that proves the team has been misleading the community.

Behind the Hawk Tuah crypto scam

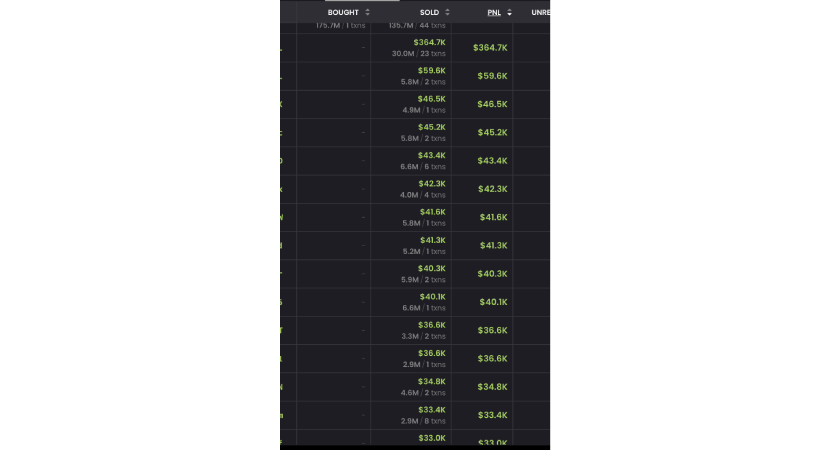

The screenshot, posted by X user @ZeusLFG, shows a lot of HAWK sales from entities that did not buy them (meaning they were allocated before the launch). This is visible from the ‘bought’ column that shows nothing and the ‘sold’ column that indicates quite the profits. As per a popular online scam investigator Stephen Findeisen, known as ‘Coffeezilla,’ it proves they were held by insiders.

(Image credit: X)

In other words, as Coffeezilla pointed out, the Hawk Tuah team really didn’t sell one token, but only “because they pre-sold them.” Specifically, they “sold them to a bunch of ‘investors’ in a presale, and then those people were unlocked immediately upon launch,” which can be seen in the “hawkanomics.” As a reminder, Haliey was locked for 12 months from selling HAWK, but the “strategic allocation” of 17% of the total supply was fully unlocked right on the token generation event. According to Coffeezilla, this means that the team raised about $2.8 million by preselling the tokens. After that, those investors dumped on Haliey’s fans. Specifically, among the 285 wallets partaking in the presale, 89 of them sold 100% of their holdings, 47 sold over 50%, and 19 wallets sold less than 50%, which means $3.3 million worth of HAWK were sold. On the company’s X profile, someone representing overHere tried to explain it away by stating that the 96% cluster isn’t evidence of any wrongdoing. It just shows how the tokens were distributed according to the published tokenomics. They explained that, as planned, 96% of the tokens were sent to various wallets, and 3% was used to create liquidity on Meteora and then burned (destroyed) to stabilize the market. Another 0.3% was added to a Raydium liquidity pool. Referring to Haliey’s team’s piece of the cake, they said they really hadn’t sold a single token because their 10% allocation is locked for a year and will be gradually released over three years.

(Image credit: X)

But the community once again would have none of it, linking the definition for “exit liquidity” and the above analysis by Bubblemaps, a supply auditing tool, which investigates the crypto industry and unveils potential scams. Coffeezilla even called Haliey and her team out on X Spaces, asking them how much they made for themselves and who exactly profited. Yet he was stonewalled and muted, despite the team’s claim they were “completely open” to hearing and answering questions. As the investigator explained on his YouTube channel, upon the launch, the Hawk Tuah crypto team had 15% fees on trading, which they claimed was to “stop snipers.” However, it also meant they profited a lot from these fees, earning almost $2 million in the 24 hours after the launch.

Interestingly, during the X Spaces call, Doc Hollywood, one of the HAWK promoters and apparently Howie Mandel’s son-in-law, tried to justify it… poorly. He actually went on a rant, quoting all the expenses they had and basically saying that it doesn’t really matter where those millions of dollars went. “Do you know how much it costs for lawyer fees, to create a foundation in the Cayman Islands, to hire directors? You think this stuff pays for itself? (...) overHere has around 18 people working on this right now as we speak. (...) Who cares where fees go, it goes to bills, it goes to attorneys, it goes to directors, it goes to staff.” As Coffeezilla pointed out, there are four groups of people to look out for here. The first is the Hawk Tuah Girl, promoting the token. The second is Alex Larson Shulz, a.k.a. Doc Hollywood, who has some connections in the world of entertainment and seems to be the person connecting Welch with crypto, as he said he was teaching her a memecoin class at one point.

(Image credit: YouTube)

The third group is the people organizing and running the crypto token - the company overHere. Finally, the last group consists of the insiders who paid money to get early access to the coin and then rug-pulled a lot of genuine fans of the Hawk Tuah Girl. Meanwhile, in his huge meltdown on X Spaces in response to questions about the HAWK Tuah crypto scam, Doc Hollywood berated people in the crypto market. He addressed them directly, calling them mentally ill and refuting any suggestions of ill-doings. “You guys are not the target audience. The target audience, which is why I’m doing this, which is what’s cool about it, is not in these spaces. And listen, most of you, we don’t want you in the community, let’s be real, you’re not great people. (...) There’s a lot of negativity in this space.

I think crypto brings mentally ill people into this thing, if you guys are in crypto, most likely you’re mentally ill. (...) We’re trying actually to have fun, we’re trying to give meme tokens away for free to people who have never had any crypto before, any meme token, and you guys should be kissing my f**king *ss.” In his words, the “target audience” are the people “that are outside of crypto that we’re going to be onboarding and they don’t give a sh*t, they don’t even know what a market cap is, they just go ‘oh cool, free coin! Now I get to join the community. Cool. Done.’” Coffeezilla presented all the facts: the team generated over $1 million in fees while the fans got rug-pulled; yes, there were snipers but there was also insider trading linked to the creators’ account; and they had the “worst tokenomics I have ever seen and it IS a scam.” After that, he got muted. Nonetheless, other participants in the X Spaces sided with him until they themselves got gaslit.

How did the Hawk Tuah girl respond?

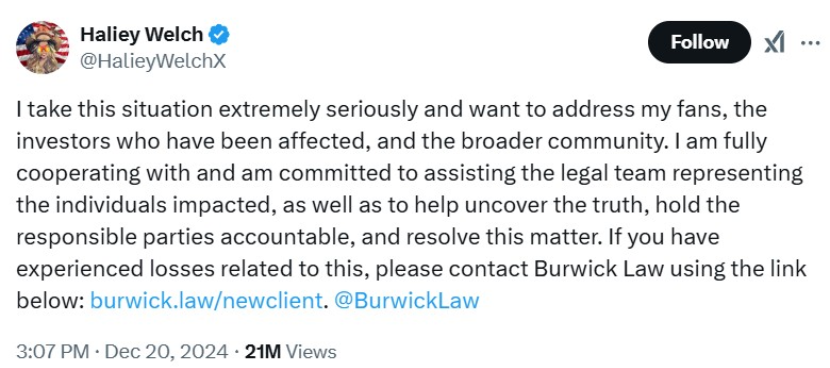

Now, during this conversation, Welch didn’t have much to say, except in response to Coffeezilla’s stating that it was “one of the most miserable, horrible launches I’ve ever seen,” to which she gracefully asked him “why the f**k” was he there for then. And how did the Hawk Tuah girl respond to the scam accusations? On December 20, 2024, Haliey Welch posted on X that she would cooperate with legal representatives to help the scammed victims, find the truth, and hold the lawbreakers accountable. She also urged anyone affected to contact law firm Burwick Law, which represents consumers who have lost money to crypto scams.

(Image credit: X)

This seems to be a 180-turn from her previous attitude demonstrated during the X Spaces call, when she also abruptly cut off crypto entrepreneur Nick O’Neal asking about the fees to say she was going to bed, effectively shutting down the conversation. What’s more, after the X Spaces fiasco, she has reached out to Coffeezilla through a “transactional entertainment lawyer.” He had told him that Welch “truly didn’t intend to fleece fans,” and that she “genuinely wanted to make this a community token of fans and onboard Web2 and Web3 and be a long-term face.”

Current HAWK Tuah crypto scam status

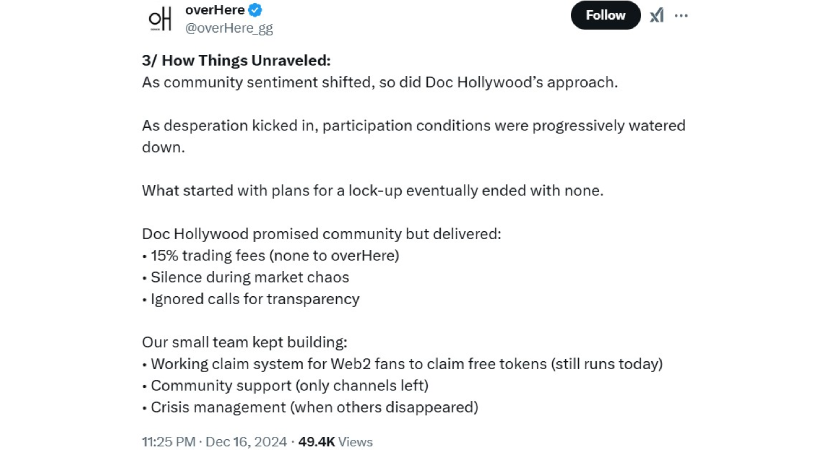

According to a lawsuit against Haliey’s team, HAWK is an unregistered security. Allegedly, it was sold under the pretense of harmless fun, although promoters were fully aware it was destined for disaster, profiting from hefty fees and insider trading. However, Haliey is not (yet) named defendant in the lawsuit. Instead, it targets Tuah The Moon Foundation, which collected funds from the HAWK token, overHere Ltd and its founder Clinton So who launched the memecoin; and Alex Larson Schultz who promoted it online. That said, the folks at overHere seem to have decided to throw Doc Hollywood under the bus. Per their claims, he “controlled all token decisions, fees, [and] treasury,” and his team “vanished when things got hard.” According to them, they had “no involvement, no prior knowledge of bad actor(s),” and “nothing to gain.” Moreover:

(Image credit: X)

They also said that Doc Hollywood’s statement regarding 18 people on staff was a lie, and in fact, they had only four developers, that they had zero revenue and control over the decisions, and that their concerns regarding transparency and changes “fell on deaf ears.” Whatever the actual truth, the HAWK sellers and promoters will have to answer some difficult questions, perhaps even from the Securities and Exchange Commission (SEC) or the Department of Justice (DoJ). Considering that the federal lawsuit cites securities laws violation, this may well happen, and soon. Should these authorities decide to get involved in the case, the Hawk Tuah Girl and her team may face serious legal repercussions, including prison time. According to Yuriy Brisov, partner at law firm Digital and Analogue Partners, civil charges for securities fraud, alleging misrepresentation or deception in the sales of securities could be on the table if HAWK qualifies as a security under the Howey Test.

The DOJ might also look into the possibility of criminal charges like money laundering or wire fraud, particularly if evidence surfaces of intentional deceit or financial misconduct. Insider trading could also be one of the charges. As Brisov explained: “Insider trading traditionally involves trading securities based on material, non-public information, breaching a duty of trust or confidence. (...) If Welch’s team possessed non-public information about the token’s launch or had pre-arranged strategies to sell significant portions of the supply, leading to the token’s price collapse, such actions could be scrutinized under fraud or market manipulation statutes.” Currently, the penalty for securities fraud ranges from substantial fees to a prison sentence with a maximum of 25 years. For market manipulation, one faces financial penalties of up to $5 million, all the way to 20 years behind bars.

Haliey Welch: scammer or victim?

It’s difficult to say whether Haliey is to blame for the scam or if she is a victim herself. Judging from her background, she may not have had a lot of experience with the crypto world or memecoins before becoming famous. Nevertheless, this brings us to an important question: Should you listen to crypto influencers? If the HAWK Tuah crypto scam makes you uneasy about trusting influencers promoting crypto tokens that they themselves likely don’t know a lot about, we hear you. It’s not easy placing your trust in celebrities after many of their endorsements end up nowhere or prove to be a scam. Among these influencers, popular crypto personality Ben Armstrong, a.k.a. Bitboy Crypto himself has had some experience with crypto projects that either dropped 99% in price or turned out to be outright scams, leading to weighty accusations against him.

For instance, he vouched for DistX, a “scam-proof” coin that turned out to be a rug pull, and SafeMoon, which ended up being another, yet slower, rug pull. Then there came Pamp Network (PAMP), which dipped in value not long after its launch and initial price growth. So, should uneducated influencers peddling various tokens on Crypto Twitter bear responsibility in the memecoin scam landscape? According to the law, yes. This is something that Caitlyn Jenner can testify to herself after launching her JENNER memecoin that plummeted after significant trading activity. Currently, the former Olympic gold medalist is facing a lawsuit accusing her and her manager, Sophia Hutchins, of “fraudulently soliciting financially unsophisticated investors in the US and abroad to purchase unregistered securities.”

Did Haliey Welch break the law?

Unlike Jenner, the Hawk Tuah Girl is not explicitly named in any lawsuits. Be that as it may, everyone else on her team, including the Tuah The Moon Foundation (which she may or may not be a part of), is. So, did Haliey Welch break the law? As of now, it’s not clear whether the Hawk Tuah Girl broke the law, as she only (sort of) has a financial lawsuit against her and no criminal charges brought up. As seen above, she seems to be showing at least some remorse and is “fully cooperating” with the lawyers and plaintiffs in the Hawk Tuah crypto scam.

Key takeaways and lessons

The Hawk Tuah crypto scam teaches us several important lessons. The first is that there are many people out there who will try to scam you as they lack integrity, including in moral, intellectual, personal, and corporate aspects, which are the concepts that we hold dear here at PlasBit. The second is the importance of doing your own research. To this end, PlasBit does its best to assist its readers, crafting professional articles, guides, and courses covering a wide range of topics. Our goal? To simplify crypto education, help you navigate this complex ecosystem, and avoid scams. Thirdly, aggressive promotion of a token and using someone’s popularity to force it into the limelight often hides a lack of intrinsic value. This is why you should be suspicious of any hype-driven memecoin investments - you might find they have no fundamentals. For regulators, it is yet another example of why the crypto industry is in dire need of a clear and unified set of standards and laws. This would help deter criminals from scamming investors through rug pulls and pump and dump schemes or using unassuming public figures to do so.

How to spot a crypto pump and dump?

At the end of the day, pump and dump schemes are an unfortunate reality of the cryptoverse. But how to spot a crypto pump and dump? Usually, there are some red flags to look for: The first is token allocation. If anything seems off about the planned distribution of a token or it’s downright missing, it’s a warning signal. Another red flag are the issues with the founding team information. No identifiable people listed on the team? Their social media and online presence are inconsistent? Another red flag. Finally, many pump and dump projects act suspiciously on social media, disabling comments for their posts to fend off negative feedback or avoid awkward questions.

What did we learn?

All things considered, the HAWK Tuah crypto scam is a cautionary tale about the dangers of hype-driven, influencer-backed investments. While memecoins often thrive on speculation, this case exposes the darker side of viral fame when you mix in an opportunity for a quick buck. Whether Haliey was a mastermind or merely a pawn, her name is now tied to a token that left many of her fans with empty wallets. For investors, the takeaway is clear: don’t let celebrity endorsements replace real due diligence. And for regulators, it serves as yet another reminder that the Wild West of crypto won’t police itself.