If you have ever asked yourself, Do you have to pay taxes on cryptocurrency gains? A recent research report from Divly has shown that Cryptocurrency traders and investors are highly unlikely to report their crypto holdings to the tax authorities.

Even tho tax experts have questioned the report’s statistics and methodology of research, the conclusion is that only 0.53% of cryptocurrency investors worldwide will pay tax on their holdings in 2022. The report acknowledges that not all taxpayers fulfill their tax obligations. The findings may be limited, as search volume data may not accurately reflect the number of cryptocurrency taxpayers.

After analyzing the relationship between the number of taxpayers who reported Bitcoin and the volume of searches for tax-related cryptocurrency terms across various countries, the Divly report, released on April 5th, arrived at the calculation. The report also considered the number of cryptocurrency owners in each country, as Statista's Global Cryptocurrency Report reported, while making its estimates.

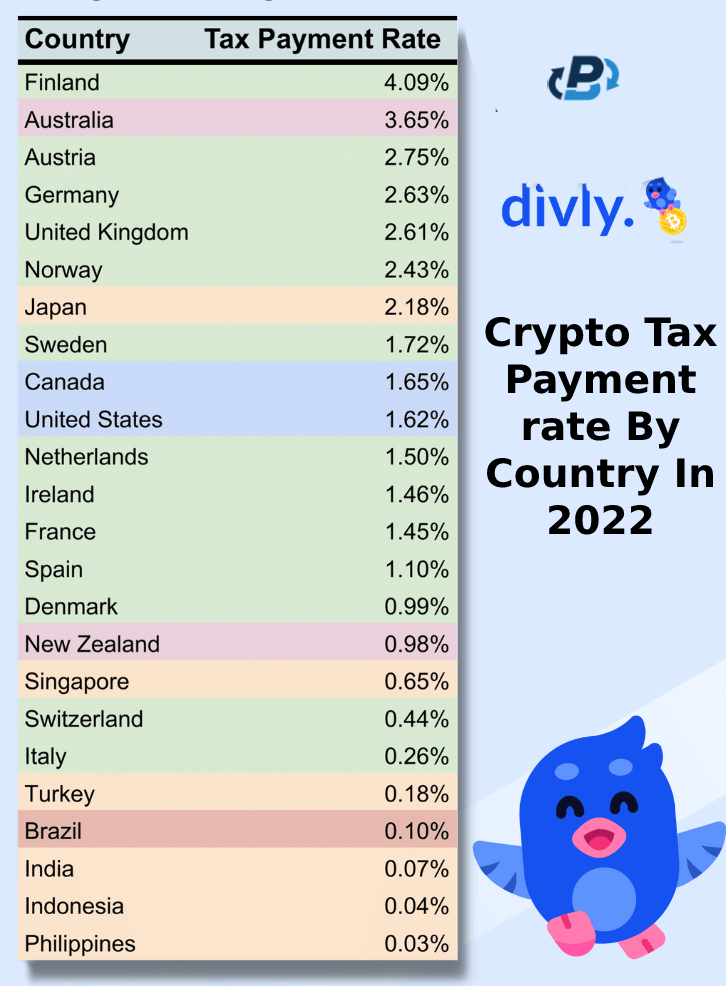

Finland and Australia are expected to have the highest percentages of cryptocurrency investors who fulfilled their tax obligations in 2022, with 4.09% and 3.65%, respectively. The United States ranked tenth on the list, with an estimated 1.62% of cryptocurrency owners paying taxes. On the other end of the spectrum, India, Indonesia, and the Philippines had the lowest percentages of tax-paying crypto investors, at only 0.07%, 0.04%, and 0.03%, respectively.

In Austria, Germany, the United Kingdom, and Norway, the percentage of investors who reported their crypto holdings was between 2.43% and 2.75%. The United States, with the world's largest number of cryptocurrency users, had a relatively low rate of crypto tax payment at 1.62%. It was ranked just below Canada, with 1.65% of investors paying their crypto tax.

The study's methodology assumed no regional differences in crypto tax reporting searches but warned of potential biases in countries with better internet access and more accurate data.

While there is a higher risk of non-compliance with cryptocurrencies, many countries have mechanisms for tax authorities to obtain information from crypto exchanges. The low rate of cryptocurrency tax payments is likely due to various factors, including a lack of public awareness and unclear reporting requirements. Japan and Germany have higher rates due to increased government enforcement and accessibility of tax services. The global push for clearer tax regulations may lead to a significant increase in crypto tax payments in 2023, such as proposed EU and UK changes mandating the declaration of crypto holdings. In the US, President Biden plans to propose changes to crypto taxation, including targeting wash trading and introducing a new tax on electricity for Bitcoin mining, which could increase government oversight and push investors to declare their holdings.

A further presumption in the methodology was that there was no regional variation in the volume of searches for crypto tax reporting. It also warned that there might be a bias toward nations with better internet access and more precise search volume data.

As government technology becomes more specialized and sophisticated, it will be simpler to identify anyone who is not complying.

Tax authorities and governments cautioned individuals who do not declare their cryptocurrency income today that they risk having their actions caught up with them in the future in an attempt to try to intimidate investors and crypto holders into coming forward and paying their taxes.

Governments are currently lagging behind technology-wise, and without clear regulations, investors ask themselves why do you have to pay taxes on cryptocurrency gains if nobody can track them.

Although non-compliance with cryptocurrencies is more dangerous than other asset classes, many countries have mechanisms to allow tax authorities to acquire information from cryptocurrency exchanges. Still, as for now, investors are not rushing in to declare their crypto assets as the exchange's jurisdictions are still not clear and are often too unclear for most users.

The low rate of cryptocurrency tax payments worldwide likely results from multiple factors.

Divly also noted that increased government enforcement could result in higher rates recorded in Japan and Germany. Increased enforcement led to higher availability of tax calculators and other tax services, making tax payments more accessible to users.

An ongoing global push to introduce clearer tax regulations could significantly increase crypto tax payments in 2023. The E.U. proposed to change its Directive of Administrative Cooperation (DAC) in December 2022, requiring exchanges to share user data with local governments. If the changes are adopted, local tax authorities in the E.U. could enforce tax payments on cryptocurrency traders and investors.

Starting next year, the U.K. wants to mandate the declaration of crypto holdings in Self Assessment tax return forms.

The U.S. could also see an increase in cryptocurrency taxes this year as President Joe Biden proposes changes to crypto taxation in a new budget blueprint for 2024, which would specifically target wash trading and introduce a new tax on electricity for Bitcoin mining. And while the electricity tax won’t directly affect the amount of taxes paid on cryptocurrencies, increased government oversight of the industry could push more investors to declare their holdings.

If you want, you can calculate your crypto profits in our crypto profit calculator.

In my view, the ground is still unclear. Whether you have to pay taxes on cryptocurrency gains depends on the circumstances of each investor's country of residence and portfolio status. It is essential to seek advice from a qualified accountant or tax professional before declaring cryptocurrency gains to tax authorities. They can help investors understand their tax obligations and ensure they comply with all applicable tax laws.