With over a dozen high-ROI advertising platforms competing for your ad spend, why wouldn’t you want to maximize your reach? Of course, juggling ad spend across all these platforms is no easy task. Legacy payment methods like bank transfers and PayPal complicate the process with long approval times, low spending limits, and statements that make no sense. The more clients you take on and the more platforms you use, the harder it is to parse your ad spend records. That’s exactly why so many marketers prefer using virtual cards for online ads PlasBit’s cards can be used as a payment method on platforms like Google, TikTok, or Facebook, and they can be issued instantly, with high monthly limits. Just fund your account with your favorite crypto, choose the card currency, load it with crypto from your wallet, and add the card details to your ad platform accounts as a payment method.

Why Even Use Virtual Cards for Online Ads?

Whether you’re an enterprise-level agency or a solo affiliate, you know there’s no such thing as a “slow day” in digital marketing. So first and foremost, you need a payment method that can keep pace with you. If that doesn’t sound like the banking system, you’re onto something. Let’s break down why legacy payment methods are no match for virtual cards in today’s fast-paced digital marketing world.

Slow Issuance Process

Three to five business days is not an amount of time you can afford to waste when your campaign is taking off. Waiting days for approval on new credit cards can mean starting a whole campaign from scratch. Not only will these delays eat into your revenue, they will make you seem incompetent to your clients through no fault of your own. On the other hand, as long as you have a verified account, you can issue a dedicated virtual card and start buying ads within minutes. Even if you’ve never used virtual cards before, the verification process is much quicker and easier than an average bank account application.

Limited Number of Cards

Banks won't let you order an unlimited number of cards. That leaves you charging all your clients’ various campaigns on a handful of cards, with no way of compartmentalizing spending. One mistake and you're stuck sorting through a mess of transactions to figure out who spent what. But with virtual cards, each campaign, client, or platform can be assigned its own dedicated card.

Restrictions on Currency and Excessive Exchange Fees

Running international campaigns for clients paying in different currencies? Your bank is happy to bill you extra fees and force you into sub-optimal conversion rates. Those small losses add up quick, shrinking each ad dollar's impact to your bottom line. PlasBit enables you to choose the currency that works best for your needs. That means marketers who frequently work with European clients can simply create a EUR card to manage those overseas accounts.

Spending Limits That Restrict Scaling

When you hit your credit card spending limit, you're out of luck until the following month. While your payments are on hold, your ads lag behind and momentum is lost. Once you go virtual, there’s no more need to worry about maxing out your limit. Our cards come with an extremely high spending ceiling. And if you do reach the card limit, you can issue another one without losing a beat.

Hard-to-Track Ad Spending

If you’re charging Google, Facebook, TikTok, and native ads for multiple clients on the same card, your statement ends up being a money black hole. With a seemingly endless list of very similar transactions, it'll take Sherlock Holmes to find details on any particular payment. Going the virtual route with cards for online ads means being able to use as many payment cards as needed, which eliminates the bottomless statement issue altogether.

Risk of Payment Declines and Account Freezes

The sheer number of transactions that comes with testing and managing multiple campaigns is often wrongly flagged for fraud, leading to bank account freezes. That leaves you with outstanding bills, suspended campaigns, and lost sales while you wrestle with customer care to have your account restored. In contrast, virtual cards are built for ad spending. So any issuer worth their salt will ensure your payments won’t be flagged or frozen. The best issuers even give you a unique BIN number with every new card to avoid bans.

No Payment Control for Teams

Having one card in your team's hands is a security risk. All members have access to the same amount of cash, and you can't limit spending at an individual level. If someone on your team spends too much or leaves, you're fighting to get back in control. Well, virtual cards are built for ad spending. So using any issuer worth their salt should ensure your payments won’t be flagged or frozen. The best issuers even give you a unique BIN number with every new card to avoid bans.

How to Get and Load a PlasBit Virtual Debit Card

Getting your PlasBit virtual card fully set up and ready to use is nothing like applying for a bank account or a credit card. In fact, the entire process can be completed in seven easy steps.

Step 1. Log in and Access Your Wallet

Start by signing into your PlasBit account. Once inside your dashboard, head over to the Wallet section.

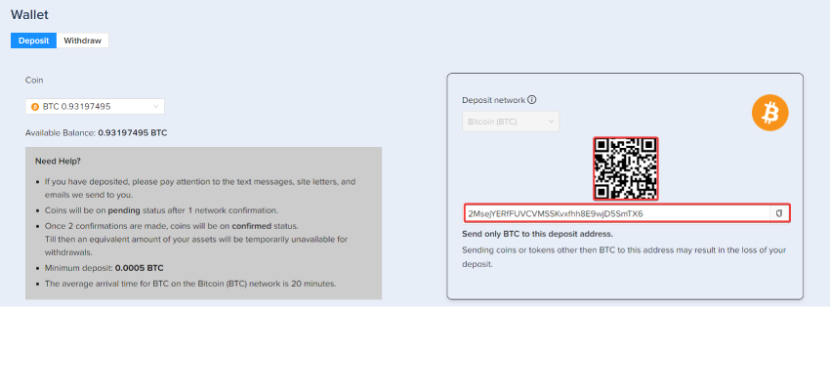

Step 2. Add Funds to Your Wallet

Next, deposit the crypto you’d like to use to fund your account. Transfer it to your PlasBit wallet, wait for the usual confirmations, and you’re ready for the next step.

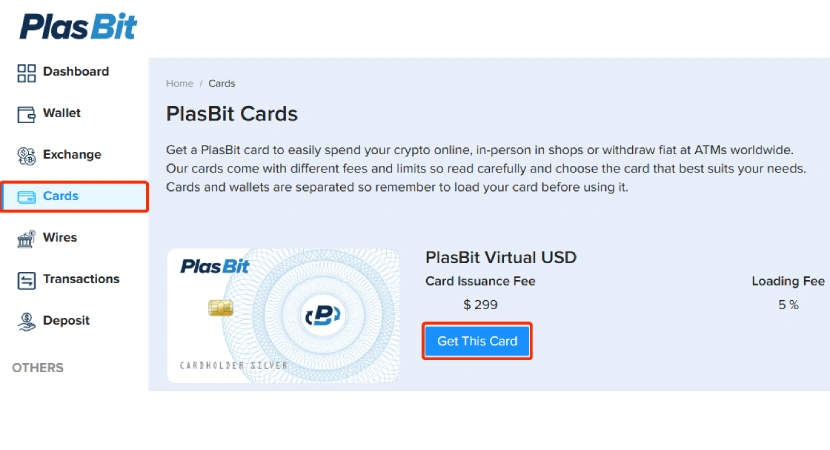

Step 3. Select a Virtual Card

Navigate to the Cards section and browse the available options.

Choose a virtual card in USD or EUR, depending on your preferred currency. Once you’ve made your selection, hit "Get This Card" to proceed.

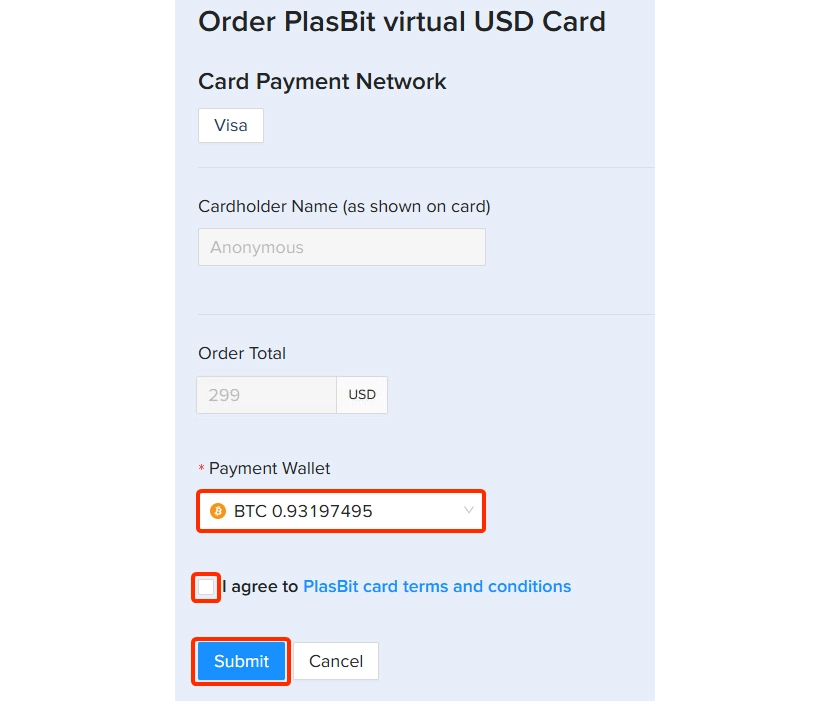

Step 4. Pick Your Payment Wallet

PlasBit gives you the flexibility to choose which wallet you’d like to use for payment.

Select the wallet that holds the crypto you want to spend on issuing the card, then confirm your choice.

Step 5. Wait for Confirmation

You’ll receive an email as soon as your new card is successfully issued—usually within minutes.

Step 6. Add Money to Your Card

To add spending power to your new card, go back to the Cards section and click on "Open Details." There, move to the Funding tab, select the wallet you want to draw funds from, enter the amount you want to add, and click on "Load." Triple-check everything, then click on "Submit."

Step 7. Get Your Card Info

Now that your card is funded, you can access the card details and get your card number, expiry date, and CVV by clicking on the "View Card Details" button.

And you’re good to go! Your PlasBit virtual card is now active and ready to be linked for ad payments.

The Harsh Reality of the Virtual Card Market

With all the fuss over the state of the virtual card market, we decided to see it for ourselves. We dug around among a range of providers, tested out their cards, and what we found was a sector riddled with confusing sign-ups, hidden fees, and outright scams. Based on our experience, here’s why you need to choose your issuer carefully.

Onboarding That’s Just as Painful as a Bank’s

You’d think a digital-first product like a virtual card would come with a smooth, user-friendly sign-up process. Instead, we found the opposite: clunky interfaces, long wait times, and pricing structures that make no sense. Some companies go as far as letting you buy a card first, then dropping a surprise KYC process on you after you’ve already paid. After seeing this, we made sure our signup process is proactively transparent. That’s why we will never accept any payments from you until you fully clear KYC, so there’s zero risk of getting blindsided. Every step, from verification to fees, is crystal clear because trust goes both ways.

Customer Support That’s Practically Nonexistent

When an ad campaign gets hit with a sudden payment failure, you don’t have days to waste – you need a fix now. But most virtual card providers trap you in a ticket system, where you’ll wait at least five business days for a generic response that barely answers your question. Some don’t even offer live support, opting out via an outsourced help desk. For obvious reasons, we went in another direction with our customer service policy. If you have a problem with your PlasBit virtual card, a real person will be assigned to sort it out ASAP. And the same person will work on your issue until it is resolved before moving on.

Creatively Disguised Fees

The biggest scam in the virtual card industry isn’t the cards themselves, it’s the fees they don’t tell you about. Some providers brazenly lie: they advertise a low upfront cost, but once you start using the card, they hit you with hidden transaction fees, deposit fees, maintenance fees, etc. If you want to avoid the minefield when dealing with cards for online ads, you’ll need an issuer like PlasBit. Our fees are clearly displayed upfront so you never have to deal with buyers remorse written in fine print. Virtual cards are a premium product, and you get what you pay for.

Cards That Don’t Even Work

One thing we came across far too often was the sheer number of virtual cards that were completely useless for marketing purposes. Some cards labeled “widely accepted” were declined by the largest ad platforms, including Meta Ads and Google Ads. Others claimed Apple Pay and Google Pay compatibility but failed to deliver. Well, if a PlasBit card is advertised as compatible with Apple Pay or Google Pay, you can be 100% confident it is. If there are restrictions, you’ll know about them before you buy. No false advertising, no last-minute “feature updates”—just a virtual card that actually works.

Some Issuers Reuse BINs & Get Rejected by Ad Platforms

Some providers issue multiple cards under the same BIN (Bank Identification Number), and if an ad platform blocks that BIN, none of those cards will work. This can leave you scrambling for a new payment method while your campaigns sit inactive. As such, every PlasBit virtual card comes with its own unique BIN, ensuring compatibility across all major ad platforms.

A Tale (Virtually) as Old as Time

Here’s a scenario that happens all too often: you’ve landed a big-ticket direct-to-consumer luxury watch brand as a client. They’re launching a new collection, and your agency is handling their social media ad campaigns for the next three months. At first, everything is going off without a hitch in sight. You’re running split tests, fine-tuning the targeting, and dialing in audience segments. After a few days, the campaigns start yielding insane results: intrigued users are clicking through, browsing, and converting. Your client is pumped and is hinting they’re open to scaling the budget up. Then, out of nowhere, TikTok hits you with the Payment Declined notice. You check the dashboard: Payment declined. Has the agency’s credit card hit its limit? Did the platform flag the charges as fraud? You don’t know, and it doesn’t matter at this point because either way, those high-converting ads are all dead in the water. Before you can recover, the client checks their analytics to see their campaign dead in the water. Understandably, they call asking "Why aren’t our ads running? What happened to our budget?" You pull up the credit card statement—a mess of transactions from multiple clients across different ad platforms. There’s no easy way to separate out this brand’s specific charges without manually sorting through the numbers. Every second spent figuring it out makes you look less in control. By the time you call back with a half-answer, the client isn’t impressed anymore. Instead of scaling up, they’re questioning if they even want to keep working with you.

A Reliable Alternative

But what if, instead of a PayPal account or a credit card, you managed your campaigns using virtual cards? Before launching the campaign, you’d issue a dedicated virtual card specifically for this client’s TikTok ads. The ads would do equally well but, this time, there’s no risk of a maxed-out shared credit card or a surprise payment failure stopping everything. If an ads platform charges the card, it pulls from the pre-loaded budget, not an overburdened agency credit card. There’s no confusion, no limits hit unexpectedly, and no delayed transactions flagging fraud alerts. Plus, when the client calls to check how much has been spent, you have the answer instantly.

Measuring Ads Success: What Is a Good Cost Per Click?

You’d be hard pressed to find a single affiliate marketer who talks down the importance of CPC. Keeping track of this seemingly simple metric allows you to ensure every click you pay for converts at a high enough rate where your commissions stay higher than your ad spend. But how do you determine what is a good cost per click? It must be lower than the conversion rate multiplied by the average sale price and divided by your target ROI. For instance, if you’re converting 3% of clicks, and making about $80 per sale with a target ROI of 300%, then you shouldn’t be paying more than $0.60/click.

Here is the formula for determining whether you’re getting enough bang for your ad bucks:

Plugging in the numbers from our example:

Post-Game Ads Analysis: What Is a Good PPC Conversion Rate?

It seems obvious why achieving a high conversion rate usually requires the targeting, ad creatives, and landing pages to be dialed in just right. But for some reason, there is no clear consensus on the specifics. So, what kind of numbers do you need to hit, what is a good PPC conversion rate? An average of 5-10% is considered a good PPC conversion rate according to industry standards. When you achieve (or just stumble into) rates beyond 10%, consider recording and repeating the way you dialed everything in. Likewise, if your PPC conversion rate falls below 5%, it’s probably time to refine your targeting, change up your creatives, or revamp your landing page.

The Ten Commandments of Online Ads

- Start with a Clearly Defined Strategy.

Define your goals, budget, audience, campaign duration, and success metrics before going live. Decide whether you're optimizing for conversions or brand awareness and outline how you'll measure results. Without a clearly defined strategy, your campaign lacks direction and will perform less well. - Aim for narrow targets.

The more specific your audience definition—by age, device, or location—the better your social ads and PPC will do. - Know Your Audience.

It’s no longer enough to know the demos of the people you want to reach. Nowadays, you have to understand the consumer behavior that drives them. And most platforms allow you to leverage some form of that by letting you target their users by habits, preferred formats, and media consumption. - Get to the Point.

Your ad should be clear, direct, and easy to understand without unnecessary fluff or industry jargon. Focus on the goal, whether it’s driving sales, generating leads, or growing engagement, and make sure every element of the ad supports that objective. - Provide Value Right Off The Bat.

Attention is easy to get, but keeping it is what drives results. Clickbait might get people through the door, but if the content feels empty or misleading, they will leave just as fast. To turn traffic into conversions, focus on content that educates, entertains, or solves a real problem. When people find genuine value in what you create, they are far more likely to stick around, trust your brand, and eventually make a purchase. - Stay True to Your Brand.

Authenticity matters. If users remember the product but not the company behind it, your ad just did free marketing for a competitor. Every ad, from PPC to social media, should showcase your brand’s personality, visuals, and tone to create strong brand recall. - Use Clear Calls to Action.

A CTA (Call to Action) does exactly what its name implies by directly telling users what action to take. Whether it’s “Subscribe Now,” “Shop the Sale,” or “Get Started”, your CTA should be visually catchy, direct, and actionable in an immediate way. - Retarget Website Visitors.

Most visitors won’t convert on their first visit, but that doesn’t mean they’re a lost cause. Retargeting lets you follow up and bring them back using email marketing or PPC remarketing ads. In particular, Google Analytics is a great tool for retargeting audiences based on specifics like time on site, page views, and many others. Plus, you can just import that data into Google Ads and start a retargeting campaign in minutes. - Target with the Right Ad Formats.

Search ads are ideal for high-intent buyers, social ads are ideal for engagement, and video ads are ideal for storytelling. Don't waste money on the wrong formats for the wrong behavior. - Keep your eyes on the KPIs.

If you're not tracking results, you're flying blind. KPIs indicate what is and isn't working. Luckily, you can use tools such as Google Analytics and Google Search Console to monitor those Key Performance Metrics in real-time because, without data-driven adjustments, even the greatest marketing plan can crash out very quickly.

Do All Platforms Accept Virtual Cards For Ad Campaigns?

Though this isn’t a problem for PlasBit card holders, users of other card issuers have reported being unable to pay on major platforms like Google and Snapchat Ads. Understandably, you might wonder whether virtual cards work across different platforms. Can you use them without issues, or will some of the big advertising platforms reject these cards for ad campaigns? You can use virtual cards to pay for Google, TikTok, and Facebook ads with high limits, instant issuance, and no cap on the number of cards you can create. Just deposit crypto into your wallet, order a card, load it with funds, and add the card details to your ad platform for seamless payments.

Final Thoughts: The Smarter Way to Manage Ad Spend

For affiliate marketers and agencies, payment issues shouldn’t be the reason your campaigns fail. Legacy payment tools like credit cards and PayPal come with spending limits, account freezes, and tracking nightmares, all of which can stall your momentum and cost you revenue. Virtual cards for online ads solve these problems by giving you full control over your ad budgets, preventing payment failures, and making expense tracking effortless. With PlasBit, you get instant issuance, high spending limits, and seamless crypto funding, ensuring your ads run without interruptions. If you’re serious about scaling your campaigns and maximizing ROI, switching to virtual cards isn’t just an upgrade—it’s a necessity.