Explore the methods of converting BTC to USD, unravel the surrounding Bitcoin's price volatility, and anticipate the upcoming halving event. You are deciphering the factors influencing exchange rates and discovering the power of a crypto calculator designed for real-time BTC-to-USD conversions. This concise exploration offers a comprehensive understanding of Bitcoin's workings, ensuring you understand the cryptocurrency market clearly.

How Does Bitcoin Work?

Bitcoin operates on a groundbreaking decentralized system that revolutionizes traditional financial transactions. Let's explore BTC's workings in more detail and informatively, going beyond surface-level understanding.

Blockchain Technology:

Bitcoin transactions are transparently recorded on a public and distributed ledger known as the blockchain. This decentralized ledger, maintained by a network of participants, ensures that every transaction is verifiable and secure. Each participant, known as a node, has a copy of the whole blockchain, making it resistant to tampering or fraud.

Peer-to-Peer Transactions:

Unlike traditional finance, which relies on banks as intermediaries, BTC transactions occur directly between the sender and receiver. This peer-to-peer nature eliminates the need for a central authority, allowing faster and more cost-effective transactions.

Cryptographic Security:

BTC holders have complete control over their funds through cryptographic keys. A cryptographic key comprises a public key (an address visible to others) and a private key (known only to the holder). This dual-key system ensures the security and authenticity of transactions, as access to funds is only possible with the private key.

Limited Supply:

Bitcoin's fixed supply of 21 million coins distinguishes it from traditional fiat currencies. This scarcity is encoded into the protocol, significantly shaping the cryptocurrency's value proposition. With no possibility of creating more Bitcoin and a predetermined issuance rate, scarcity becomes a fundamental demand driver. Transaction Fees and Mining: To maintain the network's integrity, miners validate and add transactions to the blockchain. Incentives for miners come in the form of transaction fees and block rewards. Transaction fees are attached to each transaction, creating a competitive environment where miners prioritize transactions with higher fees.

Proof-of-Work:

Bitcoin's security model relies on a proof-of-work system, where miners compete to decipher complex mathematical problems using specialized hardware. This energy-intensive process adds a layer of security to the network, making it economically unfeasible for malicious actors to manipulate the blockchain.

Mining Process:

The mining process involves cryptographic hashing, where miners attempt to produce a unique hash lower than or equal to the target hash set for the next block. This trial-and-error approach, combined with the randomness of hash functions, ensures the decentralization and security of the network.

Halving Events:

Bitcoin experiences periodic halving events approximately every four years, reducing the block rewards miners receive. This intentional reduction gradually limits the supply of new Bitcoin entering the market, creating scarcity. The next halving event in 2024 will further reduce block rewards to 3.125 BTC per block, intensifying competition among miners.

BTC to USD with Crypto Exchange

Convert Bitcoin to USD on our PlasBit crypto exchange with these secure steps:

1. Select "Get Started" in the upper right corner to register using your email and a robust password.

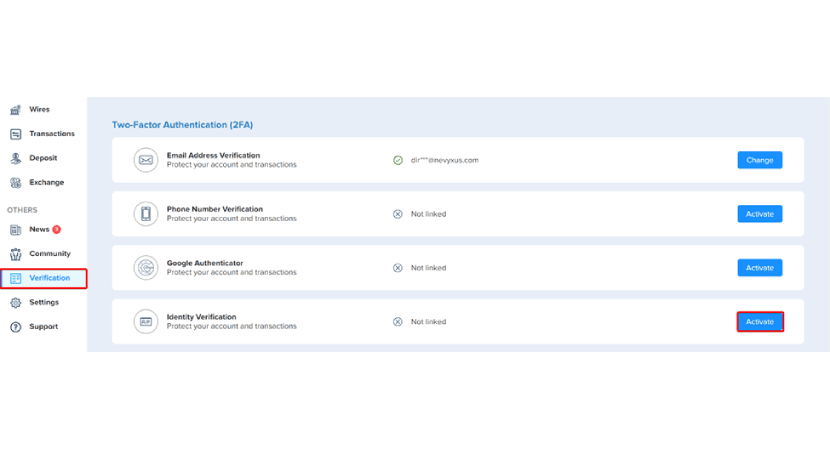

2. Once logged in, proceed to the verification section on your account dashboard. Initiate KYC by clicking "Activate Verification."

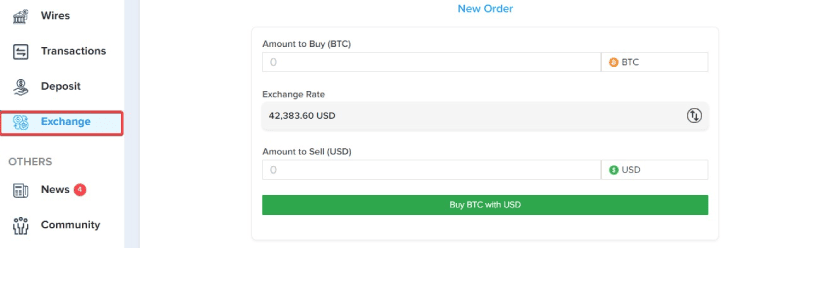

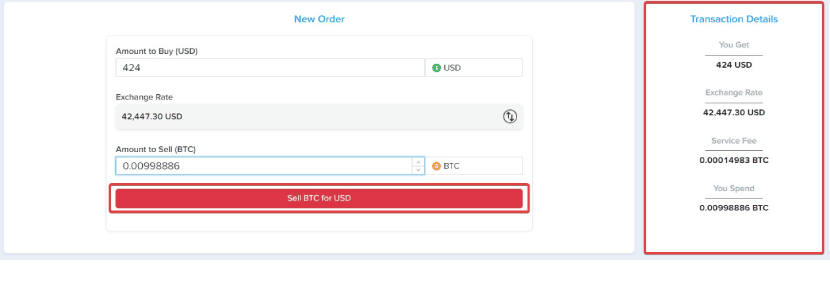

3. Proceed to the "Exchange" section. Choose USD to buy Choose USD to buy.

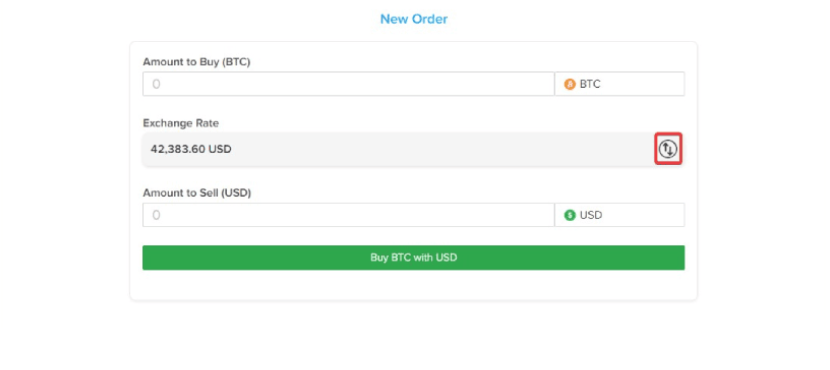

4. Switch from BTC to USD

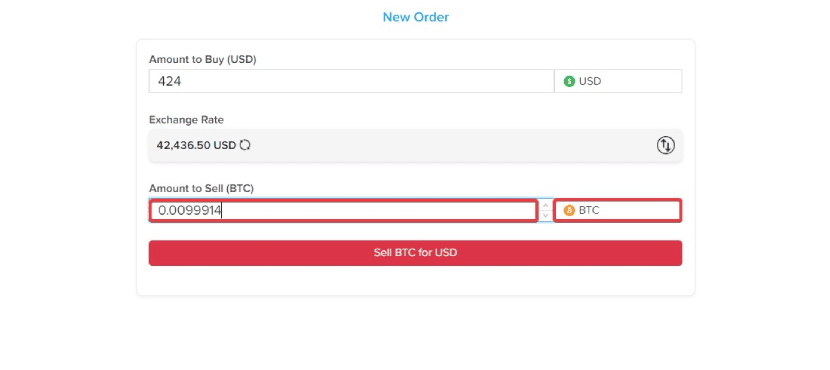

5. Input the amount of USD you wish to sell.6. Confirm the transaction amount and click "Sell BTC for USD."

6. Confirm the transaction amount and click "Sell BTC to USD"

7. Upon confirmation, your wallet will reflect the amount of BTC received.

Exchange BTC to USD with a Wire Transfer

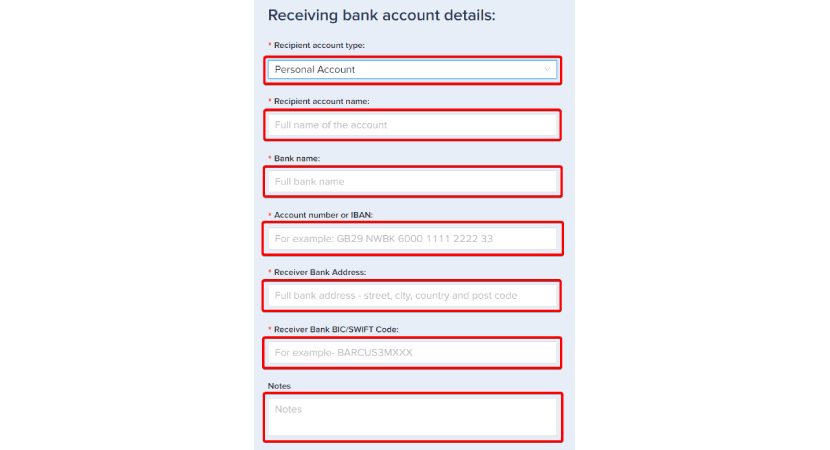

Navigate to the "Wires" section for all details on BTC to USD bank wire transfers:

- Review transfer details like completion time, fees, and minimum/maximum amounts per transaction.

2. Input recipient account information: account name, type, number/IBAN, bank name, BIC/SWIFT code, bank address, and additional notes.

3. Select BTC for conversion to USD. Our system auto-calculates amounts, fees, and total transfers after deducting fees. Ensure sufficient BTC in your wallet.

4. After the transfer request submission, receive a confirmation prompt. The deducted crypto amount is reflected in your account and listed as a pending request.

Successfully initiated a wire transfer from BTC to USD. Track progress in your account; the transfer will be processed within the specified timeframe.

Exchange BTC to USD with Debit Card

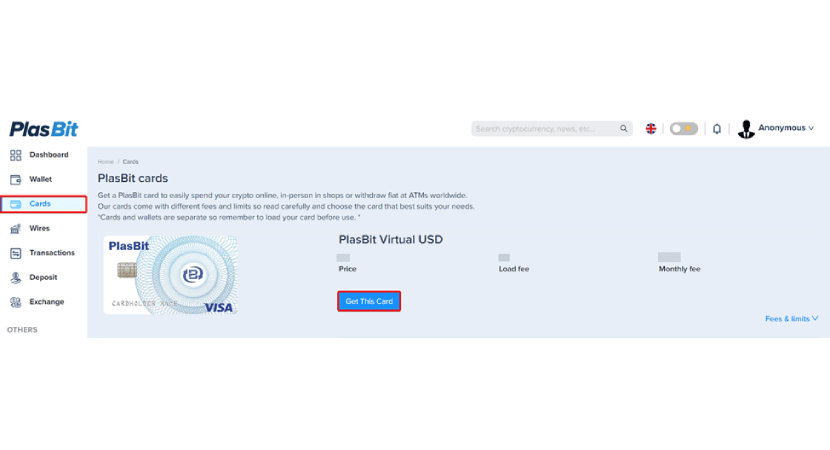

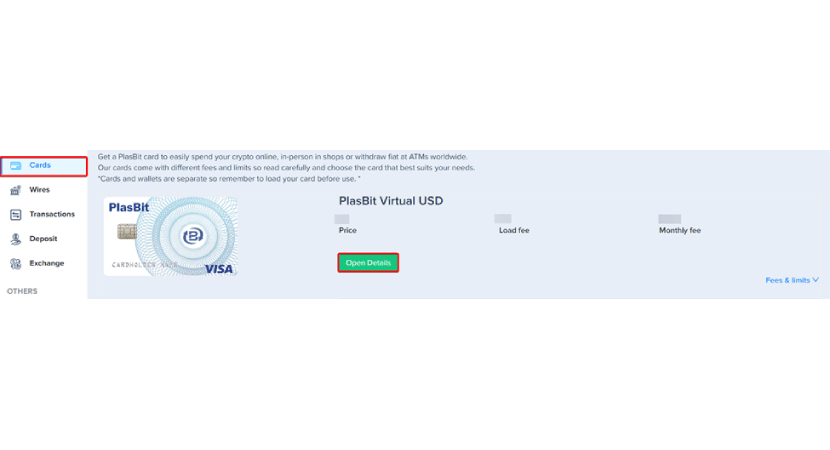

Head to the 'Cards' section for a BTC to USD exchange using PlasBit's crypto debit cards:

- Choose your desired card—Virtual USD, Plastic USD, or Metal USD.Each comes with its price and fees. Click 'Get This Card' to proceed.

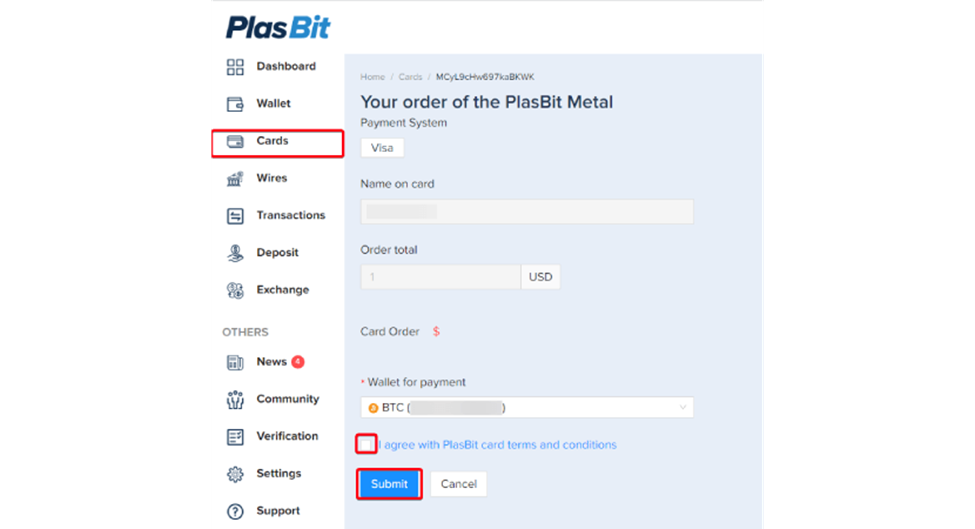

2. Confirm payment information, enter your card name, agree to terms, and click 'Submit.'

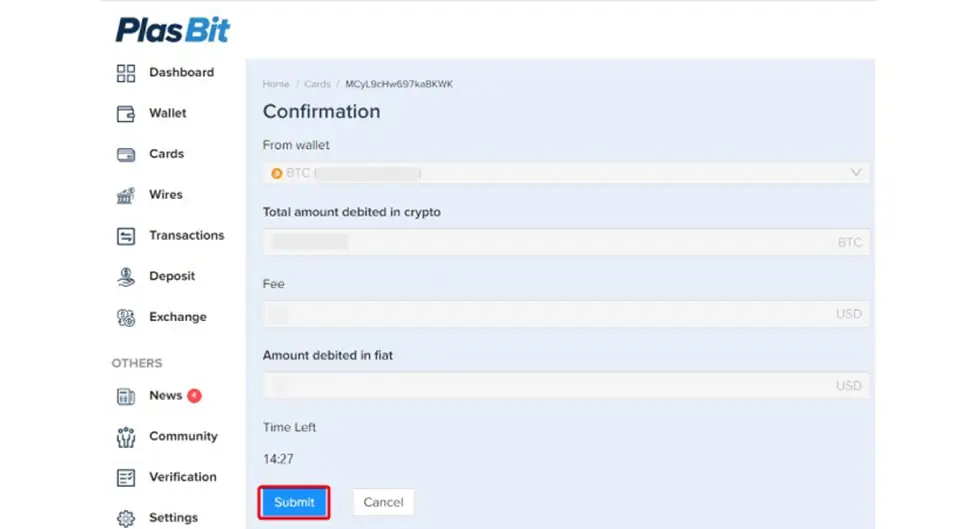

3. Review wallet balance, total crypto debited, associated fees, and fiat amount. Click 'Submit' after confirming the details.

4. Click the 'Open Details' button to review your selected card details.

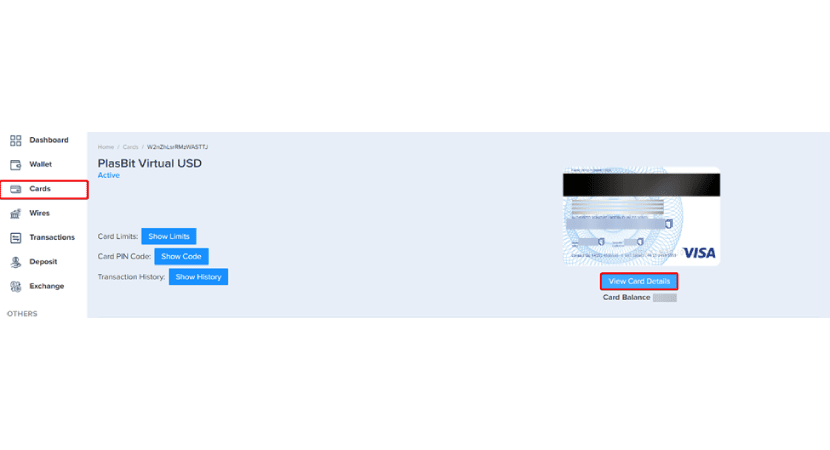

5. This includes card specifics like limits, PIN code (not applicable for virtual cards used exclusively online), transaction history, validity, CVV, and signature.

6. Choose to fund your debit card with USD for withdrawals.

7. Select the Bitcoin wallet to load USD onto the debit card.

8. Choose the debit card, specify the amount, review fees, and see the final amount to be received.

9. Witness the deduction of BTC, automatic fee subtraction, and the display of the total amount your debit card will receive.

10. After reviewing, click submit, and your debit card will be loaded with funds.

Factors Influencing Exchange Rates

Understanding the complex factors that sway exchange rates between BTC and USD is essential for informed decision-making in the volatile cryptocurrency landscape. Here's a detailed exploration of these influential factors presented in a list:

Supply and Demand Dynamics:

The price of BTC is subject to the fundamental economic principles of supply and demand. Increased demand for Bitcoin typically results in a price surge, while excess supply can lead to a decline. The delicate balance between the availability of Bitcoin (supply) and market participants' desire to acquire it (demand) shapes its valuation.

Market Sentiment:

Cryptocurrency markets are susceptible to sentiment and perception. News events, social media trends, and global occurrences create a ripple effect, influencing trader sentiment. Swift shifts in market sentiment can impact BTC's value as emotional responses and perceptions play a significant role.

Regulatory Developments:

Regulatory changes and government interventions wield significant influence in the cryptocurrency market. Positive regulatory develo pments often increase adoption, fostering a BTC value surge. Adverse regulatory actions or uncertainties can introduce caution among traders, impacting demand and influencing BTC's price trajectory.

Global Economic Factors:

Bitcoin's exchange rates can be affected by broader global economic factors. Economic instability or uncertainty may drive traders towards assets perceived as stores of value, potentially impacting Bitcoin's demand.

Technological Advances and Innovation:

Technological advancements in the crypto space can influence market perceptions. New developments, technological improvements, or the introduction of novel features can impact Bitcoin's attractiveness to traders.

Market Liquidity:

Influenced by trading volumes, liquidity in the cryptocurrency market plays a role in price stability. Lower liquidity may contribute to more pronounced price fluctuations, while higher liquidity can mitigate extreme volatility.

Macro-economic Trends:

Broader macroeconomic trends, such as inflation or deflation concerns, can impact trader attitudes towards BTC as a hedge against economic uncertainties.

Methods of Converting Bitcoin to USD

Navigating the conversion of BTC for USD involves carefully considering various methods, each presenting its unique advantages and considerations. Here's an in-depth exploration of the primary avenues for converting BTC for USD:

Centralized Exchanges (CEX):

Centralized exchanges (CEX) are pivotal in the cryptocurrency ecosystem, serving as the predominant platform for exchanging crypto to fiat currencies. Operating as intermediaries, these exchanges facilitate trading by efficiently matching buyers with sellers, fostering a transparent and efficient marketplace. CEX platforms distinguish themselves with a user-friendly interface, ensuring accessibility for novice and experienced traders. The high liquidity these exchanges offer contributes to market stability and swift execution of trades. Additionally, the extensive array of trading pairs available on CEX platforms provides diverse investment options. Despite these advantages, engaging with CEX platforms needs to place significant trust in exchanging your funds, emphasizing the importance of selecting reputable and secure platforms. It's essential to note that regulatory compliance varies among CEX platforms, necessitating thorough research to ensure adherence to relevant legal frameworks and standards.

Decentralized Exchanges (DEX):

Decentralized Exchanges (DEX) represent a paradigm shift in the cryptocurrency landscape by operating without a central authority, providing a platform to trade directly from your crypto wallets. The fundamental advantage of DEXs lies in their enhanced privacy and security, as you maintain control over your private keys, mitigating the risks associated with centralized control. This decentralized nature aligns with the core ethos of blockchain technology, emphasizing peer-to-peer transactions and minimizing the reliance on intermediaries. However, it's crucial to acknowledge that DEXs may exhibit lower liquidity than their centralized counterparts, potentially leading to more pronounced price fluctuations. The user interface of DEX platforms might demand a steeper learning curve, especially for beginners navigating the intricacies of decentralized trading. Despite these considerations, the growing popularity of DEXs underscores the increasing demand for greater autonomy and security in cryptocurrency trading.

BTC to USD Crypto Calculator

Our crypto calculator is essential for you and crypto/finance site owners seeking a streamlined method to convert Bitcoin to USD. This calculator provides real-time insights into the exchange rate between BTC and USD, offering accurate information for making well-informed decisions in the volatile cryptocurrency market. PlasBit's crypto calculator ensures a seamless and transparent currency conversion experience, allowing you to effortlessly determine the equivalent value in USD by entering your desired BTC amount. This tool holds significant value for individuals actively involved in BTC transactions, informing you about the current exchange rate and facilitating timely decisions based on precise calculations. Beyond individual users, crypto and finance site owners can elevate the functionality of their platforms by integrating our Bitcoin to USD crypto calculator.

This integration improves the overall user experience by providing an invaluable tool for instantaneous currency conversions. With a user-friendly interface and real-time data, the calculator contributes to a positive and engaging experience, fostering your satisfaction and engagement. The calculator becomes a valuable asset for website owners, attracting a broader audience interested in BTC conversions, thereby increasing site traffic and expanding their user base. Furthermore, the accuracy and reliability of our crypto calculator bring a layer of credibility and professionalism to finance websites. Site owners can leverage this tool to position their platforms as reliable sources for cryptocurrency-related information. Integrating our crypto calculator not only aids in user retention but establishes the site as a go-to resource for those seeking accurate Bitcoin-to-USD calculations.

Who Created Bitcoin?

The origin of BTC can be traced back to the creative mind behind its creation, concealed under the pseudonym "Satoshi Nakamoto." Revealing a groundbreaking vision in a 2008 whitepaper. Satoshi Nakamoto conceptualized a decentralized digital currency that operates on a peer-to-peer network, effectively sidestepping the need for centralized authorities such as governments or traditional banks. This visionary step addressed a long-standing challenge in digital transactions—the double-spending problem. Satoshi achieved this by introducing a proof-of-work consensus mechanism nested within the innovative structure of a blockchain, laying the foundation for a revolutionary shift in how financial transactions could be conducted. The activation of Bitcoin's network in January 2009 marked a historic moment, as Satoshi Nakamoto personally mined the first block, commonly referred to as the "genesis block." This initial block not only kickstarted the blockchain but also symbolized the commencement of a new era in digital finance. Despite the profound impact of BTC on the global financial landscape, the identity of Satoshi Nakamoto remains an enigma, preserving an element of mystery and reinforcing the privacy-centric principles inherent in the ethos of the cryptocurrency movement. The elusive nature of Nakamoto continues to fuel speculation and curiosity, adding an intriguing layer to the narrative of Bitcoin's origin.

Bitcoin Price

Bitcoin's price has earned a reputation for its remarkable volatility. Yet, paradoxically, it is the most high-performing asset across various classes, including stocks, commodities, and bonds, over the past decade. The cryptocurrency's ascent has been meteoric, experiencing an astonishing surge of approximately 9,000,000% between 2010 and 2020. In the nascent days of 2009, Bitcoin emerged as Satoshi Nakamoto mined the inaugural Bitcoin genesis block, introducing 50 BTC into circulation at an initial value of $0.00 per coin. This marked the beginning of a decade-long journey that saw the continuous entry of fifty BTC into circulation every 10 minutes, a cycle persisting until Bitcoin's first halving event in November 2012, where the issuance system automatically reduced the new BTC supply by half every 210,000 blocks. As Bitcoin's narrative unfolded, a significant milestone was reached in February 2011 when BTC achieved parity with the U.S. dollar for the first time.

This pivotal moment acted as a catalyst, attracting new investors into the market. Over the ensuing four months, Bitcoin's value experienced a remarkable ascent, soaring to a peak of over $30. However, the cryptocurrency faced challenges, including the infamous Mt Gox hack and China's initial ban on crypto, leading to a prolonged bearish period. It wasn't until early 2017 that BTC's price surpassed $1,000 again, and from that point, it embarked on a dramatic surge throughout the year, culminating in its previous long-standing all-time high of $19,850 by the end of 2017. The subsequent year, 2018, witnessed the entire crypto market entering a "crypto winter," characterized by a yearlong bear market. Bitcoin's resilience prevailed, and in December 2020, it not only revisited the previous all-time high but also surpassed it, surging 239% over the next 119 days to establish a new peak at $64,799.

Why Bitcoin Price So Volatile?

The volatility in the price of BTC can be attributed to various factors that have characterized the cryptocurrency since its inception:

Size of the Crypto Market:

Compared to traditional financial markets, the relatively smaller size of the crypto market contributes to heightened volatility. Big trades in this less heavily traded space can lead to substantial price swings, as the market lacks the larger trading volumes that act as a stabilizing factor in more established markets.

Influence of Public Sentiment and Speculation:

Bitcoin's value is heavily dependent on public sentiment and speculative behavior. Media coverage, influential opinions, and regulatory developments often drive short-term price changes. These elements introduce uncertainty that affects the delicate balance between demand and supply, contributing to the dynamic nature of Bitcoin's valuation.

Fixed Supply of Bitcoin:

With only 21 million BTC set to ever be in circulation, the fixed supply of Bitcoin adds to its volatility. The scarcity of this digital asset can lead to dramatic price fluctuations, especially as demand for Bitcoin varies over time.

Role of "Whales":

Large BTC holders, commonly called "whales," are pivotal in market dynamics. The substantial transactions executed by these entities have the potential to sway the market significantly, amplifying price volatility.

When Is the Next Bitcoin Halving?

Anticipated on the horizon is the next significant event in the world of Bitcoin – the much-anticipated halving, scheduled to unfold in April 2024. Pinpointing the exact date remains a challenge due to the dynamic nature of blockchain processes, hinging on the cumulative block height. This metric signifies the number of blocks leading up to a specific block in the blockchain. The forthcoming Bitcoin halving is anticipated to materialize when the block height reaches 840,000, a momentous juncture in the sequence of 210,000-block intervals that characterize the periodicity of Bitcoin halving events. Occurring approximately every four years, Bitcoin halving reduces the rewards miners receive for successfully mining new blocks. In the impending halving, expected in April 2024, this reward reduction will play out as the block rewards are halved. This strategic mechanism is intrinsic to the Bitcoin protocol and is designed to uphold the cryptocurrency's inherent value as a deflationary currency. By systematically diminishing the issuance of new Bitcoins, the protocol endeavors to counteract the devaluation risks typically associated with inflationary currencies, fostering a sustainable and resilient Bitcoin ecosystem.

Will Bitcoin Halving Affect BTC's Price?

Examining the historical trends surrounding Bitcoin halving events reveals a notable pattern traders closely monitor. Typically, Bitcoin's price has demonstrated an upward trajectory in the months preceding a halving. This phenomenon is often attributed to the anticipation of a supply shock, prompting consumers and traders to position themselves favorably in anticipation of reduced coin issuance. The scarcity created by halving events tends to generate heightened interest in BTC, fostering an environment where demand outpaces the newly limited supply. Post-halving, the trajectory of BTC's price hinges on many factors. Sustained upward momentum may persist if the demand for Bitcoin remains robust and continues to surpass the diminished supply. However, it's crucial to recognize that the cryptocurrency market is multifaceted, with influences extending beyond halving dynamics. Elements such as market sentiment, regulatory developments, and global events can introduce additional variables that impact the price of BTC. As a result, while historical patterns provide insights, the future price trajectory of Bitcoin remains subject to the intricate interplay of these multifactorial influences.

Conclusion

Delving into the intricacies of BTC reveals a transformative decentralized system reshaping the landscape of traditional financial transactions. Bitcoin's workings are detailed and innovative, from the transparency of blockchain to the dynamics of peer-to-peer transactions and the cryptographic security safeguarding your holdings. As we navigate the factors influencing exchange rates, explore conversion methods, and anticipate the upcoming halving event, it becomes clear that the cryptocurrency market is dynamic, influenced by factors ranging from market sentiment to regulatory developments. Integrating crypto calculators enhances user experience, offering real-time insights for informed decision-making. While the identity of Bitcoin's creator, Satoshi Nakamoto, remains a mystery, the cryptocurrency continues to captivate with its fixed supply, volatility, and imminent halving event, shaping its trajectory in the evolving digital finance landscape.