In today's fast-paced digital economy, advertising has found a dominant foothold online, with platforms like Google Ads leading the charge in connecting businesses to potential customers worldwide. As digital currencies gain traction, combining cryptocurrency with online payment systems has become a topic of keen interest for many, especially affiliates eager to leverage their digital assets. Amidst this evolving financial landscape, a burning question arises for those at the intersection of e-commerce and digital currencies: Does Google Ads accept crypto? Currently, Google Ads does not accept cryptocurrency as a direct form of payment. However, this article delves into the current capabilities and workarounds for using crypto with Google Ads.

Payment Options: Does Google Ads Accept Crypto?

While the tech giant has shown interest in the blockchain technology that underpins cryptocurrencies, it has yet to translate this into accepting digital currencies for ad payments. This policy is primarily due to the volatility, regulatory concerns, and security issues surrounding cryptocurrencies. Google's payment infrastructure is built to support more traditional and widely accepted forms of payment, such as credit cards, bank account debits, and digital wallets - options that currently offer more stability and are regulated within the existing financial systems.

Implications for Advertisers

This limitation poses a noteworthy constraint for you as an affiliate and advertiser who might hold significant wealth in cryptocurrencies. You cannot directly use your crypto holdings to fund campaigns or capitalize on the potential of Google Ads to expand reach and drive affiliate sales. This disconnect between digital currency assets and advertising expenditures represents a gap in the market. However, the absence of direct crypto payments does not spell the end of the road for affiliates looking to use your digital coins. Instead, it has given rise to innovative solutions that bridge the gap between cryptocurrency assets and platforms like Google Ads. Our cryptocurrency cards offer a viable workaround, allowing for the effective use of cryptocurrencies to fund Google Ads campaigns.

Crypto Cards as an Alternative

Google Ads provides several conventional payment methods for advertisers to fund their campaigns. These traditional payment methods, such as bank transfers and credit and debit cards, provide stability and are widely accepted. However, they may not align with the preferences and assets of all advertisers, particularly those who wish to utilize their crypto money holdings. If you are interested in using cryptocurrency to fund your Google Ads, PlasBit crypto cards present an innovative solution. These cards act as a bridge between cryptocurrency assets and Google Ads' traditional payment infrastructure. These cards function similarly to prepaid debit cards but are funded with cryptocurrencies. You can load the cards with digital currencies like Bitcoin, converted into the card's default currency (e.g., USD, EUR). Once converted, these funds can be used to make payments anywhere that accepts traditional card payments, including Google Ads.

Benefits for Affiliates Running Multiple Google Ads Campaigns

As an affiliate, you require flexible and efficient financial tools to power your marketing efforts. Our crypto cards offer a tailored solution for running multiple Google ads campaigns, providing a convenient and secure method of managing funds.

Ease of Transaction:

If you are an affiliate managing a multitude of campaigns, the adaptability of our affiliate crypto cards is a crucial benefit. The ability to quickly convert cryptocurrency into fiat currency eliminates the usual barriers associated with currency conversion, such as high fees and waiting times. This immediate conversion facilitates a seamless transaction process, enabling affiliates to react swiftly to market changes, capitalize on emerging trends, and ensure their campaigns are continuously funded and active. By simplifying the payment process, you can deploy your strategies across various platforms without the typical financial frictions that impede rapid execution and scaling.

Budget Management:

Effective budget management is critical for affiliates tracking and optimizing spend across numerous campaigns. Our crypto cards offer a level of budgetary precision that is particularly advantageous when fine-tuning the performance of each campaign. The ability to allocate specific amounts to individual campaigns allows for a meticulous approach to spending, which is essential for evaluating the return from each ad spend. It also helps quickly identify which campaigns are performing well and deserve more fund allocation. This strategic financial segmentation is invaluable if you aim to maximize the effectiveness of every dollar spent on Google Ads campaigns.

Avoidance of Monthly Limits:

Affiliates often push for aggressive growth, which can be hindered by the monthly spending limits imposed by traditional credit cards. Our crypto cards provide a dynamic solution to this problem, with the flexibility to rapidly top up funds. This facility ensures that high-performing campaigns are never throttled due to credit limits, allowing for continuous scaling and optimization. An uninterrupted flow of funding is particularly crucial during peak advertising periods or when quickly scaling up successful campaigns is necessary. By leveraging our cards, you can maintain your campaign's momentum and capitalize on the full potential of your advertising strategies on Google Ads.

Rapid Fund Availability:

In digital marketing, timing can distinguish between spectacular campaign success and a missed opportunity. Our crypto cards offer rapid fund availability, crucial for affiliates moving quickly to outpace competitors and capture market share. The almost instantaneous loading of funds onto the cards means that you can react in real time to analytics, making prompt adjustments to campaigns or seizing opportunities as they arise. This agility is essential for maintaining the continuity of ad campaigns and can provide a competitive edge in the marketplace.

Security:

As an affiliate, the stakes are high regarding managing and protecting financial resources online. Our crypto cards offer a robust layer of security by minimizing the exposure of sensitive financial details, which is a significant concern when conducting numerous transactions across various advertising platforms. By using our cards, you can reduce the risk of unauthorized access and fraud, for example, by choosing to enable Google authentication. The added security fosters a safer advertising environment where you can confidently run your campaigns, knowing your financial data is well-protected. This peace of mind is invaluable, as it allows you to concentrate on optimizing your campaigns and scaling your success on Google Ads.

Solving Monthly Credit Card Limit Problem

When running multiple advertising campaigns on Google Ads, affiliates and businesses often encounter the challenge of hitting their credit card limits. This occurrence can disrupt your campaign continuity and result in lost opportunities if ads stop running due to payment failures. The traditional credit card model isn't always flexible enough to accommodate the dynamic spending needs if you are a high-volume advertiser. To circumvent these limitations, allocating a dedicated card for each campaign can be a game-changer.

Maintain Continuous Campaign Activity:

By assigning a specific card to each advertising campaign, you can avoid the pitfalls of a card reaching its credit limit, which is a common issue when using a single card for multiple campaigns. This strategy ensures that each campaign has a dedicated funding source that is less likely to be exhausted unexpectedly. Usually, when a card hits its limit, the associated campaign is paused until funding is restored, which can lead to missed engagement opportunities and a potential loss in revenue. With individual affiliate debit cards, this risk is mitigated. Separate cards mean that issues with one will not affect the others, leading to a more stable and reliable overall advertising strategy.

Improved Budget Management Across Campaigns:

Allocating a unique card to each campaign empowers your affiliate business with superior budget control. This approach allows for precise management of campaign finances and prevents overspending. It's easier to assign specific budget amounts to each campaign when they have their card, making financial planning more straightforward. By preventing the mingling of funds across campaigns, you can ensure that each campaign is adequately funded according to its performance and needs.

Enhanced Tracking and Performance Analysis:

Dedicating a card to each Google Ads campaign simplifies the monitoring process of expenses and allows for a precise analysis of the return or ROI for individual campaigns. This data is crucial for optimizing advertisement spend and adjusting strategies for better performance. With separate cards, it becomes much easier to review and reconcile expenses for each campaign without confusion arising from a single statement listing all transactions. Isolated financial data per campaign facilitates a more accurate assessment of which campaigns perform well and which may require adjustments or discontinuation.

Using Crypto Card to Pay for Google Ads

Following this guide, you can obtain our cards and leverage your cryptocurrency holdings to finance Google Ads campaigns. This service allows you to bypass the direct crypto payment restrictions while enjoying the benefits of Google's powerful advertising platform.

1. Signup for Account:

Directly visit the signup page of our website or click the light-blue 'Get Started' button in the top right-hand corner of your browser. Type your chosen email address to register with and click the 'Continue' button. Finally, check your email and complete verification to get your account up and running.

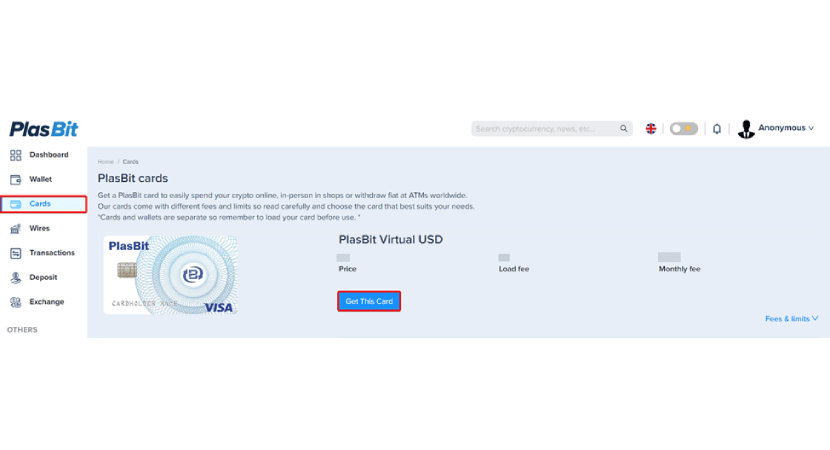

2. Choose Your Card:

Once logged in, access your account dashboard and click on 'Cards' on the left-hand side. You can then view and select a card to buy.

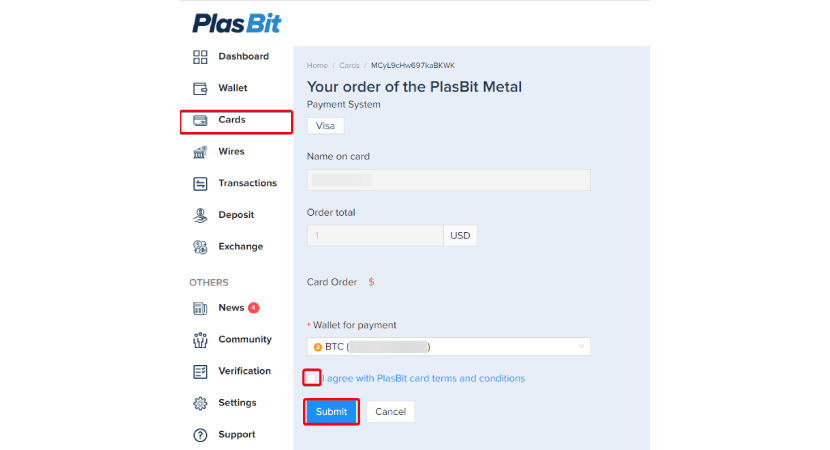

3. Complete Details for Card Application:

Enter your details and ensure you tick the agree to 'Terms and Conditions' box before clicking the 'Submit' button. You can select which wallet to pay for your card from, for example, Bitcoin (BTC). Ensure that you have funded this wallet enough to cover the card purchase.

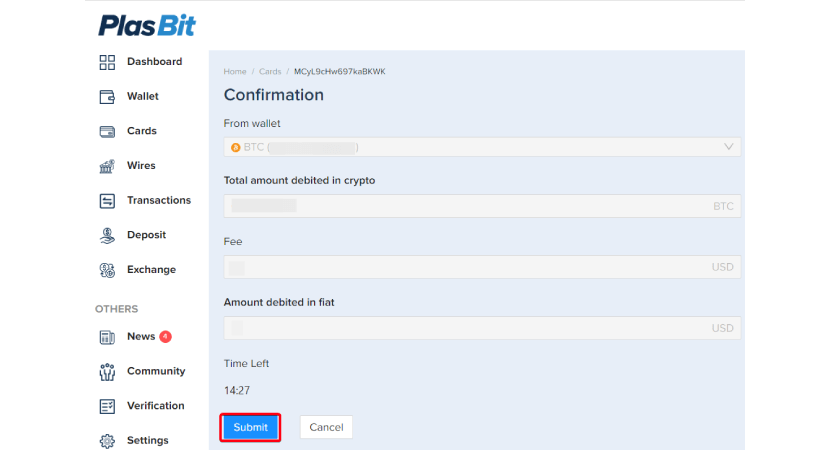

4. Confirm Card Purchase:

Check the purchase amount and details before clicking 'Submit' to pay for your new card.

5. Load Your Card

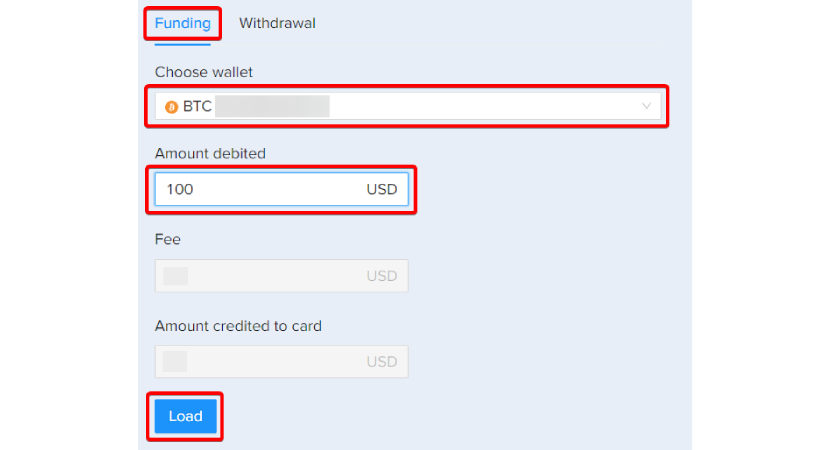

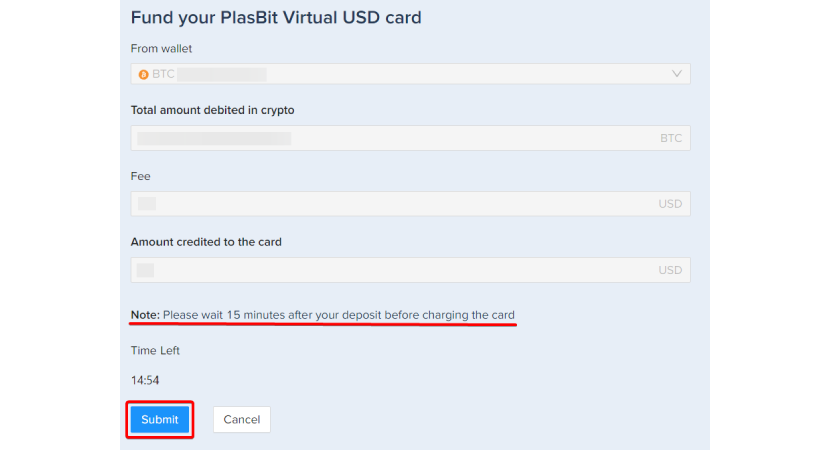

Once your card is active, click on 'Card,' go to the 'Funding' tab, and select a wallet and amount to fund your card. Click on the 'Load' button to proceed.

6. Confirm Card Funding and Wait

Ensure all the funding details are correct, and then click' Submit' to complete. Note that you should wait 15 minutes before using the card to pay.

7. Check Balance Updated:

Once successfully loaded, your card will show the balance, indicating that the funds are now ready to use.

.png)

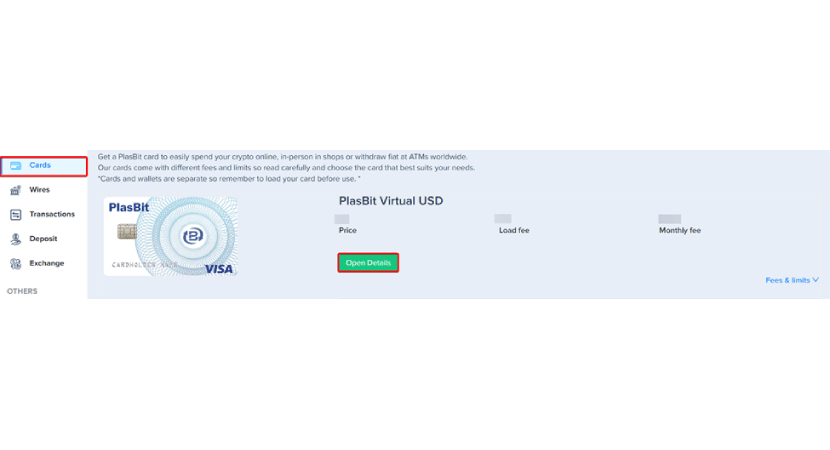

8. Open Card Details:

Via' Cards' on the dashboard, click the green 'Open Details' Button.

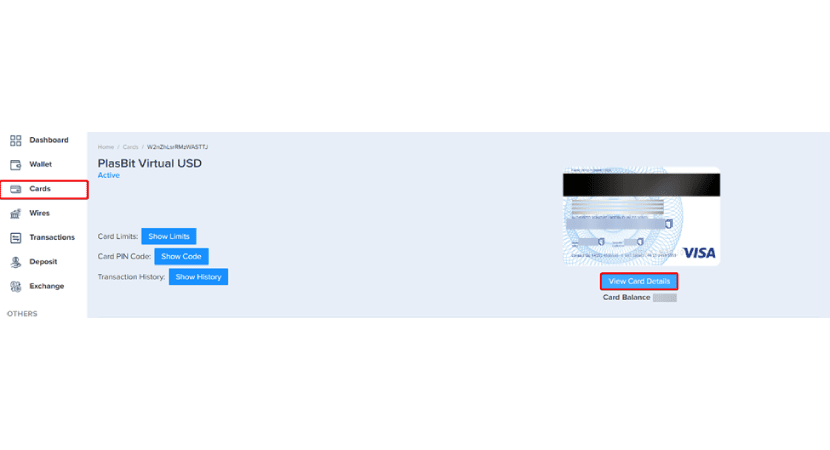

9. View Card Details:

You can now click on the 'View Card Details' button to access and view the details for your card, which will be required when using it to make payments.

10. Add Card to Google Ads Account:

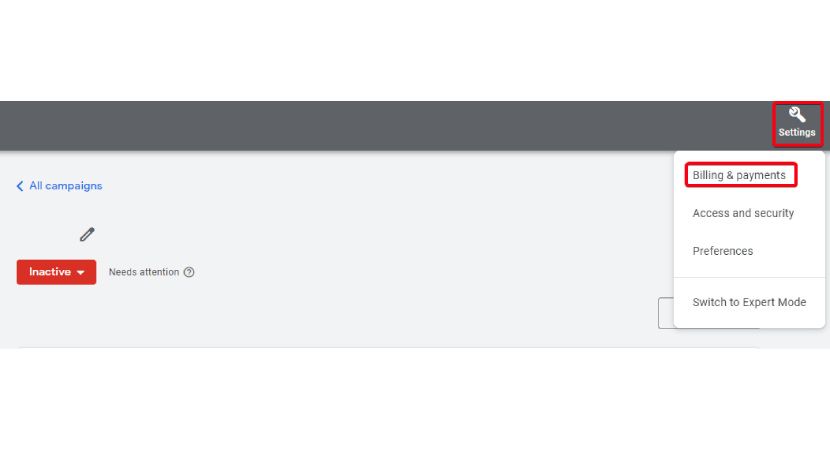

Sign in to your Google Ads account. Navigate to the ‘Billing & payments’ section under ‘Settings’ and the tools icon.

11. Add Payment Method:

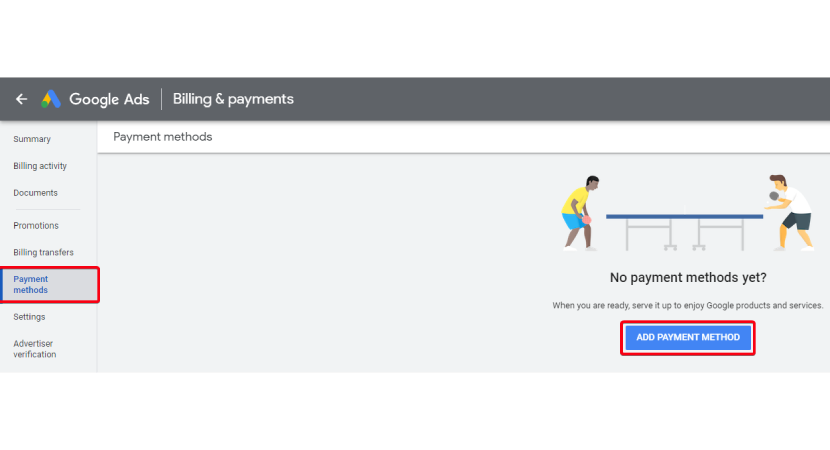

Click ‘Payment methods’ on the left-hand sidebar and then the blue ‘Add Payment Method’ button.

12. Enter Card Details

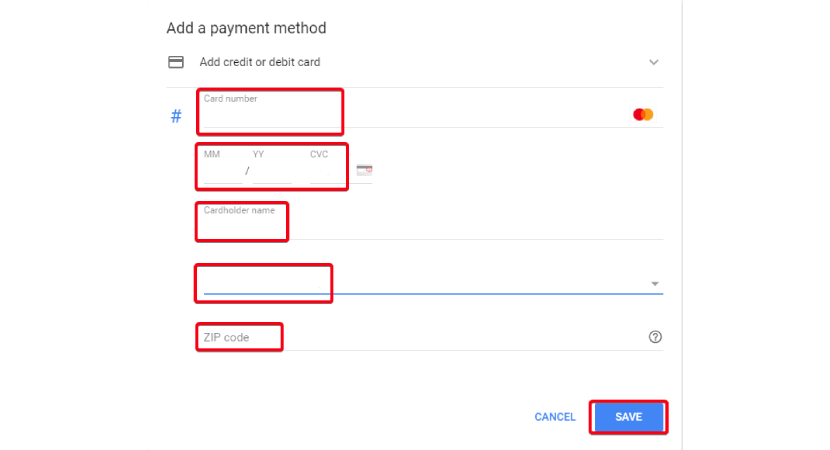

Type in your card number, expiry date, CVC number, cardholder name and address details (including ZIP code). Click ‘Save’ to add your PlasBit card as a payment method. Does Google Ads accept crypto? The answer is yes now that you are using our crypto debit card to spend it.

13. Select Payment Setting and Fund Campaigns:

Choose the appropriate payment setting (for example, automatic or manual) that aligns with your advertising strategy. Allocate funds from your card to your Google Ads campaigns, ensuring each campaign has the correct budget. You should also regularly monitor your campaign spending and reload your card to maintain active campaigns.

Payment Settings for Google Ads

Navigating the payment settings of Google Ads is crucial for an advertiser to help maintain an effective and uninterrupted online presence. The platform supports various payment options tailored to your business needs and preferences, providing flexibility and control over advertising spend. From automated billing to manual fund management and even monthly credit terms, each setting is designed to accommodate the unique financial workflows of businesses ranging from small startups to large enterprises. Understanding these payment settings is essential for optimizing your budget allocation, avoiding disruptions in ad delivery, and ultimately, achieving a better return for your business.

Automatic Payments:

When managing Google Ads, automatic payments offer a seamless and worry-free approach to billing. Once you've set up your billing information, Google takes care of the rest. Your ads run, and the costs you accrue are automatically charged 30 days after your last payment or upon reaching your preset payment threshold, whichever happens first. This adjustable threshold allows some flexibility in managing how frequently you are charged. It's also convenient because if you're preoccupied with managing a campaign, you won't have to stress about your ads stopping; payments are processed without your direct intervention. However, it's important to note that this method isn't available in every region, such as China and Russia, and for those advertisers, manual payments would be the alternative option.

Manual Payments:

Manual payments put you in the driver's seat of your advertising budget. This setting benefits those who prefer to pay upfront and control their spending closely. Once you pay to Google Ads, your ads will start running almost immediately after receiving funds. As your ads accrue costs, these are deducted from your prepaid balance. Vigilance is required with this method to ensure that your account is continuously funded; otherwise, your ads could stop running. Google assists by sending reminders when your balance is running low and again when it has been depleted. It's a proactive approach to budget management that can work well for advertisers who wish to avoid surprises in billing.

Monthly Invoicing:

Monthly invoicing is an option for businesses with a credit relationship with Google. This payment method allows you to run ads throughout the month, accumulating costs that are settled through an invoice at month's end. This facility is particularly convenient for businesses that prefer to manage their expenses through a credit line and handle payments through traditional means such as checks or bank transfers. Not all businesses qualify for monthly invoicing, as it requires meeting specific criteria set by Google, including a good payment history and passing a credit check.

Promotional Codes:

Also known as coupons or vouchers, these are incentives that Google or its partners occasionally offer to new advertisers. These codes provide a monetary credit to your account, helping reduce the initial costs of running ads. Specific criteria must be met to benefit from a promotional code, which typically includes spending a minimum amount on advertising within a set period. This feature is an excellent way for new advertisers to trial Google Ads at a lower risk and get a sense of the platform's potential impact on their business.

Case Studies: Paying for Google Ads Via Crypto Cards

The case studies presented here highlight the versatility and strategic advantage of using our cards in managing Google Ads campaigns. These real-world scenarios demonstrate how they can streamline budget allocation, provide immediate access to funds, and enhance security, thus offering a flexible and efficient solution for affiliates and businesses. By examining these cases, we can see the tangible benefits the cards bring to the complex landscape of digital advertising, ensuring that campaigns remain active and optimized even under the pressures of high demand or financial constraints.

Case Study 1: Diversified Campaign Management for an Affiliate Marketer

In the dynamic affiliate marketing world, Jordan juggled five campaigns for various product categories on Google Ads. Each campaign had its target audience and revenue potential. Still, Jordan faced a significant challenge: ensuring that the success of one campaign didn't come at the expense of the others due to shared credit card spending caps. As a solution, Jordan allocated a unique PlasBit card to each of his Google Ads campaigns. This decision paid off when his tech gadgets campaign started generating substantial returns, rapidly approaching the spending cap. In the past, this surge would have paused his other campaigns, as they shared a single credit card limit. However, with our cards, each campaign operated independently, ensuring that his successful tech campaign could continue scaling without affecting the continuity of his other campaigns. The separate cards allowed Jordan not only to maintain all his campaigns without interruption but also to analyze the performance and expenses of each campaign more efficiently. He could quickly identify which campaigns required budget adjustments and reallocate funds accordingly without the risk of hitting a combined credit limit. Jordan's strategic use of cards significantly increased overall profitability across his diverse product categories on Google Ads.

Case Study 2: Real-Time Budget Flexibility for E-commerce Store During Holiday Season

Emily, the digital marketing manager for an e-commerce store, was gearing up for the high-traffic holiday season. She knew that the timely allocation of budgets across her Google Ads campaigns would be crucial to capitalize on the surge of potential customers. Traditional credit cards with monthly limits could not offer the flexibility needed for such a critical period. With our cards at her disposal, Emily allocated different cards to each of her Google Ads campaigns. As the holiday season unfolded, Emily monitored the performance of each campaign in real time. She observed that the electronics campaign was hitting record engagement levels, signaling an opportunity for increased spend. Thanks to the immediate availability of funds on her cards, she quickly redirected the budget from other campaigns to the electronics ads, seizing the moment. This agile budget management with our crypto cards allowed Emily's e-commerce store to optimize ad spending effectively during the peak season on Google Ads. Campaigns that showed higher conversion rates received more funding, while underperforming ads were scaled back, ensuring an efficient use of the advertising budget. The store experienced a substantial increase in sales, outperforming expectations and previous years' performance. Moreover, the enhanced card security gave Emily peace of mind, knowing she could manage her Google Ads budgets without exposing the company's financial details online. This holiday season became a benchmark for the e-commerce store, demonstrating the power of using our cards to manage Google Ads campaigns during busy sales periods.

Embracing Innovation: Crypto Cards and Digital Advertising Payments

Does Google Ads accept crypto? The digital landscape is constantly evolving, yet as it stands, Google Ads does not directly accept cryptocurrency as payment. This situation presents a unique challenge as an affiliate seeking to utilize your digital assets. We provide crypto debit cards as a novel solution to bridge the gap between cryptocurrency holdings and digital advertising spending. These cards allow for seamless conversion of crypto to fiat currency, which can then be used to fund Google Ads campaigns. With the ability to assign dedicated cards to individual campaigns, you gain unparalleled control over your budgeting as an affiliate, ensuring you avoid the common pitfall of maxed-out credit limits and maintain continuous campaign activity. The flexibility, control, and ease of use offered by our cards underscore the benefits of this method, making it an attractive option if you are running multiple Google ads campaigns or seeking to streamline your financial workflows. As we look to the future, the intersection of crypto payments and digital advertising is poised for further innovation, promising to enhance the efficiency and accessibility of online marketing tools. With our solution, you can position yourself at the forefront of this emerging trend and capitalize on the potential of your crypto assets to fuel advertising success.