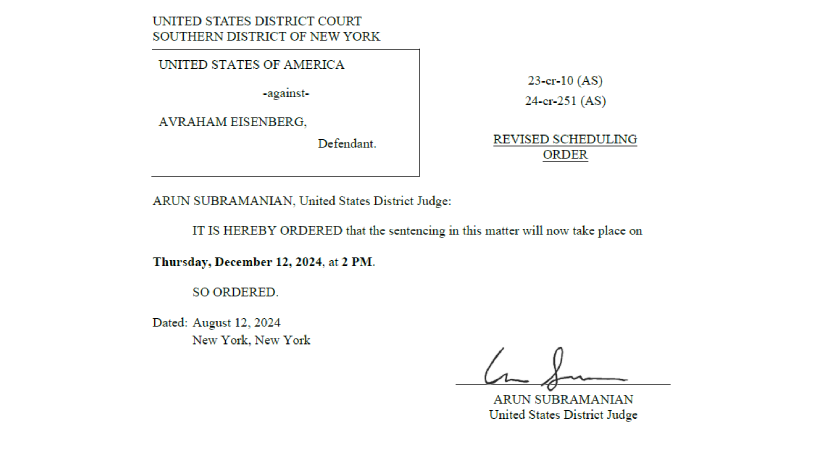

Avraham Eisenberg's trial marked a significant chapter in the fields of cryptocurrency and law as the renowned crypto trader faced charges stemming from his involvement in a scheme that exploited vulnerabilities in decentralized finance protocols. The Avraham Eisenberg trial saga began when Eisenberg manipulated the Mango Markets platform to artificially inflate the price of Mango's native token, MNGO, to borrow massive amounts of assets against the inflated collateral. In the process, he was able to drain the platform of about $110 million, and he initially defended his actions as a profitable trading strategy, which sparked a heated debate on the ethical and legal boundaries within the DeFi space. His actions were labeled as outright fraud, as he allegedly exploited the system's weakness for personal gain. He was convicted, and his sentence has been postponed from July 29, 2024 to December 12, 2024. It will be conducted by New York District Court Judge Arun Subramanian. His conviction set a precedent, underscoring the necessity for improved regulations in the cryptocurrency world. It also highlighted the vulnerabilities within DeFi platforms and emphasized why robust security measures should be implemented.

List of Charges Being Faced by Avraham Eisenberg

The charges against Eisenberg resulted from various illicit activities he perpetrated. These acts have raised the alarm among regulatory entities, and law enforcement agencies, so in this section, we at PlasBit will give a comprehensive overview of the charges being faced by Avraham Eisenberg.

1. Wire Fraud

Eisenberg faced charges of wire fraud which involved the use of electronic methods to commit illegal transactions to defraud individuals. This particular charge is extremely relevant in the cryptocurrency space because constant transactions and communications occur over the internet. The prosecuting counsels alleged that Eisenberg used sophisticated schemes to borrow funds under the appearance of legitimate opportunities, in the process earning him a wire fraud.

2. Market Manipulation

Another serious charge leveled against Eisenberg was market manipulation , as it involves actions taken to interfere with the free and fair operation of the financial markets. Eisenberg is accused of creating a false appearance of market conditions and engaging in practices such as pump and dump schemes, where the value of a cryptocurrency is artificially inflated through misleading statements, only to be sold off at a high price before the value plummets leaving unsuspecting investors with worthless assets.

3. Commodities Fraud

Also, Eisenberg was charged with commodities fraud as he violated the Commodities Exchange Act, which regulates the trading of commodity futures in the United States to prevent manipulation in the markets. Eisenberg’s alleged activities, including the manipulation of cryptocurrency markets, fall under the purview of this act, so prosecutors argued that his actions violated the provisions of the CEA, designed to ensure transparency and fairness in the trading of commodities.

Timeline Events of How Eisenberg Manipulated the Mango Markets

Mango Markets is a decentralized finance platform built on the Solana blockchain, which allows users to trade various cryptocurrencies without the need for intermediaries. Before Avraham Eisenberg's involvement, Mango Markets was operating successfully within the DeFi space, and the platform's governance token, MNGO, was used to vote on proposals and other governance-related activities. In mid-2022, Avraham Eisenberg began exploring potential vulnerabilities within the Mango Markets system. Later on, he identified a flaw in the platform's margin trading system and intended to exploit it so as to manipulate the price of MNGO tokens and other assets on the platform.

On October 11, 2022, he executed his plan to manipulate Mango Markets, and this action unfolded in several stages, which include:

1. He Built a Position: Eisenberg initially deposited a significant amount of collateral into Mango Markets to establish substantial trading positions, which were crucial for the subsequent phases of the manipulation.

2. He Inflated the MNGO Price: With his large position activated, he began to trade MNGO tokens aggressively. By executing large buy orders, he artificially inflated the price of MNGO tokens, so the sudden surge in price triggered a series of automated reactions within the platform's lending and borrowing mechanisms.

3. He Borrowed Against the Inflated Collateral: With the inflated value of MNGO tokens, Eisenberg's collateral appeared to be worth significantly more than its actual market value so he leveraged this to borrow large amounts of other cryptocurrencies from Mango Markets.

4. He Withdrew the Funds: After achieving the previous plan, he rapidly withdrew the borrowed funds totaling about $110 million, leading to a shortage of liquidity on the platform. The rapid withdrawal of assets led to a liquidity crisis in Mango Markets, causing widespread disruption for other users.

How Significant the Trial Is Toward Cryptocurrency Regulation

The Avraham Eisenberg trial marked a significant step toward defining legal boundaries for trading practices in the crypto space. Eisenberg's trial is pivotal for several reasons, as it birthed the increasing attention that regulatory bodies are paying to the cryptocurrency sector. Historically, the cryptocurrency market has operated in a relatively unregulated environment, which has both fueled its rapid growth and led to numerous instances of market manipulation and fraud. The lack of clear regulatory frameworks has often left investors vulnerable and market practices ambiguous, so Avraham Eisenberg's trial serves as a stimulating factor to the application of laws in the crypto world.

The court found Eisenberg guilty, so it already paved the way for more stringent regulations and oversight mechanisms for DeFi platforms, ensuring they adhere to standards similar to those in traditional financial markets. Another crucial significance of the trial is its implications for investor protection, as a primary goal of financial regulation is to protect investors from fraudulent and manipulative practices. The trial is bound to lead to stronger regulations that would enhance investor confidence in the cryptocurrency market, potentially leading to increased participation and stability in the sector.

How Did Eisenberg Defend Himself at the Trial?

At trial, Eisenberg’s defense claimed that his actions constituted a lawful trading strategy and asserted that the prosecutors would not be able to prove that the digital assets were commodities, challenging the basis of commodities fraud. This legal strategy aligned with prior statements made by Eisenberg after the attack, in which he claimed that it was arbitrage and a highly profitable trading strategy. He contended that he merely engaged in a trading strategy that was technically permissible under Mango Markets' existing code and protocol, so his argumentation was further based on the fact that he exploited a loophole but did not break any explicit laws or rules set by the platform. This defense aimed to differentiate between unethical behavior and illegal activity, asserting that while his actions might have been aggressive or morally questionable, they did not constitute a crime.

Potential Sentence Eisenberg Will Be Subjected To

Avraham Eisenberg's trial led to a unanimous jury's guilty decision in the first-ever cryptocurrency open-market manipulation case. Eisenberg was originally scheduled to be sentenced on July 29, 2024. However, his sentencing has been postponed to December 12, 2024. He faces a maximum penalty of 10 years in prison on the commodities fraud and market manipulation counts and a maximum penalty of 20 years in prison on the wire fraud count.

The Future of Legal Matters in Related Cases

The conviction of Avraham Eisenberg in the high-profile Mango Markets case marked a significant legal precedent for the cryptocurrency sector. It specifically challenged the long-held 'code is law' principle and is reshaping future regulatory and legal approaches to crypto-related activities.

1. Challenging 'Code is Law'

The court’s rejection of Eisenberg’s defense represents a pivotal challenge to the 'code is law' principle as it has long underpinned many activities in the decentralized crypto space, suggesting that if an action is technically possible within the parameters of a smart contract, it is not illegal or unethical. By convicting Eisenberg, the court effectively asserted that the legality and ethicality of actions in the crypto space could not solely be determined by code, so this signaled a shift towards evaluating the intent and broader impact of actions beyond their technical feasibility.

2. Regulatory Approaches

The Eisenberg trial sets a precedent for increased scrutiny and regulation of DeFi platforms as regulators may now be more inclined to pursue legal action against individuals who exploit vulnerabilities in smart contracts, even if those actions do not explicitly violate the written terms of the contract. This may lead to a more proactive regulatory stance, emphasizing the protection of investors and the integrity of financial markets over the literal interpretation of the code.

How the Prosecution Presented Its Case Against Eisenberg

The prosecution in the case against Avraham Eisenberg meticulously constructed their argument around his alleged manipulative trading scheme, focusing on how his actions constituted deliberate fraud against Mango Markets and its investors. The prosecutors began by outlining the technical aspects of Eisenberg’s scheme, which they argued was designed with the explicit intention of exploiting vulnerabilities within Mango Markets. He was accused of manipulating the price of the MNGO token to artificially inflate its value, as his aim was achieved through a series of well-coordinated trades that created a false sense of demand and liquidity for the token.

To substantiate their claims, prosecutors presented detailed evidence, including transaction records and blockchain data, showing the rapid and suspicious price movements of the MNGO token coinciding with Eisenberg’s trading activity. They emphasized that these trades were not random or coincidental but were part of a calculated effort to deceive the market and inflate the token’s value. The prosecution highlighted how Eisenberg used the artificially inflated MNGO tokens as collateral to borrow significant amounts of other cryptocurrencies from Mango Markets. They also provided evidence of the large withdrawals Eisenberg made following the manipulation, amounting to millions of dollars in various cryptocurrencies, which he allegedly moved to different wallets to obscure the origins of the funds.

Witnesses, including experts in cryptocurrency trading, were called to explain the complexity and precision of Eisenberg’s actions. They testified that the scheme required a deep understanding of both the technical infrastructure of Mango Markets and the behavior of cryptocurrency markets, suggesting that Eisenberg’s actions were not accidental but a deliberate and sophisticated fraud. Furthermore, the prosecution presented testimonies from investors who suffered substantial financial losses due to the sudden devaluation of the MNGO token following the unwinding of Eisenberg’s trades. These personal accounts were aimed at illustrating the tangible harm caused by Eisenberg’s actions, bolstering the argument that his conduct was not just a technical violation but had real-world consequences.

Eisenberg's defense emphasized in court that his actions enacted a lawful winning trading strategy, but according to reports from Inner City Press, prosecutors called it outright fraud. In their release, “A customer from the United Kingdom took the stand during Eisenberg's trial and said they could not withdraw and lost $124,000, so Eisenberg's lawyer asked the witness if Mango Markets asked if funds being put in were stolen, but the witness reiterated that it is not how DAOs work. Jurors were also shown documents last week that Eisenberg also searched the web for terms such as "market manipulation criminal" and "FBI surveillance," according to reports from Bloomberg.”

How the Jury Reached a Verdict in the Eisenberg Trial

The jury reached a verdict in the Avraham Eisenberg trial after a week-long presentation of evidence and careful deliberation. Eisenberg faced charges, including commodities fraud and wire fraud, stemming from his alleged involvement in manipulating the Mango Markets decentralized finance platform. During the trial, the prosecution presented a comprehensive case demonstrating that Eisenberg had engaged in deceptive practices to exploit the Mango Markets platform, so they argued that Eisenberg manipulated the price of the MNGO token by using a sophisticated trading strategy that involved creating and executing large buy and sell orders.

The prosecution emphasized that Eisenberg’s actions were not merely aggressive trading strategies but deliberate attempts to deceive and defraud the platform and its users, but Eisenberg's defense argued that his actions were within the bounds of legal trading strategies and that he did not intend to defraud anyone. However, the jury found the prosecution’s evidence compelling as they were convinced that Eisenberg’s actions went beyond legitimate trading strategies and constituted fraudulent manipulation. The expert testimonies and transaction analyses played a crucial role in illustrating the extent of the deception and the resulting financial harm to the platform and its users.

After a week of testimonies, evidence presentations, and cross-examinations, the jury entered deliberations. They reviewed the evidence, discussed the legal definitions of commodities and wire fraud, and examined the intent behind Eisenberg’s actions. Ultimately, the jury unanimously found Eisenberg guilty on all counts. Their verdict reflected a thorough evaluation of the evidence and a consensus that Eisenberg’s actions met the legal criteria for commodities and wire fraud. The decision underscored the seriousness of fraudulent activities in the rapidly evolving field of decentralized finance and set a precedent for future cases involving similar schemes.

Conclusion

So, the Avraham Eisenberg trial was a complicated process, and we hope you understand the legal and ethical implications of the case. To avoid being manipulated, vet crypto platforms before investing in them. Even though the trend is shifting, there are still platforms with minimal regulatory oversight, so you need to do proper research, as we have aided many people in our PlasBit posts. Alongside the negative impacts the scam has had on the crypto industry, do not forget that it is risky, and you should follow the risk management strategies as encouraged by PlasBit to protect your funds. Always be updated, and stay safe.