In this guide, we will provide you with an explanation of how you sell your Bitcoin in Germany. We will cover approaches, regulations, taxation policies and more. How do I sell Bitcoin in Germany? One convenient method is through a bank wire transfer. PlasBit is a platform that supports Germany and enables you to convert your Bitcoin into fiat currency and securely transfer it directly into your bank account.

How to Exchange Bitcoin to Euro?

Our platform facilitates this process through a few simple steps. Ensure that you have deposited your Bitcoin into your account wallet. Then, follow our guide to proceed with exchanging your Bitcoin in Germany.

1. Go to the "Wire Transfers" section to see information about converting cryptocurrency to Euros (EUR) through bank transactions. This includes transfer duration, fees and transaction limits.

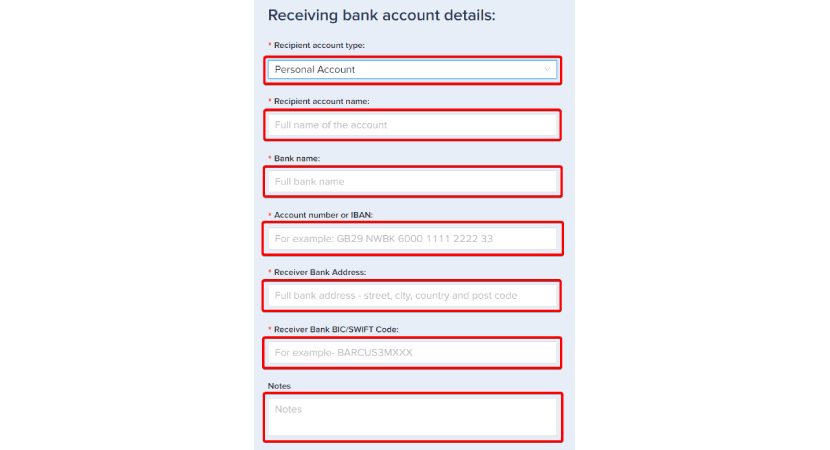

2. Provide all the recipient bank details like account name, type, number or IBAN, bank name, BIC/SWIFT code and address for a conversion process.

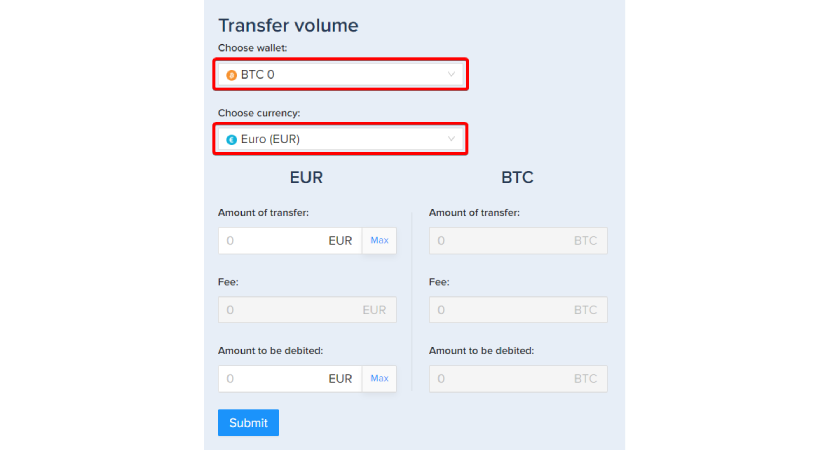

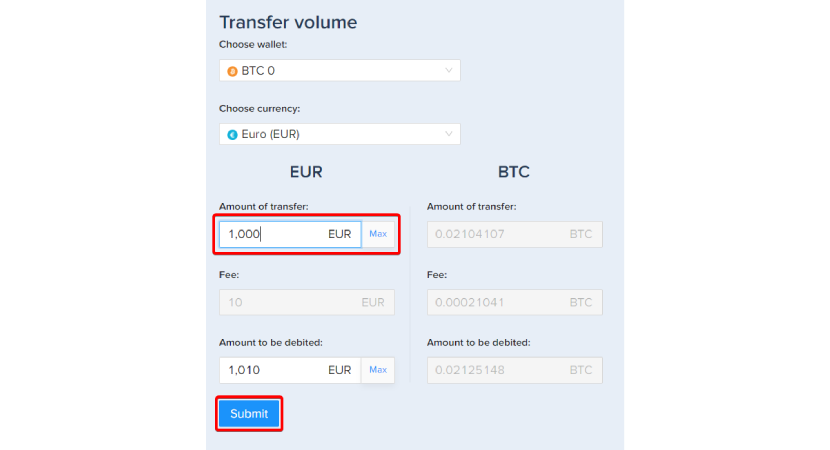

3. Select which cryptocurrency you want to convert into Euros and our system will instantly calculate applicable fees and the total transfer amount. Make sure your account has a cryptocurrency balance for the transaction.

4. After verifying all the transaction details, simply click "Submit". Receive immediate confirmation of the deducted cryptocurrency amount and you can monitor the progress of your wire transfer within your account.

Is Crypto Regulated in Germany?

Yes, crypto regulation in Germany is quite comprehensive. Covers a range of aspects of digital assets and their applications. The regulatory framework acknowledges the significance of Distributed Ledger Technology (DLT) including blockchain in the market. The Federal Financial Supervisory Authority (BaFin) takes the lead in watching and imposing these regulations working closely with the German Federal Parliament (Bundestag). They make sure that various areas are regulated such as asset tokenization, decentralized applications, smart contracts and different types of assets like Bitcoin and Ethereum. Make sure to only choose a regulated platform that adheres to regulatory standards in order to protect your assets. PlasBit is registered in Poland and holds a crypto exchange license issued by the Ministry of Finance, enabling you to conduct activities in the field of virtual currencies.

It's important to note that Germany's regulatory landscape is influenced well by EU-level regulations. Regulation on Markets in Crypto Assets (MiCA) which is an EU directive plays a role in establishing a legal framework across member states. This directive aims to address aspects like stability, market integrity and consumer protection concerning DLT and blockchain technologies. In line with these EU efforts, Germany has also implemented its national-level legislation such as the German Electronic Securities Act (eWpG) and the Fund Jurisdiction Act (FoStoG). BaFin's main focus is on maintaining market integrity and protecting consumers collectively by inspecting business models and market participants to ensure compliance with standards. BaFin holds the power to implement regulations and take action against activities making it a significant player in molding and enforcing Germany's strategy concerning crypto assets.

Crypto Taxes in Germany

When it comes to taxing cryptocurrencies in Germany, there are definitions and regulations that cover types of crypto income and transactions. The German Federal Central Tax Office (Bundeszentralamt für Steuern, BZSt) oversees this process. Cryptocurrencies are classified as "other economic goods" which means that selling them is considered a "private disposal transaction". One interesting aspect of crypto taxation in Germany is the exemption related to how long you hold your crypto assets; if you hold them for more than a year, you don't have to pay taxes on any profits made from selling them. However for types of crypto income like staking or lending there's a lower exemption limit of 256€ per year. This shows the nuanced approach taken towards taxation in this field. Our platform follows a non-deductible tax approach. This means we do not automatically withhold taxes from transactions. Instead, it is the responsibility of each user to accurately report and fulfill their tax obligations according to their jurisdiction's regulations. We recommend consulting with a tax professional to ensure compliance with tax laws and regulations relevant to your situation.

The tax rates on gains in Germany align with personal income tax rates, which range from 14% to 45%. It depends on your income level and marital status. Ensuring compliance with tax regulations is important for individuals in Germany because failing to report and accurately declare all related transactions and income to the BZSt can result in penalties, interest charges or even more severe consequences for non-compliance. Therefore it is crucial for individuals in Germany to keep records and stay updated on the changing tax laws and regulations concerning cryptocurrencies.

How Big is the Crypto Community in Germany?

The crypto scene in Germany has seen expansion over the past few years with an increase of around 1.3 million people between the end of 2022 and the end of 2021, as estimated by Statista. This growth reflects Germany's growing interest and involvement in the asset space. Known for its tech population and strong financial sector Germany has emerged as a leading hub for cryptocurrency adoption and innovation in Europe. The crypto community in Germany is vibrant and diverse encompassing stakeholders such as investors, developers, entrepreneurs, researchers and policymakers who all contribute to its growth.

Cities like Berlin, Frankfurt and Stuttgart have become hotspots for activities in Germany. These cities host communities, meetups and events that are dedicated to blockchain technology and cryptocurrencies. They serve as centers for networking opportunities and collaboration among individuals from parts of the country and beyond while facilitating knowledge exchange. Additionally, Germany's progressive regulatory approach towards cryptocurrencies along with its thriving startup ecosystem and academic institutions have further propelled the growth of the community. Consequently Germany continues to play a role in shaping global cryptocurrency adoption trends while fostering innovation and regulation within this domain.

Examples of Developed German Crypto Communities

Blockchain Bundesverband:

The Blockchain Federal Association, which was founded in 2017, is a leading advocacy group based in Berlin, Germany. It aims to promote the use of technology and encourage innovation in the cryptocurrency field. The association actively engages with policymakers, industry stakeholders and the public to advocate for regulations that support the adoption of blockchain and foster entrepreneurial growth. By organizing events, workshops and policy initiatives, the Blockchain Bundesverband promotes knowledge sharing and collaboration within the blockchain community to contribute to its expansion and progress.

Additionally the association focuses on promoting clarity and regulations that facilitate innovation for Web3 projects. Its goal is to establish Germany as a pioneer and role model in digitization efforts. The Blockchain Bundesverband highlights the importance of identities compatible with Web3 frameworks. It advocates for implementing certification processes for distributed ledger technology (DLT) systems. Moreover it champions the utilization of technology for enhancing efficiency, transparency and tokenization as incentives for investments and encouraging changes especially towards sustainable solutions. Through its approach the Blockchain Bundesverband plays a role in shaping Germany's blockchain ecosystem while driving forward its adoption as a catalyst for digital innovation and transformation.

Frankfurt School Blockchain Center (FSBC):

The Frankfurt School Blockchain Center (FSBC), established in 2017 is a respected research institute and think tank that focuses on exploring the potential of blockchain technology. Located at the Frankfurt School of Finance & Management, the FSBC conducts cutting-edge research on how blockchain can be applied in industries. It covers topics such as finance (DeFi) tokenization and digital identity. The center's main goal is to enhance understanding and awareness of technology among students, professionals and policymakers by carrying out research. This helps promote collaboration and innovation within the blockchain ecosystem.

Furthermore the FSBC acts as a networking hub where managers, startups and industry experts can exchange knowledge and share practices. The center places importance on education by offering a range of programs such as on-campus courses, workshops and conferences tailored to both students and executives looking to deepen their knowledge of blockchain technology. Additionally the FSBC actively collaborates with industry partners, startups and regulatory authorities to develop groundbreaking solutions that drive transformation. Its efforts also aim to position Germany as a leader in innovation and adoption. Through its approach the FSBC plays a role in shaping the future of blockchain technology while promoting its widespread use across various sectors.

Blockchain Research Lab:

The Blockchain Research Lab, located at the University of Hamburg is renowned for its academic achievements in the field of blockchain technology. With a commitment to groundbreaking research and innovation the lab collaborates with a network of stakeholders to explore interdisciplinary projects. Noteworthy partnerships with industry leaders like Airbus and prominent blockchain organizations such as the Ethereum Foundation highlight the lab's dedication to pushing the boundaries of technology. By fostering collaborations with institutions like Humboldt University and the University of Oldenburg the lab creates an environment that encourages knowledge exchange and collaboration enriching its research endeavors with diverse perspectives and expertise.

The core mission of the Blockchain Research Lab is centered around addressing challenges and discovering opportunities within the realm of blockchain. The lab conducts in-depth research on topics ranging from exploring scalability issues associated with technology to analyzing how decentralized finance impacts financial systems. Through efforts with industry partners including Coingecko and Chainstep, the lab bridges academia with real-world applications advancing our understanding of how blockchain technology influences society.

The collaboration encompasses Concordia, HAW Hamburg, The Sandbox and Crypto Valley Journal. These organizations form a network of institutions, industries and media outlets that collectively contribute to the development of blockchain research and innovation.

Can the German Government Track Bitcoin?

The German government, through the Bundeszentralamt für Steuern (BZSt), has the capability to monitor and trace Bitcoin transactions within its jurisdiction. They have recognized the growing importance of regulating and taxing cryptocurrency transactions with the increasing use of digital assets in financial activities. As the tax office BZSt possesses the necessary authority and infrastructure to track cryptocurrency transactions effectively. Their primary goal is to make sure that individuals and businesses comply with tax regulations by reporting any income related to cryptocurrencies. By implementing monitoring systems BZSt can identify suspicious or non-compliant activities, thereby maintaining transparency and integrity in the cryptocurrency market.

Furthermore, Germany, along with European Union member states has strengthened its ability to track cryptocurrency transactions through the implementation of the Sixth Anti-Money Laundering Directive in December 2020. This directive mandates that all cryptocurrency exchanges operating within EU countries must register with EU authorities and collect customer information. By imposing regulatory standards and implementing measures such as Know Your Customer (KYC) procedures and Anti-Money Laundering (AML) protocols this directive aims to enhance transparency and accountability within the crypto sector. These measures not only enhance the government's capacity to monitor transactions involving cryptocurrencies but also aim to safeguard consumers and reduce the potential for illegal activities like money laundering and terrorist financing which are often linked to cryptocurrencies.

History of Germany's Cryptocurrency Adoption

Germany has become a leading player in the adoption of cryptocurrencies due to its tech-savvy population and strong financial infrastructure. The country's acceptance of Bitcoin as an investment option and a means of transaction reflects the growing interest among Germans in exploring financial assets. Notably businesses across industries have started incorporating Bitcoin into their payment systems indicating a broader acceptance of digital currencies in everyday business transactions. This widespread use has been driven by factors like increased awareness of the benefits of cryptocurrencies and the availability of user-friendly platforms for buying, selling and storing digital assets.

Based on data from Statista, Germany's position in the crypto adoption landscape has steadily improved, with the country nearly breaking into the top 20 nations based on transaction volume in 2023. However there was a decline in the significance of Decentralized Finance (DeFi) in Germany that year compared to its strong performance in 2022. Nevertheless Germany maintained a ranking among the top 20 countries worldwide for both cryptocurrency value received through DeFi and retail value received through DeFi in 2022. Interestingly, Germany's higher preference for services compared to centralized services highlights users' inclination towards decentralized platforms over traditional centralized exchanges, especially when it comes to peer-to-peer trading scenarios.

Germany has made progress in adopting cryptocurrencies but there are still areas that need further development. The country's growing influence in the crypto economy indicates its potential to shape the future of digital finance. However challenges like clarity and technological innovation will play a crucial role in determining how cryptocurrency adoption progresses in Germany. Going forward, it is important to continue creating a regulatory environment and promoting technological advancements to accelerate Germany's journey toward becoming a leading hub for cryptocurrency innovation and adoption not only in Europe but also worldwide.

Other Ways of Selling Bitcoin in Germany

How do I sell Bitcoin in Germany? Aside from bank wire transfers, there are a few methods for selling Bitcoin and converting it into fiat currency in Germany. Here are three alternative ways:

Crypto Debit Cards:

Crypto debit cards act as a connection between the world of currencies and the traditional economy based on fiat currencies. They offer a practical way to convert your Bitcoin holdings into usable currency. By linking your wallet to a crypto debit card you can effortlessly access your digital assets and use them for purchases at any merchant that accepts card payments. This integration of Bitcoin into the existing payment infrastructure expands the usability of Bitcoin as a form of payment in Germany allowing you to utilize your cryptocurrency holdings for transactions.

Furthermore, crypto debit cards provide benefits beyond mere convenience. They offer financial flexibility and accessibility allowing you to instantly access your Bitcoin funds for many purposes like online shopping, bill payments or even cash withdrawals from ATMs. These cards often come with features like rewards programs, cashback incentives and advanced security measures that make them even more appealing to users. Overall, crypto debit cards play a role in facilitating the widespread adoption of cryptocurrencies by bridging the gap between digital and traditional finance worlds and seamlessly integrating Bitcoin into our daily lives.

Crypto ATMs:

Crypto ATMs, also known as Bitcoin ATMs or BTMs, have become a convenient way for people in Germany to convert their assets into physical cash. These machines make buying and selling Bitcoin effortless, allowing you to quickly exchange your cryptocurrency for money. Positioned strategically in cities throughout Germany, crypto ATMs offer accessibility making it convenient for you to conduct transactions without relying on traditional banks. Whether you want to cash out your Bitcoin or expand your cryptocurrency portfolio, crypto ATMs provide a user-friendly, straightforward solution for navigating the asset landscape.

The increasing number of ATMs in Germany demonstrates the growing acceptance of cryptocurrencies and the demand for accessible platforms to engage with digital assets. As awareness and adoption of cryptocurrencies continue to rise, we can expect ATMs across the country to give you more options to manage your digital wealth. With their locations and easy-to-use interfaces, crypto ATMs play a role in democratizing access to cryptocurrencies. They empower individuals like yourself to participate in the economy and take advantage of the opportunities presented by technology.

Peer-To-Peer Platforms:

Peer-to-peer (P2P) platforms play a role in the cryptocurrency ecosystem by connecting buyers and sellers, bypassing the need for traditional intermediaries like banks or exchanges. These platforms are marketplaces where you can trade Bitcoin for fiat currency and vice versa, allowing you to negotiate and finalize transactions based on agreed-upon terms. By removing intermediaries, P2P platforms give you control and flexibility empowering you to set your prices and trade conditions. The direct interaction between buyers and sellers fosters trust and transparency enhancing the trading experience for everyone involved.

In addition to facilitating transactions, P2P platforms often include escrow services to ensure transaction security. Escrow services act as parties that hold the cryptocurrency in trust until both parties are satisfied that the transaction terms have been met. This reduces the risk of fraud or default, giving you peace of mind and confidence in the integrity of the trading process. Moreover P2P platforms provide access to a range of counterparts from backgrounds and geographical locations. This diversity improves market liquidity. Creates a trading environment where you can discover optimal deals and maximize your trading opportunities.

What to Consider When Selling Bitcoin?

How do I sell Bitcoin in Germany? When selling Bitcoin there are a number of factors to take into account in order to have a smooth transaction. These factors cover a range of aspects, such as market conditions, transaction fees, security measures, taxation implications, liquidity and regulatory compliance. Here are some key considerations to bear in mind;

Market Conditions:

Considering the state of the market is crucial before you decide to sell your Bitcoin. Take into account factors such as the price trend, trading volume and liquidity. By keeping an eye on market index and price movements you can make informed choices about when to sell and maximize your profits.

Transaction Fees:

Don't forget to factor in transaction fees when selling Bitcoin. These fees can change depending on the method of sale and platform you use. To optimize your returns it's worth evaluating the fee structures offered by exchanges or platforms to minimize transaction costs.

Security:

Security should be a priority when selling Bitcoin in order to safeguard your funds against theft or unauthorized access. Stick with cryptocurrency exchanges or platforms that have security measures in place. Look for features like two-factor authentication (2FA) cold storage options for storing funds and encryption protocols.

Taxation:

It's also important to be aware of the tax implications associated with selling Bitcoin according to the laws and regulations of your jurisdiction. In countries such as the United States and Germany capital gains tax applies to profits made from selling Bitcoin. The tax rate varies based on factors like how you hold your Bitcoin and your individual tax bracket. Keep records of all your cryptocurrency transactions for tax reporting purposes.

Liquidity:

Consider the market or platform liquidity where you plan to sell your Bitcoin. It's important to ensure that your trade is executed promptly and at the desired price. Opting for a market with liquidity reduces the chances of experiencing price slippage. Guarantees an easy conversion of your Bitcoin into fiat currency or other digital assets.

Compliance and Regulation:

It is vital to adhere to requirements and compliance standards when selling Bitcoin. This helps with any risks and ensures a transaction process. Make sure you understand and comply with anti-money laundering (AML) regulations and know your customer (KYC) protocols applicable to cryptocurrency transactions especially when using exchanges or platforms that require user verification.

Conclusion

How do I sell Bitcoin in Germany? Selling Bitcoin in Germany is pretty simple and easy. You have options like using PlasBit bank wire transfers, crypto debit cards, crypto ATMs or peer-to-peer platforms. It's important to prioritize security, transparency and following regulations to ensure a successful transaction. When converting your Bitcoin into Euros you need to consider things like market conditions, transaction fees, security measures, taxation implications, liquidity and compliance with regulations. By staying informed and carefully evaluating these factors you can effectively and responsibly sell your Bitcoin.