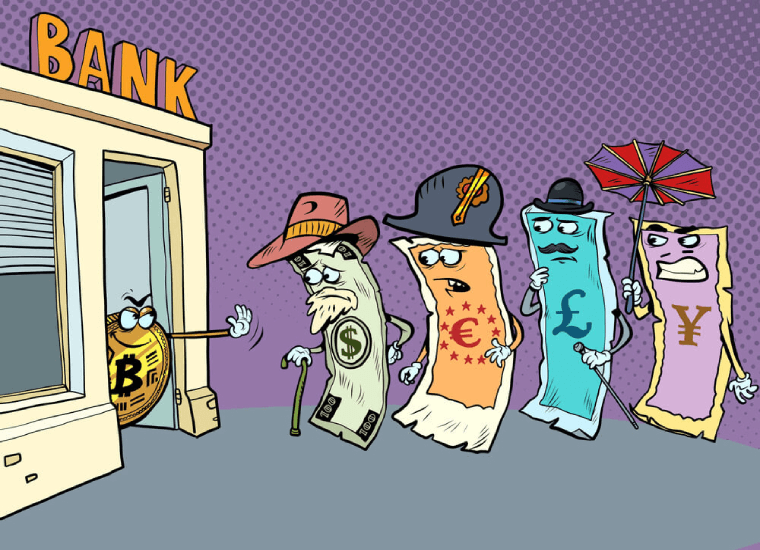

First will explain Why is crypto anti-money laundering compliance so important for financial institutions?

Banks and financial institutions are legally required to adhere to laws and regulatory guidance to combat money laundering, terrorism financing, and tax evasion if they do not wish to be a part of the criminal act. Banks manage their risk against these illicit financial activities and the compliance departments are obligated to report any suspicious activity to the authorities Every bank or financial institution incorporates regulatory compliance and risk management into their short and long-term business plan and strategy as a matter of necessity, so when dealing with cryptocurrencies they would also need to incorporate crypto compliance.

How do financial institutions know the nature of their customer’s crypto activities?

The banks are used to prevent money laundering in traditional fiat with a certain amount of information to ensure they can manage any potential risks involved in facilitating these transactions and the same applies to preventing laundering cryptocurrencies thru the banking system. If one of the bank's customers is transacting using digital assets the bank indirectly or directly is exposed to the challenges of money laundering via crypto. There are a series of checks that can help manage AML risk: Know Your Customer, Know Your Payments, Know Customer Behavior, and Know Your Partner. Given the volume of transactions that banks can process on a daily basis, ensuring the monitoring process is fully automated is essential to reduce the likelihood that suspicious activity falls through the net. For the banks, Information regarding the customer is essential in mitigating risks for exposure to crypto.

What are the processes that financial institutions need to limit risk involving cryptocurrencies?

Flexible but efficient case management and auditing solutions are required to keep up with the regulatory requirements.

Banks and financial institutions need the ability to trace transactions and connections in real time and the capacity to assess their levels of risk in a online.

Considering the volume and speed of transactions involved, they also need to have an system that provides automated updates on potentially illicit activities, providing data for further investigation.

Organizations needs information when it comes to learning how to be compliant. The Financial Action Task Force has released a range of red-flag indicators that can help raise awareness that something is wrong. Many worldwide jurisdictions and exchanges have been slow to adopt the FATF guidlines because technical hurdles but tools do exist that aim to make this achievable.

What are the practical solutions available for limiting crypto risk exposure?

FATF published the money laundering red flags indicators guideline for banks and FI.

These guidelines are detailed and comprehensive and come complete with case studies that powerfully illustrate the types of scenarios that financial institutions should be looking for.

Examples of Red flag indicators related to transactions -

* Transaction size – if the amount and frequency has no logical business explanation.

* Payments that are made in small amounts.

* Payments that are made in repeated quantities that fall under a reporting threshold.

* Alarm bells can also be raised if funds are sent to a newly created or previously inactive account.

* Transaction patterns - that are irregular, unusual or uncommon which can suggest criminal activity.

* Irregularities when it comes to the source of funds or wealth which can relate to criminal activity

* Suspicious circumstances related to geography such as if a customer’s funds originate from, or are sent to, an exchange “that is not registered in the jurisdiction where either the customer or the exchange is located.”

* Geographical risks - criminals can exploit countries with weak, or absent, national measures for virtual assets.

How does blockchain analytics software work for financial institutions exposed to crypto?

They enable transactions to be monitored on all major blockchains 24/7 and in real time and sends notifications on any suspicious activity.

The risk associated with incoming and outgoing transactions can be determined by patterns covering high value payments, transfers involving multiple digital assets and/or accounts, as well as transactions that can raise any one of the red AML flags. A clearer picture can also be gathered over time by piecing together intelligence from entities making frequent transfers over a specific timeframe and if there are irregularities it will pop out.

There are many Compliance software companies that enables suspicious patterns to be detected, and for financial institutions to understand the sources of funds and wealth. Crucially, they can also identify whether the crypto used in transactions is suspected to be stolen or fraudulent, all by assessing if the coins transferred to or from wallets have been connected with mixers or P2P services.

Blockchain analytics tools are increasingly being used by authorities and Virtual Asset Service Providers (VASP), companies providing services related to cryptoassets, and cryptoasset exchanges, to monitor transactions and detect questionable or revealing patterns related to ransom attacks.