If you’re a crypto enthusiast, chances are you are already familiar with what USDT is and stands for. But did you know that due to its popularity, its daily trading volume reaches billions, and with so many blockchain networks available, the actual cost of the transfer is vastly different depending on the network? Each of those networks uses a different technology, infrastructure, and even pricing, so the mandatory gas fees are quite diverse. In a way, it makes sense, as everyone is trying to be the most competitive and offer the cheapest fees. As always, we at PlasBit are here to help you cut through the noise and show you the costs of transferring USDT on many blockchains. So, how much does it cost to transfer USDT? It costs $0.0006 on Solana, $0.01 on the BNB Smart Chain, $0.02 on Ethereum, and $3 on the Tron network. As you can see, the differences are very noticeable, which is why we’re going to talk about these blockchain networks to give you a better idea of not just the expenses but also the advantages and disadvantages.

Cost to transfer USDT

Before we go into detailed explanations about stablecoins, let us get in on the actual transfer costs of the most popular stablecoin, USDT. Here’s a detailed table consisting of all the USDT info you need for an easier overview, so you can quickly see how much does it cost to transfer USDT, courtesy of the PlasBit team.

| Network | Token standard | Fee in native token | Fee in USD |

|---|---|---|---|

| Solana | SPL | 0.0000046 SOL | $0.0006 |

| Ethereum | ERC-20 | 0.00005 ETH | $0.02 |

| BNB Smart Chain | BEP-20 | 0.00002 BNB | $0.01 |

| TRON | TRC-20 | 13.11 – 27.24 TRX | $3 – $6.23 |

| Avalanche | Arc-20 | 0.00015 AVAX | $0.003 |

As you can see, not one blockchain has the same fees, and as you may have guessed at this point, these charges aren’t the only thing that is different. Depending on the transfer type or quantity, some networks might be more suitable than others.

- For instance, Ethereum was the first blockchain to host USDT outside of Bitcoin's Omni layer in 2017. To this day, it’s still one of the most widely used blockchains for USDT, specifically when it comes to DeFi. The network’s native token is Ether (ETH), but the network itself has rather big gas fees, so it’s less ideal for small transfers when compared to others.

- The reason why TRON became very popular for USDT, in no small part, was because of its generally low fees and fast confirmations. At least that was the case before, as in the recent months, the gas fees have increased by a lot, to the point it’s now more expensive than Ethereum. USDT launched on TRON in 2019, and the blockchain is currently the most popular one for USDT, with a huge number of daily transactions. The network’s native currency is Tronix (TRX), and TRC-20 USDT is often the primary choice for sending USDT across wallets and exchanges.

- Next in line is BNB Smart Chain, where USDT launched in 2020 at the height of the COVID-19 pandemic. If you didn’t know already, the blockchain is actually Binance’s smart contract platform that supports fast and low-cost USDT transfers. The native token is BNB, but when it comes to USDT, it’s mostly used for DeFi, trading bots, and swapping tokens on this blockchain.

- Then, there is Solana with its native token SOL and exceptionally low fees. By ‘exceptionally’, we mean the lowest from the others we mentioned, and by some margin too, since the transaction cost is practically a fraction of a cent, which makes it ideal for micro-transactions. The reason for this is because of Solana’s unique architecture and the implementation of Proof of History, which we’ll expand on later. USDT showed up on Solana in 2021 and is usually used for fast-paced DeFi environments, gaming, and NFT platforms.

- Finally, there’s Avalanche, a fast and scalable platform with AVAX as its native token. USDT was launched on it in late 2021, and it’s primarily used in the C-Chain (a blockchain component) with a growing usage in trading and decentralized apps.

You’ve probably noticed by now that gas fees are present on every blockchain, and that’s just how the system works and the “price” you pay for using any blockchain. The reason why no blockchain has the same fees is because of the variety of elements that come into play.

- For example, there’s the network congestion, which is basically how busy the network is and how many transactions there are at a given time. With high congestion, fees will rise because users will compete for a limited block space. You can think of this as an auction with a bidding war involved, as there will be users who want their transactions prioritized. Remember, validators will prioritize those who pay higher gas fees, and on high-demand blockchains like Ethereum, fees can spike dramatically.

- Native blockchain token plays a role in the cost of fees as well, or to be more precise, it’s possible price fluctuations. Gas fees are paid in the blockchain’s native token, and you’ll pay exactly the amount depending on the current market price. Since cryptocurrencies are prone to change, this means that the fee can be more expensive or cheaper than, say, several months ago.

- One more reason for the diverse cost of fees is the transaction complexity, as not all transactions are the same. Practically, this is similar to traditional banks, as you won’t ever get the same result if you’re buying or selling a currency. As an example, a simple USDT transfer is straightforward, but if you involve some DeFi protocols or do token swaps, then that will consume more gas, and hence the fee will increase.

- There is also gas priority and speed that can have a notable impact on the fee amount. What we mean by this is that users can add a priority fee to a transaction so that the validators can put it in a higher position for validation (transactions with higher fees directly translate to greater financial rewards). Essentially, faster confirmations require higher gas fees, so if you’re not in a hurry, you can save some cash on slower transactions.

Tether and TRON connection

After we had discussed how much does it cost to transfer USDT, let’s talk about what stablecoins are, specifically Tether and Tron networks. Tether (and its currency code USDT) is a crypto stablecoin launched 11 years ago (time flies fast) by Tether Limited Inc. It was created with the purpose of having a fixed exchange rate to the US dollar, and over time, it became by far the most popular and most traded stablecoin. Last year, Tether reported that there are $118.4 billion in reserves, which also includes $5.3 billion in excess reserves. Currently, the stablecoin has a $155.6 billion market cap and daily trading volume in billions, showcasing its popularity among crypto enthusiasts. According to last year's reports, the number of Tether users reached over 350 million across the globe. It holds 70% of the market share among stablecoins when it comes to trading volume, and several years ago, it even outpaced Bitcoin to become the world's most actively traded cryptocurrency.

From the time it was released to the present day, Tether has gradually expanded to more and more blockchains. It was first launched on Bitcoin’s Omni Layer (a platform created on top of the Bitcoin blockchain), and over time, it reached Ethereum, Tron, Solana, and others. Last year in August, Tether announced that there will be a stablecoin pegged to the UAE’s national currency dirham. At the moment, there are five different Tether tokens, and these are:

- US dollar tether (USDT) on Bitcoin's Omni layer

- US dollar tether (USDT) as an ERC-20 token

- US dollar tether (USDT) as a TRC-20 token (TRON network)

- Euro tether (EURT) on Bitcoin's Omni layer

- Euro tether (EURT) as an ERC-20 token

As popular as Tether is, perhaps it is not surprising that there have been some controversies as well. For example, a research paper written by Griffin and Shams indicated that during market downturns, Bitcoin's price rose following the minting of new USDT by Tether. Speculations immediately arose about potential market manipulation, and this wasn’t the only instance when such a scenario happened or when people assumed manipulation was at play. Both Tether and its linked exchange, Bitfinex, disputed these conclusions as they both accused the authors of selectively using incomplete data. Among similar debates in the past regarding Tether, a particularly noteworthy one was when Bloomberg reported that US federal prosecutors are investigating whether Tether was involved in manipulating Bitcoin’s price. In the end, nothing came out of this, but Tether wasn’t excluded from finding itself involved in situations like these. Still, users seemingly didn’t mind as the stablecoin was expanding its influence constantly, and consistently attracted users.

One of the blockchains where Tether broadened its presence over the years is TRON. In fact, “broadening its presence” is quite an understatement on our part, considering that today, over 50% of Tether’s daily transactions take place on the TRON network. It was reported last month that the total circulating supply of Tether on the TRON blockchain has exceeded $75 billion. As for TRON itself, the blockchain was founded by Justin Sun, initially starting as an Ethereum-based ERC-20 token before switching to its own blockchain in 2018. Data from May this year shows that the blockchain handles over 8.3 million daily transactions and has more than 306 million users. However, TRON earned a bad reputation for enabling organized crime and has been criticized many times because of it. According to reports from TRM Labs, more than 50% of the illegal crypto transactions last year happened on the TRON blockchain, with an estimated worth of $26 billion.

What is a stablecoin, actually?

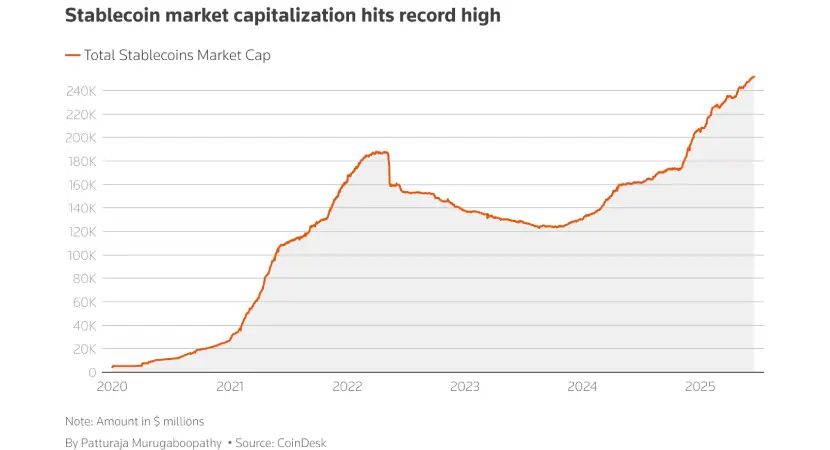

For starters, a classic definition of a stablecoin would be a type of cryptocurrency that was designed to have a consistent value by being pegged to another currency, commodity, or financial instrument. So, stablecoins are all about stability in the otherwise volatile world of crypto. They generally work and behave differently from standard cryptocurrencies, since they use two primary elements to maintain price stability. The first one is the holding of reserve assets of the financial instrument they are pegged to as collateral, while the second is the implementation of algorithmic systems that are designed to control a stablecoin’s circulating supply. For example, if the price of the stablecoin goes above $1, then the network creates more coins to bring the price down. In case the price drops below $1, then the network removes coins from circulation to push the price back up. If that is too much for you to wrap your head around, think of stablecoins as a way to mimic fiat currencies. The US dollar or any other fiat currency is much less likely to fluctuate and crash (because it is backed by the government and its own reserves of precious metals, natural resources, or other fiat currencies) compared to any cryptocurrency, including the almighty Bitcoin. This is why stablecoins gained a lot of popularity in the unpredictable crypto industry. Several days ago, per CoinDesk data, stablecoin’s market cap reached $251.7 billion, which is an all-time high.

A line graph depicting stablecoin market cap (Image credit: Reuters.com)

That being said, before we go into how much does it cost to transfer USDT, it’s important to mention that there are four types of stablecoins, each made with a different focus in mind:

- Fiat-backed: Ones that are pegged to a fiat currency, such as Tether being pegged to the US dollar to create USDT

- Commodity-backed: Stablecoins that are pegged to the market value of goods such as gold, silver, oil, and similar

- Crypto-backed: This is where things get a little bit complicated, considering these stablecoins are backed by reserves of other cryptocurrencies, as the name suggests. They often use overcollateralization, which means that the value of cryptocurrency held in reserves surpasses the pegged value.

- Algorithmic: This type is unique in a way because it doesn’t necessarily hold reserve assets. Plus, their value is maintained via algorithmic mechanisms, as opposed to being pegged to a certain value.

As much as there’s hype around stablecoins, not everything is roses, though, due to their rapid growth and nature, they often come under regulatory scrutiny. Every so often, they step into the spotlight, especially in the US, for example, in 2021, the International Organization of Securities Commissions stated that stablecoins should fall under the same regulations of financial market infrastructure, including payment systems and clearinghouses (an intermediary between buyers and sellers that is designed to ensure the market is stable and functions smoothly). Next, there was the situation where Senator Cynthia Lummis advocated for routine audits of stablecoin issuers. Then last year, alongside Senator Kirsten Gillibrand, Lummis also introduced a bill specifically designed to create a regulatory framework for stablecoins. Fast forward to mid-June this year, when the US Senate passed the bill named the GENIUS Act, which will require stablecoin tokens to be backed by liquid assets, among other things. Additionally, issuers will need to publicly disclose their reserve composition every month. It’s a similar situation in the EU as well, where, under the Markets in Crypto Assets Regulation (enacted in 2023), all algorithmic stablecoins are effectively banned. All other stablecoins under this regulation must maintain reserves held in custody by a third party, and the reserves must be liquid and maintain a 1:1 asset-to-coin ratio.

Cheapest way to transfer USDT

There you have it, we’ve covered all the main parts and then some, so it’s time to recap. As you’ve seen, fees vary a lot, and the cheapest way to transfer USDT is via the Solana network, which charges only $0.0006 per transaction. In comparison, sending USDT via Ethereum costs around $0.02, $0.016 via BNB Smart Chain, or approximately $3 via the Tron network. Speaking of Solana, it’s time to go into it a little bit deeper, considering it has the cheapest fee. For starters, you’ve likely heard of Proof of Work or Proof of Stake, but just in case you haven’t, PoW is the system enabling cryptocurrencies to function without a central authority. This means that blockchain networks have to operate based on consensus rules, not on trust. More precisely, PoW functions in a way that miners have to solve cryptographic puzzles, and the first one to do it, gets to add a new block on the blockchain and earns the cryptocurrency.

On the other hand, PoS is used to validate new transactions and add them to the blockchain by selecting validators to confirm and validate transactions, based on the amount of cryptocurrency they stake or lock up as collateral. Now, Solana has something called Proof of History (PoH), which is something of a novelty in the crypto sphere. To put it in layman’s terms, it’s a method for logging time between transactions. It functions by creating a historical record that verifies the existence of data at a specific time. This helps with efficient processing because it eliminates the need for validators to coordinate timestamps or wait for block confirmations, allowing them to process multiple transactions at once and this is the reason why Solana has very fast transaction speeds. There’s a lot of technicality to all of this, but we hope that we at least helped you understand a little bit.

USDT TRC20 transaction fee

Now that we’ve covered the cheapest blockchain, it’s time to summarize the key points for the most popular blockchain for USDT. We’re obviously talking about TRON, where the USDT TRC20 transaction fee is approximately $3 when sending to an address that already has TRX and around $6.23 to an address without TRX. These fees were calculated based on the current TRX price of $0.23, meaning you pay about 13 TRX if the recipient address has TRX and 27 TRX if it doesn’t. Due to TRON’s popularity for USDT, we feel it would be interesting to mention some additional facts. Namely, TRON's architecture is structured into three different layers, and those are the storage layer, core layer, and application layer. Its way of working follows a standard set of guidelines from Google, and because of this, practically any software can easily connect to and build on TRON. To combat the allegations of enabling organized crime and to prevent it from happening, last year in September, TRON, Tether, and TRM Labs launched the T3 Financial Crime Unit (T3 FCU). It works directly with the law enforcement agencies around the world to identify and break down criminal networks. T3 FCU achieved some good results, too, since at the beginning of this year, it was reported that it froze more than $100 million in criminal assets globally. Maybe crime doesn’t pay that much?

USDT transfer fee

As we slowly reach the end of this article, here is a quick summary of all the most important parts. Mainly, keep in mind that the USDT transfer fee is $0.0006 on Solana, BNB Smart Chain $0.01, Ethereum $0.02, and Tron at $6.42. While the dollar amount will certainly be a factor, in the end, it’s largely about user preference. Some are popular or faster while others are cheaper, so technically, there isn’t a wrong way to pick here, just the one that best suits you and your needs.

The Tether is strong in this one

We’ve come to the conclusion of another PlasBit article, where we discussed how much does it cost to transfer USDT. We hope there was just enough technical information in it to clear up some things for you without being overwhelmed with tech jargon. USDT became very popular over the years (as did the crypto industry in general) simply because people seem to be more and more drawn to the stablecoins and the idea they represent. The nature of cryptocurrencies won’t ever change, and their volatility will always be present to some degree. With how things are going right now in the world and the shifting geopolitical situation, users are more likely to invest or take an interest in something more consistent. Apart from mentioning the obvious commodities such as gold, stablecoins seem to be gradually attracting the attention of even those who aren't into cryptocurrencies all that much. The fact that USDT has more daily trading than the almighty Bitcoin tells you (almost) all you need to know about Tether and stablecoins. Still, not all stablecoins are as popular, and time will tell if they’ll reach this level of stardom and maybe, just maybe, push out USDT as the go-to stablecoin.